Publication 783 For 2022

Description

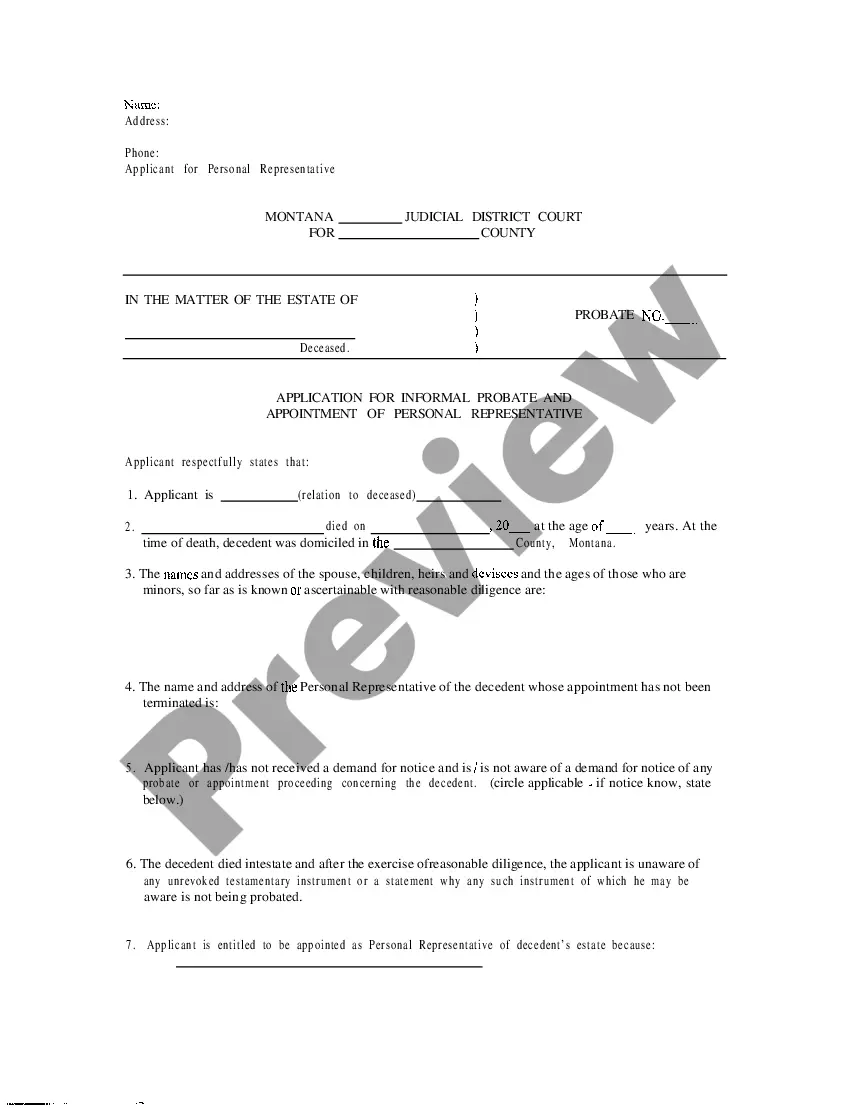

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Handling legal papers and operations can be a time-consuming addition to the day. Publication 783 For 2022 and forms like it usually require that you search for them and understand how to complete them properly. As a result, whether you are taking care of economic, legal, or personal matters, having a comprehensive and convenient web library of forms on hand will greatly assist.

US Legal Forms is the best web platform of legal templates, boasting more than 85,000 state-specific forms and a variety of tools that will help you complete your papers effortlessly. Explore the library of appropriate documents accessible to you with just a single click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Protect your document managing operations having a top-notch support that allows you to put together any form within minutes with no extra or hidden charges. Just log in to your profile, locate Publication 783 For 2022 and acquire it straight away from the My Forms tab. You may also access formerly downloaded forms.

Would it be your first time utilizing US Legal Forms? Register and set up a free account in a few minutes and you’ll gain access to the form library and Publication 783 For 2022. Then, adhere to the steps listed below to complete your form:

- Be sure you have found the proper form by using the Preview feature and reading the form description.

- Pick Buy Now as soon as ready, and choose the subscription plan that suits you.

- Select Download then complete, sign, and print the form.

US Legal Forms has 25 years of expertise assisting users manage their legal papers. Discover the form you need today and streamline any process without breaking a sweat.

Form popularity

FAQ

In March 2020, the IRS temporarily halted some debt collection efforts and later expanded the pause in February 2022 to include a suspension of collections letters, including notices of property seizure.

How to Get Rid of a Lien. Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt.

IRS Collection Notices (updated July 27, 2022) The IRS is researching the matter and will provide an update as soon as possible. Aside from the first billing notice after a tax return is processed, we have paused the issuance of most balance due notices.

Fill out Form 656. The Form 656 identifies the tax years and type of tax you would like to compromise. It also identifies your offer amount and the payment terms. Your offer amount must be equal to or greater than the amount calculated in Form 433-A(OIC) or 433-B(OIC).

These actions included the suspension of some collection notices, such as lien and levy notices. Beginning in May 2023, the IRS will begin sending these notices to taxpayers again. Before taxpayers receive any collection notices, however, they will first receive a CP-14 balance due notice.