Form Assignment Accounts Receivable With Credit Card Payments In Middlesex

Description

Form popularity

FAQ

Credit Card Payments Use your actual bank account as the Checkbook (the account the payment comes from). Place your liability account under the GL Account column (the account the payment is applied to). Check the box to Automatically Import these items.

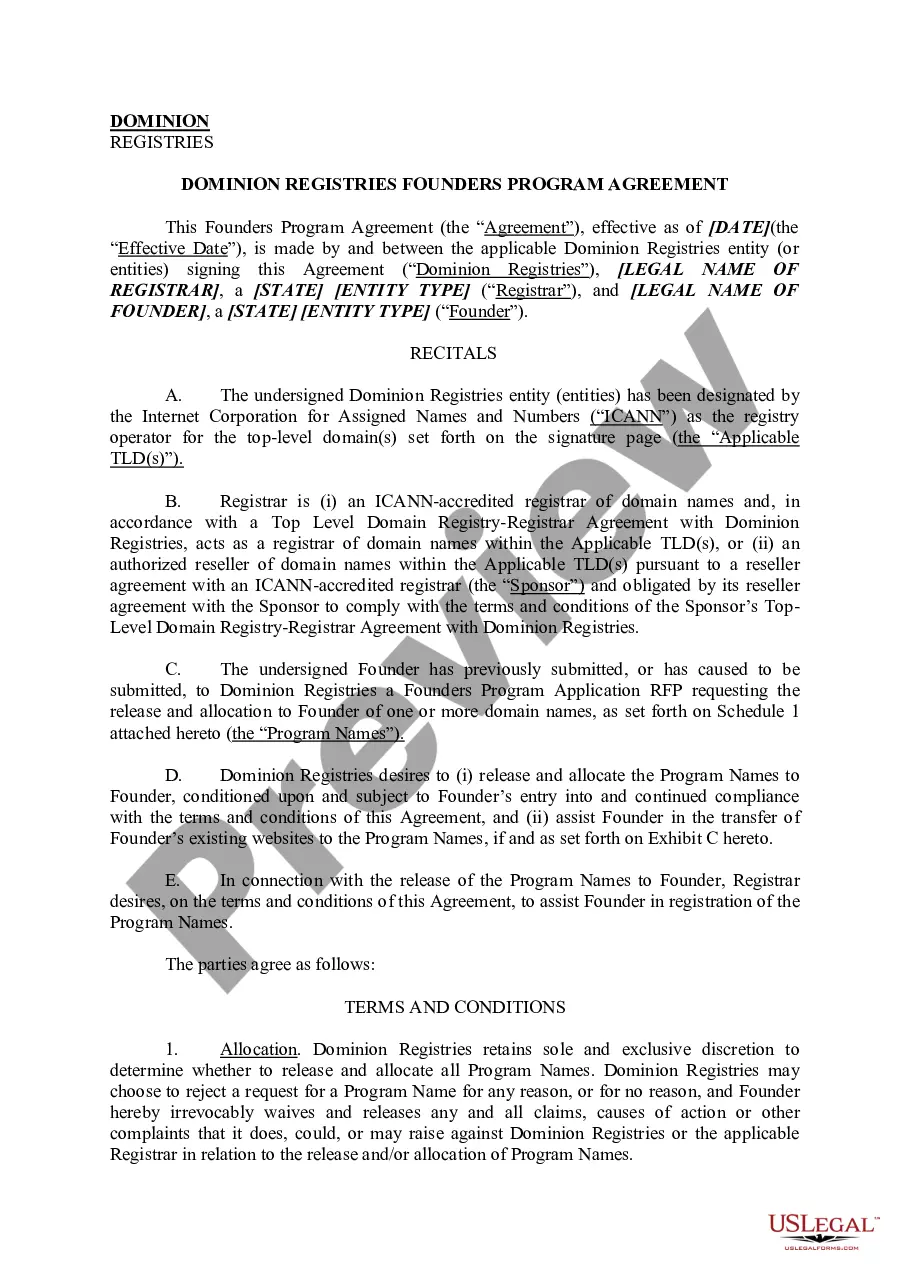

Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables. This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

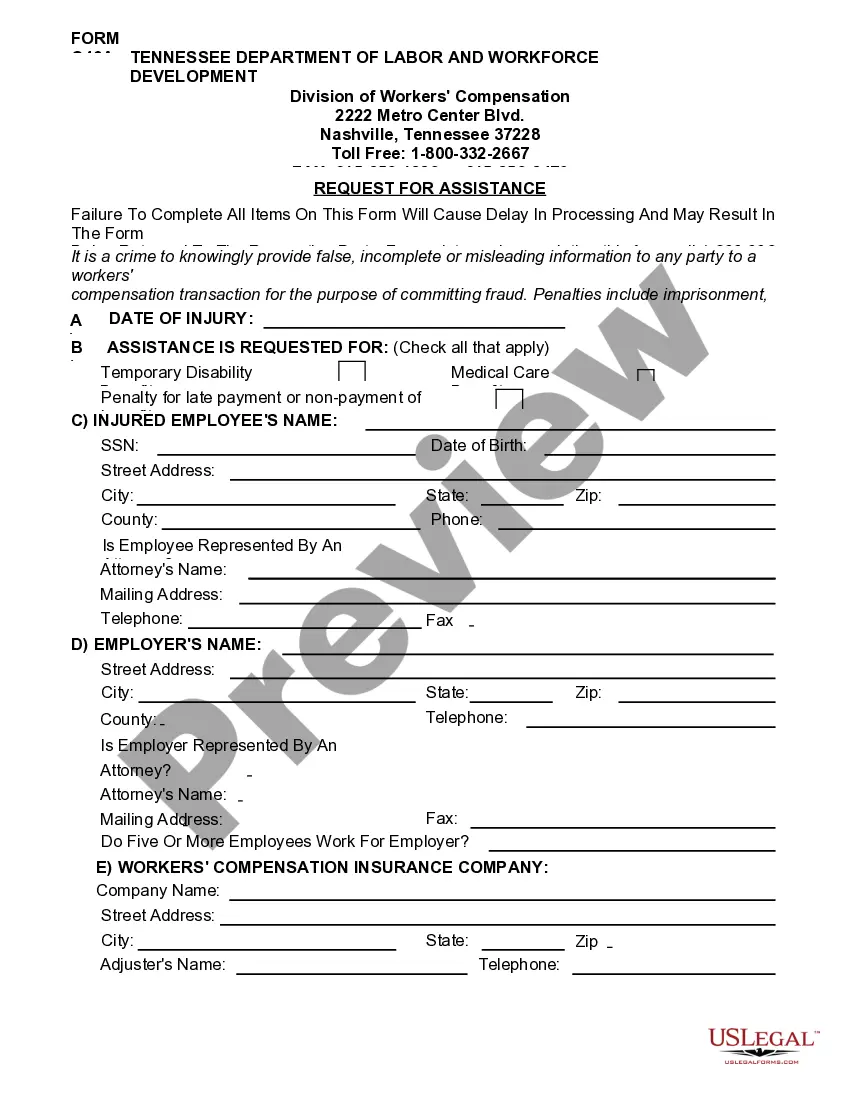

The information on such a form must include: Cardholder's name. Card number. Card network (Visa, Mastercard, American Express, Discover, etc.) Card expiration date. Cardholder's billing zip code. Business name. Statement authorizing charges. Cardholder's signature and the date they signed.

All DoD guidance and regulations indicate that sales of merchandise or services to an authorized customer using a credit card should be recorded as a receivable.

With factoring, the factor takes control of bill collection and assumes the credit risk for customer non-payment. In contrast, with the assignment of receivables, the business retains control of its customer relationships and the collection process, bearing all of the credit risk.

Record the total debit amount in the accounts receivable account ing to the invoice. When the customer pays the invoice in full, post a debit in the sales account. This helps balance the double-entry system, which can help you avoid accounting errors and balance books more effectively.

Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables. This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.