Allowance For Spouse Application In Fairfax

Description

Form popularity

FAQ

Common non-probate assets include: Life insurance proceeds or pension benefits payable to a named beneficiary. Assets such as a home owned with someone else in joint tenancy or tenancy by the entirety. Assets with a listed beneficiary outside of the deceased person's will such as an IRA or payable-on-death bank account.

Virginia Intestate Succession Estate Distribution When you have surviving children but no spouse, your children inherit everything. When you have a surviving spouse but no descendants (children, grandchildren, or great-grandchildren), your spouse inherits everything.

The right to exempt property and other assets of the estate needed to make up a deficiency of exempt property has priority over all claims against the estate, except the family allowance.

These laws generally allow your closest living relatives to inherit from your estate: If you have children and no spouse, your children inherit everything. If you have a spouse but no children, your spouse inherits everything. If you have children you share with your spouse, your spouse inherits everything.

In addition to any other right or allowance under this article, the surviving spouse of a decedent who was domiciled in the Commonwealth is entitled from the estate to value not exceeding $20,000 in excess of any security interests therein in household furniture, automobiles, furnishings, appliances, and personal ...

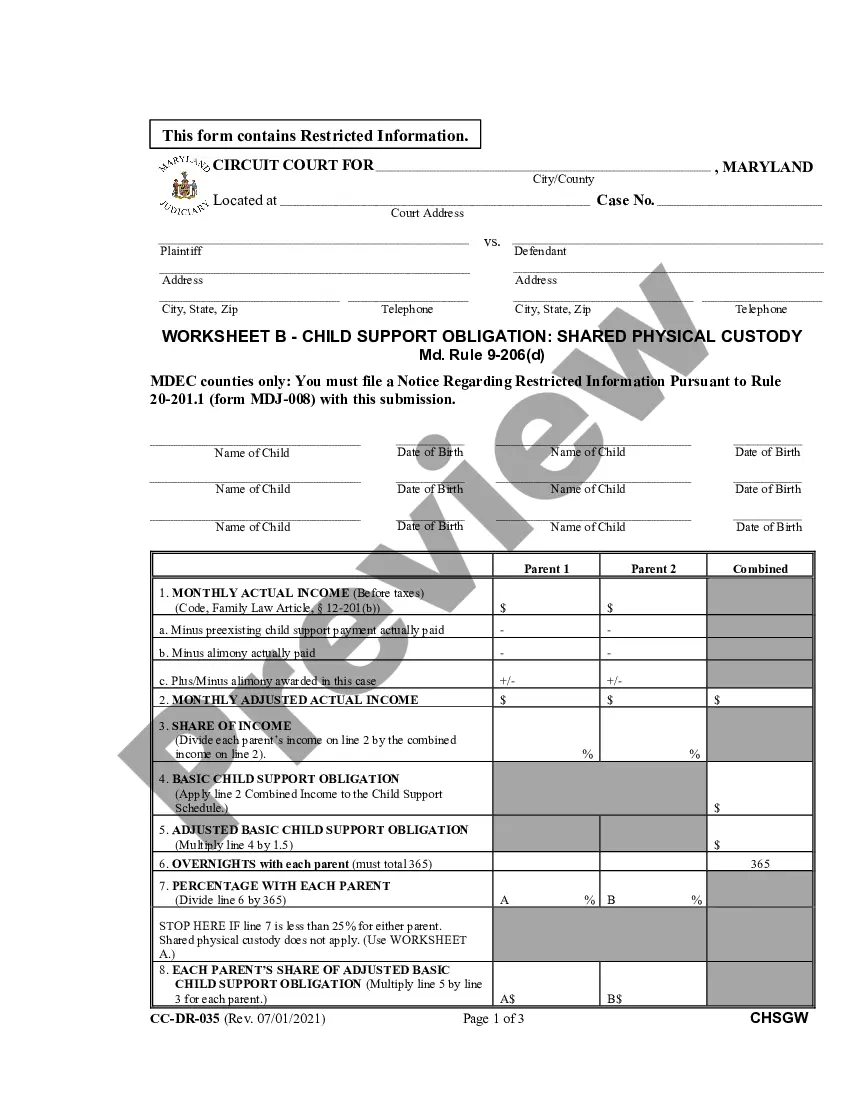

The Virginia Code permits a family allowance for the surviving spouse and minor children (or minor children if no spouse survives) of up to the amount of $24,000 (or monthly installments of $2,000 for up to one year).

The Community Spouse Resource Allowance (CSRA) is $109,560 and the Minimum Monthly Maintenance Needs Allowance (MMMNA) is $2,739.

Treatment of Assets for a Couple In 2025, the CSRA allows the community spouse (the non-applicant spouse) to retain 50% of the couple's assets, up to a maximum of $157,920. If the non-applicant's portion of the assets falls under $31,584, 100% of the assets, up to $31,584 can be retained by the non-applicant.

A community spouse can keep half of the couple's countable assets, up to their state's maximum resource standard. If the community spouse's share is under the maximum resource standard, which in most states is $157,920, this is the amount of their CSRA.