Management Package Estate Withholding

Description

How to fill out Texas Property Management Package?

Whether for business purposes or for individual matters, everybody has to handle legal situations sooner or later in their life. Completing legal documents requires careful attention, starting with picking the proper form template. For instance, when you pick a wrong version of the Management Package Estate Withholding, it will be declined once you submit it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Management Package Estate Withholding template, follow these simple steps:

- Find the sample you need by using the search field or catalog navigation.

- Look through the form’s information to make sure it matches your case, state, and region.

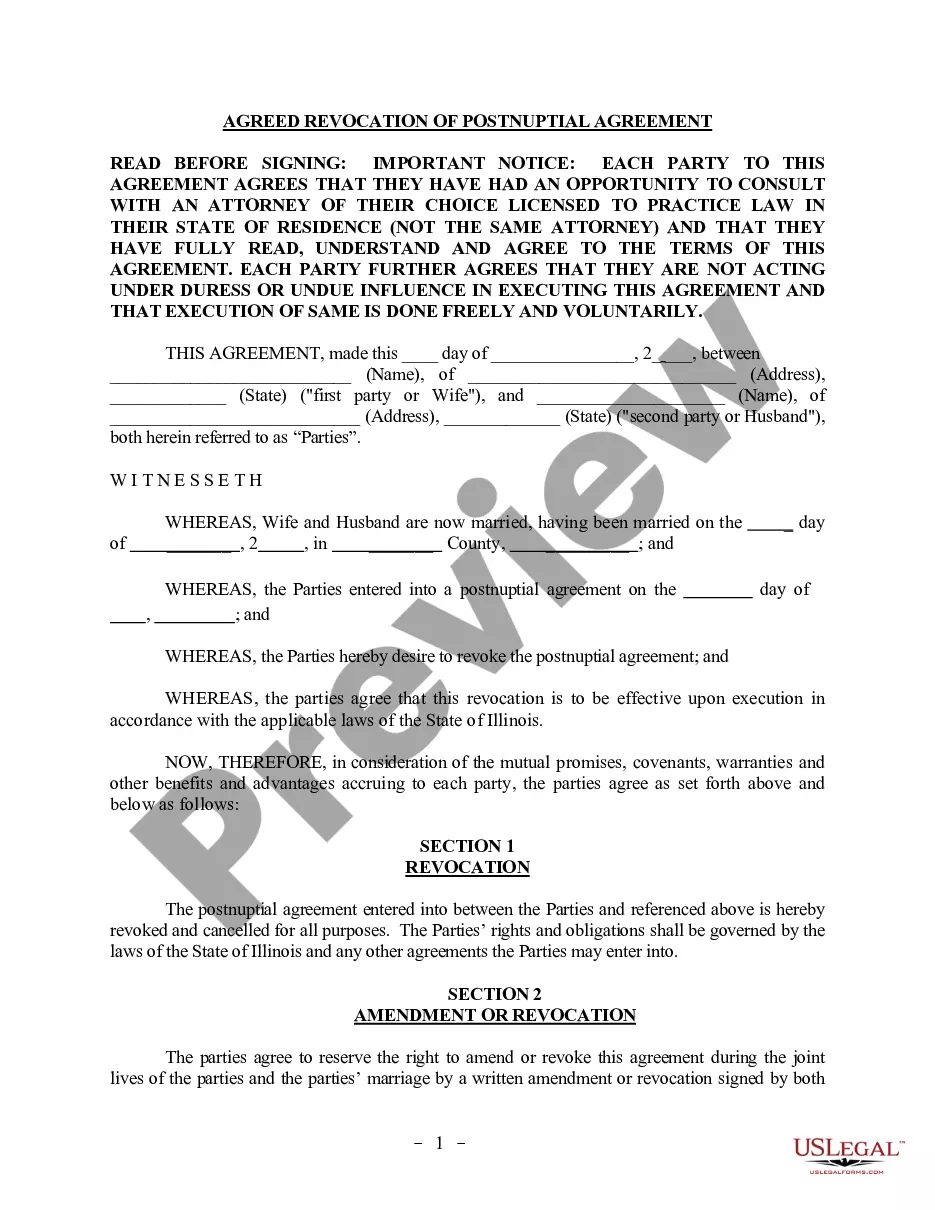

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to locate the Management Package Estate Withholding sample you require.

- Download the file if it matches your needs.

- If you already have a US Legal Forms account, just click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Pick the file format you want and download the Management Package Estate Withholding.

- When it is downloaded, you are able to complete the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time looking for the right sample across the web. Take advantage of the library’s straightforward navigation to find the right form for any occasion.

Form popularity

FAQ

US law requires that the transferee (buyer) on a sale or disposition of a United States Real Property Interest withhold a percentage (typically 15%) of the total amount realized (the sales price) at the time of disposition (closing of sale).

Claiming 0 Allowances on your W4 ensures the maximum amount of taxes are withheld from each paycheck. Plus, you'll most likely get a refund back at tax time.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

W1 ? Total salary, wages and other payments. W2 ? Amounts withheld from salaries or wages and other payments shown at W1. W4 ? Amounts withheld where no ABN is quoted. W3 ? Other amounts withheld (excluding any amount shown at W2 or W4)

Personally I use 1. If you want more money from your check and a little less going to federal/state, you could use 2. But, at the end when you do your taxes, you won't get a big refund like you normally do with 0.