Georgia 10 Day Repossession Letter With Mortgage

Description

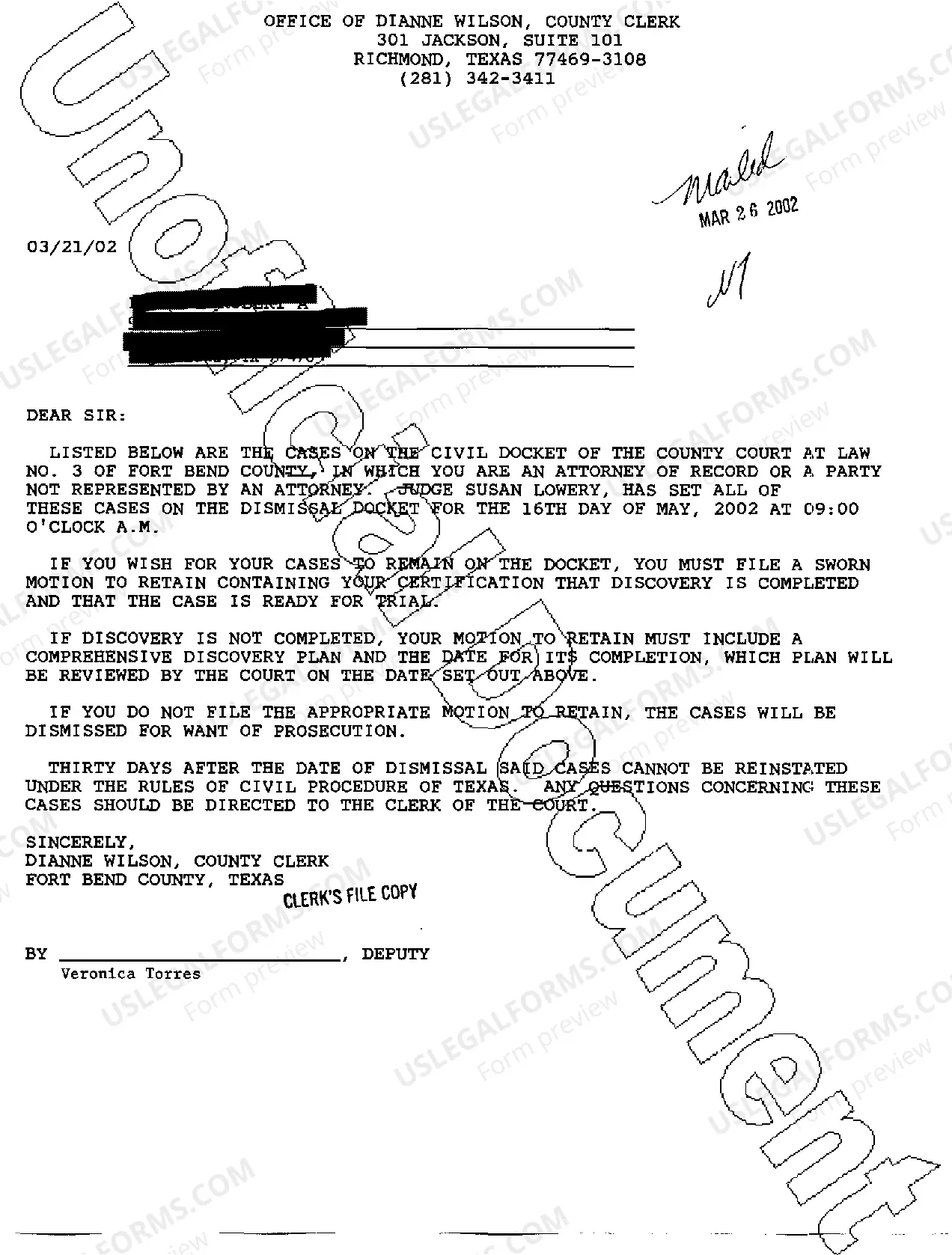

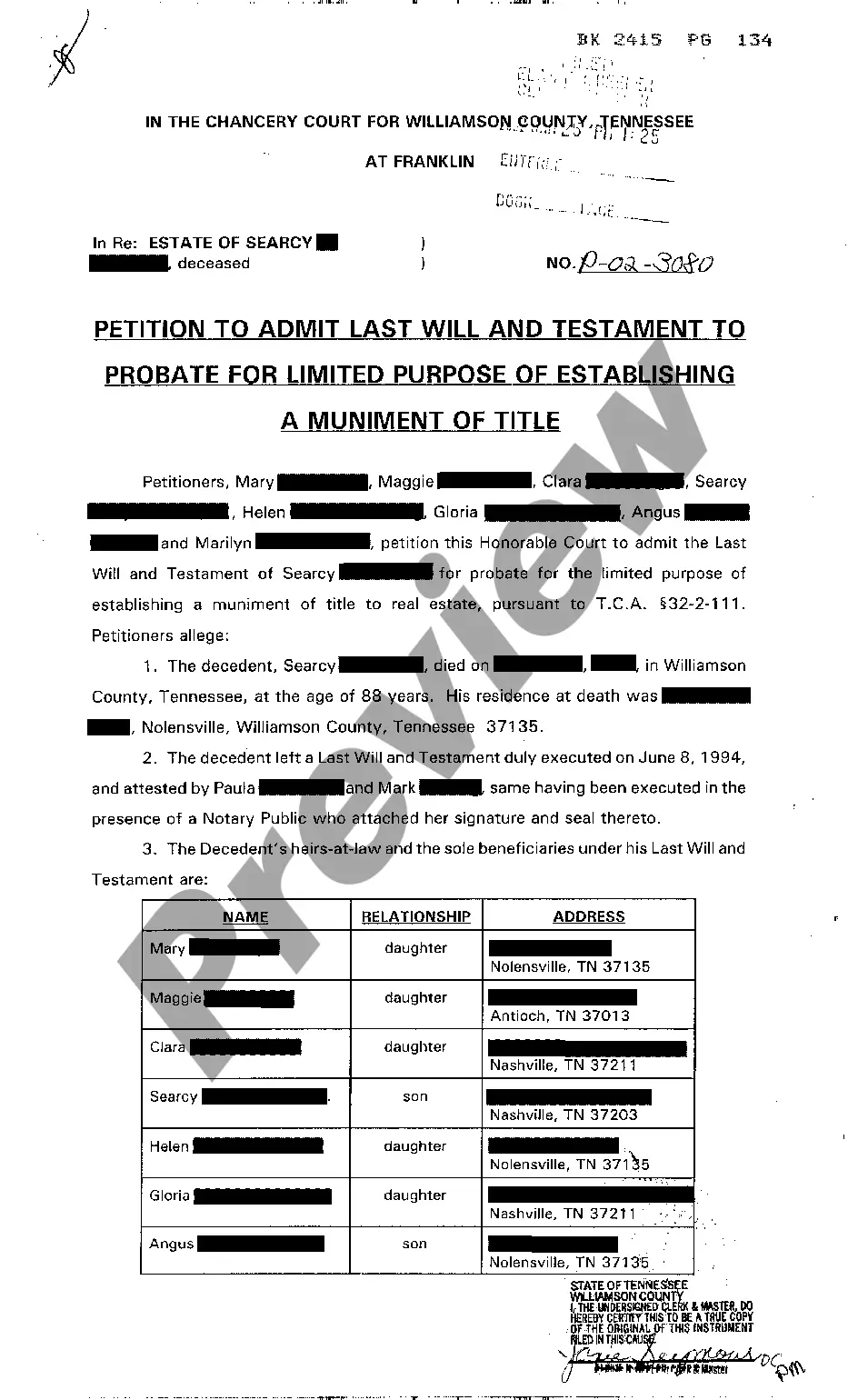

How to fill out Texas Letters?

Regardless of whether it's for professional objectives or personal issues, everyone must deal with legal circumstances at some stage in their life.

Completing legal documents requires meticulous care, beginning with selecting the appropriate form sample.

Once downloaded, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms library available, you never have to waste time searching for the appropriate template online. Use the library’s user-friendly navigation to find the right template for any situation.

- For instance, if you select an incorrect variation of a Georgia 10 Day Repossession Letter With Mortgage, it will be rejected once submitted.

- Thus, it is crucial to have a trustworthy source for legal documents like US Legal Forms.

- If you need to obtain a Georgia 10 Day Repossession Letter With Mortgage sample, adhere to these straightforward steps.

- Acquire the template you require by utilizing the search bar or catalog browsing.

- Review the form’s description to confirm it aligns with your circumstances, state, and locale.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search feature to locate the Georgia 10 Day Repossession Letter With Mortgage sample you seek.

- Obtain the template if it fulfills your criteria.

- If you already possess a US Legal Forms account, click Log in to retrieve previously saved templates in My documents.

- If you do not have an account yet, you can secure the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Georgia 10 Day Repossession Letter With Mortgage.

Form popularity

FAQ

In Georgia, there is no specific number of missed payments that automatically triggers repossession. Typically, lenders will initiate repossession after you miss a few payments and fail to communicate. If you receive a Georgia 10 day repossession letter with mortgage from your lender, it is essential to take it seriously, as it indicates your account is in serious default. We recommend contacting your lender immediately to discuss potential solutions.

In Georgia, a repo man can legally enter private property to repossess a vehicle, but they must not breach the peace while doing so. This means they cannot use force, threats, or intimidation to take possession. To stay informed, it’s beneficial to review your rights and obligations in relation to the Georgia 10 day repossession letter with mortgage. Knowing your rights helps you prepare and respond appropriately during the repossession process.

In Georgia, a lender can start the repossession process if you are at least 10 days behind on your car payment. This time frame allows for the creation of a Georgia 10 day repossession letter with mortgage, which serves as a formal notification of impending repossession. To avoid this situation, it's essential to communicate with your lender early if you anticipate financial difficulties. Staying informed helps you navigate your options.

While asking about Georgia, it’s crucial to note that repossession laws vary by state, including Louisiana. In Louisiana, lenders need a court order before they can repossess a vehicle. However, awareness of the terms in a Georgia 10 day repossession letter with mortgage is essential, especially if you face multi-state financial obligations.

To negotiate with your lender and avoid repossession, communicate openly about your financial situation. You can propose a modified payment plan or request forbearance temporarily. Using resources like US Legal Forms can help you draft a persuasive negotiation letter related to your Georgia 10 day repossession letter with mortgage.

The repossession process in Georgia begins when you fall behind on your payments. Once you are late, the lender can send a Georgia 10 day repossession letter with mortgage, notifying you of their intent. After this notification, if payments are not made, they can take back the vehicle without going through the court.

To reinstate the loan, you must get the agreement of your creditor and pay off everything you owe. If you renegotiate the loan, be aware of additional fees and unfavorable terms. Get any agreement in writing.

Once your auto vehicle is taken, the lender has to mail you a notice within 10 days explaining that your automobile has been repossessed. The notice will explain how you have to pay off the loan and repo fees if you want your car back. It will also tell you how long you have to get your car back.

There is no set time limit on when your car can be repossessed if you have defaulted on your loan. Technically, when you are even one day late with your car payments you are in default of your loan agreement. Do not avoid calls or letters, speak to your lender about your financial situation and be honest.

If you have paid less than 60 percent of the car loan when the creditor takes back the car, the creditor is allowed to keep the car to pay off the debt. However, if you believe the car is worth more than you owe, you have 21 days to object in writing. If you object, the creditor must resell the vehicle.