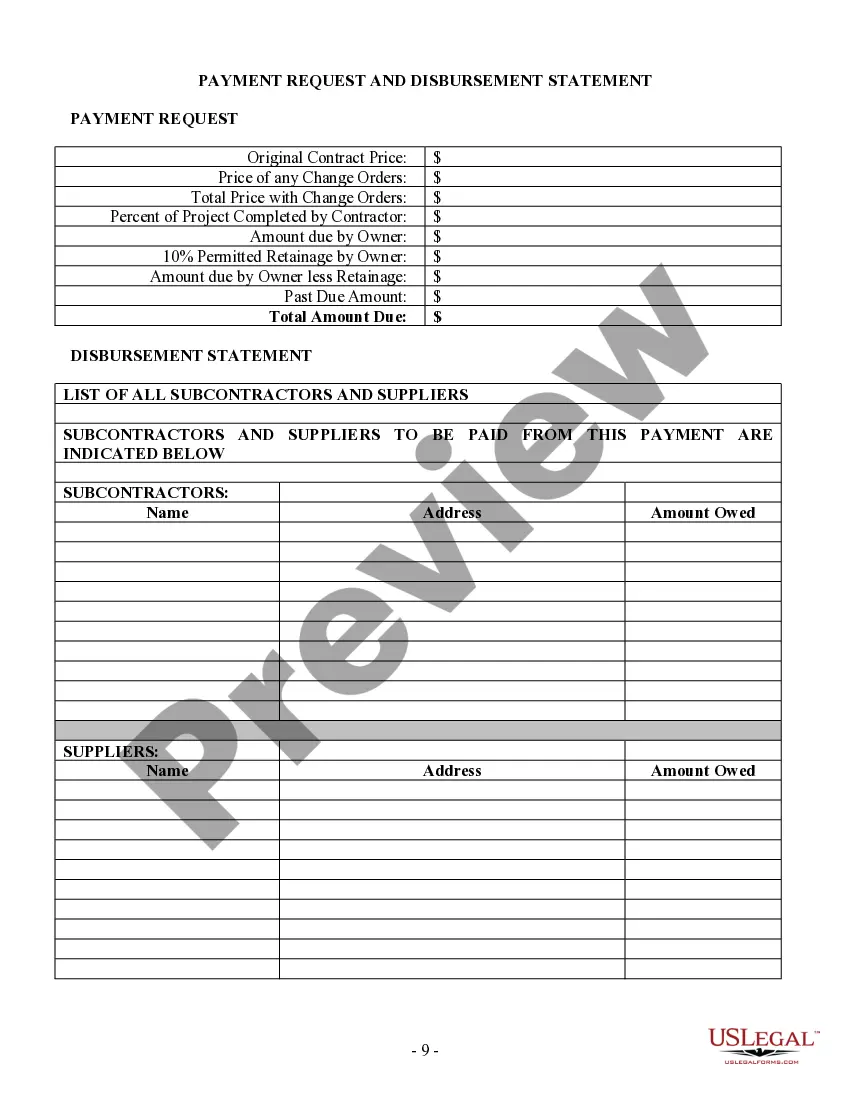

Texas Contract Form Withholding

Description

How to fill out Texas Paving Contract For Contractor?

There's no longer a need to spend hours looking for legal documents to fulfill your local state requirements.

US Legal Forms has compiled all of them in one place and made them more accessible.

Our platform provides over 85,000 templates for various business and personal legal situations categorized by state and purpose.

Completing legal documentation under federal and state laws and regulations is quick and simple with our platform. Try US Legal Forms today to organize your paperwork!

- All forms are expertly crafted and verified for accuracy, ensuring you can acquire a current Texas Contract Form Withholding.

- If you are acquainted with our service and already possess an account, please confirm that your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all stored documents whenever necessary by visiting the My documents tab in your profile.

- If you are using our service for the first time, the process will require a few additional steps to finalize.

- Here is how new users can access the Texas Contract Form Withholding from our catalog.

- Carefully examine the page content to verify it includes the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

A contract employee typically fills out the W-9 form, providing their taxpayer identification information to the hiring entity. Depending on specific circumstances, they may also need to consider the Texas contract form withholding for proper reporting. Using a trusted platform like uslegalforms can help you navigate these forms and ensure compliance with tax regulations.

Yes, Texas has payroll withholding requirements for certain types of payments, particularly for employees and contract workers. Even though Texas does not have a state income tax, the Texas contract form withholding must still be utilized to report federal income tax withholdings and other deductions. Adhering to these requirements helps maintain compliance and avoids potential penalties.

Texas does not impose a state income tax, which means it has no corresponding state tax form like many other states do. However, you may still need to fill out various withholding forms, such as the Texas contract form withholding, to comply with federal regulations and other tax responsibilities. Keeping up-to-date with these forms ensures that you meet your tax obligations efficiently.

On your withholding form, you should provide accurate personal information, including your name, address, and Social Security number. Additionally, specify the number of allowances you are claiming, as this impacts your overall tax withholding. Ensuring accuracy on your Texas contract form withholding is important to avoid issues with tax filings in the future.

State withholding forms are documents required by states to report income tax deductions from employee paychecks. For Texas, the Texas contract form withholding is essential to ensure that proper amounts are withheld for state taxes. These forms are crucial for both employers and contractors, as they help maintain compliance with tax laws and provide a clear record of withholdings.

The Texas C-4 form is a state document used for reporting tax withholding for employees. It plays a crucial role in the Texas contract form withholding process, helping you report and manage the taxes withheld from your payments. When working with contract employees in Texas, ensuring proper use of this form is vital for compliance with state regulations.

Yes, you typically need to issue a 1099 form for contract labor to report payments made to individuals who are not your employees. This requirement is vital for accurate tax reporting and complies with the IRS guidelines. Using the Texas contract form withholding can help streamline this process and ensure all required information is included.

Yes, contract workers may receive tax returns, depending on their income and tax situation. If taxes were withheld using the Texas contract form withholding, they may qualify for a refund. It’s essential to keep track of all income and withholding to determine your eligibility for a tax return.

Filing taxes on contract work involves reporting income on your tax return, specifically on Schedule C for self-employment. Record any taxes withheld using the Texas contract form withholding, which makes your filing process smoother. Keeping precise records of your income and expenses will also benefit you during tax season.

To file taxes for contract labor, you must report your income and expenses as a self-employed individual. Use the Texas contract form withholding to track any taxes withheld from your earnings. Filing your taxes correctly helps you avoid penalties and ensures you receive any eligible refunds.