Texas Contract Form For Gifting A Car

Description

How to fill out Texas Paving Contract For Contractor?

Properly prepared official documents are one of the essential assurances for preventing disputes and lawsuits, but acquiring them without the help of an attorney may require time.

Whether you need to swiftly locate a current Texas Contract Form For Gifting A Car or other forms for job, family, or business events, US Legal Forms is consistently available to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected file. Additionally, you can access the Texas Contract Form For Gifting A Car at any time later, as all documents ever acquired on the platform are stored in the My documents section of your profile. Save both time and money on creating official documents. Experience US Legal Forms today!

- Ensure that the document is appropriate for your needs and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar at the top of the page.

- Press Buy Now when you find the pertinent template.

- Choose a pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (with a credit card or PayPal).

- Select PDF or DOCX format for your Texas Contract Form For Gifting A Car.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

A motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into Texas.

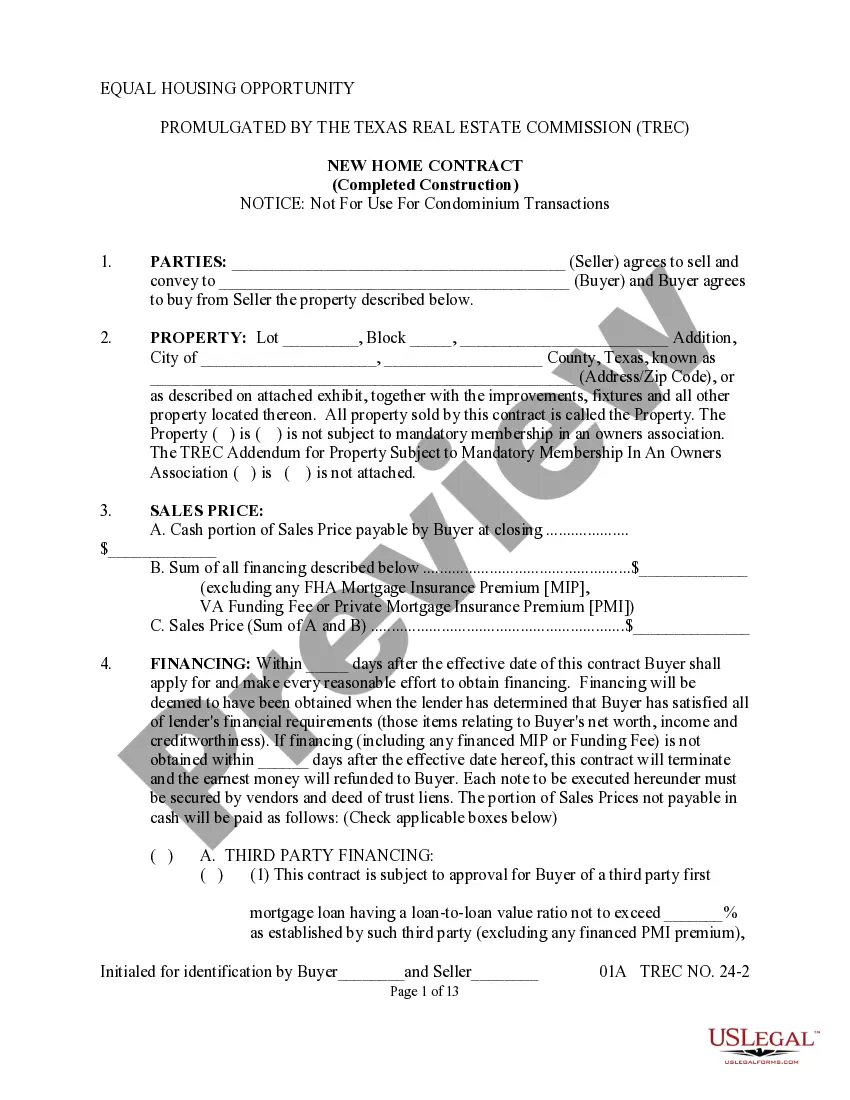

To give a vehicle as a gift to a relative or qualifying 501(c)(3): The signed negotiable title and completed Application for Texas Title and/or Registration (Form 130-U), must be provided to the county tax office to title the vehicle.

If you buy a vehicle from a dealer, the dealer is required to file the title application on your behalf. If you purchase your vehicle from an individual, the seller should provide you with a signed Form 130-U and any other supporting documents so you can file an application with the tax office.

Documents Required In addition to completing Application For Texas Certificate of Title, Form 130-U, both the donor and person receiving the vehicle must complete Form 14-317, Affidavit of motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and recipient.

According to Texas law, when you gift a used car to your family member, the immediate family members must pay a $10 Gift Tax just like the sales tax. You may contact your local county tax office to know more about the gift tax on a car.