Lien Codified Laws For Minors

Description

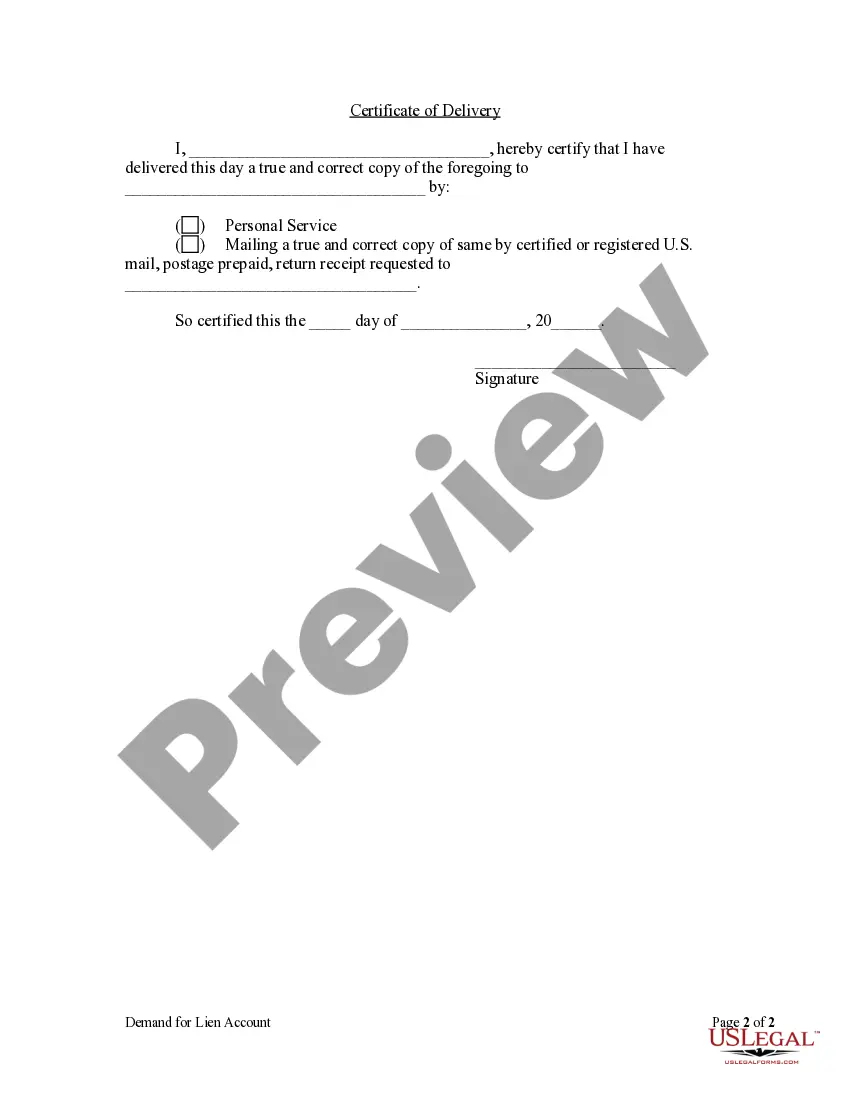

How to fill out South Dakota Demand For Lien Account By Corporation?

Legal documentation handling can be exasperating, even for experienced experts.

When you are seeking a Lien Codified Laws For Minors and lack the time to invest in finding the suitable and current version, the procedures can be overwhelming.

Gain access to a valuable repository of articles, guides, and resources relevant to your circumstances and needs.

Conserve time and energy searching for the documents you require, and leverage US Legal Forms’ enhanced search and Review option to find and retrieve Lien Codified Laws For Minors.

Ensure that the template is authorized in your state or county. Choose Buy Now when you are ready. Select a subscription option. Download the format you need, and Download, complete, eSign, print, and send your documents. Take advantage of the US Legal Forms online library, backed by 25 years of experience and reliability. Change your routine document handling into a straightforward and user-friendly experience today.

- If you possess a monthly subscription, Log In to your US Legal Forms account, locate the form, and retrieve it.

- Review the My documents section to view the documents you have previously downloaded and manage your files as needed.

- If this is your first encounter with US Legal Forms, create an account to gain unlimited access to all the platform’s benefits.

- Follow these steps after locating the required form.

- Verify it is the correct document by previewing it and checking its description.

- Utilize state- or county-specific legal and business documents.

- US Legal Forms meets any requests you may have, ranging from personal to corporate documents, all in one location.

- Utilize sophisticated tools to complete and manage your Lien Codified Laws For Minors.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers' credit information and access to their credit reports. It was passed in 1970 to address the fairness, accuracy, and privacy of the personal information contained in the files of the credit reporting agencies.

The CFPB's changes to the Summary include non-substantive revisions to correct contact information for various federal agencies. The CFPB also revised the Summary to update references to obsolete business types, such as ?Federal Land Banks,? and to make other technical corrections.

Major Amendments to the Fair Credit Reporting Act (FCRA) Since the enactment of the original act, two major amendments have been made: the Consumer Credit Reporting Reform Act of 1996 and the Fair and Accurate Credit Transactions Act of 2003 (?FACT ACT? or ?FACTA?).

The Dodd-Frank Act also amended two provisions of the FCRA to require the disclosure of a credit score and related information when a credit score is used in taking an adverse action or in risk-based pricing.

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer. [1]

In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

Major Amendments to the Fair Credit Reporting Act (FCRA) Since the enactment of the original act, two major amendments have been made: the Consumer Credit Reporting Reform Act of 1996 and the Fair and Accurate Credit Transactions Act of 2003 (?FACT ACT? or ?FACTA?).