Power Attorney For Irs

Description

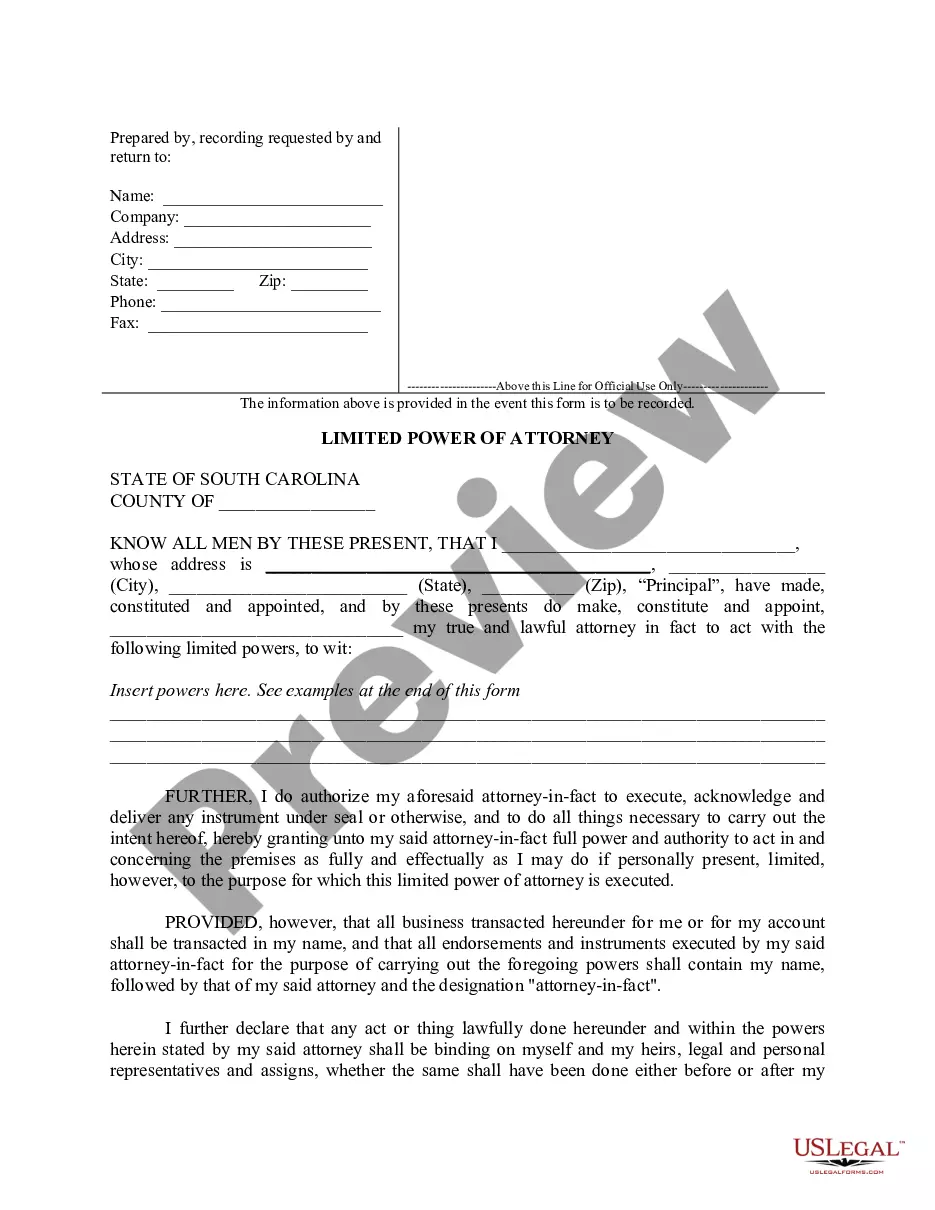

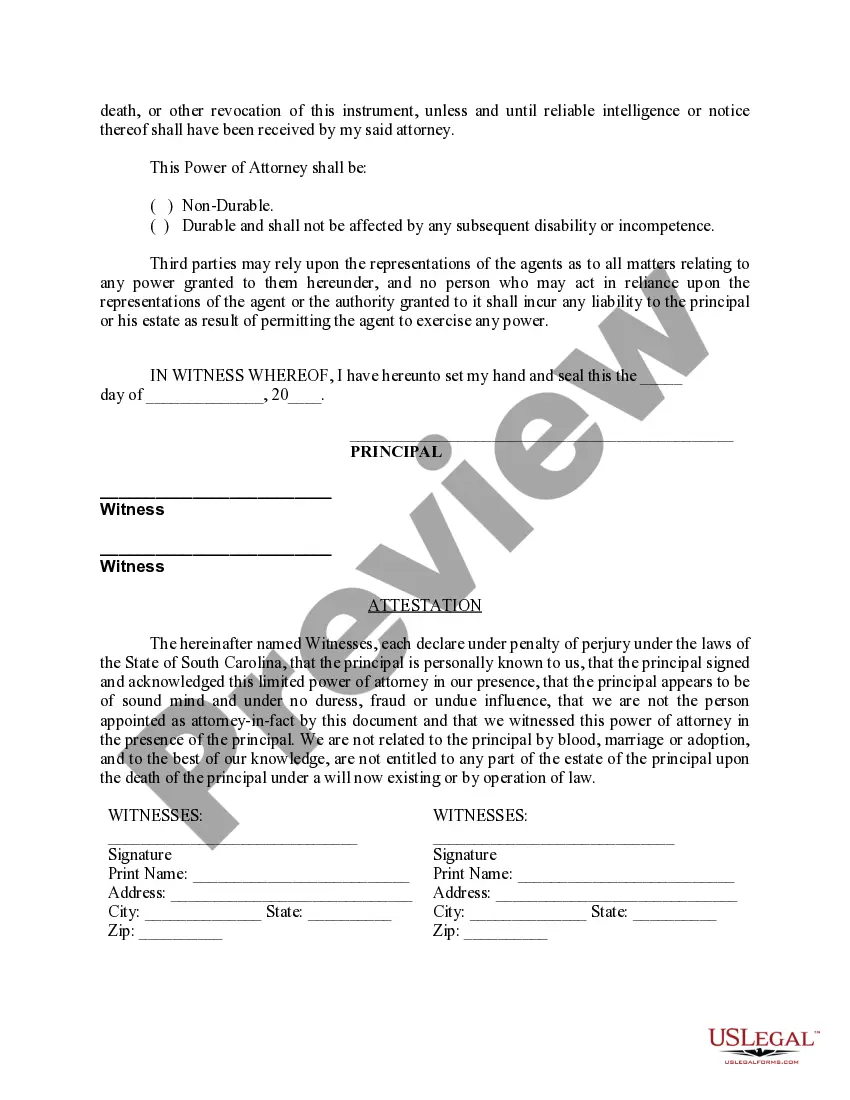

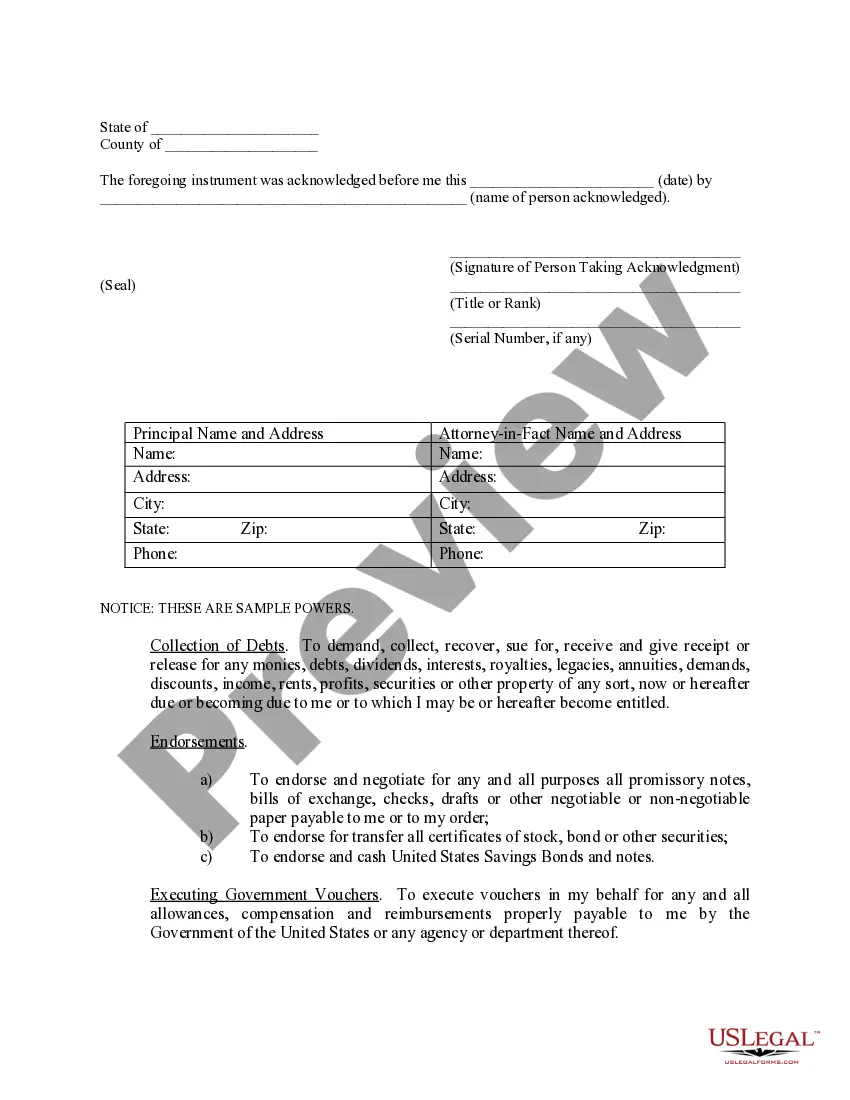

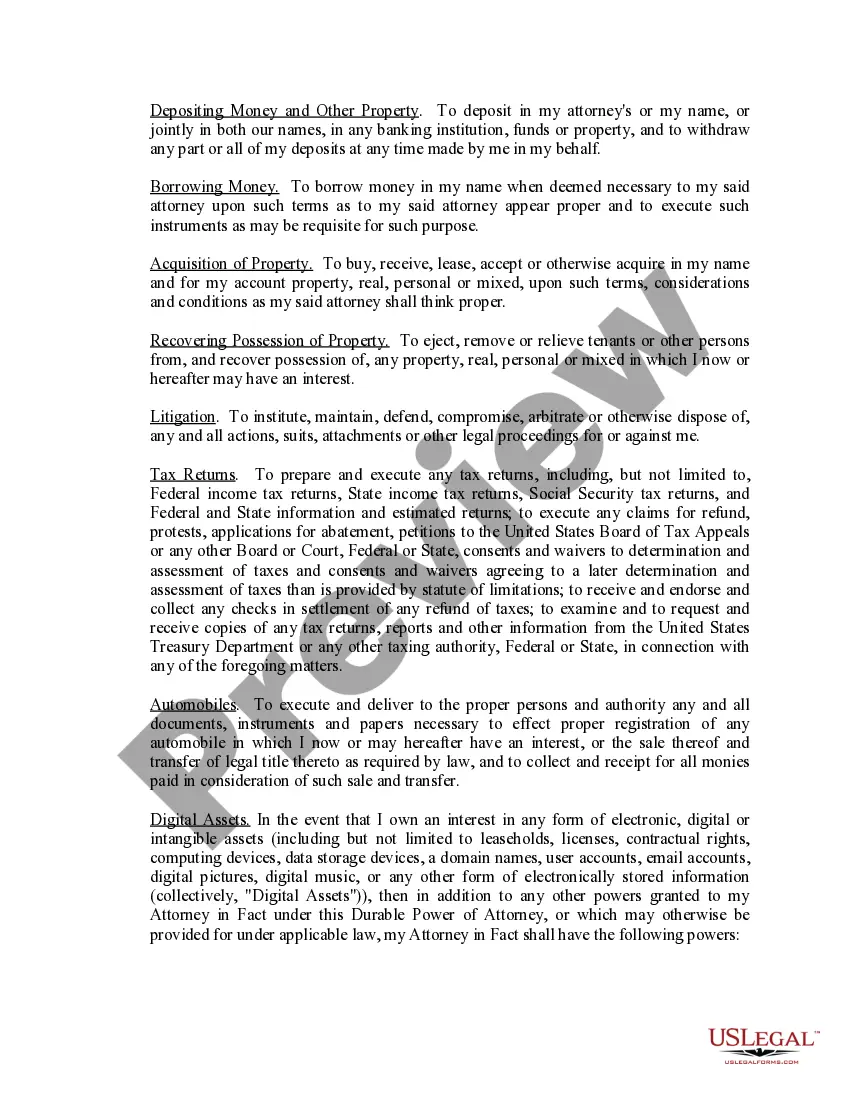

How to fill out South Carolina Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you are an existing US Legal Forms user, log in to your account and download your required form template by clicking the Download button. Ensure your subscription is active; if not, renew it as per your payment plan.

- For new users, start by checking the Preview mode and form description to confirm you have selected the correct document that aligns with your needs and local jurisdiction.

- If you need a different template, use the Search tab above to identify the appropriate form and assess its relevance before moving forward.

- Proceed to purchase the document by clicking on the Buy Now button and selecting your preferred subscription plan. Register an account for full access to the library.

- Complete your purchase by entering your credit card information or utilizing your PayPal account for the subscription payment.

- Finally, save your form to your device. You can access it anytime from the My Forms section of your profile.

With US Legal Forms, you gain access to over 85,000 templates, more than competitors, at a similar cost. The platform is designed to empower individuals and attorneys with precise and legally sound documents.

Take the first step towards managing your tax documents effectively. Start using US Legal Forms today!

Form popularity

FAQ

The IRS typically does not accept a general power of attorney for tax matters. They prefer specific forms such as IRS Form 2848, which is designed to grant a limited power of attorney for IRS purposes. Ensuring you use the correct form will facilitate your representation, so consider utilizing services like USLegalForms for accurate documentation.

Filing taxes as power of attorney involves submitting your client's tax returns on their behalf. You must have a valid power attorney for IRS on file, granting you the necessary authority. Ensure that you follow all IRS guidelines while filing, as you will be responsible for all financial information shared with the IRS during this process.

The IRS usually processes a power of attorney for IRS within a few weeks, but it can vary depending on their workload. Once submitted, they will review the documentation to ensure everything is in order. To avoid delays, ensure you fill out all necessary forms correctly; using a platform like USLegalForms can help streamline this and minimize waiting time.

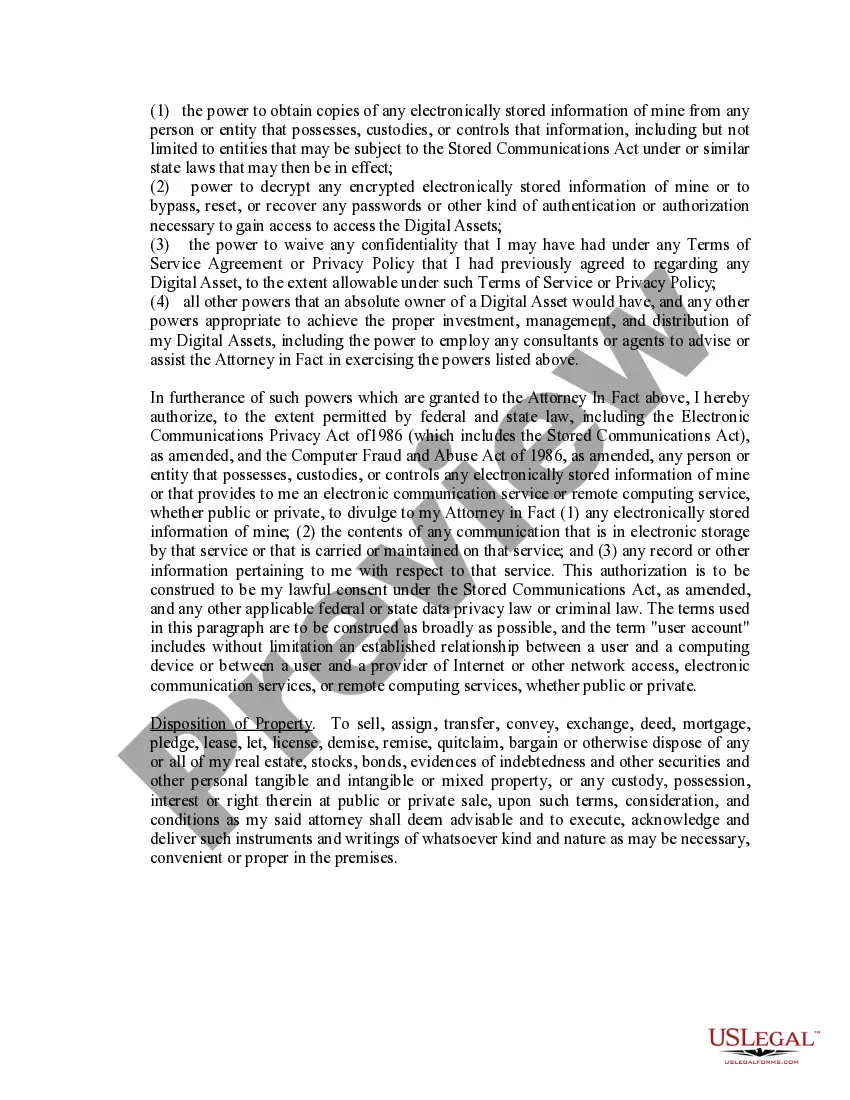

Filling out a power of attorney form requires careful attention to detail. You need to provide information about yourself, the individual you are designating, and the specific powers you are granting. Using a reliable platform like USLegalForms can simplify this process, offering clear templates and guidance to ensure you accurately complete your power attorney for IRS.

A power of attorney for IRS does not have a strict time limit, but it typically covers specific tax years or a defined period as specified in the document. You can grant powers for current tax matters or for a specific duration depending on your need. If you have ongoing tax commitments, it’s advisable to keep the POA updated to ensure representation over time.

Yes, the federal government recognizes power of attorney documents. This legal instrument grants someone the authority to act on your behalf in various matters, including financial and legal decisions. When it comes to tax-related issues with the IRS, having a power attorney for IRS allows a designated person to handle your tax submissions and communications efficiently.

Yes, the IRS recognizes power of attorney for IRS purposes. When you appoint someone as your attorney-in-fact, they can represent you in tax matters, allowing them to interact with the IRS on your behalf. This includes submitting forms, responding to inquiries, and managing your tax affairs effectively. Thus, utilizing a power attorney for IRS can simplify your tax experience.

To submit a power of attorney to the IRS, you need to complete IRS Form 2848 accurately. You can either mail this form to the appropriate address or fax it directly to the IRS. For best results, consider utilizing the tools on USLegalForms to streamline your preparation and ensure compliance.

The IRS does not accept digital signatures for power of attorney documents. Handwritten signatures are required to authenticate the document. It is essential to follow this guideline carefully to ensure that your power attorney for IRS is processed without issues.

To submit a power of attorney for the IRS, you'll need to complete Form 2848, which can be sent via mail or fax. Make sure to include all required information and signatures. Using resources from USLegalForms can simplify this process and ensure that your submission meets IRS standards.