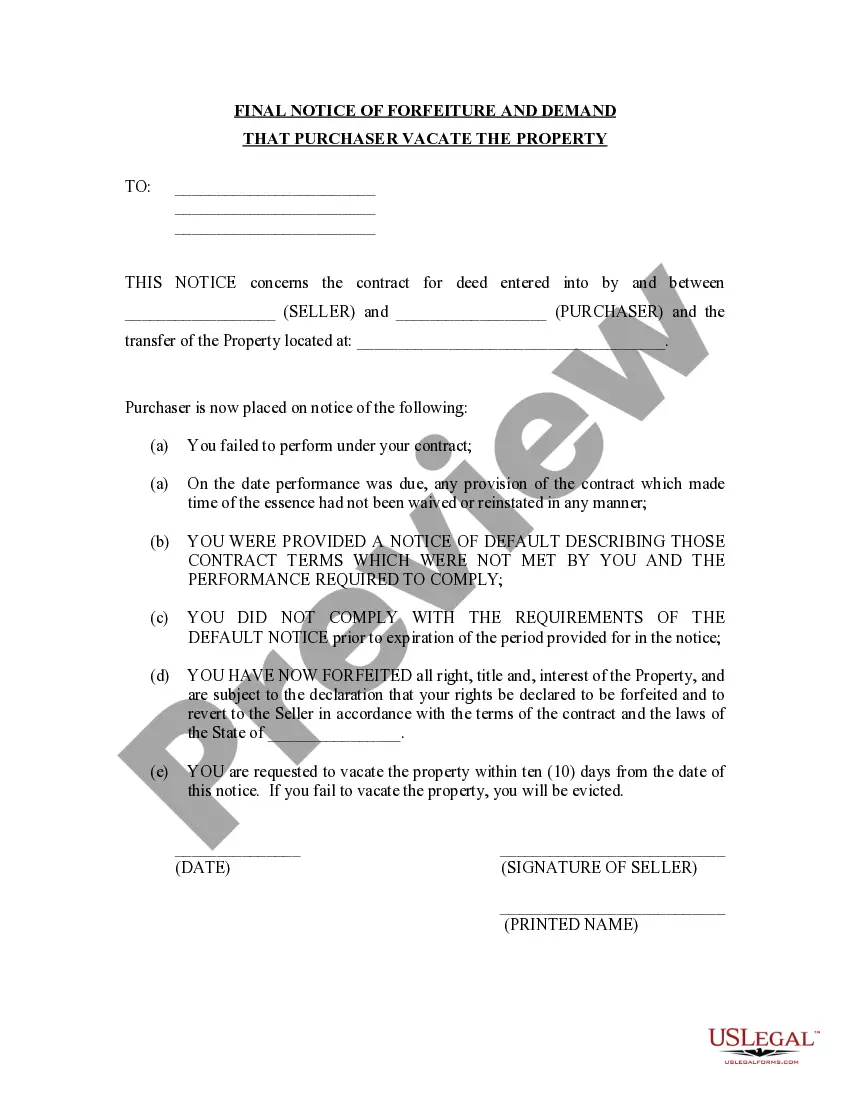

The Final Notice of Forfeiture and Demand Buyer Vacate Property form notifies the Purchaser, after all prior notices of breach have expired, that Seller has elected to cancel the contract for deed in accordance with its terms and all past payments made by Purchaser are now considered forfeited and any future occupancy of property will result in action by the court.

South Carolina Notice Withholding Form

Description

How to fill out South Carolina Notice Withholding Form?

Steering through the red tape of official documents and templates can be difficult, particularly if one does not engage in this professionally.

Even selecting the appropriate template to acquire a South Carolina Notice Withholding Form will be laborious, as it must be both legitimate and precise to the final digit.

However, you will need to invest considerably less time identifying a suitable template from a reliable source.

Acquire the appropriate document in just a few simple steps: Enter the title of the paperwork in the search box. Locate the relevant South Carolina Notice Withholding Form from the list of results. Review the description of the sample or open its preview. When the template matches your requirements, click Buy Now. Continue to choose your subscription plan. Use your email and create a password to register for an account at US Legal Forms. Select a credit card or PayPal payment method. Download the template document onto your device in the format you prefer. US Legal Forms will save you time and energy determining whether the form you found online is appropriate for your needs. Set up an account and gain unrestricted access to all the templates you require.

- US Legal Forms is a site that streamlines the process of locating the correct forms online.

- US Legal Forms is a singular source you require to access the latest examples of documents, verify their usage, and download these examples for completion.

- This is a repository comprising more than 85K forms applicable in diverse fields.

- When looking for a South Carolina Notice Withholding Form, you will not have to question its validity since all documents are authenticated.

- Establishing an account at US Legal Forms will ensure that all the required documents are at your fingertips.

- You can save them in your history or incorporate them into the My documents collection.

- You can access your saved documents from any device by clicking Log In at the library site.

- If you do not possess an account yet, you can always re-search for the template you need.

Form popularity

FAQ

Yes, South Carolina offers a state income tax form that residents use for state tax filings. Most commonly, residents use Form SC1040 to report their income and calculate their tax liability. Completing the South Carolina notice withholding form correctly helps prepare you for submitting your state income tax form efficiently.

South Carolina does have a state payroll tax, which includes state income tax withholding from employees' wages. Employers are responsible for withholding these taxes and remitting them to the state. This process ensures that state tax obligations are met, facilitating public services and infrastructure in the state.

Yes, South Carolina does have a state tax withholding form, known as the South Carolina W-4. This form allows employees to instruct their employers on the amount of state tax to withhold from their earnings. It is important to complete and submit the South Carolina notice withholding form accurately to ensure proper tax deductions and compliance with state regulations.

Applying for a South Carolina withholding number is a straightforward process. You can obtain it by completing the South Carolina Form SCDOR-111, which you can find on the South Carolina Department of Revenue website. Once you submit this form, your application will be processed, giving you a unique withholding number to use for state tax purposes.

To fill out a South Carolina notice withholding form, start by gathering the necessary information, such as your personal details and employment information. Then, carefully complete the form, ensuring that you provide accurate information about your income and withholding allowances. After filling out the form, submit it to your employer to facilitate proper tax withholding from your paychecks.

Filling out your withholding form involves stating your personal details, including your name and Social Security number, as noted on the South Carolina notice withholding form. Clearly indicate the number of allowances you are claiming which directly affects your withholding amounts. Carefully follow the instructions provided and double-check your entries. If you need assistance, platforms like USLegalForms can offer valuable resources to help you complete your form correctly.

To set up employee withholding, begin by obtaining the South Carolina notice withholding form, which is an essential document for this process. Fill out the required information for each employee, including their allowances and exemptions. Ensure you keep updated records for all employees to comply with South Carolina tax laws. For convenience, consider using USLegalForms to access the necessary forms and guidance.

Filling out the SC W4 form involves collecting your personal and financial information to determine the best withholding amount. Use the South Carolina notice withholding form as a guide for claiming allowances and exemptions for your situation. Provide accurate details to avoid over- or under-withholding on your taxes. Review your form carefully before submitting it to ensure correctness.

You can register for withholding in South Carolina by completing the South Carolina notice withholding form. This step establishes your business’s tax obligations regarding employee wages. Registration can be done online through the South Carolina Department of Revenue's website, which simplifies the process. Ensure you have all necessary business information handy for smooth registration.

To fill out a South Carolina employee's withholding allowance certificate, first obtain the official form, which is often referred to as the South Carolina notice withholding form. Next, provide your personal information, including your name, address, and Social Security number. Indicate the number of allowances you wish to claim, which aids in calculating your correct tax withholding amount. Submit the completed certificate to your employer for processing.