Pennsylvania General Partnership With The Us

Description

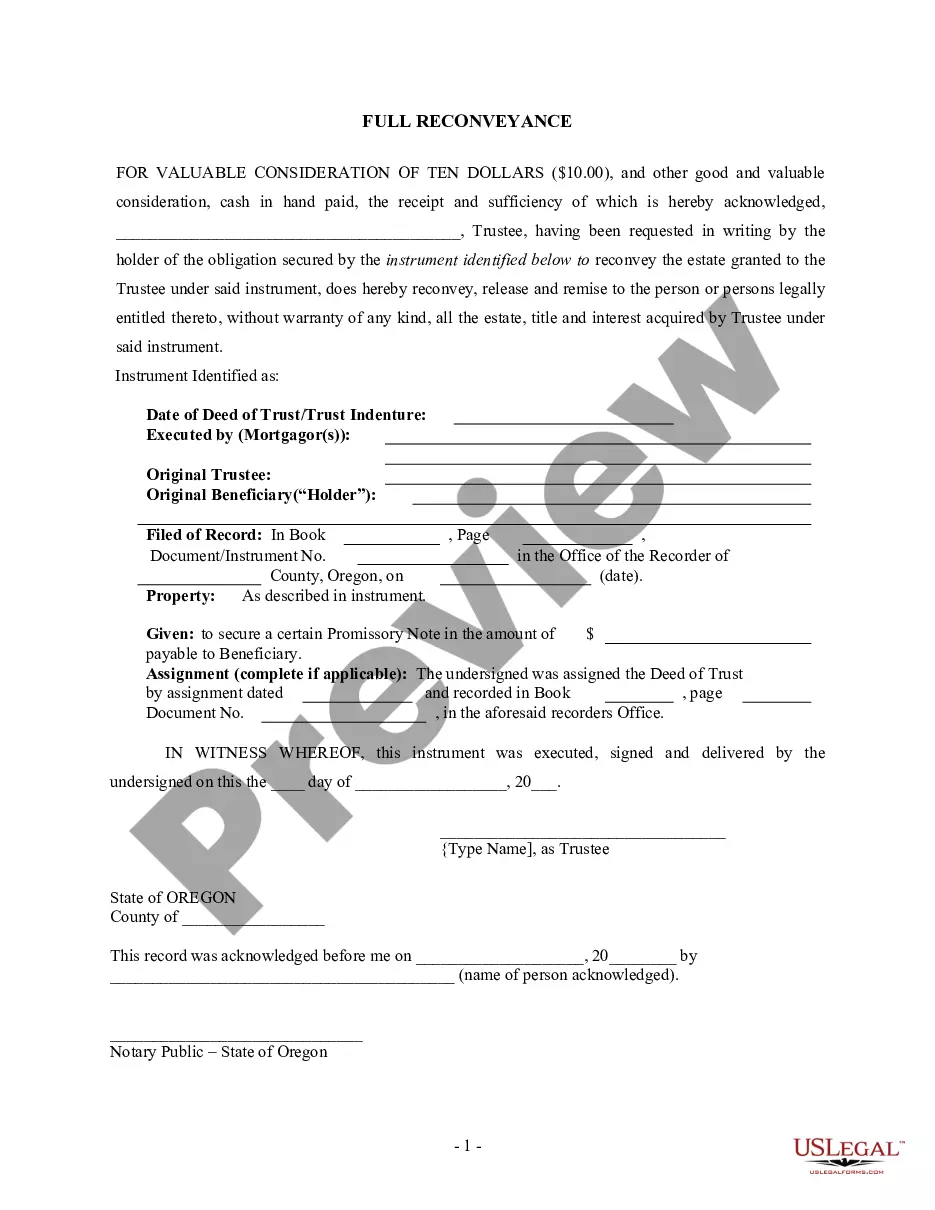

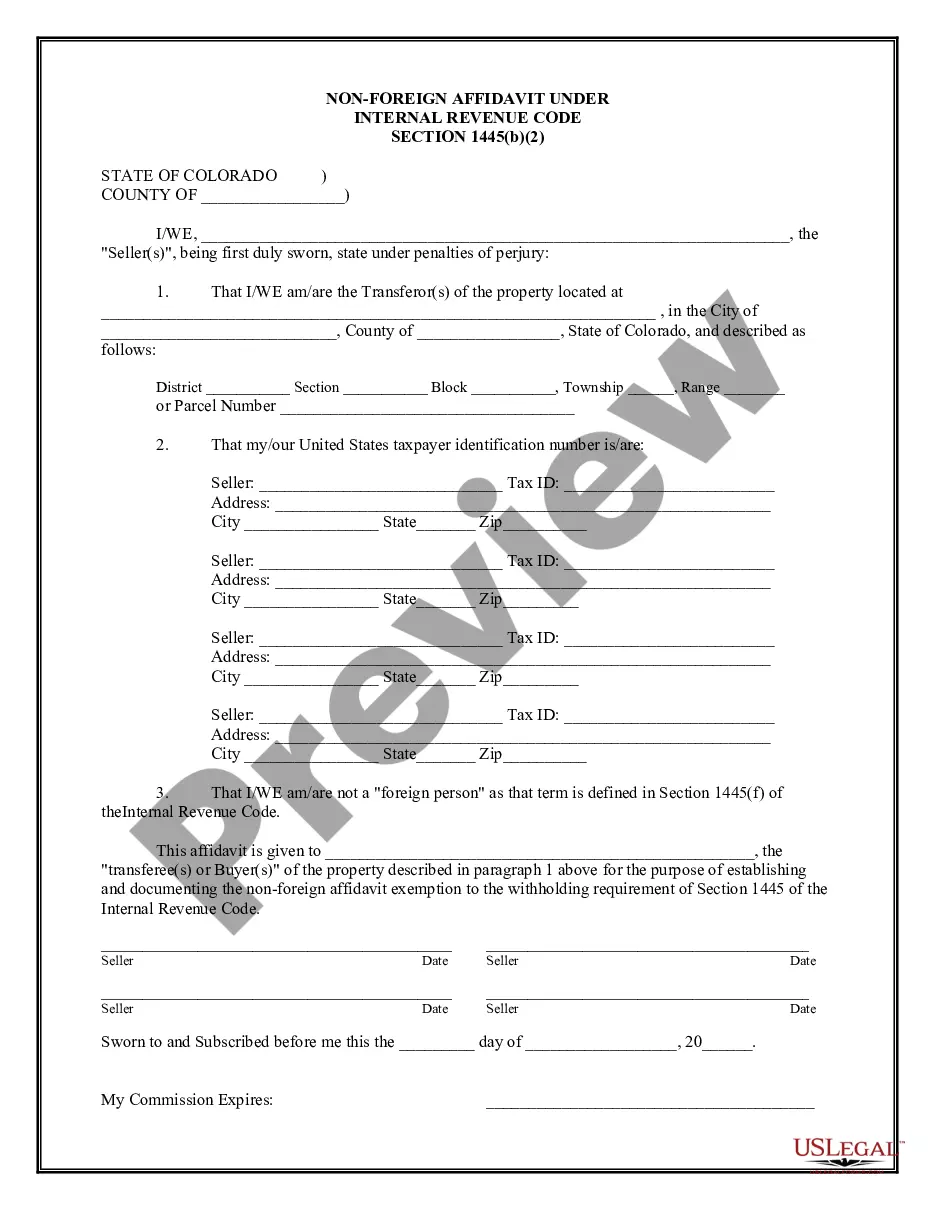

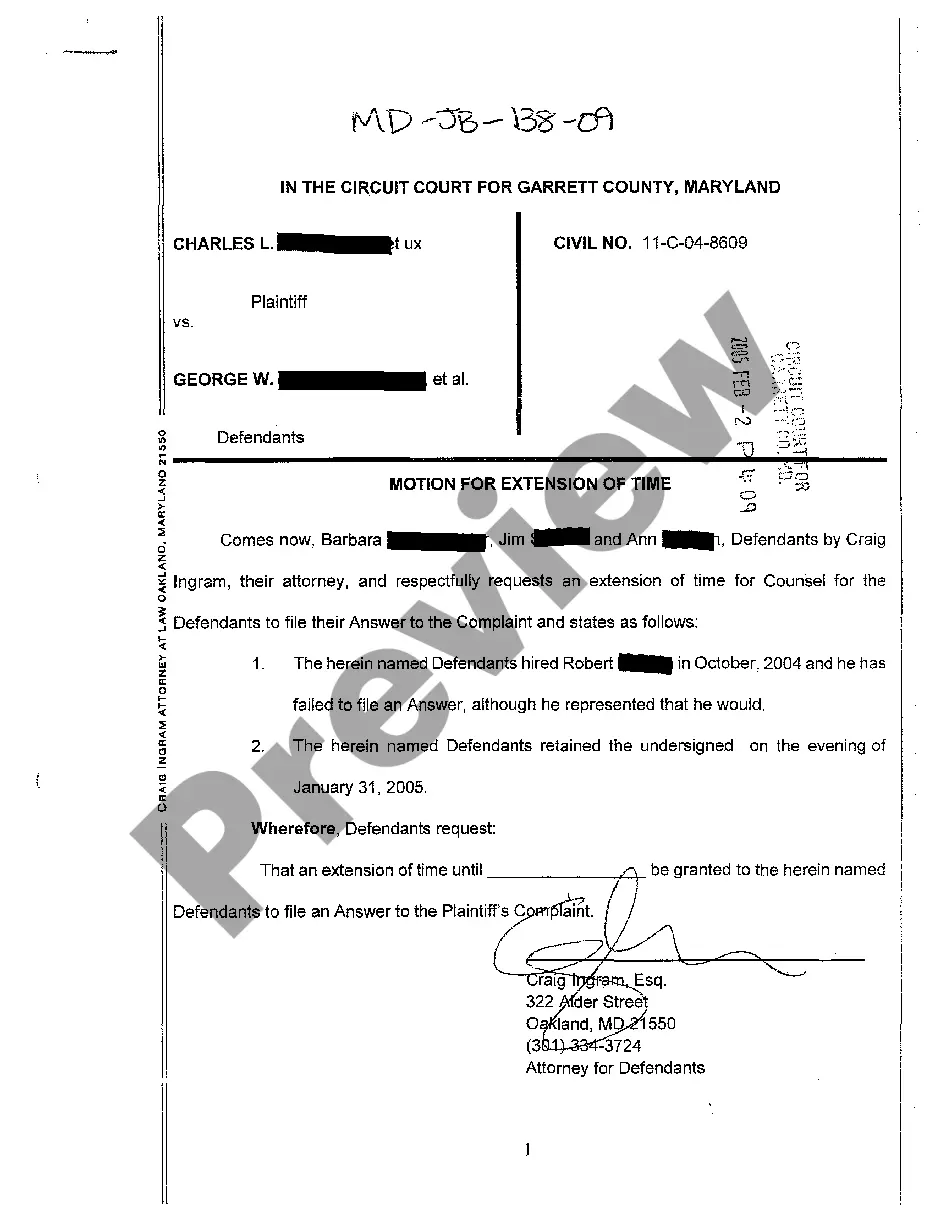

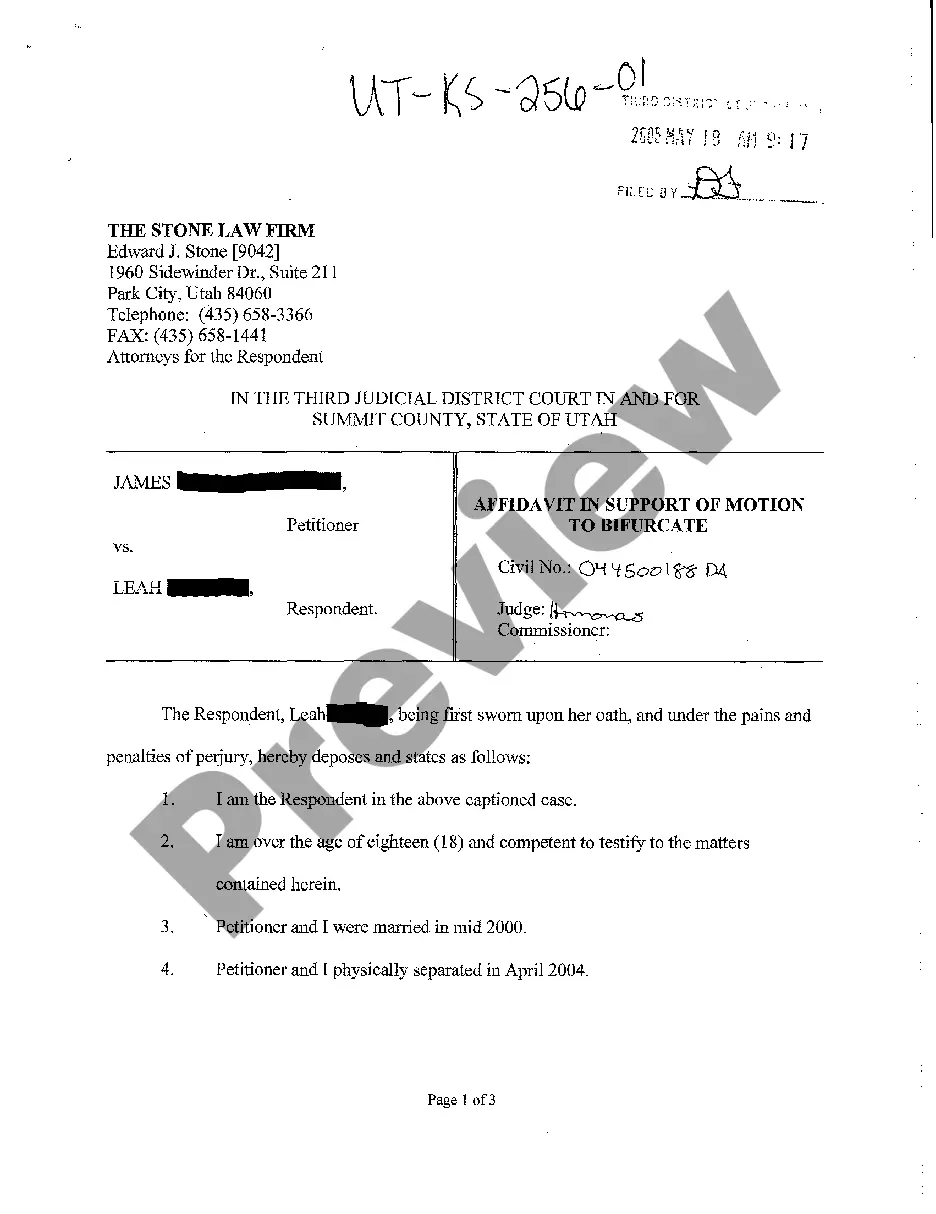

How to fill out Pennsylvania General Partnership Package?

- Log into your US Legal Forms account if you're already a user to access your downloaded templates. Ensure your subscription is current.

- For new users, check the Preview mode and description of the desired form. Make sure it fits your requirements and complies with Pennsylvania regulations.

- Search for alternate templates if necessary. If the initial choice doesn't fit, use the Search option to find another that meets your needs.

- Proceed to purchase the required document by clicking the Buy Now button. Select an appropriate subscription plan and create an account if you haven't already.

- Complete your transaction by entering your payment details, either through credit card or PayPal.

- Download the form to your device for completion. You can always revisit it later via the My Forms section of your profile.

Once you've downloaded and completed your forms, you will be well on your way to establishing your Pennsylvania general partnership. Remember, having a legally sound document is crucial for the success of your business.

Ready to get started? Visit US Legal Forms today to access a comprehensive library of legal documents and expert assistance!

Form popularity

FAQ

Filling out a partnership form for a Pennsylvania general partnership with the us involves several straightforward steps. Start by gathering all essential information about your business and its partners, including names, addresses, and contributions. Visit a trusted platform like US Legal Forms to access the correct form tailored for Pennsylvania. Ensure you carefully follow the instructions provided on the form, and don’t hesitate to reach out for support if needed.

Partnerships offer certain benefits over LLCs, including simpler management structures and direct profit distribution. In a Pennsylvania general partnership with the US, partners can make quick decisions without formalities that an LLC may require. Additionally, partnerships do not involve the same level of regulatory oversight as LLCs, potentially resulting in lower administrative costs. These factors can make partnerships appealing for some entrepreneurs.

One key disadvantage of a general partnership is the personal liability that partners face for business debts and obligations. This risk can deter potential partners and investors. Additionally, conflicts among partners can arise, complicating decision-making and operations. Understanding these challenges is crucial when considering a Pennsylvania general partnership with the US.

The main difference between a general partnership and an LLC lies in liability protection and structure. A general partnership offers no liability protection, meaning partners are personally responsible for debts and legal actions. In contrast, an LLC provides a shield against personal liability, protecting individual assets. Choosing between these structures involves weighing your priorities regarding liability versus management flexibility in a Pennsylvania general partnership with the US.

In Pennsylvania, a general partnership does not require formal registration with the state. However, partners may choose to file a certificate of partnership to enhance credibility or to protect the partnership name. It is important to adhere to local regulations and ensure that any necessary permits or licenses are obtained. Consulting resources like US Legal Forms can aid in understanding the registration process.

A general partnership in the US is a business arrangement where two or more individuals share ownership and management responsibilities. In this structure, partners work together for profit and share both profits and losses equally or as agreed. This type of partnership allows for greater flexibility compared to a corporation but does come with personal liability for each partner. Understanding the implications of a Pennsylvania general partnership with the US is essential before starting.

Whether an LLC is better than a Pennsylvania general partnership with the US depends on your specific business needs. LLCs provide limited liability protection, meaning owners are not personally liable for business debts. In contrast, a general partnership exposes partners to personal liability, which can be a significant risk. Each structure has its advantages, so consider your goals and consult with legal experts.

Yes, Pennsylvania partnerships can benefit from federal extensions. However, it's essential to ensure that your partnership complies with both federal and state requirements when filing for such extensions. This means staying informed on taxation and reporting obligations to avoid penalties. To simplify the process of managing your Pennsylvania general partnership with the us and to ensure compliance, consider utilizing the services of US Legal Forms, which provides valuable insights and tools.

To form a general partnership, gather a group of individuals who share a common business interest and are eager to collaborate. Next, draft a partnership agreement that outlines the key terms of your partnership, such as management duties and profit-sharing. Once agreed upon, you may want to file for a fictitious business name if operating under a different name. For more guidance on this process, US Legal Forms offers various resources to assist in establishing a Pennsylvania general partnership with the us.

Forming a general partnership in Pennsylvania begins with selecting partners who are willing to share the business's responsibilities. Next, partners should create a partnership agreement detailing the structure and management of the business. Once these steps are complete, consider registering your partnership name if you are not using the legal names of the partners. US Legal Forms can help you navigate this formation process efficiently for your Pennsylvania general partnership with the us.