Pennsylvania Lien Waiver Form For Subcontractor

Description

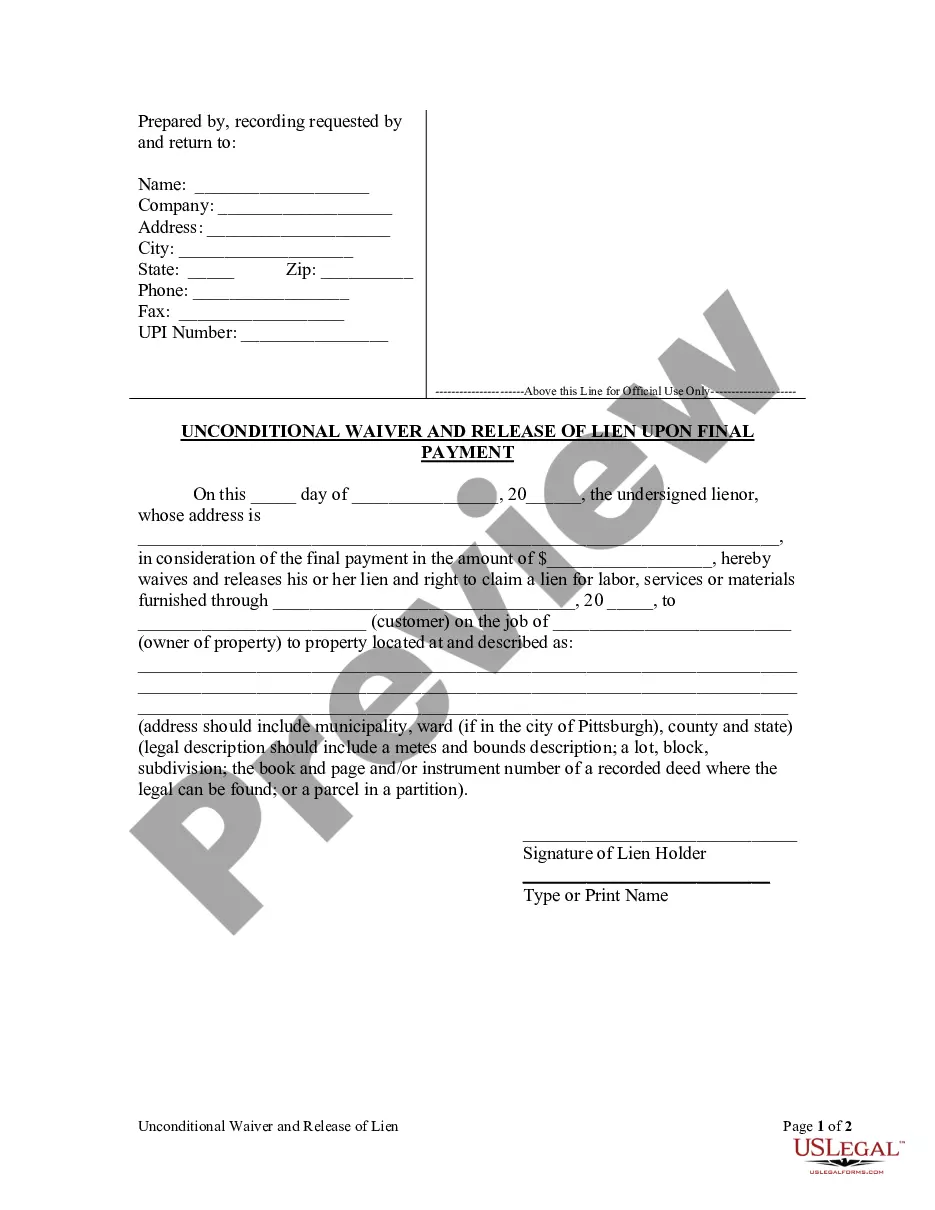

How to fill out Pennsylvania Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

Individuals typically link legal documentation with something intricate that only an expert can manage.

In a specific sense, this is correct, as preparing the Pennsylvania Lien Waiver Form for Subcontractor requires considerable knowledge of subject matter, including state and local laws.

However, with US Legal Forms, situations have become easier: pre-made legal documents for any personal and business circumstance relevant to state legislation are compiled in a single online directory and are now accessible to everyone.

Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once acquired, they are stored in your profile. You can access them at any time via the My documents tab. Explore all the advantages of using the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85,000 current documents organized by state and application area, so finding the Pennsylvania Lien Waiver Form for Subcontractor or any other specific template only takes a few moments.

- Previously registered individuals with an active subscription must Log In to their account and click Download to retrieve the document.

- New users of the service will need to register for an account and subscribe before they can download any materials.

- Here is a detailed guide on how to obtain the Pennsylvania Lien Waiver Form for Subcontractor.

- Review the content on the page thoroughly to confirm it meets your requirements.

- Read the form description or examine it through the Preview feature.

- If the earlier template does not meet your needs, look for another sample using the Search bar above.

- When you identify the correct Pennsylvania Lien Waiver Form for Subcontractor, click Buy Now.

- Choose a pricing plan that aligns with your requirements and financial situation.

- Create an account or Log In to move on to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Select the format for your document and click Download.

Form popularity

FAQ

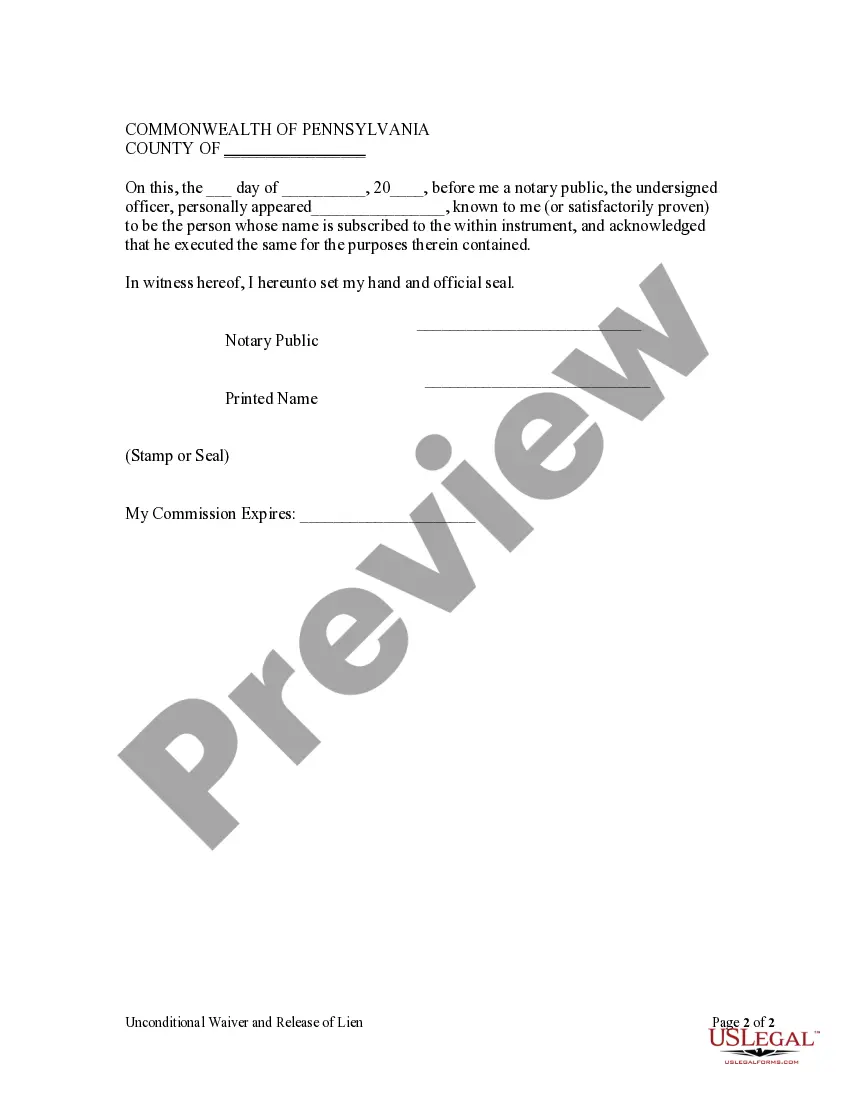

Lien waivers do not need to be notarized to be effective in Pennsylvania.

Steps to file a mechanics lien in PennsylvaniaFill out the Pennsylvania mechanics lien form. Fill out the PA lien form completely and accurately.File your lien claim with the county recorder.Serve a copy of the lien on the property owner.15-Feb-2022

The deadline to file a Pennsylvania mechanics lien claim is 6 months from the claimant's last date of furnishing labor and/or materials to the project. This is a hard deadline, and is strictly enforced.

The waivers need not be notarized. It is sufficient that it is in writing. The taxpayer is bound to submit his duly executed waiver to the officers of the Bureau and to retain his copy of the accepted waiver.

Waiver of Lien Most of the standard form building contracts make provision for the Employer to provide a payment guarantee to the Contractor in return for which the Contractor waives his lien over any work done in terms of that contract.