Operating Agreement Llc Pa Withholding Tax

Description

How to fill out Pennsylvania Limited Liability Company LLC Operating Agreement?

Creating legal documents from the ground up can occasionally be somewhat daunting.

Some situations could necessitate extensive research and significant financial investment.

If you're searching for a more straightforward and budget-friendly method of producing Operating Agreement Llc Pa Withholding Tax or any other forms without complications, US Legal Forms is always accessible.

Our online repository of over 85,000 updated legal documents covers nearly every facet of your financial, legal, and personal matters.

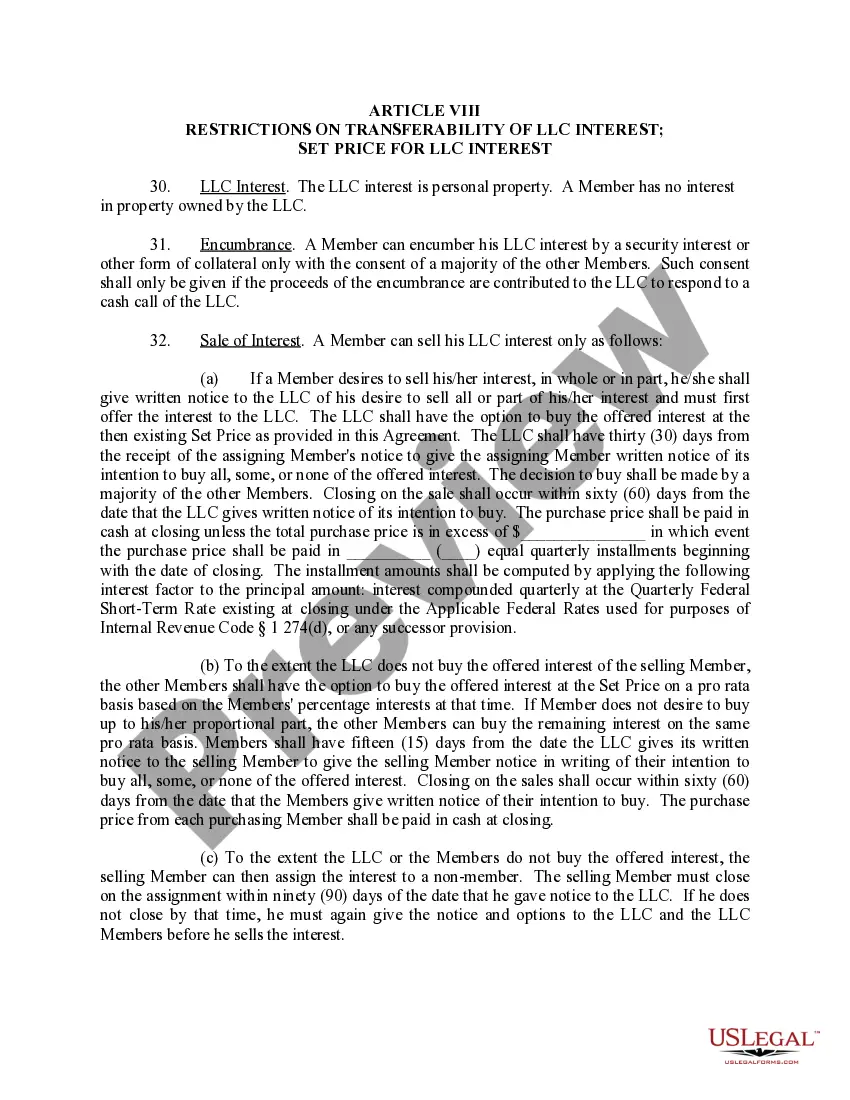

However, before you proceed to download the Operating Agreement Llc Pa Withholding Tax, keep these suggestions in mind: Review the document preview and descriptions to ensure you have located the form you need, verify that the form you select adheres to the laws and regulations of your state and county, choose the appropriate subscription option to purchase the Operating Agreement Llc Pa Withholding Tax, download the document, and then complete, validate, and print it out. US Legal Forms has a strong reputation and over 25 years of experience. Join us today and make form completion a simple and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-specific templates thoughtfully prepared for you by our legal professionals.

- Utilize our platform whenever you require dependable services that allow you to easily locate and download the Operating Agreement Llc Pa Withholding Tax.

- If you're already familiar with our site and have set up an account previously, simply Log In to your account, select the form, and download it or retrieve it at any later time in the My documents section.

- No account yet? No worries. It only takes a few minutes to register and browse the library.

Form popularity

FAQ

Pennsylvania law requires every employer located or transacting business in Pennsylvania to withhold Pennsylvania personal income tax from compensation of resident employees for services performed either within or outside Pennsylvania, and from compensation of nonresident employees for services performed within ...

Pennsylvania Individual Tax The Pennsylvania individual income tax withholding rate remains at 3.07% for 2021.

Business owners in Pennsylvania are not legally required to write an operating agreement for their LLCs. However, most LLC managing members choose to do so, as it is a highly recommended practice.

Pennsylvania State Income Tax You will file using Form PA-20S. Single member LLCs, only have to pay the state's personal income tax, which is 3.07%. If your LLC is filing as a C-corp, you pay Pennsylvania's 9.99% corporate net income tax rate and the state's corporate loans tax, which is 4 mill on each dollar.

For each payroll period, an employer must calculate the tax to be withheld from an employee's compensation by multiplying such compensation subject to withholding by the current per- centage rate, 3.07%, which can be found by visiting the department's Online Customer Service Center at .revenue.pa.gov.