Creating An Llc In Pennsylvania Withdraw Foreign

Description

How to fill out Pennsylvania Limited Liability Company LLC Operating Agreement?

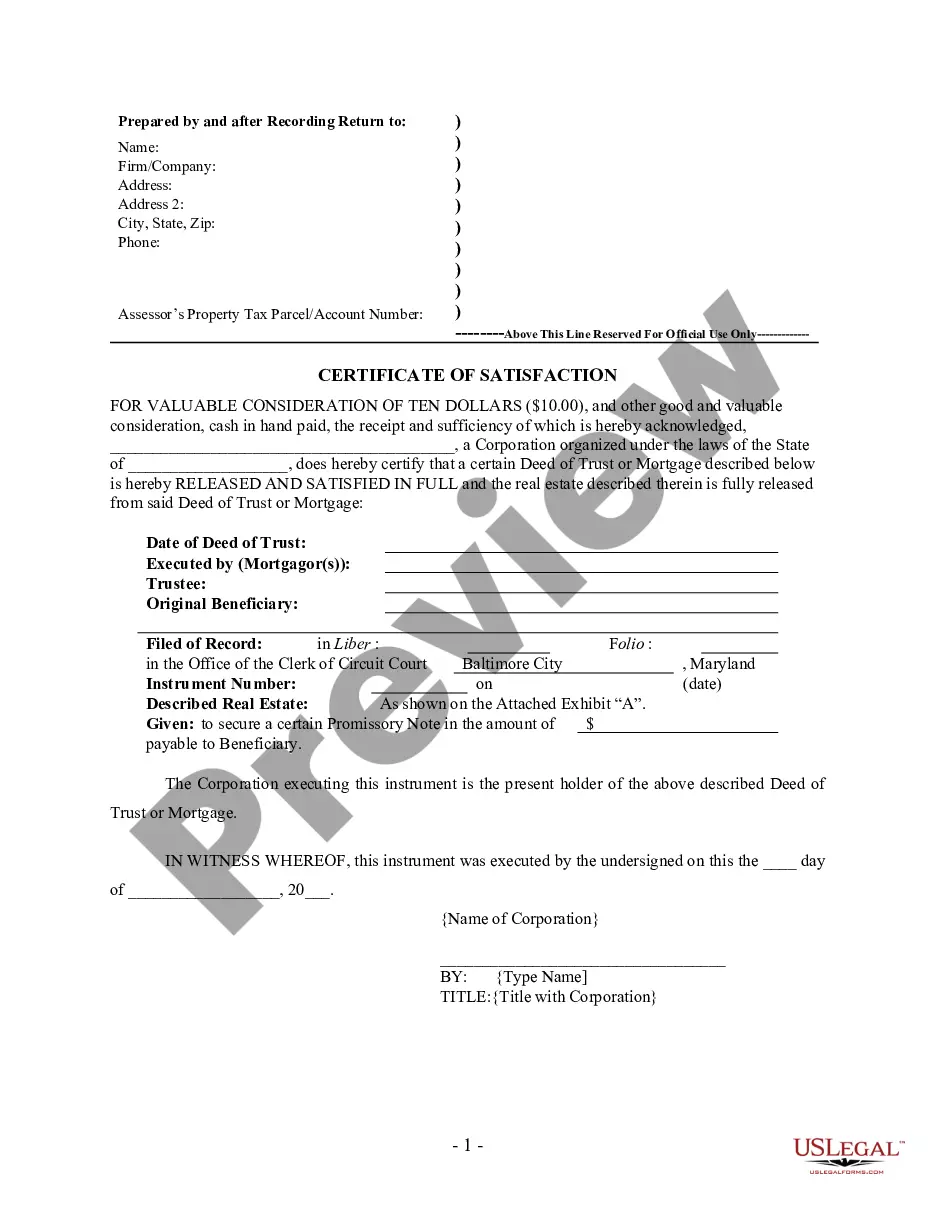

Drafting legal documents from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of preparing Creating An Llc In Pennsylvania Withdraw Foreign or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of more than 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-compliant forms diligently put together for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Creating An Llc In Pennsylvania Withdraw Foreign. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

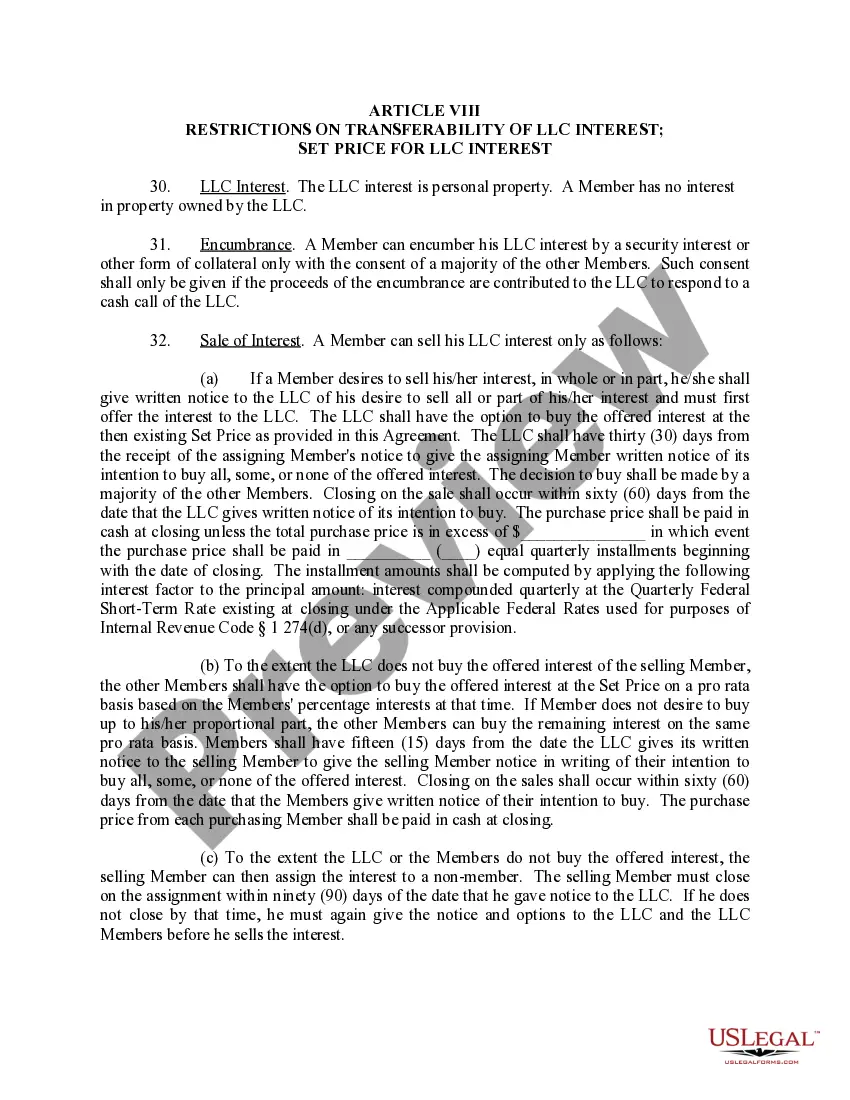

Don’t have an account? No worries. It takes little to no time to set it up and navigate the catalog. But before jumping straight to downloading Creating An Llc In Pennsylvania Withdraw Foreign, follow these recommendations:

- Review the form preview and descriptions to make sure you are on the the form you are searching for.

- Check if form you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the Creating An Llc In Pennsylvania Withdraw Foreign.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and transform form completion into something simple and streamlined!

Form popularity

FAQ

How do you dissolve a Pennsylvania Limited Liability Company? To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

Yes, foreign LLCs in Pennsylvania need to file the Decennial Report. It needs to be filed every 10 years at a cost of $70. The Pennsylvania Decennial Report is due by December 31st in every year ending with the number ?1? (2031, 2041, 2051?).

To terminate or withdraw from doing business, an LLC should file an affidavit with PA's Corporation Tax Bureau because the LLC was either formed in PA (domestic LLC) or is doing business in PA... How do I dissolve a business entity in Pennsylvania?

To remove a member from your Pennsylvania LLC, you'll need to update your operating agreement and possibly amend your Certificate of Organization. If you're changing from a multi-member to a single-member LLC or vice versa, you'll also need to contact the IRS.

Foreign Limited Liability Partnership/Limited Liability Company Registration$250Amended Registration$250Domestication of Foreign Limited Liability Company$125Each ancillary transaction$250Annual Registration (Partnership)at least $3401 more row