Oregon Security Deposit Demand Letter With Payment

Description

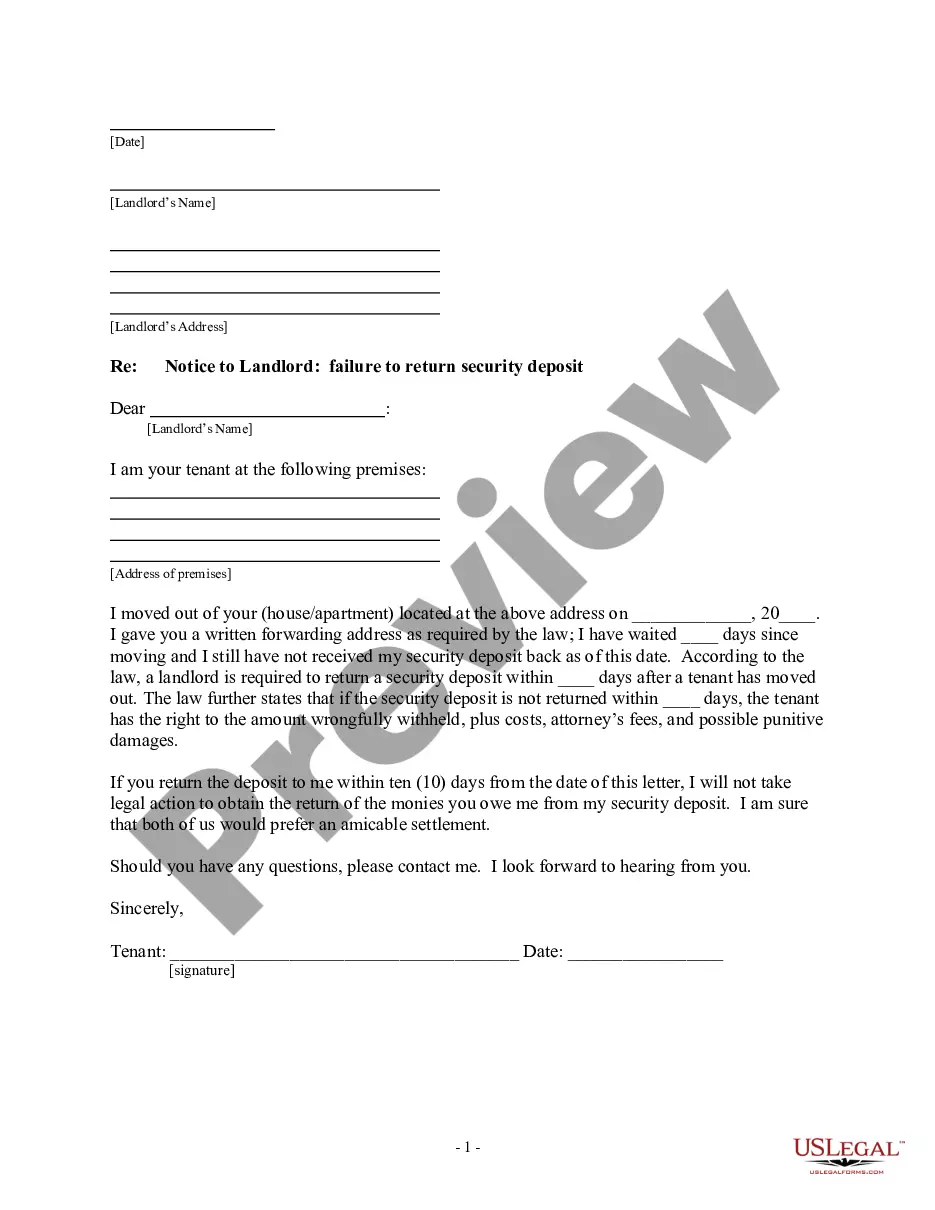

How to fill out Oregon Letter From Tenant To Landlord Containing Notice Of Failure To Return Security Deposit And Demand For Return?

It's widely recognized that you cannot transform into a legal expert instantly, nor can you swiftly understand how to efficiently draft an Oregon Security Deposit Demand Letter With Payment without possessing a specialized background.

The process of creating legal documents is a lengthy journey that necessitates specific training and skillsets. Therefore, why not entrust the drafting of the Oregon Security Deposit Demand Letter With Payment to the professionals.

With US Legal Forms, which boasts one of the most comprehensive legal template collections, you can find anything ranging from court documents to templates for internal communication.

If you need any additional form, initiate your search once again.

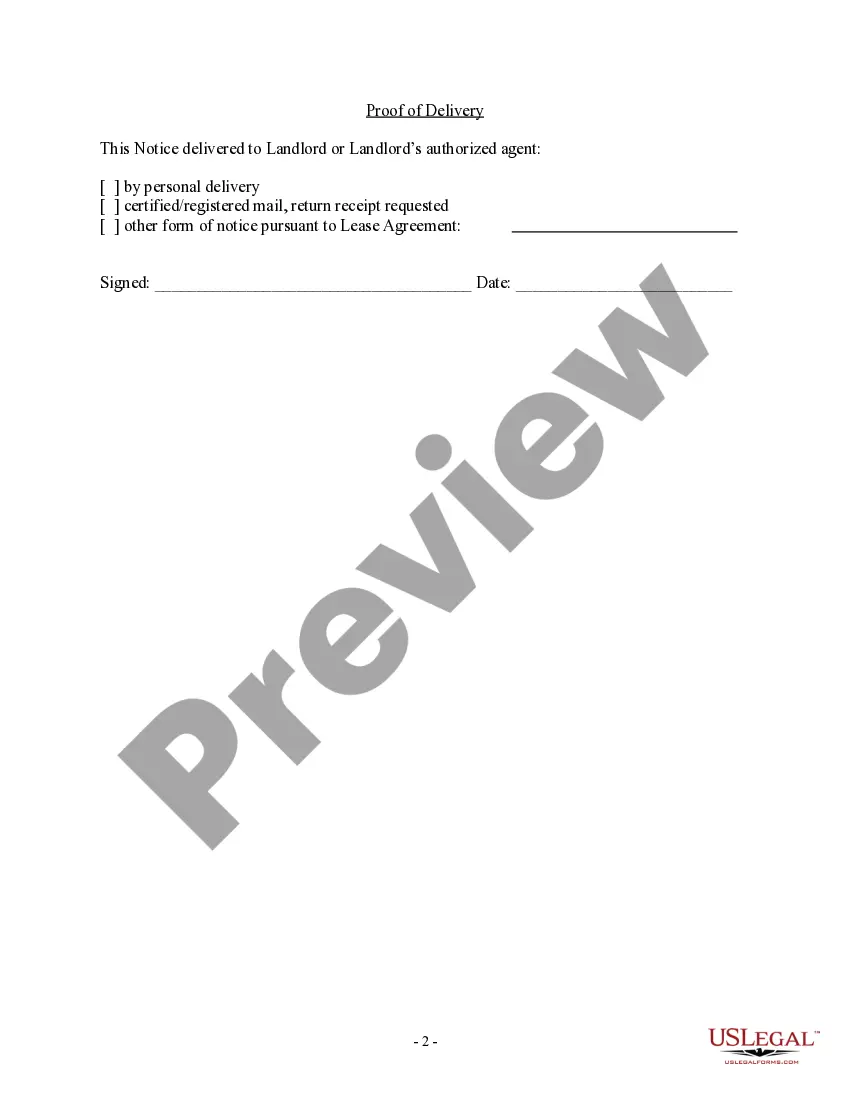

Create a free account and select a subscription plan to buy the template. Click Buy now. Once your payment is processed, you can obtain the Oregon Security Deposit Demand Letter With Payment, complete it, print it, and send or mail it to the appropriate parties or organizations.

- We acknowledge the significance of compliance and adherence to both federal and state regulations.

- That's why, on our platform, every form is tailored to specific locations and remains current.

- To kick off with our platform and acquire the form you need in just a few minutes.

- Search for the document using the search bar at the top of the page.

- View a preview (if available) and check the accompanying description to ascertain if the Oregon Security Deposit Demand Letter With Payment meets your requirements.

Form popularity

FAQ

Begin your letter requesting payment with a formal salutation, followed by a brief introduction of the situation. Clearly state the amount owed and any relevant background information. An effective approach is to reference the Oregon security deposit demand letter with payment to ensure all necessary details are included.

Estate Plan Drafting The cost of creating a will in Massachusetts can range from roughly $250 to $1,000. A trust typically costs anywhere between $900 and $3,450. At Snug, any member can create a Power of Attorney and Health Care Directive for free.

To make a living trust in Massachusetts, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A will won't help you during your lifetime other than giving you the peace of mind of knowing that your loved ones will receive your intended distributions though probate proceedings in court. A trust in Massachusetts, on the other hand, can step in to manage your financial matters if you become incapacitated.

The Massachusetts living trust form is a legal document wherein a Grantor signs all of their assets over to a trust, which, in the event of their death, will be transferred to a designated Beneficiary.

The cost of creating a trust in Massachusetts varies, but a basic Revocable Living Trust generally ranges from $1,000 to $3,000. The cost may be higher for more complex trusts or if you require the assistance of an attorney. Online legal services can offer more affordable alternatives for creating trusts.

Living trusts in Massachusetts You may choose anyone, but it is common to name yourself, with a successor trustee in place for after your death. A revocable living trust can be changed or cancelled by you at any time during your life. An irrevocable living trust is unalterable once it is signed.

If you go the online, ?DIY? route, you might wind up paying less than $100. However, some web resources can charge up to $400. If an attorney helps you set things up, the attorney's fees will obviously raise your total costs. There's no one-size-fits-all cost, but they can frequently exceed $1,000.