Quitclaim Deed To Add Spouse To Title For House

Description

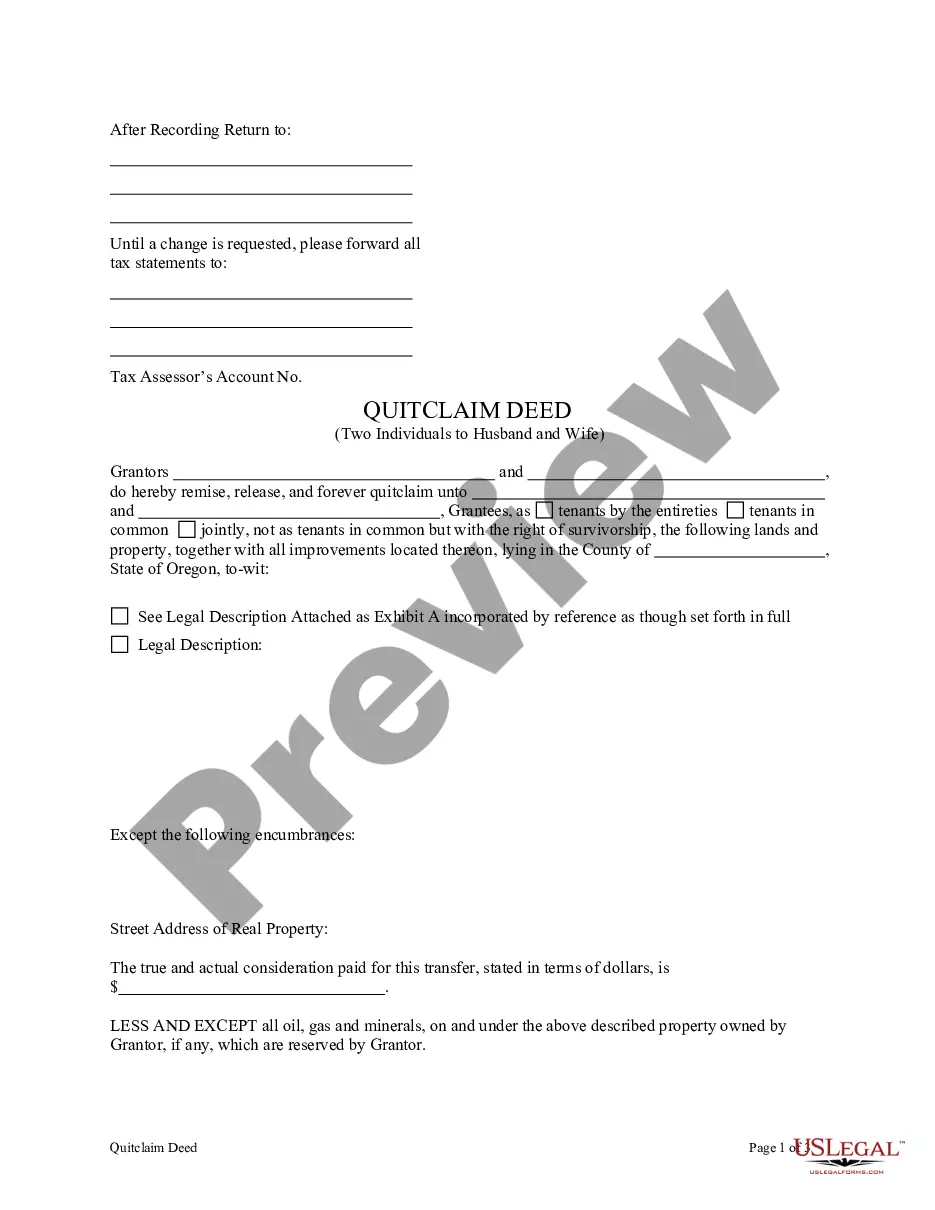

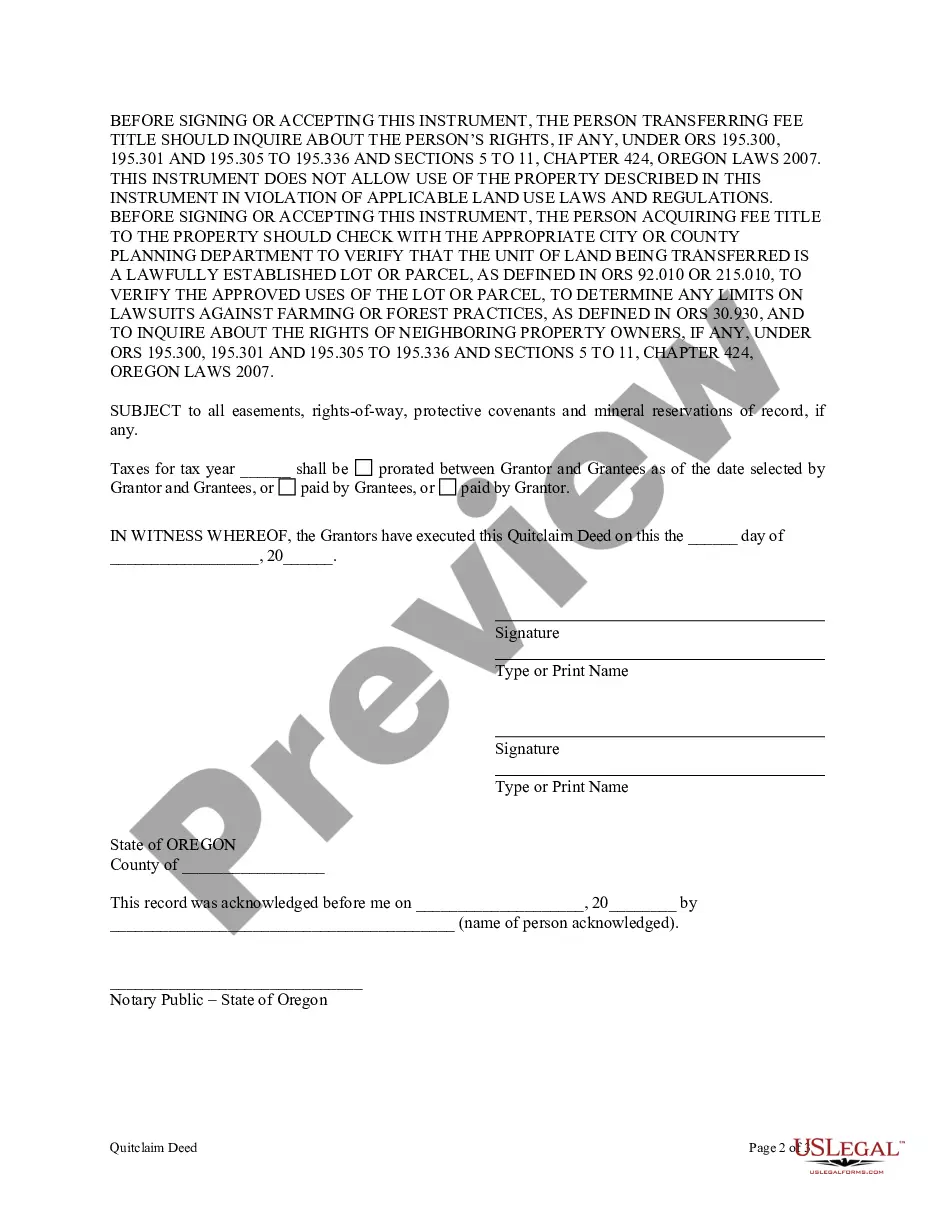

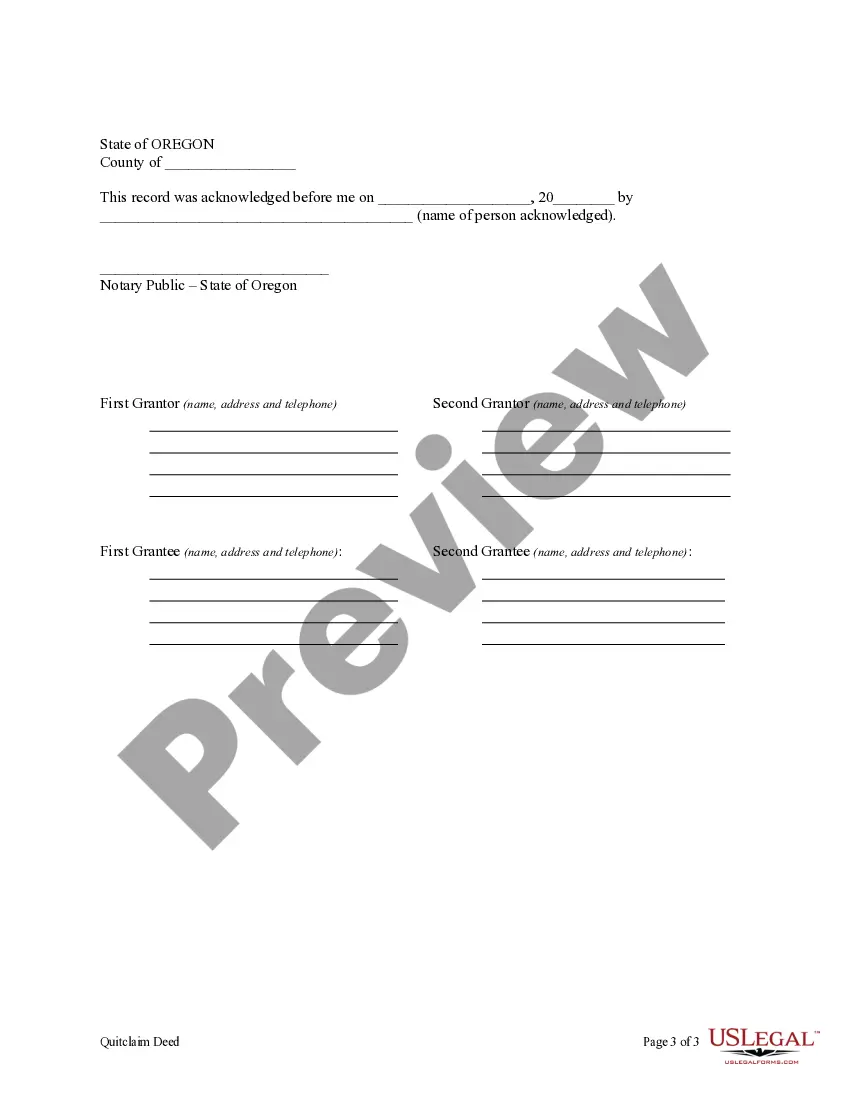

How to fill out Oregon Quitclaim Deed By Two Individuals To Husband And Wife?

It’s no secret that you can’t become a legal professional overnight, nor can you figure out how to quickly draft Quitclaim Deed To Add Spouse To Title For House without having a specialized set of skills. Creating legal documents is a time-consuming venture requiring a certain training and skills. So why not leave the creation of the Quitclaim Deed To Add Spouse To Title For House to the pros?

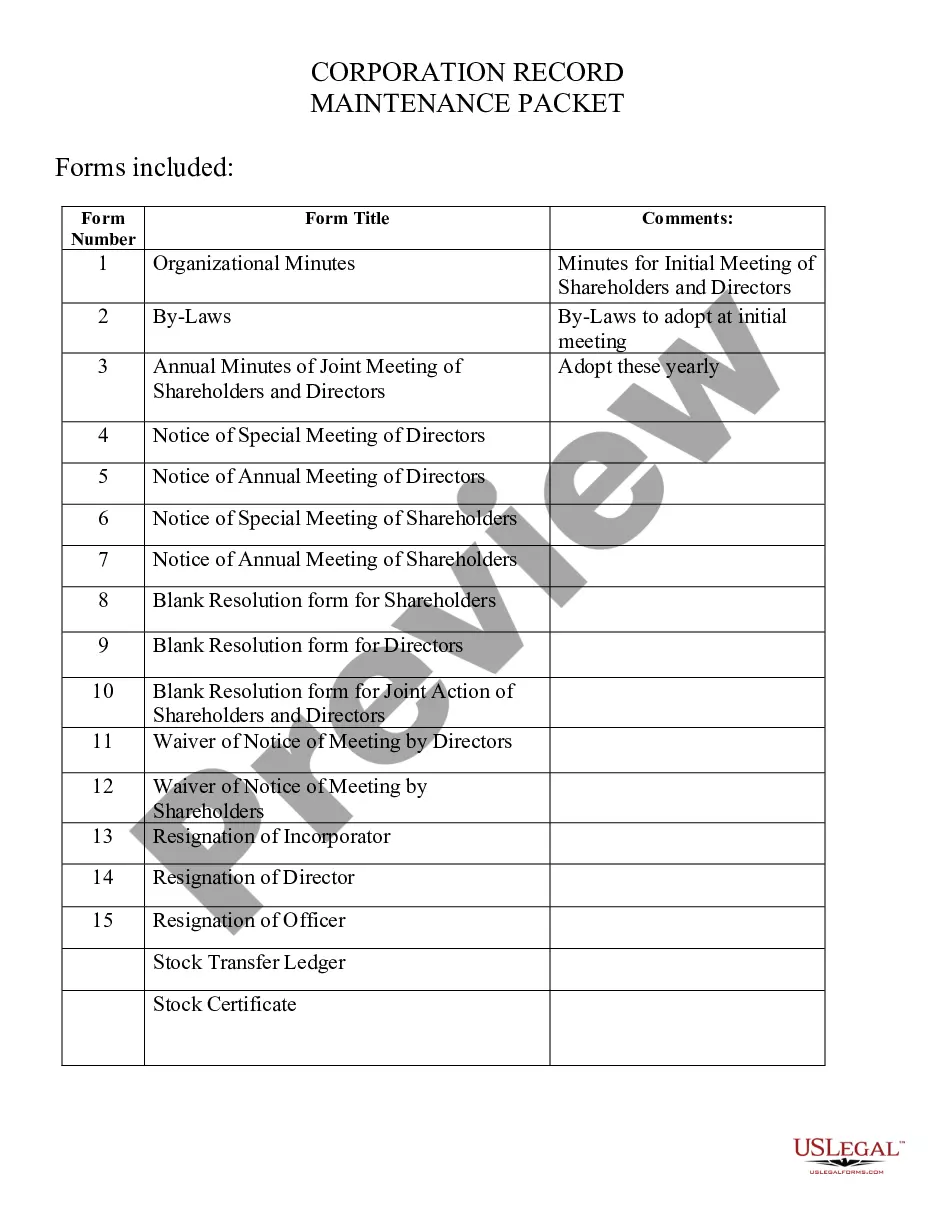

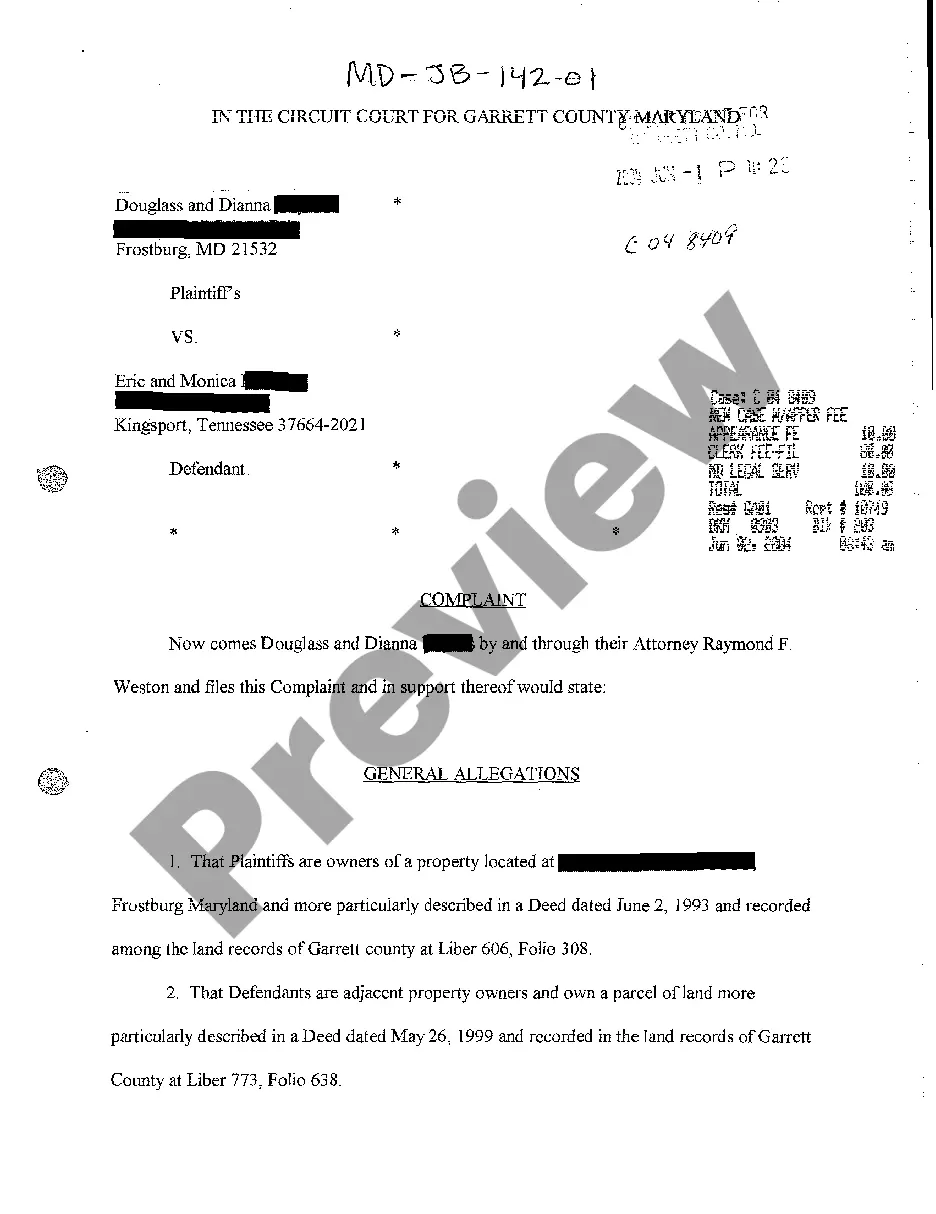

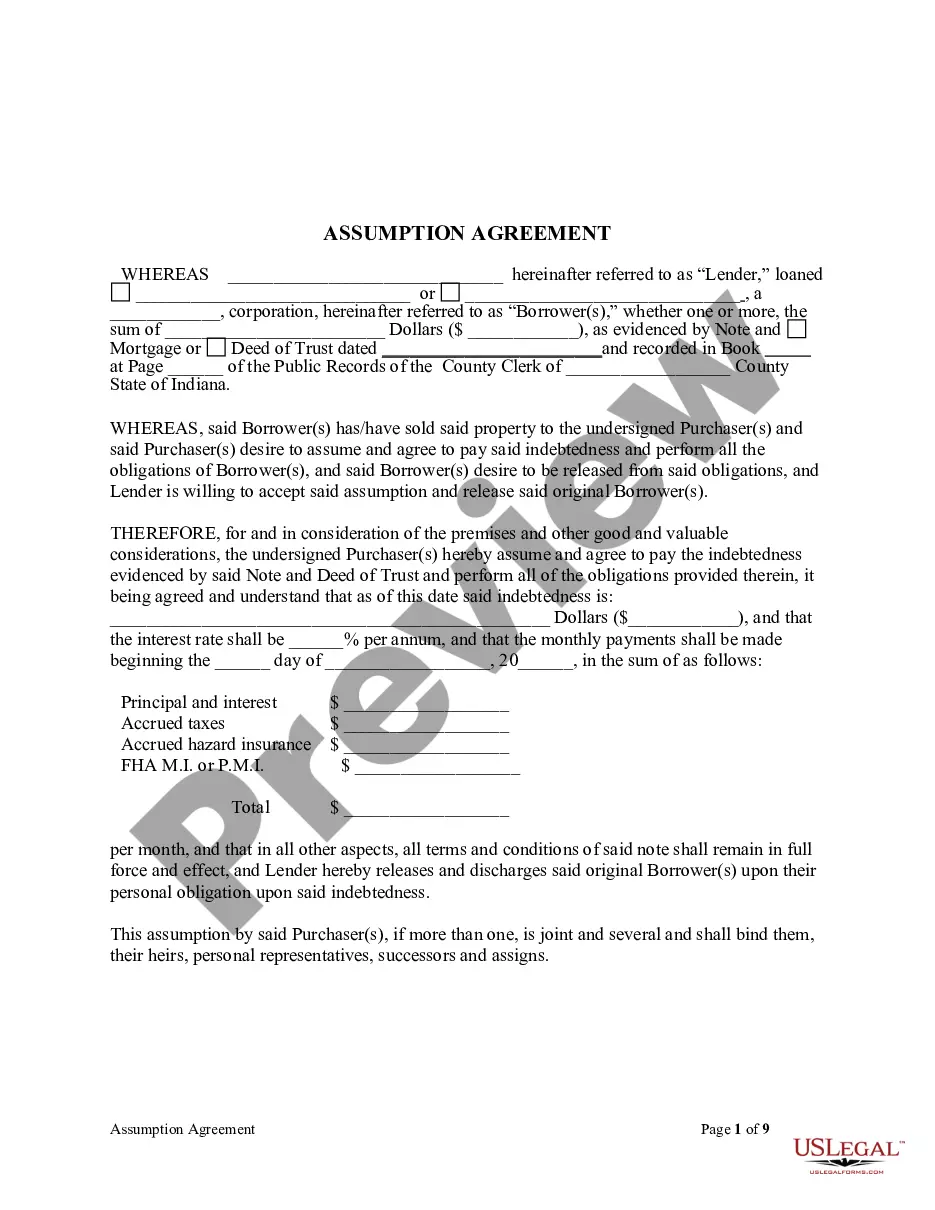

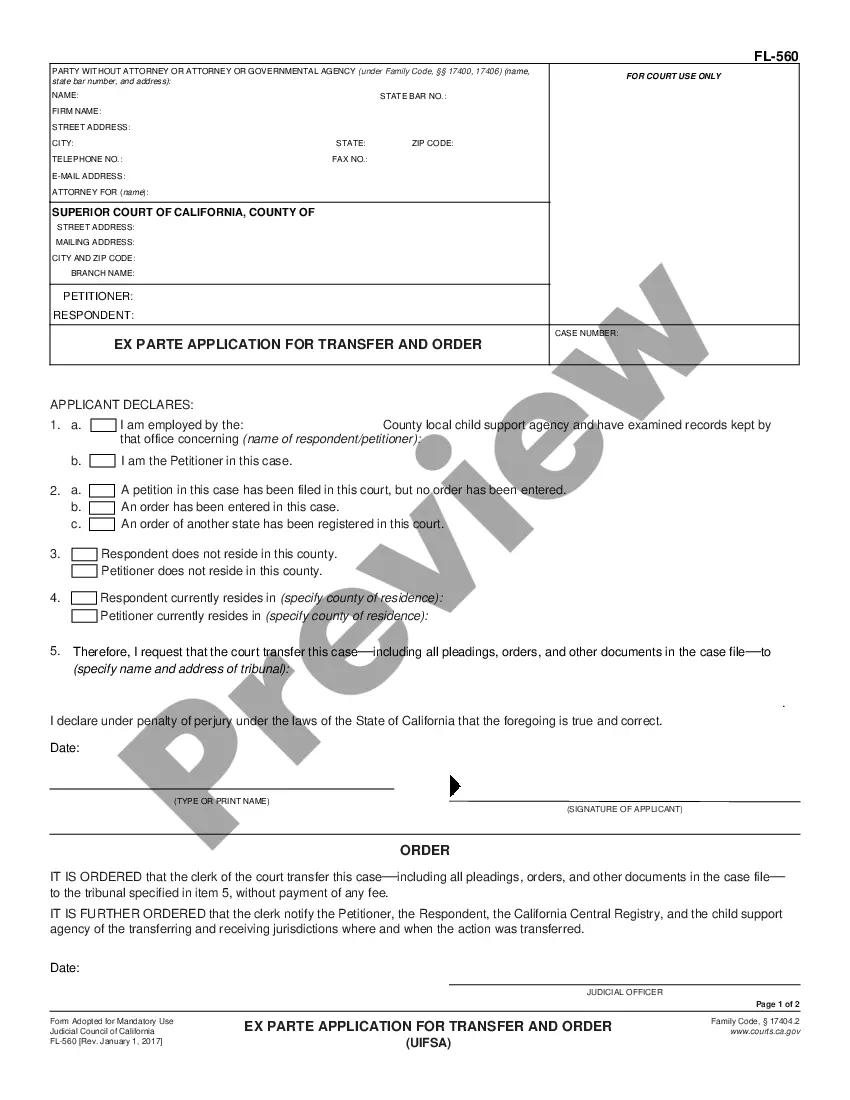

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Quitclaim Deed To Add Spouse To Title For House is what you’re searching for.

- Start your search again if you need a different template.

- Register for a free account and select a subscription plan to buy the template.

- Pick Buy now. As soon as the transaction is through, you can get the Quitclaim Deed To Add Spouse To Title For House, complete it, print it, and send or mail it to the designated people or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Due to this, quitclaim deeds typically are not used in situations where the property involved has an outstanding mortgage. After all, it would be difficult for many grantors to pay off a mortgage without proceeds from the sale of the property.

Most couples vest property jointly as tenancies by the entirety (where allowed by law) or joint tenancies with right of survivorship. There are also states where homes owned by couples are vested as community property. Identifying relationships has as much legal significance as all other language on the deed.

It is possible to borrow additional money on your mortgage, but it may not be your best option. Taking out a larger mortgage than you need can help you cover upfront expenses such as moving costs, new furniture and home renovations.

A quit claim deed in a divorce or legal separation gives one party the sole ownership of the property. This allows that party to sell or mortgage the property without the approval or consent of the other party.

Yes, you can put your spouse on the title without putting them on the mortgage. This would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.