Ohio Identity Theft With Social Security Number

Description

How to fill out Ohio Identity Theft Recovery Package?

Whether for business purposes or for individual affairs, everyone has to deal with legal situations at some point in their life. Filling out legal paperwork demands careful attention, starting with selecting the proper form template. For instance, when you pick a wrong edition of a Ohio Identity Theft With Social Security Number, it will be declined when you submit it. It is therefore essential to get a dependable source of legal files like US Legal Forms.

If you have to get a Ohio Identity Theft With Social Security Number template, stick to these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to ensure it matches your case, state, and region.

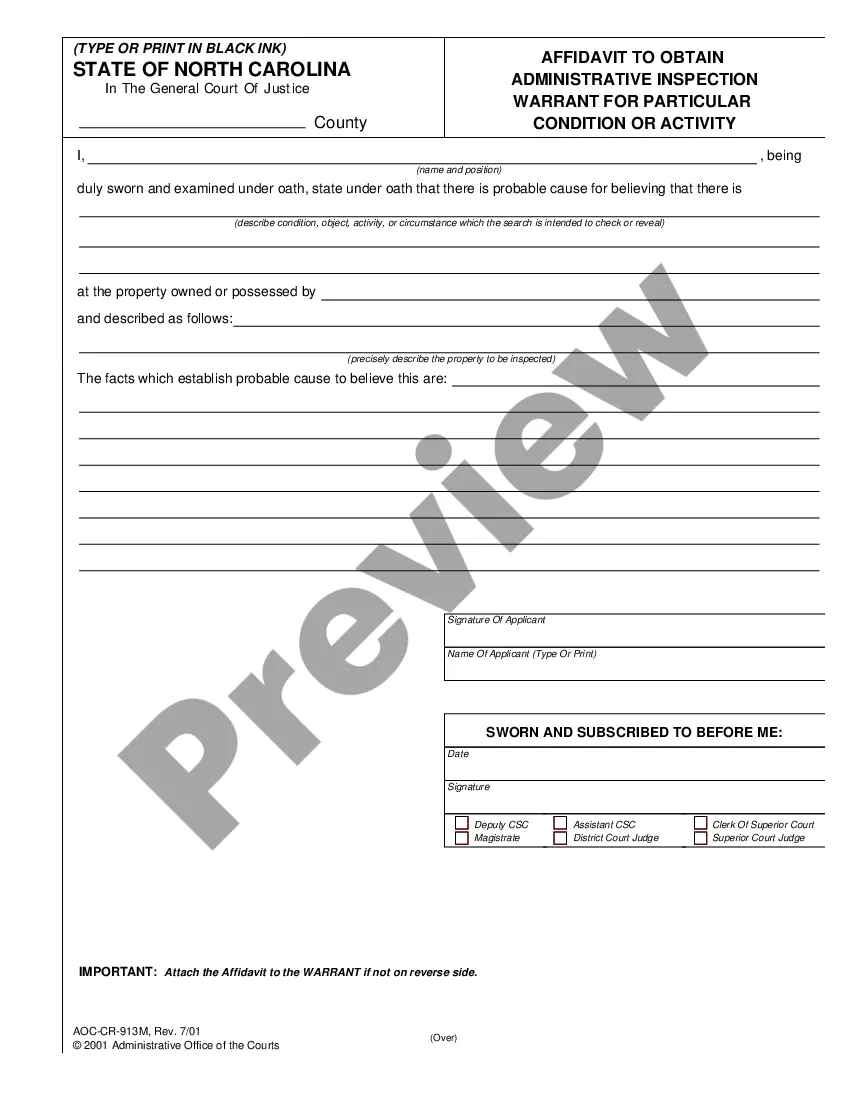

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to find the Ohio Identity Theft With Social Security Number sample you need.

- Get the template if it meets your needs.

- If you already have a US Legal Forms profile, simply click Log in to access previously saved templates in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the profile registration form.

- Select your transaction method: you can use a credit card or PayPal account.

- Pick the file format you want and download the Ohio Identity Theft With Social Security Number.

- After it is saved, you can fill out the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the right template across the internet. Use the library’s simple navigation to find the right form for any situation.

Form popularity

FAQ

Notify the IRS and the Social Security Administration. Contacting the IRS online at .irs.gov/uac/Identity-Protection or by phone at 800-908-4490 can help you avoid employment fraud and prevent someone else from accessing your tax refund.

You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov. Our investigations are most successful when you provide as much information as possible about the alleged suspect(s) and victim(s) involved.

How to report fraud. Do you suspect someone of committing fraud, waste, or abuse against Social Security? You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov.

Your Social Security number is the key. It is the key to a lot of your personal information. With your name and SSN, an identity thief could open new credit and bank accounts, rent an apartment, or even get a job.

If you believe a thief is using your Social Security number to work or claim Social Security benefits, call the Social Security Fraud Hotline at 1-800-269-0271. Or report Social Security benefits fraud online at .