Ohio Promissory Note With Balloon Payment

Description

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Properly formulated official records are among the essential assurances for preventing complications and legal disputes, but acquiring them without assistance from an attorney can be time-consuming.

Whether you require a prompt access to a current Ohio Promissory Note With Balloon Payment or other documentation for employment, familial, or business circumstances, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and hit the Download button beside the chosen file. Furthermore, you can retrieve the Ohio Promissory Note With Balloon Payment at any time, as all documents previously obtained on the platform remain accessible within the My documents section of your profile. Conserve time and resources on preparing official papers. Experience US Legal Forms today!

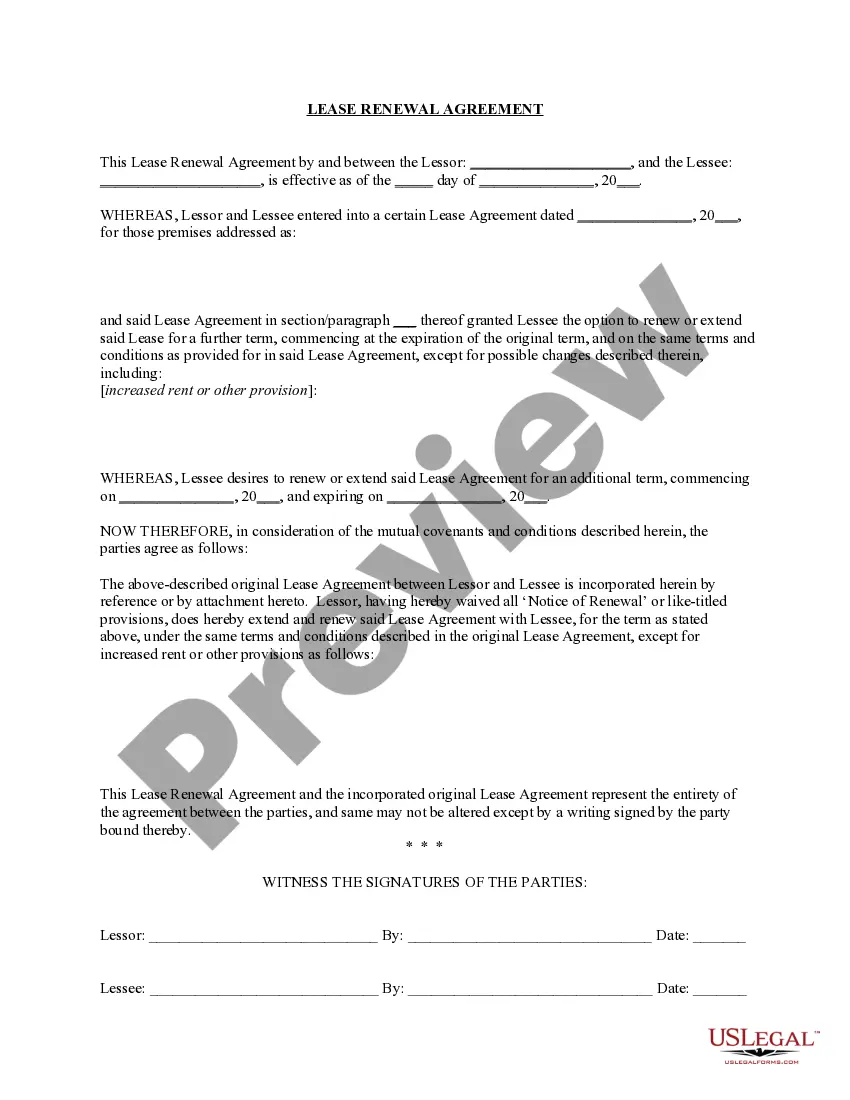

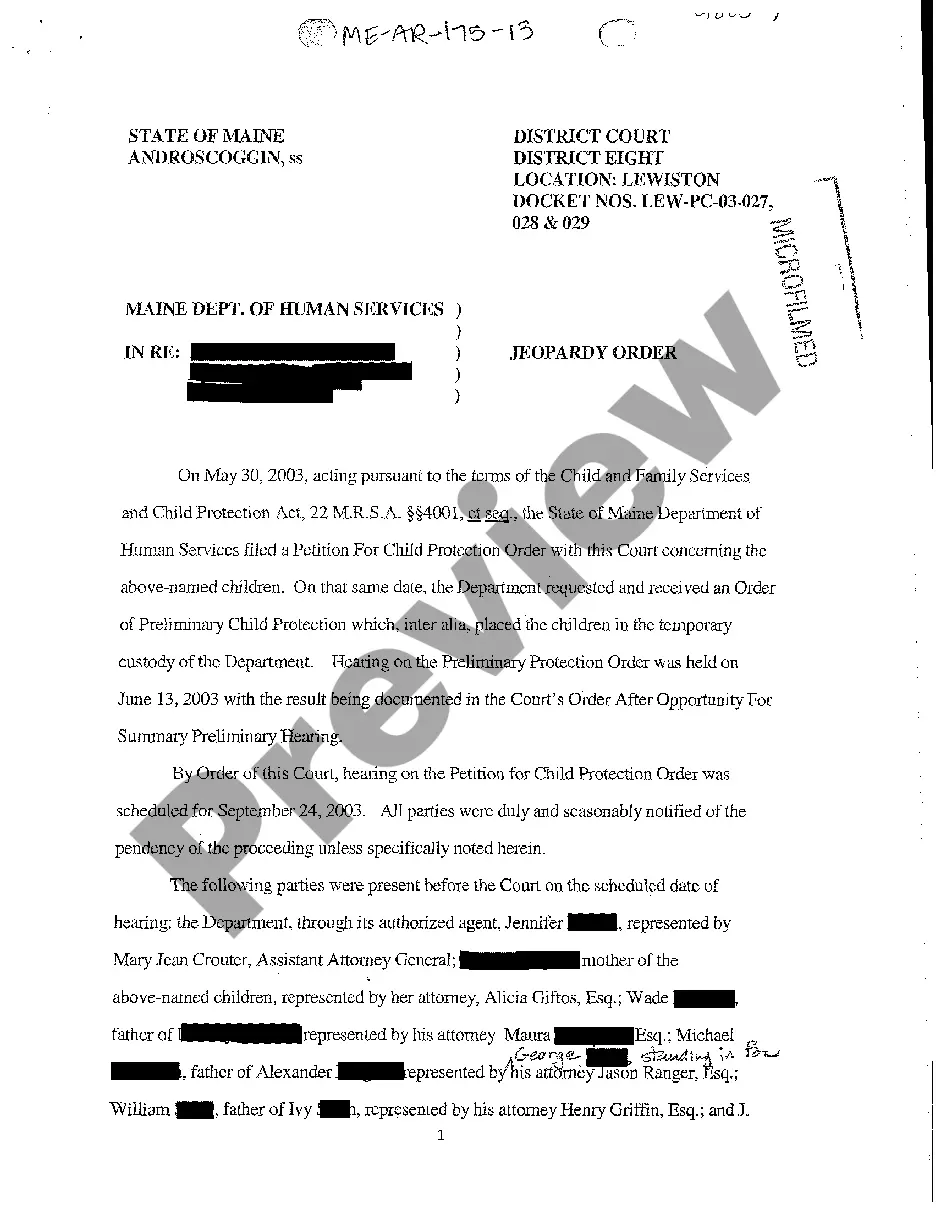

- Ensure that the document aligns with your case and jurisdiction by reviewing the description and preview.

- Seek another example (if necessary) using the Search bar located in the page header.

- Hit Buy Now when you find the appropriate template.

- Choose a pricing plan, sign into your account or establish a new one.

- Select your preferred method of payment to purchase the subscription (via credit card or PayPal).

- Choose either PDF or DOCX file format for your Ohio Promissory Note With Balloon Payment.

- Click Download, then print the document to complete it or incorporate it into an online editor.

Form popularity

FAQ

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

There is no legal requirement for promissory notes to be witnessed or notarized in Ohio. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.