Contract For Removal Of Barn Ohio Form

Description

How to fill out Ohio Demolition Contract For Contractor?

Individuals often link legal documentation with something complex that solely an expert can manage.

In a sense, this is accurate, as creating the Contract For Removal Of Barn Ohio Form requires considerable knowledge in subject matters, including state and county statutes.

Nonetheless, with US Legal Forms, the process has become simpler: ready-to-use legal templates for various life and business scenarios tailored to state regulations are compiled in one online repository and are now accessible to everyone.

All templates in our library are reusable: once acquired, they remain saved in your profile. You can access them anytime when needed through the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- U.S. Legal Forms offers over 85,000 current documents categorized by state and usage area, making it quick to find the Contract For Removal Of Barn Ohio Form or any other specific template.

- Existing registered users with a current subscription need to Log In to their account and click Download to get the form.

- New users on the platform must first register for an account and subscribe before they can save any documents.

- Here’s the detailed guide on how to secure the Contract For Removal Of Barn Ohio Form.

- Review the page contents carefully to confirm it meets your needs.

- Read the form description or examine it through the Preview feature.

- Search for another sample using the Search field above if the previous one doesn’t meet your requirements.

- Click Buy Now once you find the correct Contract For Removal Of Barn Ohio Form.

- Select a pricing plan that suits your needs and budget.

- Create an account or Log In to advance to the payment page.

- Complete your payment using PayPal or your credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

Contractors and home remodelers do not collect sales tax on their work. They do however, pay sales tax on the supplies they purchase. Available on the Ohio Department of Taxation's website is the form STEC CC, which is the construction contract exemption certificate.

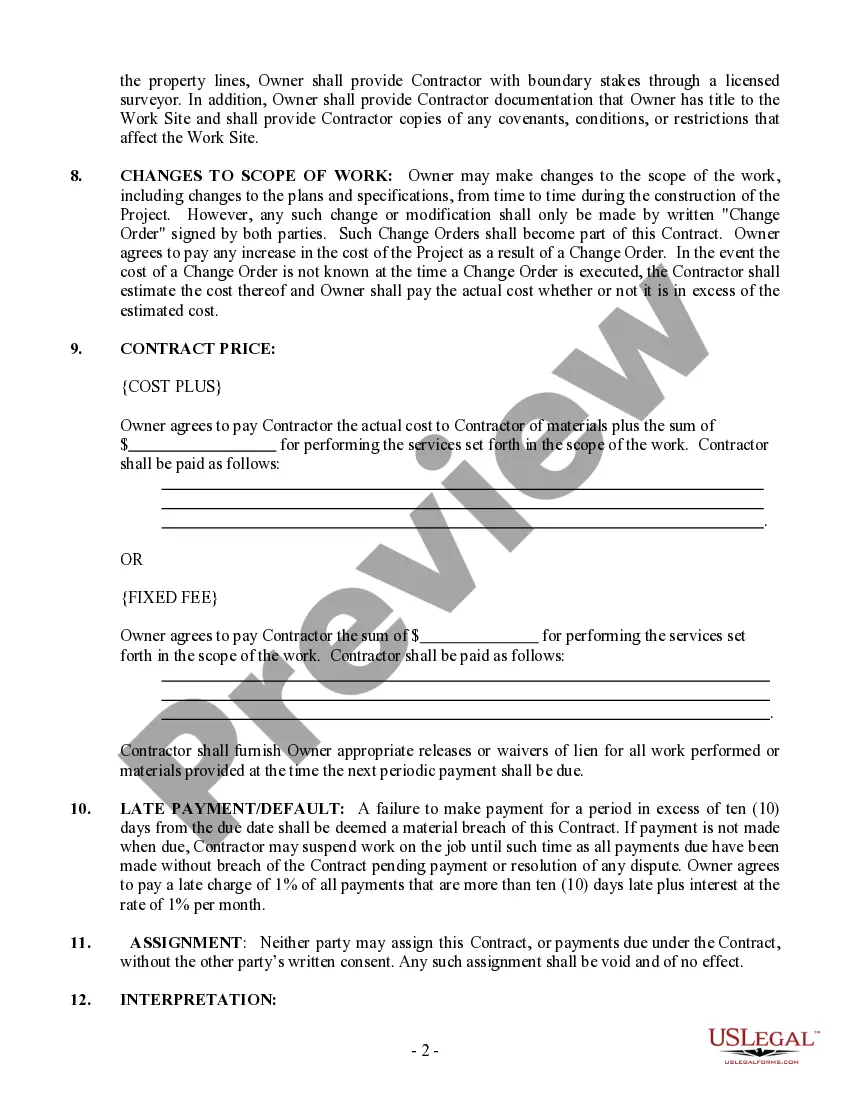

Ohio's written contract Statute of Limitations used to be fifteen (15) years, but has now been shortened to eight (8) years. Ohio's Statute of Repose requires certain claims be asserted within ten (10) years after substantial completion of the work.

Professional, personal, and insurance transactions are not taxable when any transfer of tangible personal property is a small item for which no separate charge is made.

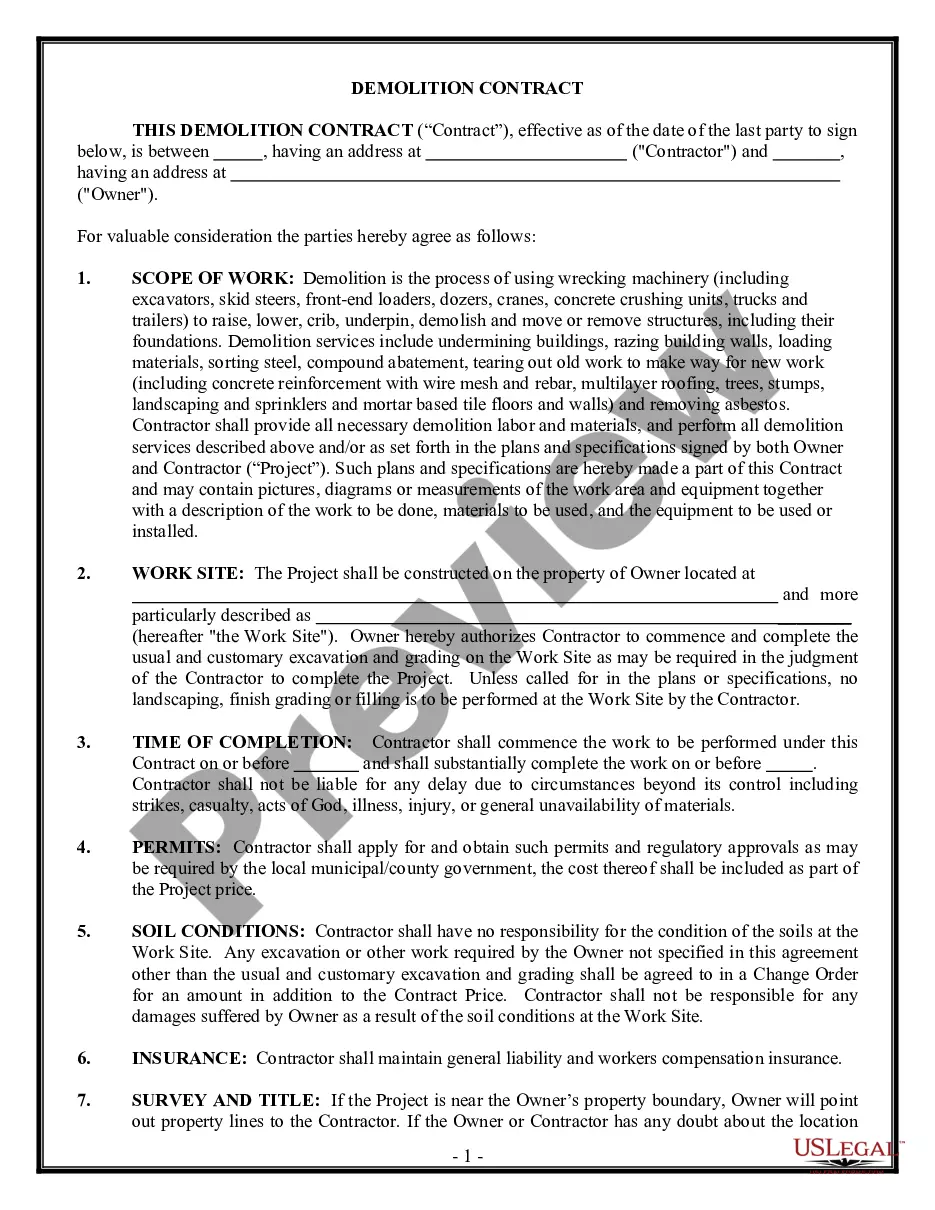

A demolition contract is a legally binding agreement between a contractor and their company, with a client. A demolition contract is a legally binding document specifically for situations where a building or structure is demolished.

By definition, a demolition plan is a document that entails the entire strategic steps to be followed by demolition contractors to ensure that the building or structure being brought down does not harm the environment and people living nearby.