New York City Partnership Filing Requirements

Description

How to fill out New York General Partnership Package?

Identifying a reliable venue to obtain the most up-to-date and pertinent legal templates is half the challenge of navigating bureaucracy.

Finding the correct legal documents requires precision and carefulness, which is why it is important to take samples of New York City Partnership Filing Requirements only from trustworthy sources, such as US Legal Forms.

Eliminate the stress that comes with your legal paperwork. Explore the extensive US Legal Forms library where you can discover legal templates, assess their applicability to your case, and download them immediately.

- Utilize the catalog navigation or search bar to find your template.

- Access the form's details to determine if it aligns with the requirements of your state and county.

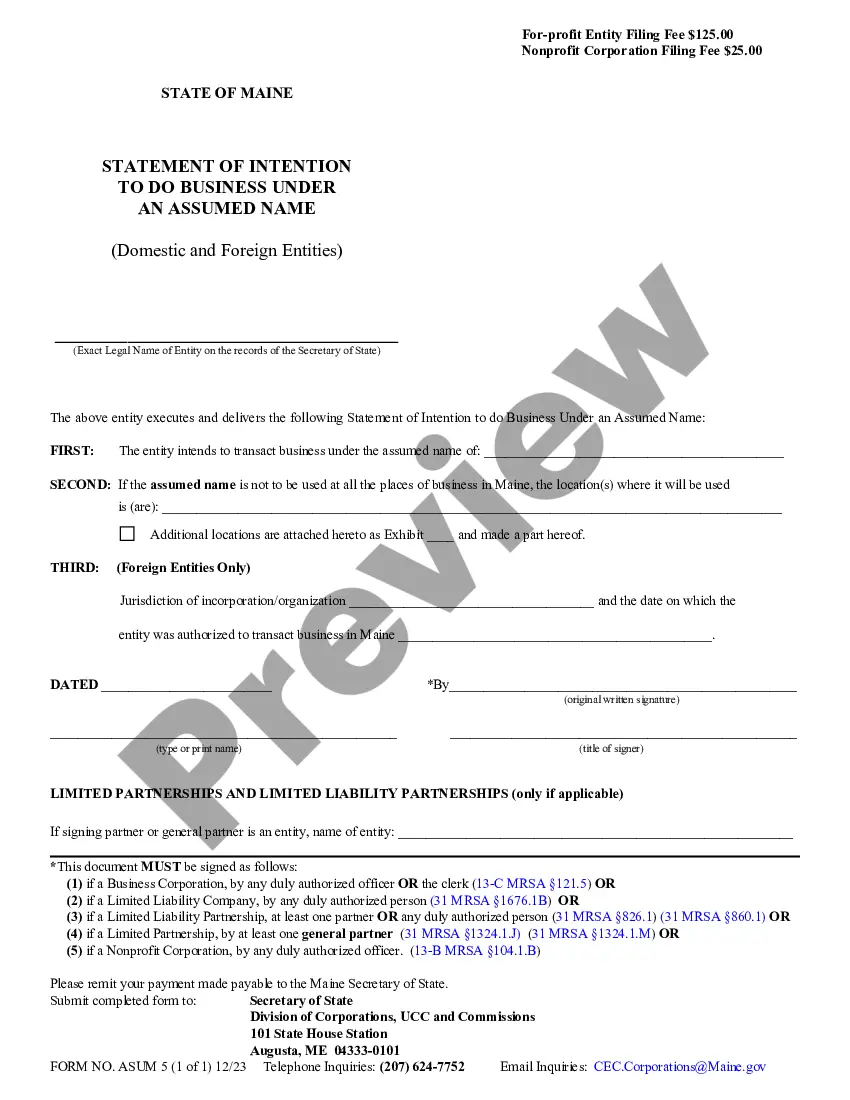

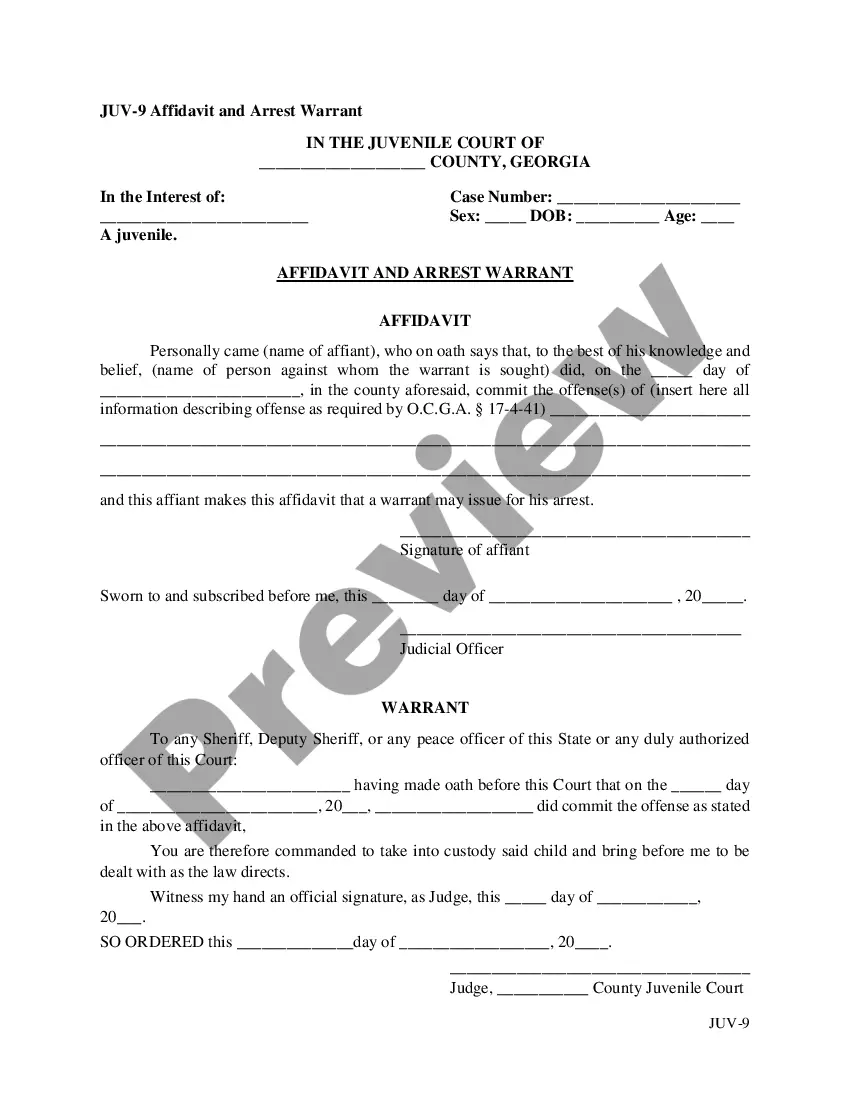

- View the form preview, if available, to confirm that the form is indeed what you need.

- Return to the search and locate the appropriate template if the New York City Partnership Filing Requirements does not suit your needs.

- If you are confident about the form's relevance, download it.

- As a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Choose the pricing option that meets your needs.

- Proceed to the registration process to complete your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Choose the file format to download New York City Partnership Filing Requirements.

- Once you have the form on your device, you can edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

Mail your return to: STATE PROCESSING CENTER, PO BOX 15198, ALBANY NY 12212-5198.

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an ...

The NYC PTET is an optional tax that city partnerships or city resident New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2022.

How to form a New York General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2 ? Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

Mail your return to: STATE PROCESSING CENTER, PO BOX 15198, ALBANY NY 12212-5198. B 1) Did the partnership have any income, gain, loss, or deduction derived from NY sources during the. ... C Mark applicable box(es)