New York State Promissory Note Form

Description

How to fill out New York Unsecured Installment Payment Promissory Note For Fixed Rate?

There’s no longer a necessity to dedicate time hunting for legal documents to fulfill your local state criteria.

US Legal Forms has gathered all of them in a single location and enhanced their accessibility.

Our platform presents over 85,000 templates for various business and personal legal matters categorized by state and use area. All forms are correctly composed and validated for authenticity, allowing you to trust that you’re obtaining a current New York State Promissory Note Form.

Creating formal documentation under federal and state regulations is quick and straightforward with our platform. Experience US Legal Forms today to maintain your paperwork organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, choose the document, and click Download.

- You can also return to all saved documents whenever needed by opening the My documents tab in your profile.

- If you've never utilized our platform previously, the process will involve several more steps.

- Here’s how new users can find the New York State Promissory Note Form in our library.

- Carefully review the page content to confirm it contains the sample you require.

- To do so, utilize the form description and preview options if available.

- Utilize the Search field above to find another sample if the current one didn’t meet your needs.

- Click Buy Now next to the template name once you identify the correct one.

- Choose the most appropriate pricing plan and register for an account or sign in.

- Make payment for your subscription with a credit card or via PayPal to continue.

- Select the file format for your New York State Promissory Note Form and download it to your device.

- Print your form to complete it manually or upload the sample if you prefer to do it in an online editor.

Form popularity

FAQ

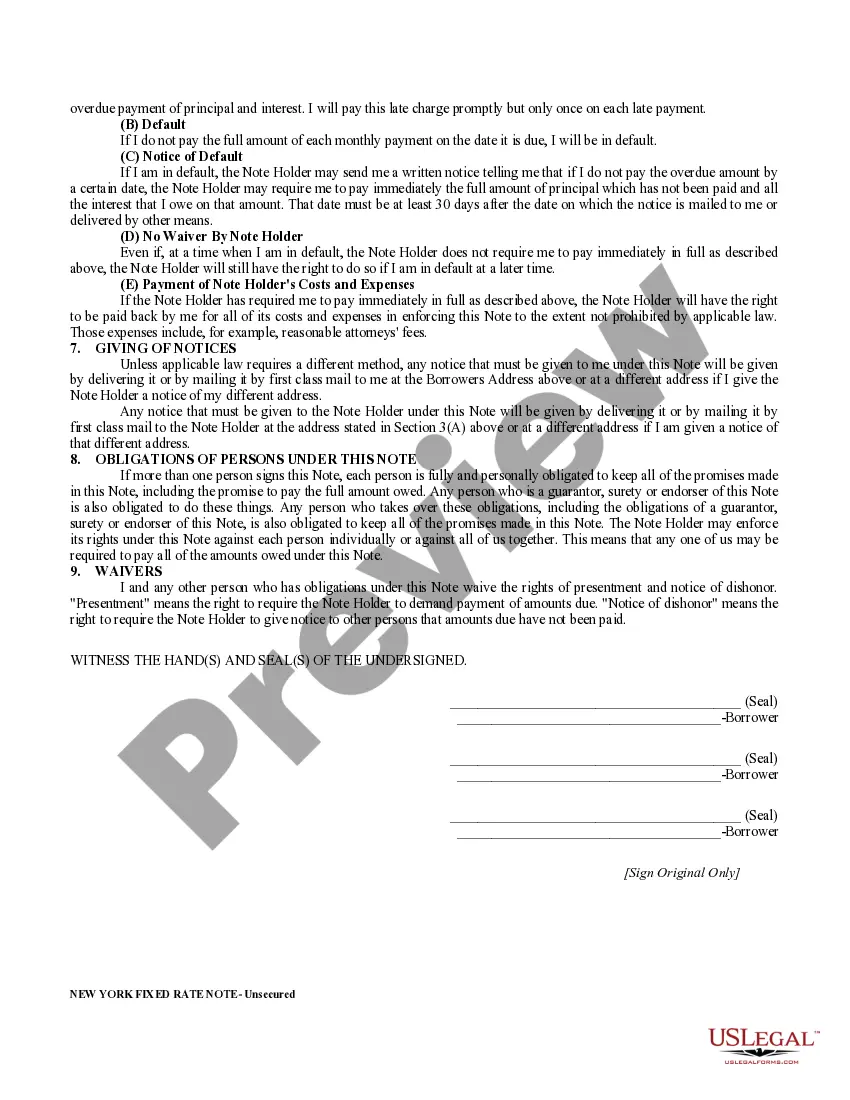

In New York, the promissory note and mortgage are contracts and the six-year statute of limitations is applicable.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

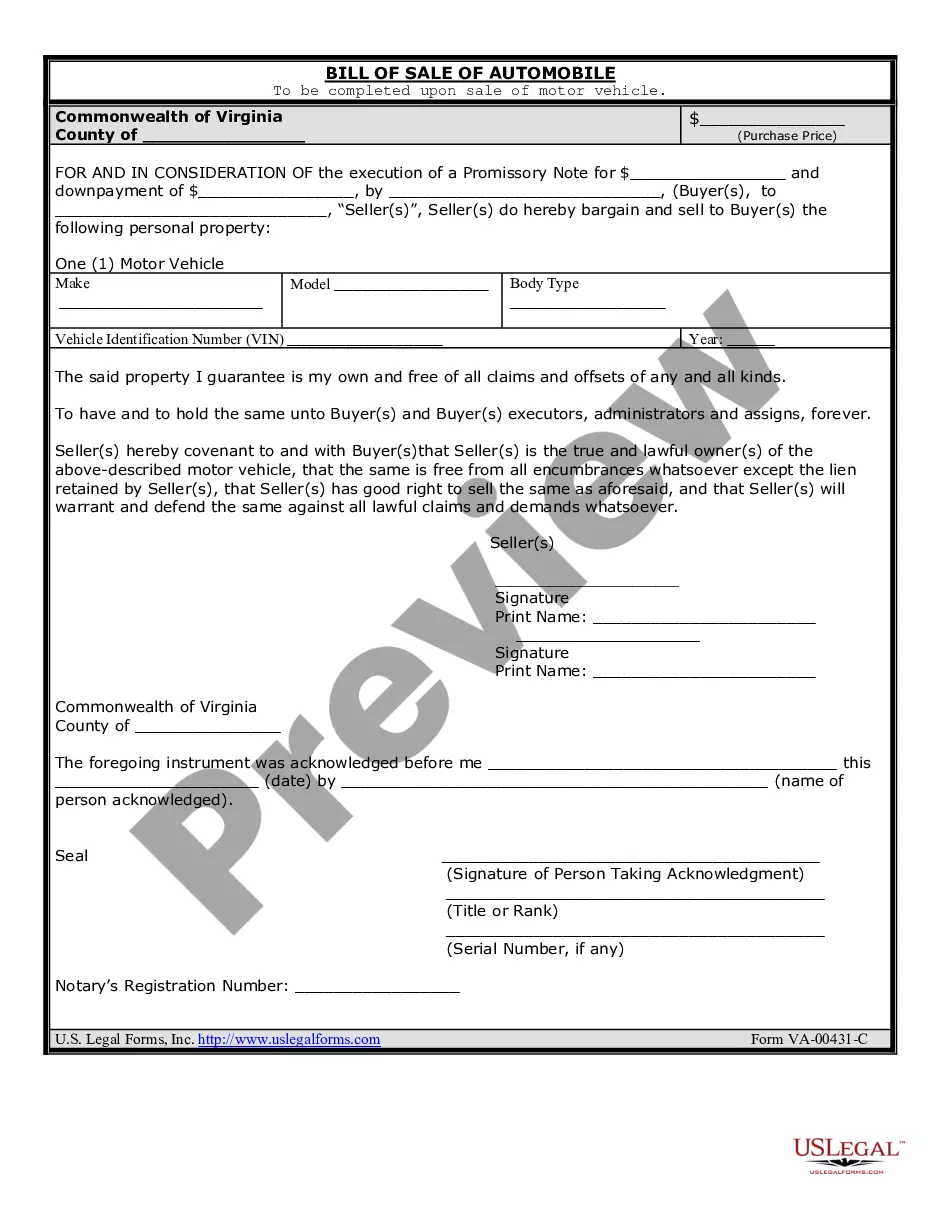

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.