Nys Child Support Arrears Forgiveness Program For Texas

Description

How to fill out New York Stipulation For Child Support - 9-99?

The Nys Child Support Arrears Forgiveness Program For Texas displayed on this page is a reusable official template crafted by expert attorneys in compliance with national and state laws and statutes.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with more than 85,000 validated, state-specific documents for any professional and personal situation. It is the fastest, easiest, and most dependable means to acquire the paperwork you require, as the service promises the utmost level of data protection and anti-malware measures.

Access the same document again whenever necessary. Visit the My documents section in your account to redownload any previously acquired forms.

- Search for the document you require and assess it.

- Browse the sample you sought and preview it or verify the form description to ensure it meets your needs. If it falls short, utilize the search bar to find the correct one. Click Buy Now when you have identified the template you seek.

- Choose a pricing plan that fits you and create an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and review your subscription to continue.

- Select the format you desire for your Nys Child Support Arrears Forgiveness Program For Texas (PDF, Word, RTF) and save the document on your device.

- Print the template to fill it out manually. Alternatively, employ an online multifunctional PDF editor to quickly and accurately complete and sign your document with a legally binding electronic signature.

Form popularity

FAQ

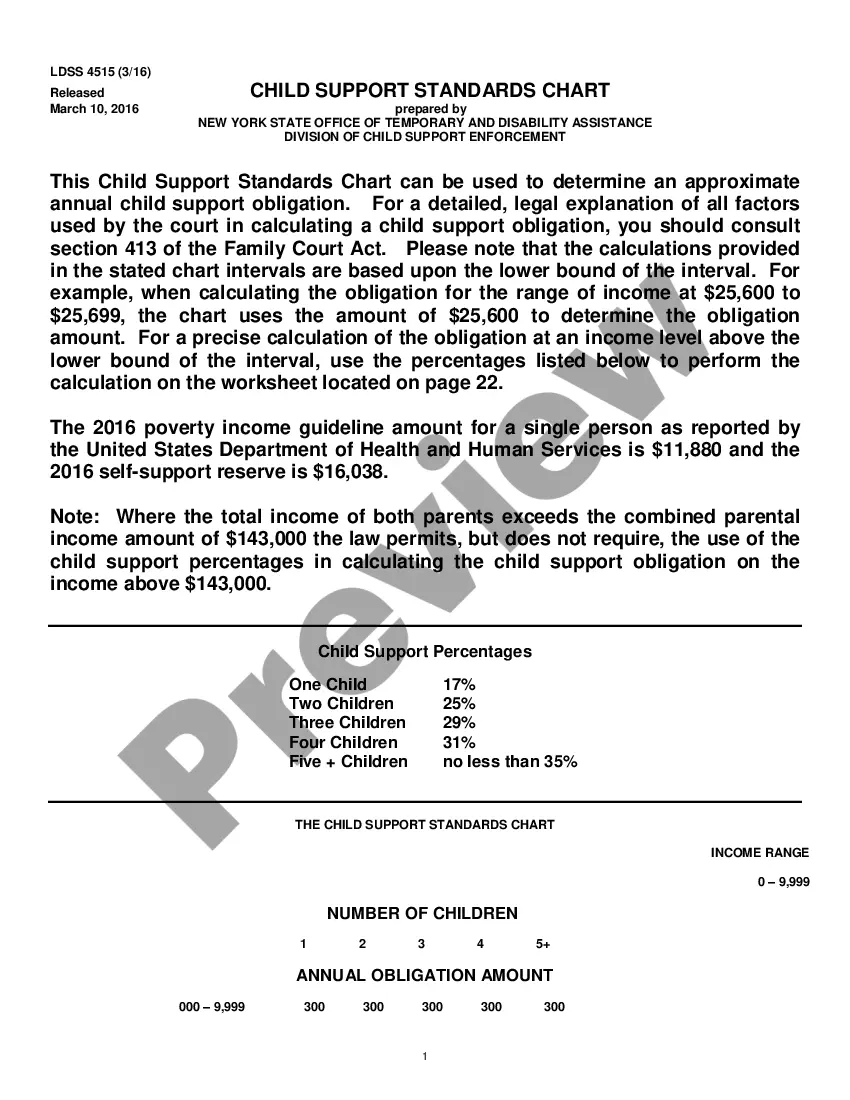

Debt Reduction Programs The amount of arrears can be reduced to as low as $500. To qualify, noncustodial parents must owe child support debt to the NYC Department of Social Services (DSS). The parent's income must have been below the federal poverty level when their DSS arrears accumulated.

The program is established pursuant to Texas Family Code § RSA 231.124. The program provides a credit for every dollar amount paid by the obligor on interest and arrearage balances during each month of the obligor's voluntary enrollment in the program.

The former spouse or girlfriend is the only person who can forgive the missing child support payments. She can do so for just a part of what's owed or for the whole amount. You can start the process by calling the Office of the Attorney General in Texas.

In Texas, child support can be waived by agreement between the parties as long as the custodial parent did not receive government benefits for the child. However, even if the parents agree to waive the child support, the Judge has the discretion to not follow that agreement.

The program is established pursuant to Texas Family Code § RSA 231.124. The program provides a credit for every dollar amount paid by the obligor on interest and arrearage balances during each month of the obligor's voluntary enrollment in the program.