Fiduciary Deed Nh Withdrawal

Description

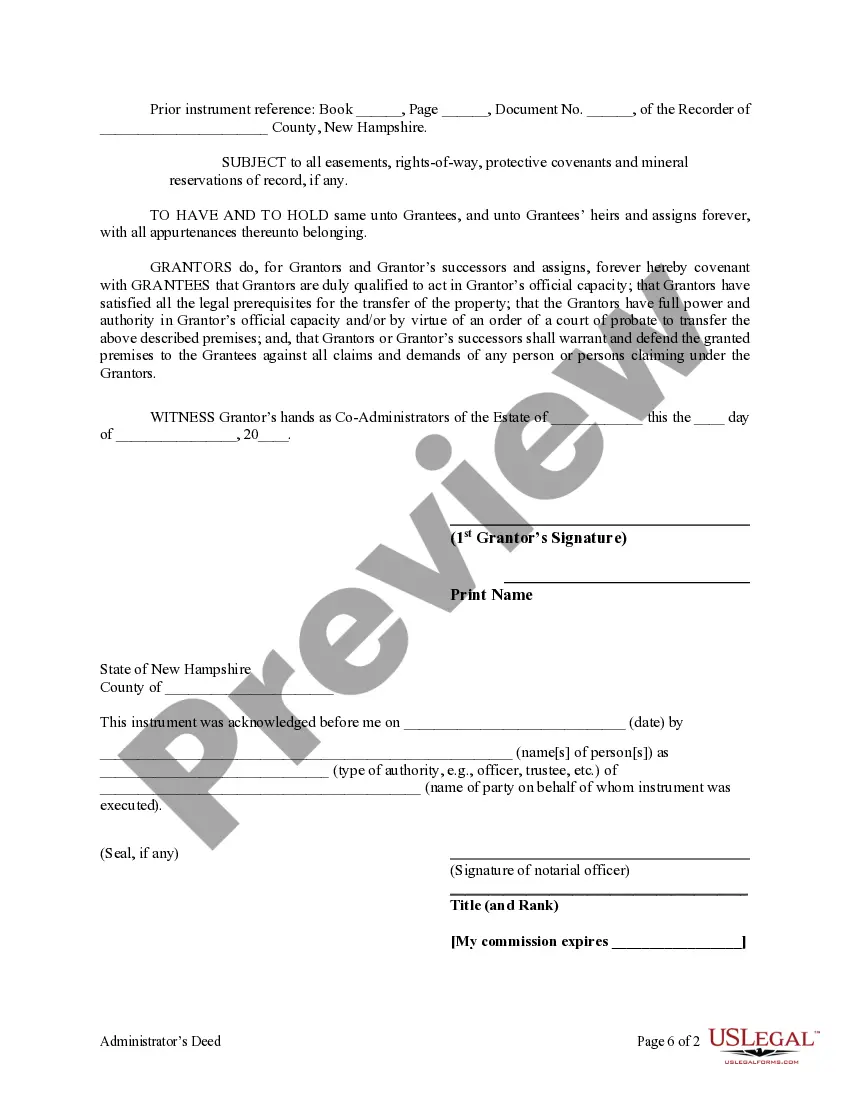

How to fill out New Hampshire Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

It’s clear that you cannot transform into a legal expert instantly, nor can you understand how to swiftly create a Fiduciary Deed Nh Withdrawal without having a certain set of abilities.

Assembling legal documents is a lengthy undertaking that necessitates specific training and expertise.

So why not entrust the creation of the Fiduciary Deed Nh Withdrawal to qualified experts.

You can access your documents again from the My documents section at any time. If you’re already a client, you can simply Log In, and find and download the template from the same section.

Regardless of the aim of your paperwork—whether it’s financial and legal or personal—our platform can assist you. Try US Legal Forms today!

- Locate the document you require by utilizing the search feature at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Fiduciary Deed Nh Withdrawal fits your needs.

- Initiate your search again if you need a different template.

- Establish a free account and select a subscription plan to acquire the template.

- Click Buy now. After the transaction is complete, you can receive the Fiduciary Deed Nh Withdrawal, complete it, print it, and deliver or mail it to the intended recipients or organizations.

Form popularity

FAQ

This form is used to show the court the details of the assets of an estate, whether for an estate administration, guardianship, conservatorship or trust. It should contain an itemization of real and personal properties and their values.

Rule 11. (a) A request for court order must be made by motion which must (1) be in writing unless made during a hearing or trial, (2) state with particularity the grounds for seeking the order, and (3) state the relief sought.

Probate Court Rule 108(E). The account shall show significant transactions that do not affect the amount for which the fiduciary is accountable.

(a) An Answer or other responsive pleading shall be filed with the court within 30 days after the person filing said pleading has been served with the pleading to which the Answer or response is made.

(a) An Answer or other responsive pleading shall be filed with the court within 30 days after the person filing said pleading has been served with the pleading to which the Answer or response is made.