New Hampshire Contract Form Foreign Corporation Registration

Description

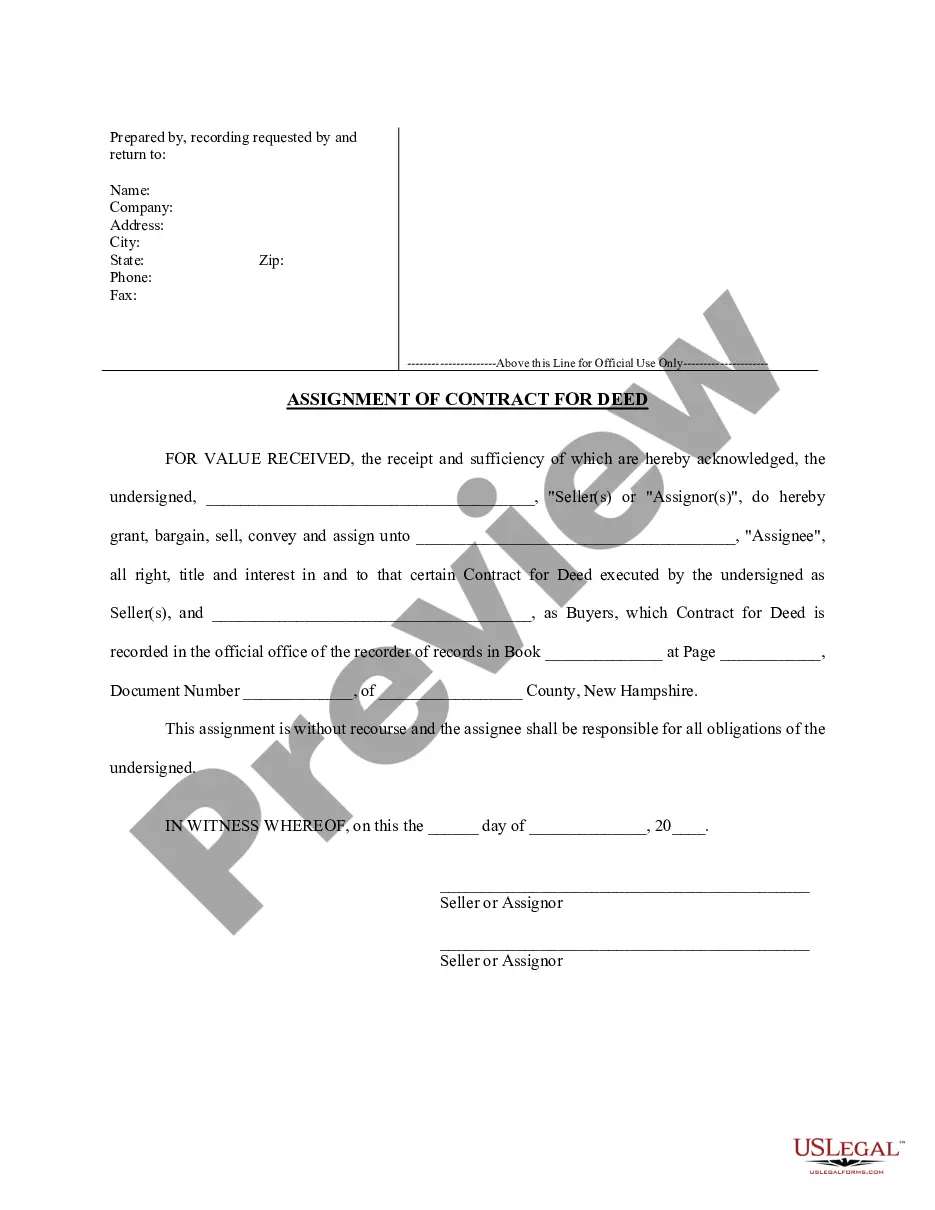

How to fill out New Hampshire Assignment Of Contract For Deed By Seller?

There's no longer a necessity to squander time seeking legal documents to comply with your regional state requirements.

US Legal Forms has assembled all of them in one location and enhanced their accessibility.

Our website offers over 85,000 templates for any business and personal legal situations categorized by state and usage area.

Using the search field above to look for another example if the previous one did not meet your needs is also an option.

- All forms are expertly crafted and validated for authenticity, allowing you to feel assured in acquiring an up-to-date New Hampshire Contract Form Foreign Corporation Registration.

- If you are acquainted with our platform and already possess an account, you must confirm your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You may also revisit all stored documents whenever needed by navigating to the My documents tab in your profile.

- If you are encountering our platform for the first time, the procedure will require a few additional actions to finalize.

- Here’s how new users can find the New Hampshire Contract Form Foreign Corporation Registration in our library.

- Examine the page content closely to ensure it holds the example you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

To register a foreign corporation in Illinois, you must file an Illinois Application for Authority with the Illinois Secretary of State, Department of Business Services. You can submit this document by mail or in person. The Application for Authority for a foreign Illinois corporation costs $175 to file.

To withdraw/cancel your foreign New Hampshire Corporation, file an Application for Certificate of Withdrawal with the Department of State by mail or in person. Type or print on the form in black ink. Submit the signed, dated original cancellation/withdrawal form, the tax clearance certificate, and the fee.

Choose a Corporate Structure. Incorporating means starting a corporation.Check Name Availability.Appoint a Registered Agent.File New Hampshire Articles of Incorporation.Establish Bylaws & Corporate Records.Appoint Initial Directors.Hold Organizational Meeting.Issue Stock Certificates.

If you plan to do business in the state of New Hampshire, but your company was not formed there, you will often need to obtain a New Hampshire Foreign Qualification. Typically, doing business is defined by activities such as maintaining a physical office or having employees in the state.

Dissolving a domestic LLC in New Hampshire simply requires you to file the Certificate of Cancellation. However, dissolving a foreign LLC requires you to file the Certification Request Form with the Department of Revenue, followed by a different version of the Certificate of Cancellation with the Department of State.