Nebraska Lien With Title Participating Lender Application

Description

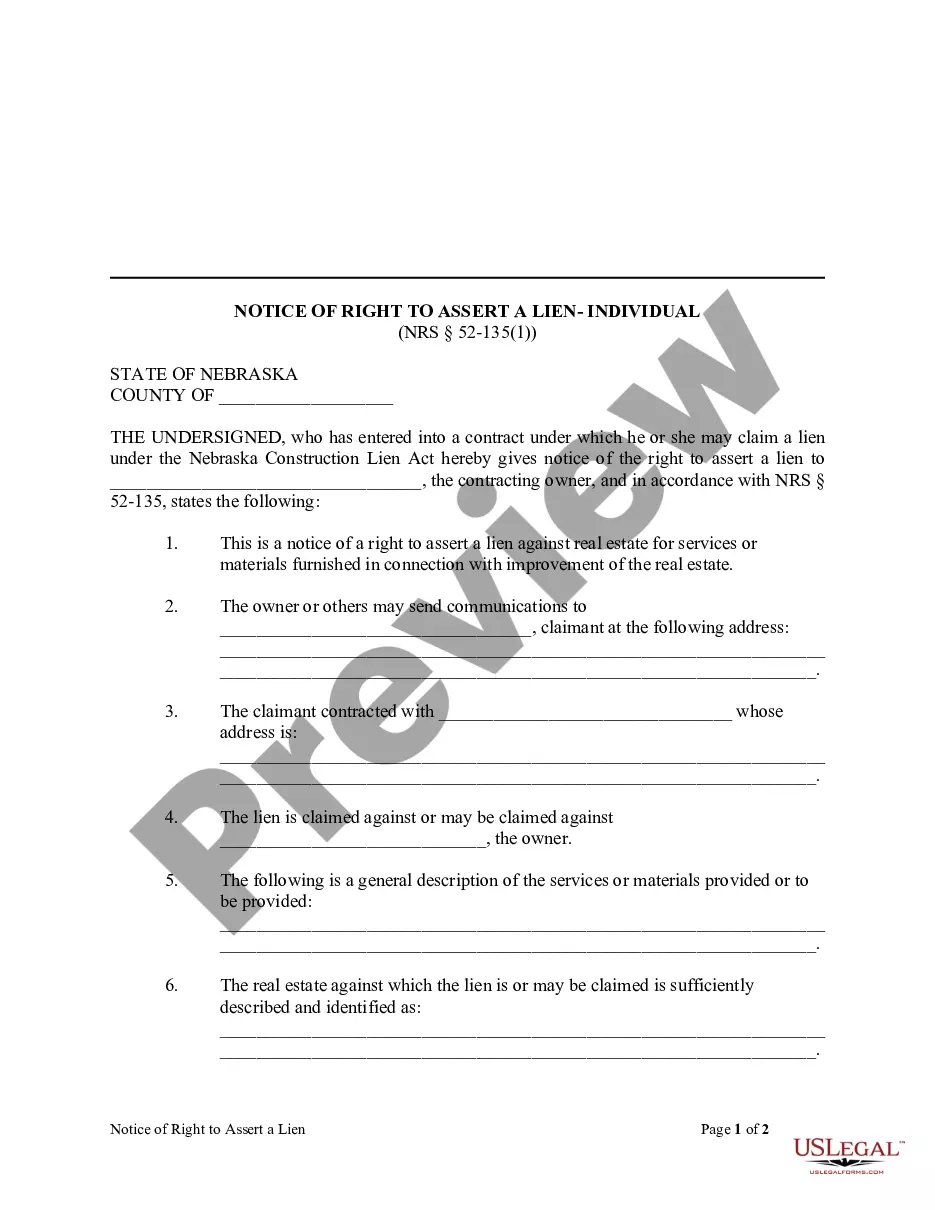

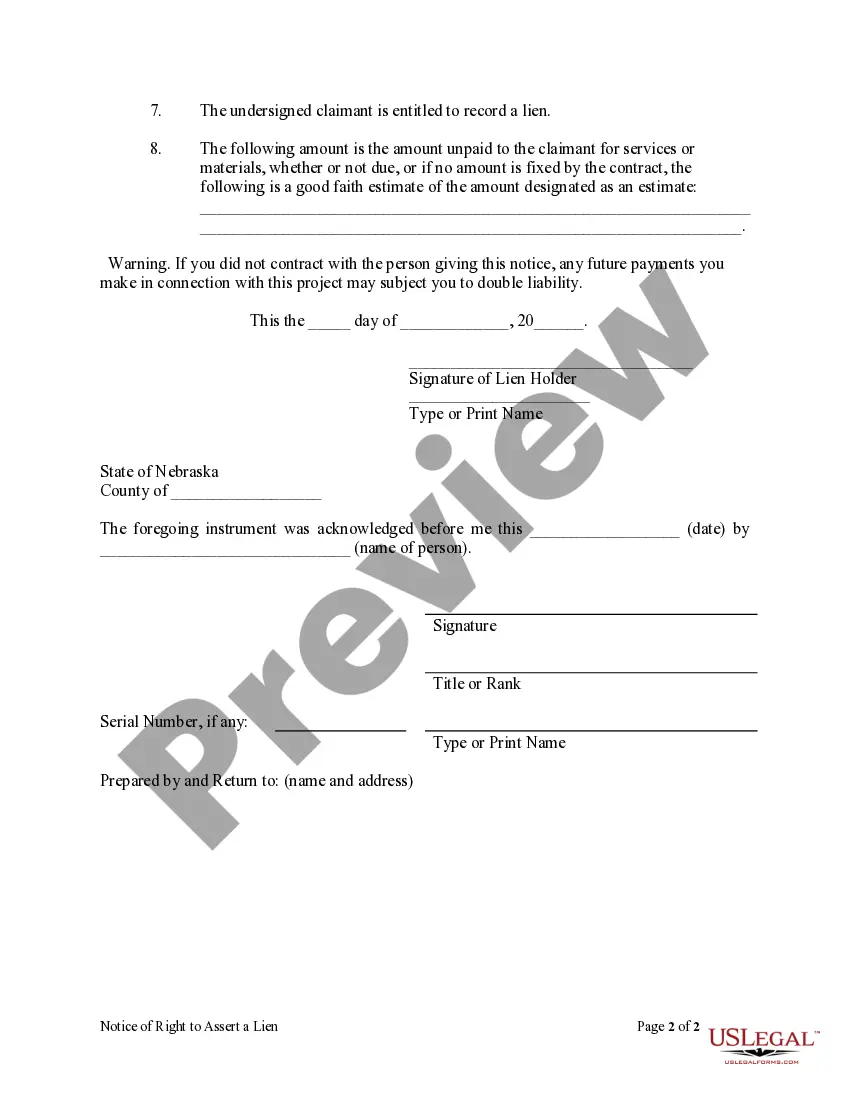

How to fill out Nebraska Notice Of Right To Assert A Lien - Individual?

Individuals frequently link legal documentation with complexity that can only be handled by an expert.

In a sense, this is accurate, as composing the Nebraska Lien With Title Participating Lender Application necessitates considerable understanding of relevant criteria, including state and county laws.

Nonetheless, with US Legal Forms, the process has become more straightforward: ready-made legal documentation for various life and business scenarios that comply with state regulations are compiled in one online directory and are now accessible to everyone.

Register for an account or sign in to advance to the payment page. Complete the payment for your subscription via PayPal or with your credit card. Choose the desired format for your file and click Download. You can print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them whenever necessary through the My documents tab. Explore all the advantages of using the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85,000 current forms categorized by state and purpose, allowing you to search for the Nebraska Lien With Title Participating Lender Application or any specific template in just a few minutes.

- Users who are already registered with an active subscription must Log In to their account and click Download to retrieve the document.

- New users must first create an account and subscribe before they can download any files.

- Below is a detailed guide on how to acquire the Nebraska Lien With Title Participating Lender Application.

- Carefully review the content of the page to confirm it meets your requirements.

- Read the form description or review it using the Preview option.

- If the previous sample isn’t appropriate, discover another option utilizing the Search field in the header.

- Once you locate the correct Nebraska Lien With Title Participating Lender Application, click Buy Now.

- Select a subscription plan that fits your needs and financial capability.

Form popularity

FAQ

Selling a car with a lien isn't illegal, but it does come with specific requirements. The lien must be settled, or the buyer must be informed about the outstanding debt, as they will not receive a clear title. It is advisable to work closely with the lender to resolve the lien before completing the sale. Utilizing the Nebraska lien with title participating lender application can provide clarity on this process.

In Nebraska, you generally cannot register a vehicle without a title. If your car is under a lien, the lien holder usually holds the title, which complicates matters. However, when applying for a Nebraska lien with title participating lender application, you may be able to obtain a new title after addressing the lien. It’s best to consult with the Nebraska Department of Motor Vehicles for precise instructions.

To get a title with a lien, you must first complete the necessary forms and ensure that the lienholder submits their information. The Nebraska lien with title participating lender application is designed to facilitate this process, ensuring all parties are represented properly. After submission, the title will reflect the lien in the state's records.

To obtain a title for a vehicle with a lien, first contact the lienholder to understand any specific requirements. Typically, you need to complete the Nebraska lien with title participating lender application. Once you submit this application along with any fees, the state will process it and may issue a new title reflecting the lien.

Filing a lien on a vehicle in Nebraska involves submitting specific forms to the DMV along with proof of the debt that the lien secures. You must provide detailed information about the vehicle and the lienholder. To facilitate this process, consider the Nebraska lien with title participating lender application, which outlines the necessary steps clearly.

To obtain a title with a lien on it, you typically need to apply through the state DMV or equivalent authority, providing documentation about the lien. The title will indicate that a lien exists, ensuring that any outstanding debts are noted before the title is transferred. This is essential when navigating a Nebraska lien with title participating lender application.

To file a lien in Nebraska, you need to complete the appropriate forms and submit them to the local county clerk or Secretary of State's office. Make sure to include all required details, such as the debtor's information and the nature of the lien. For convenience, using a Nebraska lien with title participating lender application can simplify this filing process.

Yes, Nebraska is considered an Electronic Lien and Title (ELT) state. This means that lenders can electronically manage liens and titles through a secure system. If you are involved in a Nebraska lien with title participating lender application, being aware of the ELT process can streamline your transactions.

A notice of intent to lien serves as a formal communication to notify a property owner of the impending lien. This notice must be sent before filing the lien to give the property owner an opportunity to resolve the debt. Understanding this process is important when dealing with a Nebraska lien with title participating lender application.

In Nebraska, a lien generally remains effective for a period of five years from the filing date. However, it can be renewed by filing a continuation statement before the expiration date. Utilizing a Nebraska lien with title participating lender application can ensure that your lien remains enforceable for an extended period.