Nebraska Bill Automobile Without License

Description

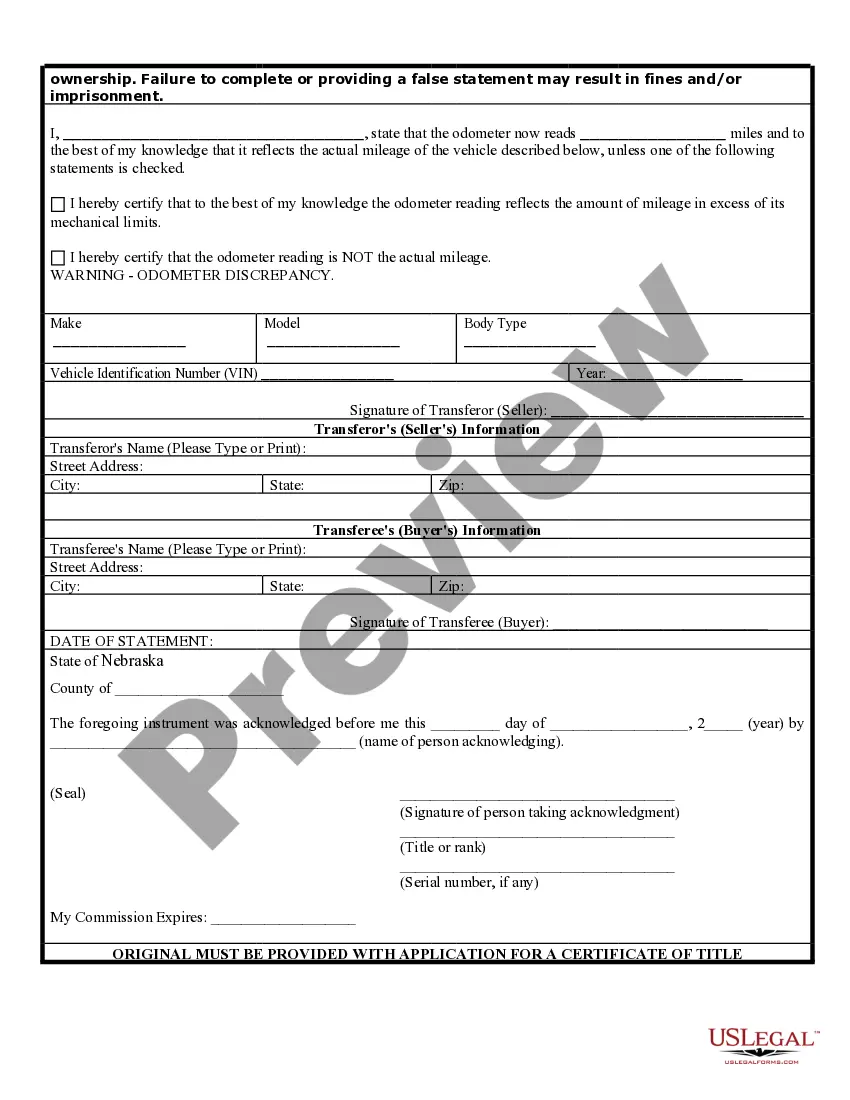

How to fill out Nebraska Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Using legal document samples that meet the federal and local laws is crucial, and the internet offers many options to pick from. But what’s the point in wasting time looking for the right Nebraska Bill Automobile Without License sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all files collected by state and purpose of use. Our experts keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Nebraska Bill Automobile Without License from our website.

Obtaining a Nebraska Bill Automobile Without License is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, adhere to the steps below:

- Analyze the template using the Preview feature or through the text description to make certain it fits your needs.

- Look for another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Nebraska Bill Automobile Without License and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

FAQ: About the Nebraska Bill of Sale Date of purchase. Contact information of buyer and seller. Purchase amount. Description of the sold item. Guarantee that the asset is cleared of any liens or claims. Ongoing terms, such as warranties. Signatures of buyer and seller. Signature of a notary public.

For first time registration, the following documents must be presented to the County Treasurer: Proof of Financial Responsibility (Insurance). Proof must be in the form of an original document. ... Proof that sales or excise tax has been paid; A copy of the signed lease agreement, if the vehicle is a leased vehicle.

The following paperwork is required for selling a car in Nebraska: Certificate of Title. A notarized Bill of Sale (form 6)

Any consumer who transfers ownership of a motor vehicle must first obtain a certificate of title in his or her name, register the vehicle and pay sales tax. Failure to do so is a Class IV felony. Licensed motor vehicle dealers are exempt from this requirement.

For first time registration, the following documents must be presented to the County Treasurer: Proof of Financial Responsibility (Insurance). Proof must be in the form of an original document. ... Proof that sales or excise tax has been paid; A copy of the signed lease agreement, if the vehicle is a leased vehicle.