Spousal Allowance Nc Form With Medicaid

Description

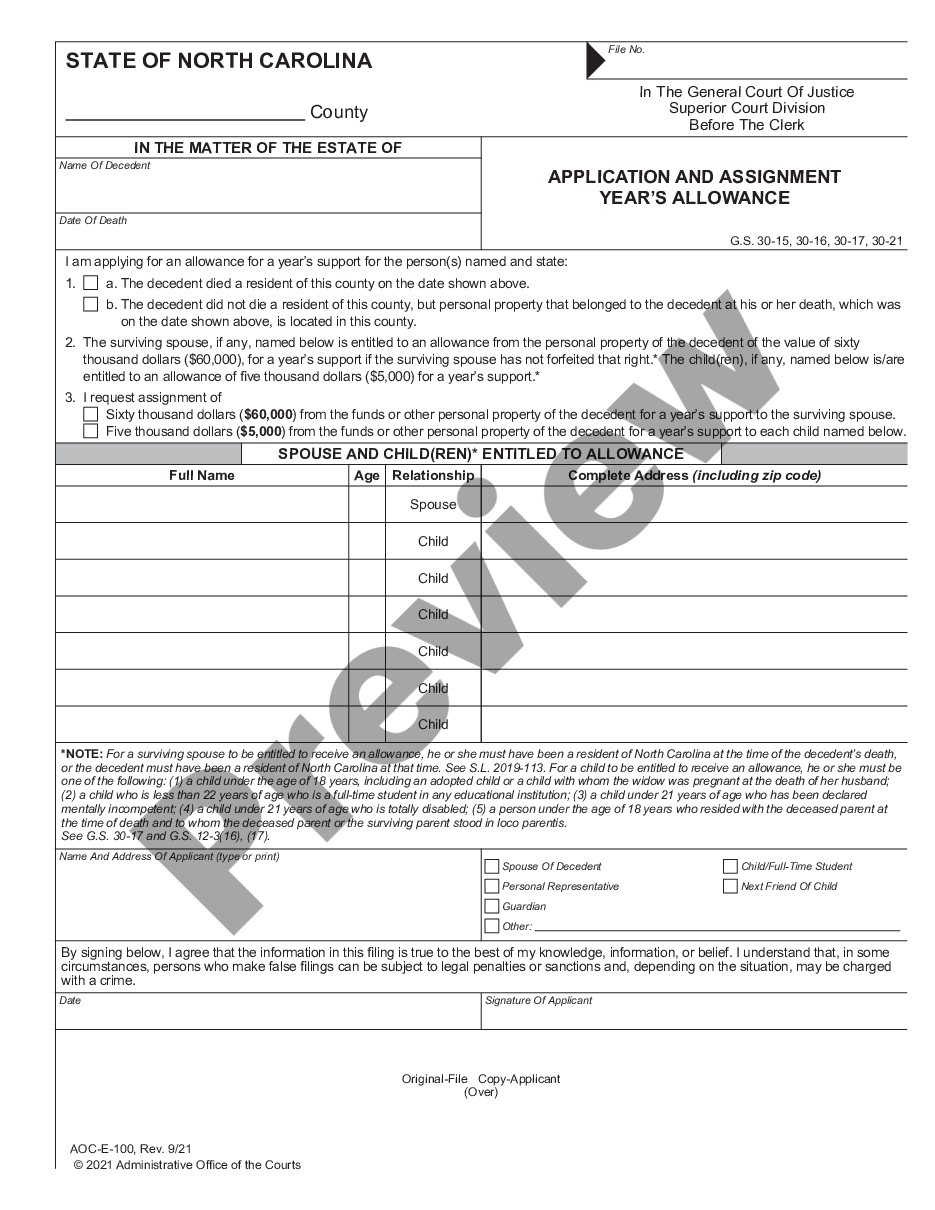

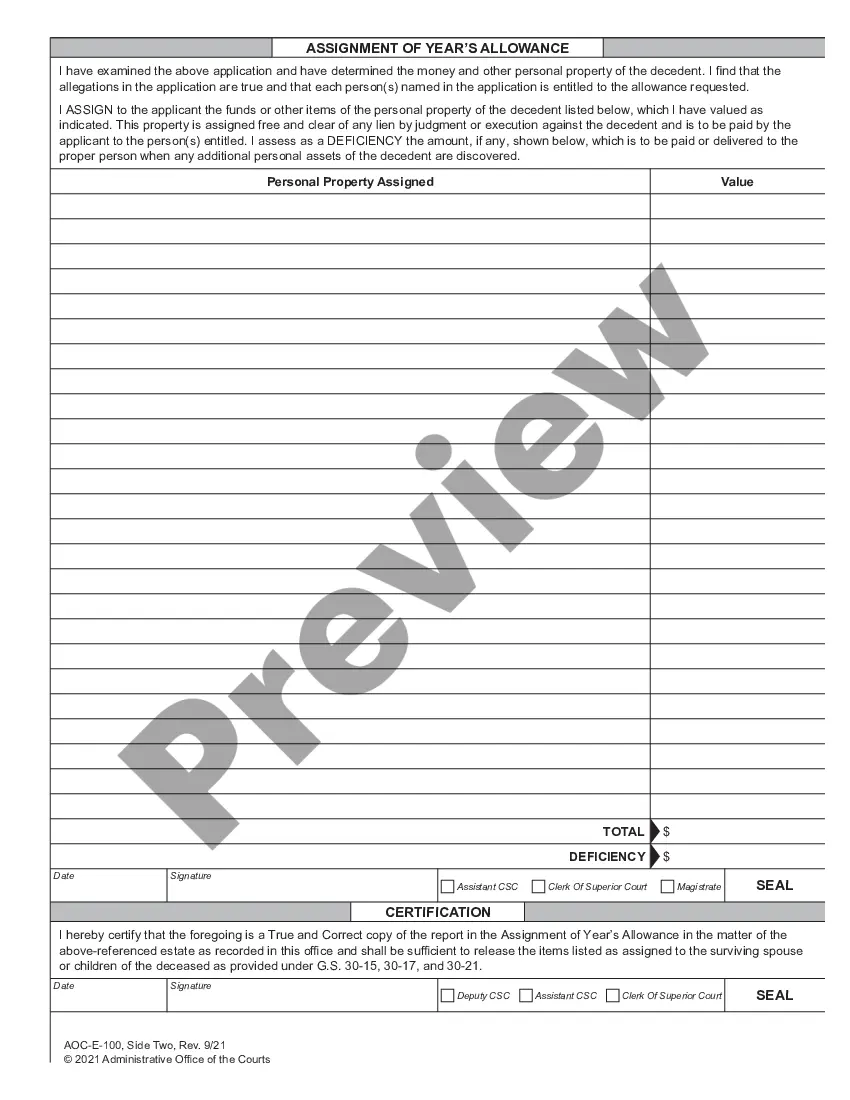

How to fill out North Carolina Application And Assignment Year's Allowance?

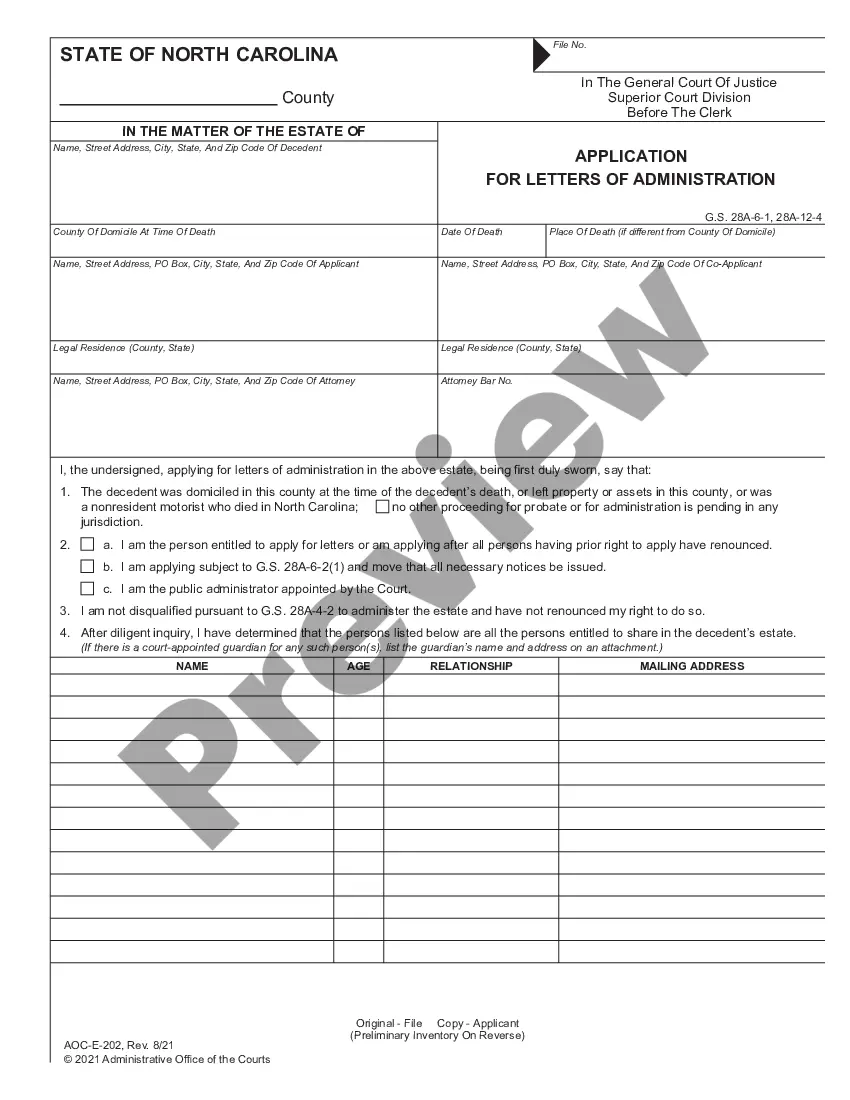

Whether for business purposes or for individual affairs, everyone has to deal with legal situations sooner or later in their life. Completing legal paperwork demands careful attention, starting with selecting the correct form sample. For instance, if you choose a wrong version of a Spousal Allowance Nc Form With Medicaid, it will be rejected when you submit it. It is therefore essential to have a dependable source of legal documents like US Legal Forms.

If you have to get a Spousal Allowance Nc Form With Medicaid sample, follow these simple steps:

- Find the template you need using the search field or catalog navigation.

- Look through the form’s description to make sure it suits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to find the Spousal Allowance Nc Form With Medicaid sample you require.

- Get the file if it meets your needs.

- If you have a US Legal Forms account, just click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Select the document format you want and download the Spousal Allowance Nc Form With Medicaid.

- After it is saved, you are able to complete the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time searching for the right template across the internet. Take advantage of the library’s easy navigation to find the right template for any occasion.

Form popularity

FAQ

The spousal allowance (or ?year's allowance?) is an allowance that one receives from the deceased spouse's estate after the death of the spouse. It is typically given in the form of a lump sum or the assignment of certain assets, such as vehicles titled in the name of the deceased spouse.

The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death. The deceased spouse or surviving spouse must have been a resident of North Carolina. This allowance will be exempt from any lien, judgment, or other creditor claims in the decedent's estate.

This surviving spouse benefit is equal to one-half of the monthly retirement benefit under the maximum allowance to which you would have been entitled on the first day of the month following your death reduced by 2% for each full year your age exceeds that of your spouse.

Medicaid provides special protections for the spouse of a nursing home resident, known in the law as the ?community? spouse. Under the general rule, the spouse of a married applicant is permitted to keep one-half of the couple's combined countable assets up to $148,620 (2023).

Who is eligible for North Carolina Medicaid Program? Household Size*Maximum Income Level (Per Year)5$46,7376$53,5737$60,4098$67,2454 more rows