Dissolving Dissolve Company With Bounce Back Loan

Description

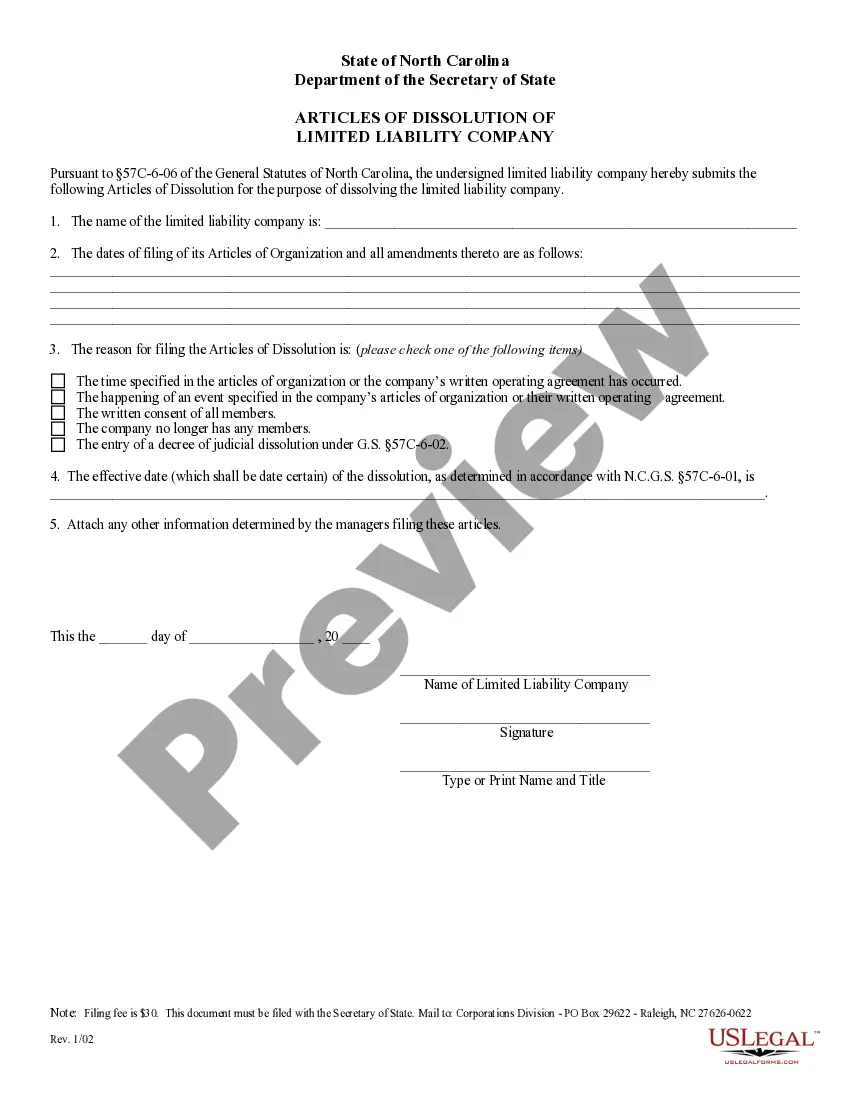

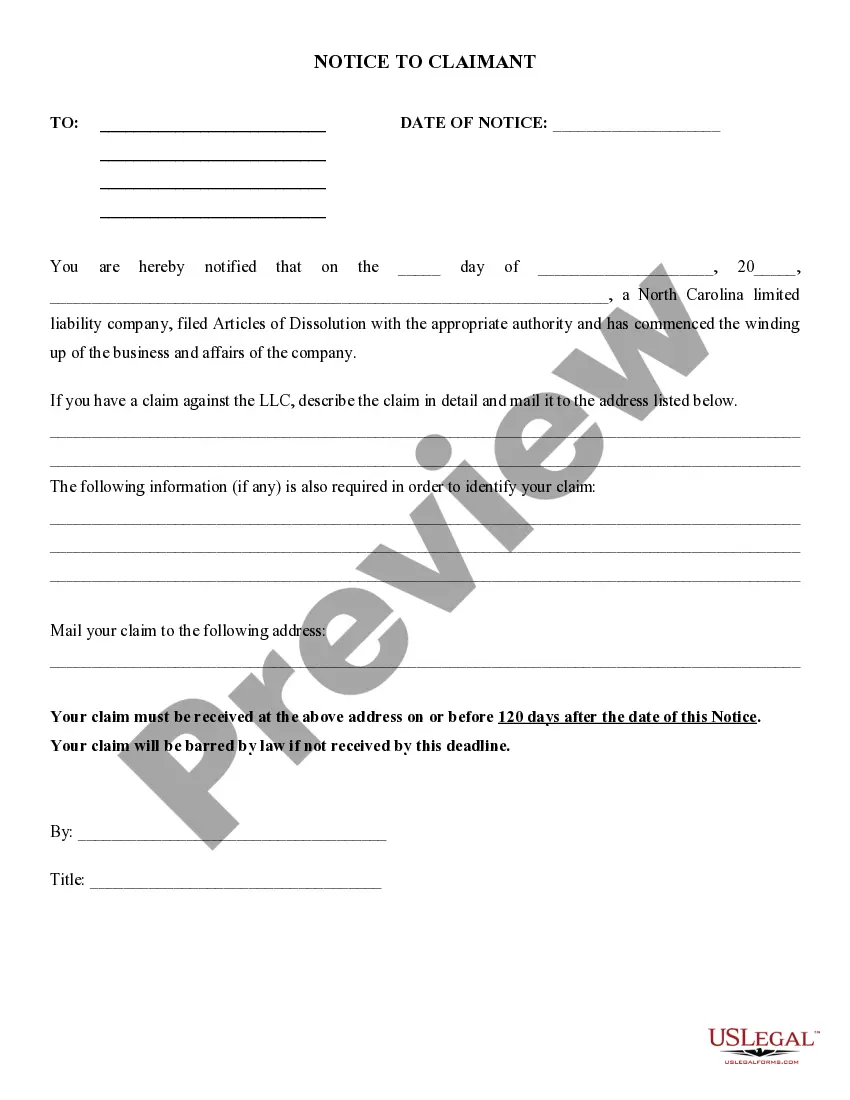

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Whether for commercial reasons or personal matters, everyone must handle legal issues at some stage in their life.

Filling out legal documents requires meticulous care, starting with selecting the appropriate template.

Once downloaded, you can complete the form using editing software or print it out and finish it manually. With an extensive catalog of US Legal Forms available, you don’t have to waste time searching for the correct sample online. Use the library’s user-friendly navigation to find the right template for any situation.

- Locate the template you require by utilizing the search box or browsing the catalog.

- Review the form’s description to ensure it aligns with your situation, jurisdiction, and area.

- Click on the preview of the form to view it.

- If it is the incorrect form, return to the search option to find the Dissolving Dissolve Company With Bounce Back Loan template you require.

- Download the template if it suits your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- In case you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing choice.

- Complete the account registration form.

- Choose your method of payment: you can use a credit card or a PayPal account.

- Select the file format you want and download the Dissolving Dissolve Company With Bounce Back Loan.

Form popularity

FAQ

To address a bounce back loan while dissolving your company, consider negotiating with your lender for a repayment plan or seeking a settlement. You may also explore if your company qualifies for insolvency options, which could alleviate some financial burdens. Using USLegalForms can help you navigate the legal requirements and paperwork for dissolving your company with a bounce back loan efficiently. Always seek advice from a financial advisor to understand your best course of action.

When you are dissolving a company with a bounce back loan, the outstanding balance of the loan remains your responsibility. The lender may pursue repayment even after the company is closed. It is crucial to settle any debts before formally dissolving your company to avoid personal liability. Consulting with a legal professional can provide clarity on your obligations.

Yes, you can make your company dormant even if you have a bounce back loan, but there are specific steps to follow. You must inform your lender and adhere to any ongoing obligations related to the loan. Making your company dormant can be a strategic move while you sort out your financial situation. For assistance with this process, consider using USLegalForms, which provides valuable tools and templates.

When you sell a company that has a bounce back loan, the loan typically transfers to the new owner. This means the new owner assumes responsibility for the debt. However, it’s crucial to outline this in the sale agreement to avoid future complications. Utilizing services like USLegalForms can help ensure that all legal aspects of the sale are handled correctly.

Bounce back loans may be eligible for forgiveness under certain conditions, but this depends on your specific situation. If you meet the criteria set by the lender, you could potentially have the loan written off. However, it’s essential to understand your obligations before proceeding with dissolving a company with a bounce back loan. Consulting with a professional can provide clarity on your options.

Dissolving a company with a bounce back loan involves a few steps. First, you need to settle any outstanding debts and obligations, including the loan. Then, file for dissolution with the appropriate state authorities. It's advisable to consult with a legal expert or use a platform like USLegalForms, which offers resources and guidance to streamline the process.

To get a bounce back loan written off, you first need to understand the terms of your loan agreement. Contact your lender and discuss your situation, as they may offer options like repayment plans or even partial forgiveness. If you are in the process of dissolving your company, it’s essential to seek advice from professionals who specialize in dissolving companies with bounce back loans. Platforms like US Legal Forms can provide you with the necessary resources and guidance to navigate this process smoothly.