Montana Assets For Medicaid

Description

How to fill out Montana Organizing Your Personal Assets Package?

When you have to complete Montana Assets For Medicaid in alignment with your local state's rules, there can be many choices to select from.

There's no need to examine every document to confirm it fulfills all the legal requirements if you are a US Legal Forms member.

It is a reliable source that can assist you in acquiring a reusable and current template on any topic.

Utilizing US Legal Forms facilitates the process of obtaining professionally designed official documents.

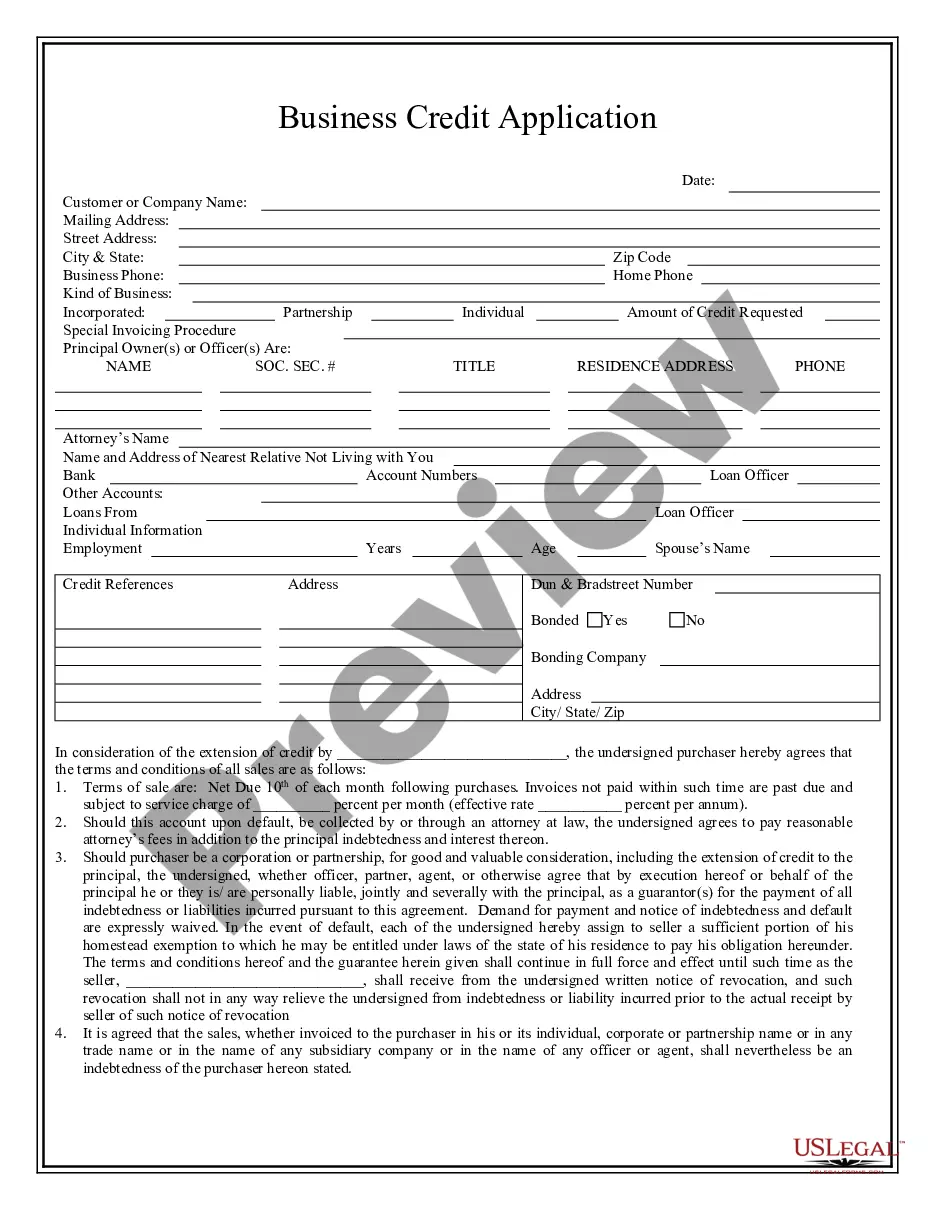

- US Legal Forms is the largest online database with a compilation of more than 85k ready-to-use documents for business and personal legal matters.

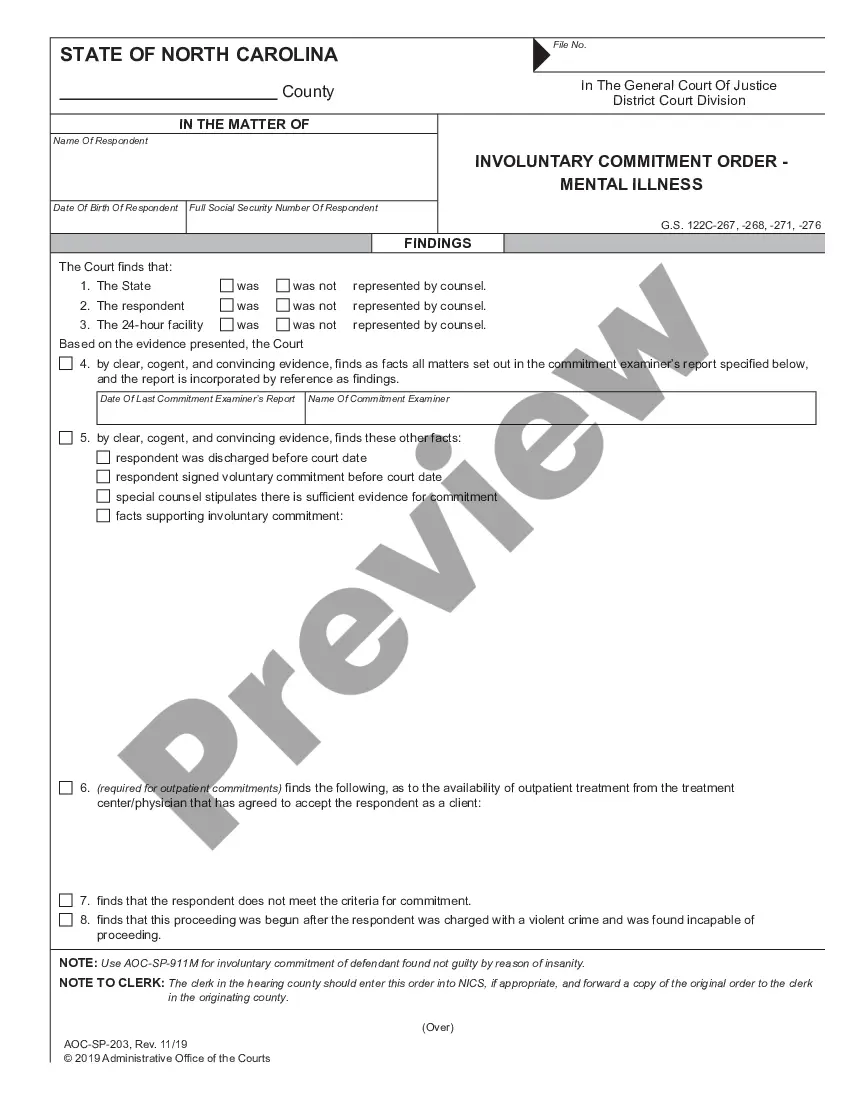

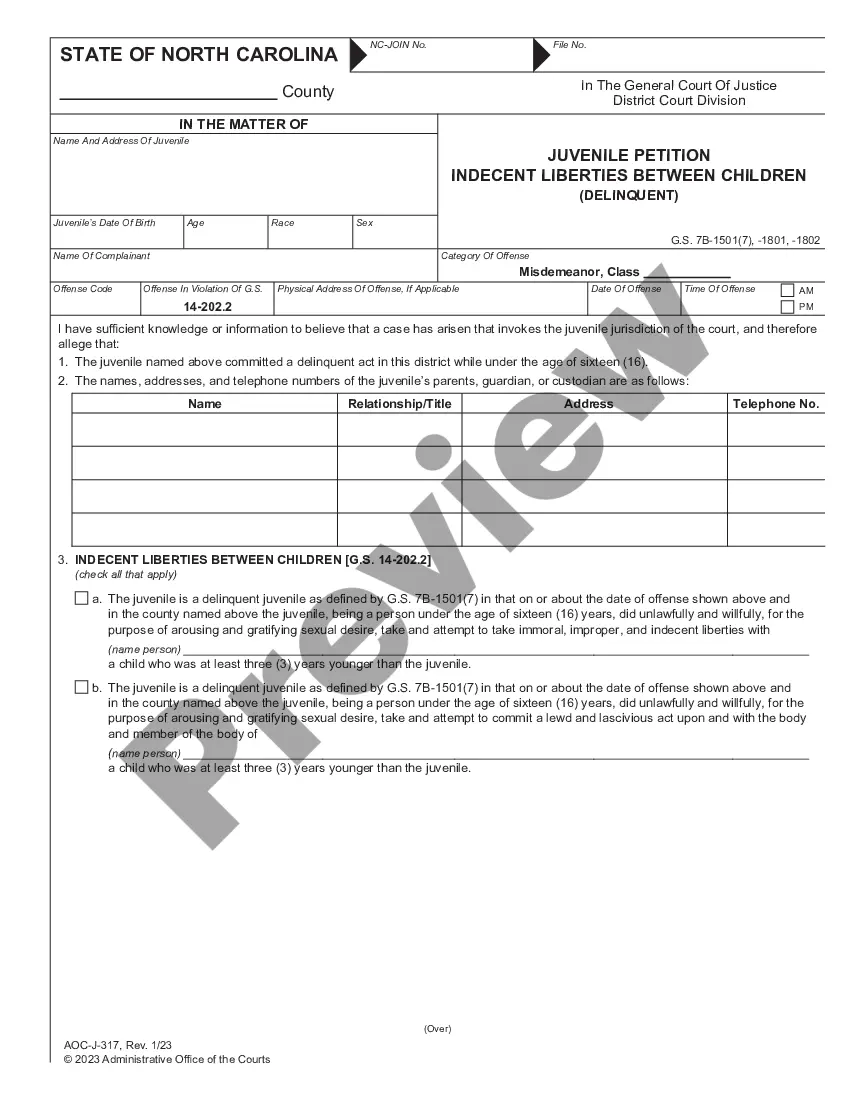

- All templates are verified to meet each state's laws and regulations.

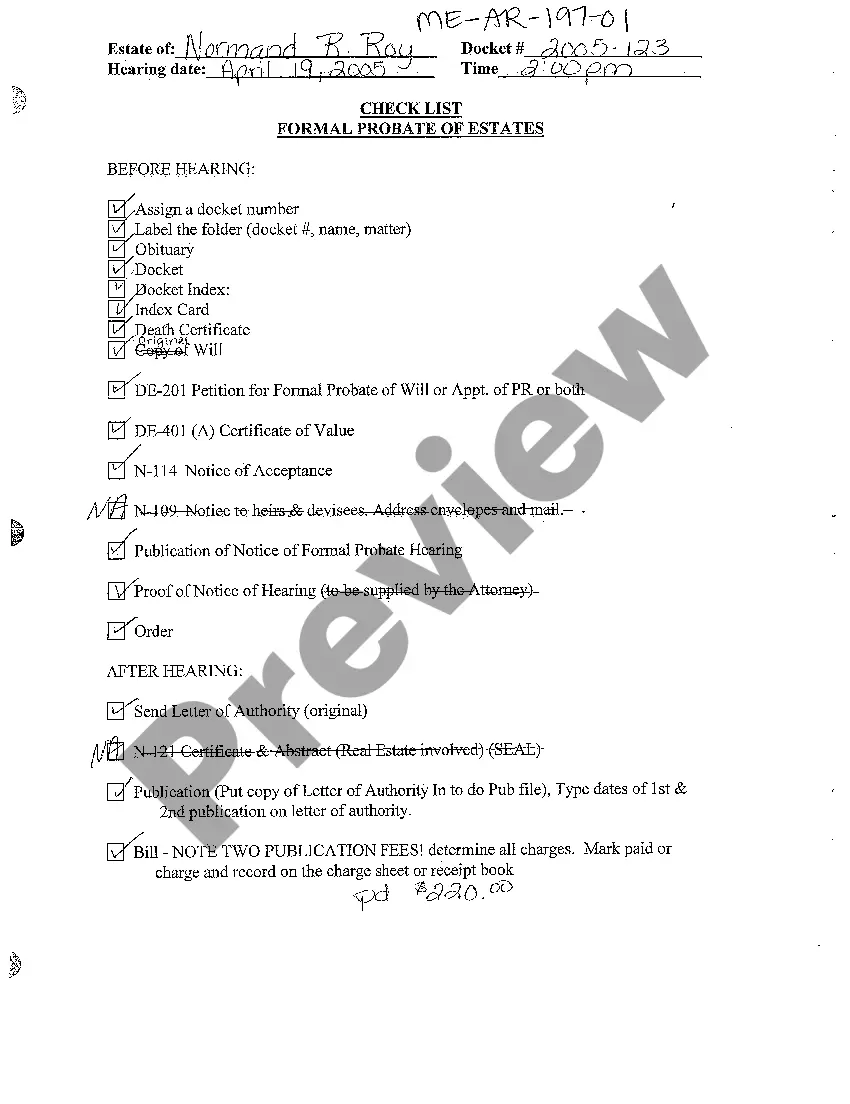

- Therefore, when downloading Montana Assets For Medicaid from our platform, you can be assured that you hold a valid and current document.

- Obtaining the required sample from our platform is very straightforward.

- If you already possess an account, simply Log In to the system, verify your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and maintain access to Montana Assets For Medicaid at any time.

- If it's your initial experience with our library, please adhere to the guidance below.

- Browse the recommended page and verify it for alignment with your needs.

Form popularity

FAQ

In Montana, certain assets are exempt from Medicaid recovery, meaning they don't need to be repaid after a beneficiary's passing. This includes the primary residence, personal belongings, and a vehicle, among others. Understanding which Montana assets for Medicaid are protected can help you plan more effectively and ensure you retain essential resources. Consulting with professionals can provide clarity on these exemptions.

The spend down rule for Medicaid in Montana allows individuals to become eligible for benefits by reducing their countable assets to meet the program's financial limits. This typically involves using excess funds for qualified medical expenses or other necessities. It's important to understand that not all Montana assets for Medicaid must be spent down; some may qualify for exemptions. Seeking guidance from a legal expert can help you navigate this complex process.

To protect your Montana assets for Medicaid, start by understanding the eligibility requirements and asset limits that apply. Consider strategies such as creating trusts or making strategic changes to your asset ownership before applying. It's important to consult with a legal advisor to explore options specific to your circumstances. Using US Legal Forms can simplify the process with resources designed to help you navigate these complexities effectively.

Certain assets are exempt from being counted toward Medicaid eligibility in Montana. For example, your primary home, personal belongings, and a vehicle used for transportation may not affect your eligibility. Understanding which Montana assets for Medicaid are exempt can help protect your resources. Always consult a qualified professional for personalized advice.

The asset limit for Medicaid in Montana is set at $2,000 for an individual. Married couples may have higher limits, depending on specific conditions. It's essential to account for all your resources, as exceeding this limit can affect your eligibility. For detailed guidance, consider the services provided by USLegalForms to help manage your Montana assets for Medicaid.

In Montana, the maximum assets you can have to qualify for Medicaid varies based on individual circumstances. Generally, a single applicant can have up to $2,000 in countable assets. However, when planning, remember that certain resources may be classified as exempt. Understanding these limits helps manage your Montana assets for Medicaid more effectively.

The look back period for Medicaid in Montana is 60 months prior to your application date. During this time, Medicaid reviews any asset transfers you made. If you transferred any assets for less than fair market value, it could impact your eligibility. Knowing this helps you effectively plan your Montana assets for Medicaid.

To avoid Medicaid taking your assets in Montana, you should consider effective planning strategies. Start by understanding the rules surrounding Montana assets for Medicaid. You can use options like an irrevocable trust to protect your assets. Consulting a qualified attorney can help you navigate the process and safeguard your finances.