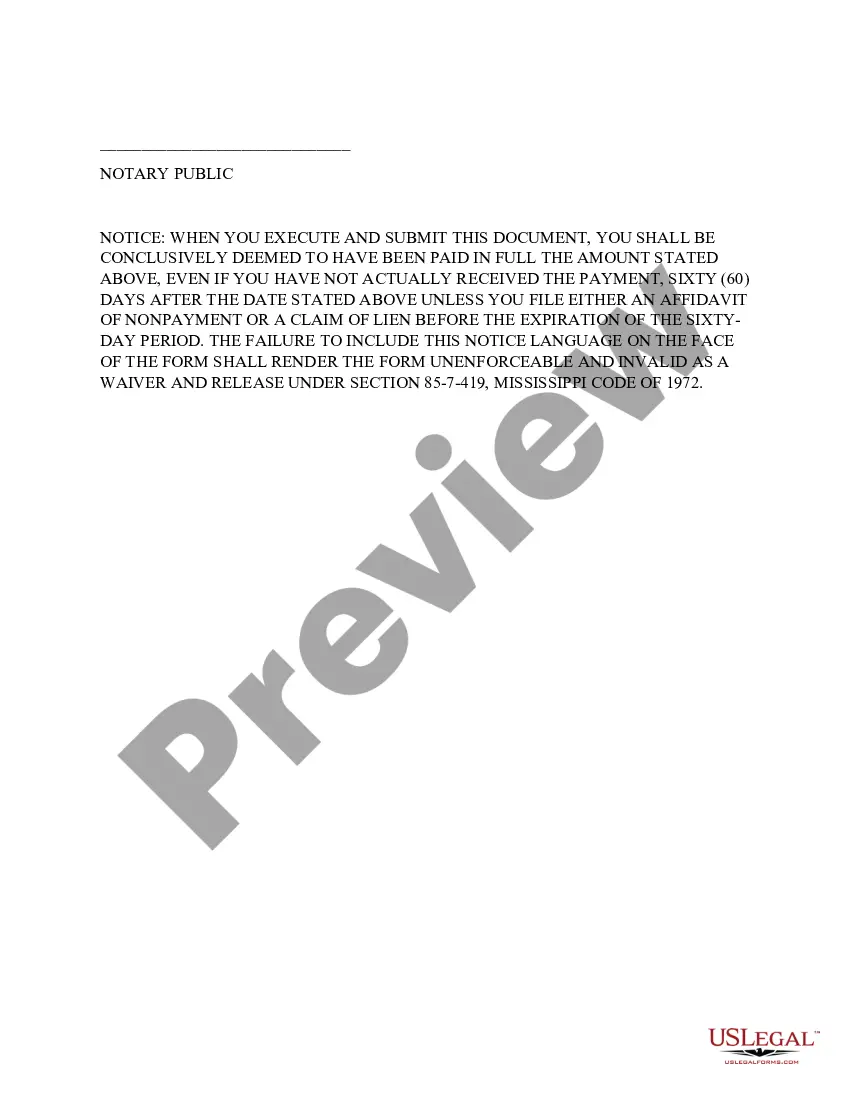

Lien Release Form Mississippi Without Notary

Description

How to fill out Mississippi Waiver And Release Of Lien Upon Final Payment Form?

Regardless of whether it's for commercial reasons or personal issues, every individual will encounter legal matters at some stage in their life.

Completing legal documents requires meticulous care, starting with choosing the appropriate form template.

With an extensive library of US Legal Forms available, you no longer need to waste time searching for the appropriate template online. Take advantage of the library's straightforward navigation to find the suitable form for any circumstance.

- Acquire the template you need by using the search bar or browsing the catalog.

- Review the form's description to ensure it suits your circumstances, state, and locality.

- Access the form's preview for inspection.

- If it is the incorrect document, return to the search feature to find the Lien Release Form Mississippi Without Notary sample that you need.

- Download the template if it satisfies your demands.

- If you possess a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- In case you don't have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing choice.

- Complete the account registration form.

- Choose your payment method: a credit card or PayPal account.

- Select the file format you wish and download the Lien Release Form Mississippi Without Notary.

- After downloading, you can fill out the form using editing software or print it out and complete it by hand.

Form popularity

FAQ

Consider including: Names and addresses of the parties to the agreement. Loan amount (principal). Interest rate. Repayment terms, including dates, and any late fees or penalties. Signature lines.

At a minimum, your loan contract should include: Your name and the borrower's name. The date the loan was granted. The amount of money being lent. Minimum monthly payment. Payment due date. Interest rate, if you're charging interest. Consequences for defaulting on the loan.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

In general, a personal loan contract is just as legally binding between friends or family as it would be with a bank. However, a contract between friends or family might be simpler or have fewer terms. Each agreement, though, is likely to have the same main provisions.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

The Do's for Lending to Friends and Family Lend Money Only to People You Trust. Limit Loans to What You Can Afford. Get It in Writing. Don't Lend More Than You Can Afford. Don't Let Guilt Drive Your Decision. Don't Lend Someone Your Credit.

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).

The IRS mandates that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate. (The IRS publishes Applicable Federal Rates (AFRs) monthly.)