Child Support Cost Of Living Adjustment Calculator With Taxes

Description

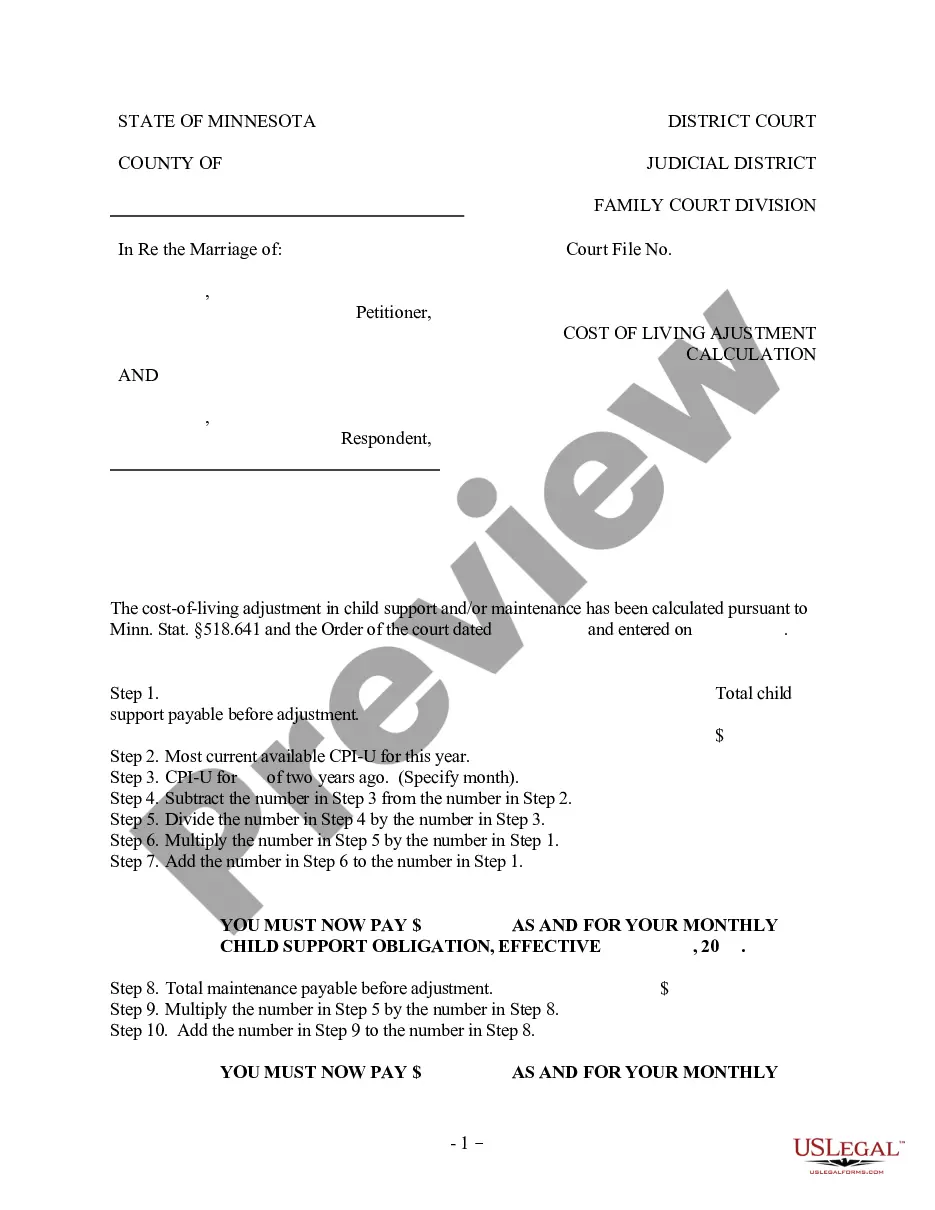

How to fill out Minnesota Cost Of Living Adjustment Calculation For Child Support?

It’s no secret that you can’t become a legal professional overnight, nor can you learn how to quickly draft Child Support Cost Of Living Adjustment Calculator With Taxes without having a specialized background. Putting together legal forms is a long venture requiring a specific education and skills. So why not leave the preparation of the Child Support Cost Of Living Adjustment Calculator With Taxes to the professionals?

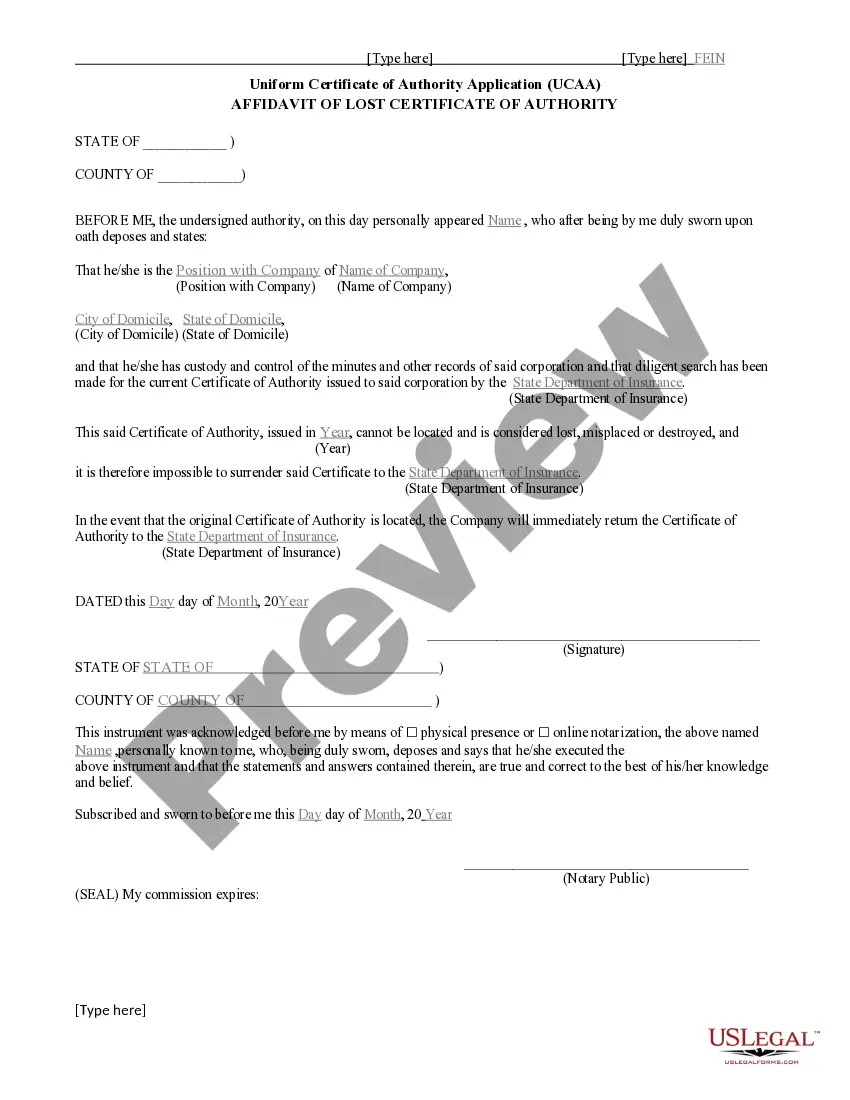

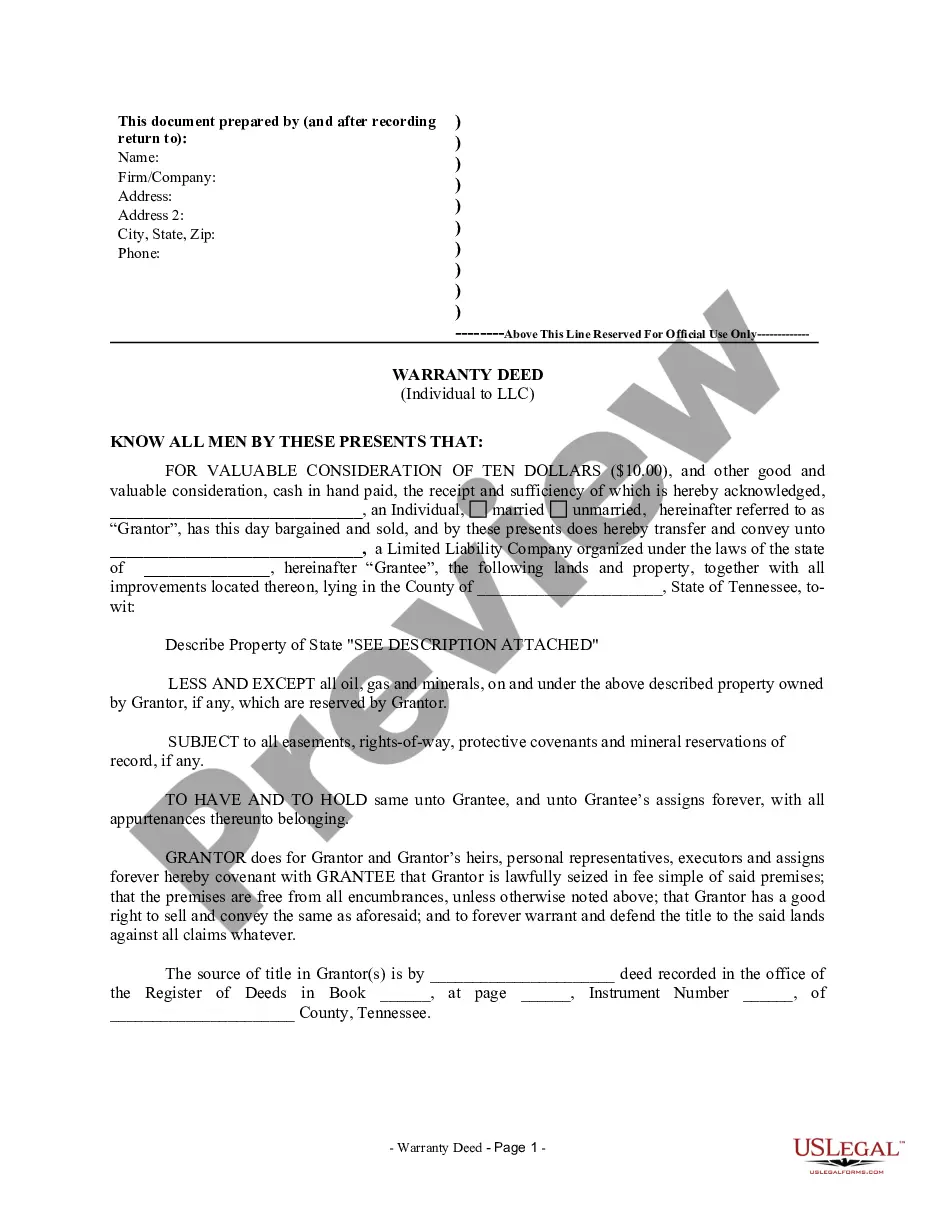

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the document you need in mere minutes:

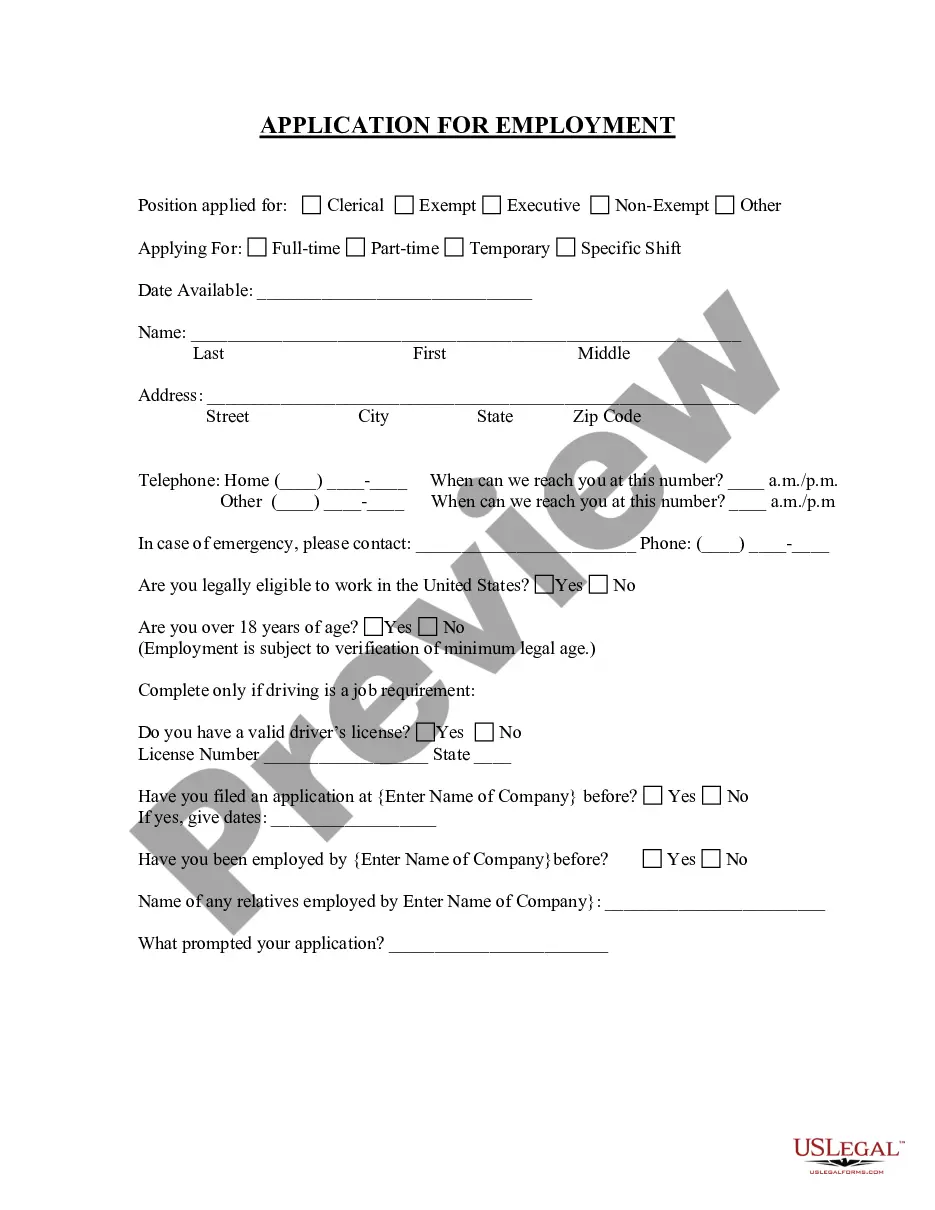

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether Child Support Cost Of Living Adjustment Calculator With Taxes is what you’re looking for.

- Start your search over if you need any other form.

- Set up a free account and choose a subscription plan to purchase the form.

- Pick Buy now. As soon as the transaction is complete, you can get the Child Support Cost Of Living Adjustment Calculator With Taxes, complete it, print it, and send or mail it to the necessary people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The court looks at the combined net income of the parents and compares it to the average cost of raising a child in the county where the custodial parent will live. The judge adjusts this cost based on the amount of parenting time each parent has with the child during an average month.

For a hypothetical example, if two parents have one child and jointly earn $1,000 per week, then the non-custodial parent must pay $233 in child support each week. If these parents had two children, the non-custodial parent would pay $257 per week.

Is There a Maximum Amount of Child Support? Yes. Texas divorce laws state the maximum child support amount for one child is $1,840. This is because state law dictates a maximum amount of net monthly income that can be used to calculate child support, which is $9,200.

However, it is believed that, on average, residents of California paying child support pay between $400-500 per child every month. If you're wondering how much you might have to pay in child support, you should consult with a legal professional, as it will be based on your and your co-parent's financial situation.

This is decided by looking at something called the Consumer Price Index for urban areas (CPI-U), which is published by the federal government. There has to have been a change of at least 10% from the year of the most current order, or since 1994, whichever is later.