Transfer On Death Deed With Multiple Beneficiaries

Description

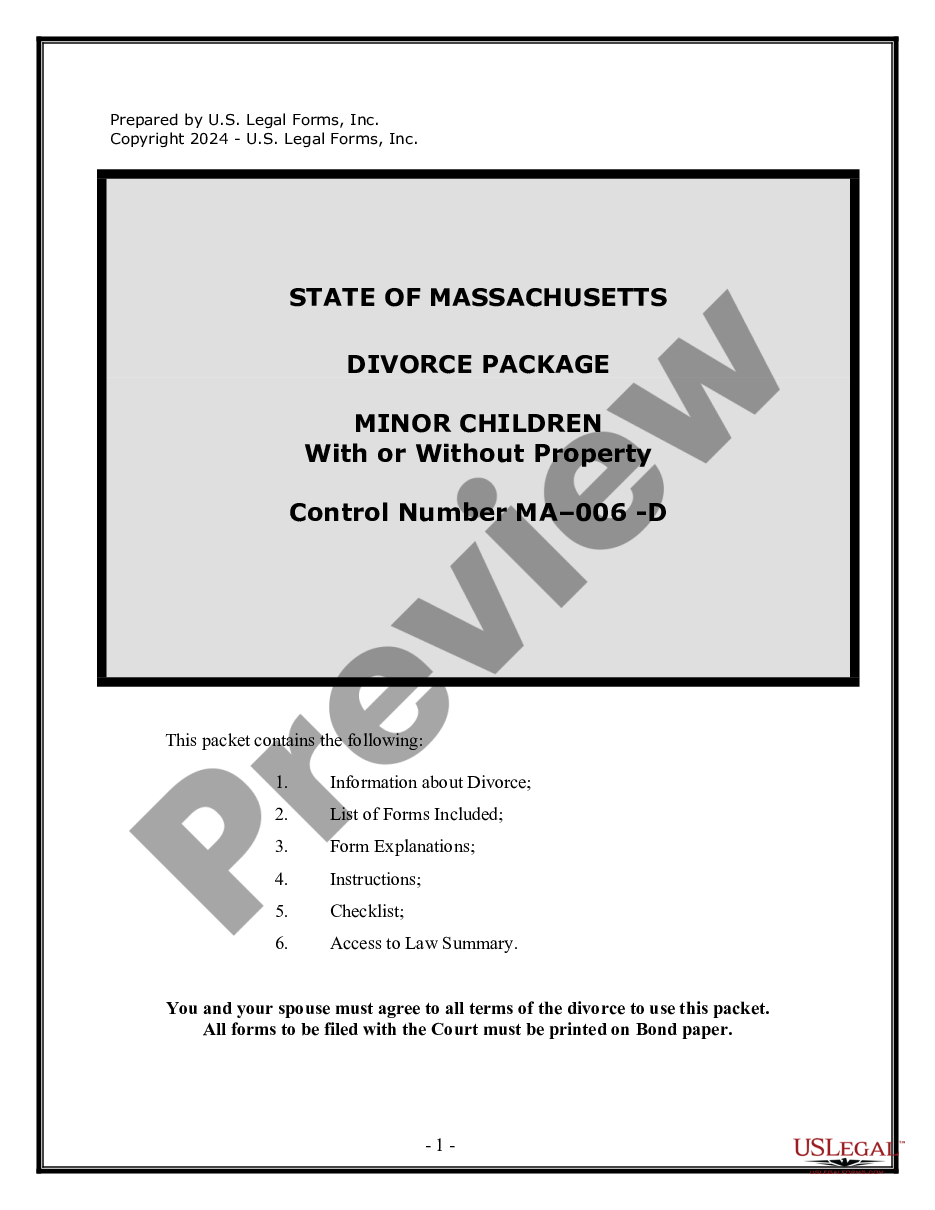

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

- Log into your US Legal Forms account if you're an existing user. Ensure your subscription is active; renew if necessary.

- For first-time users, begin by browsing the extensive legal library that includes over 85,000 forms. Utilize the search feature for efficiency.

- Preview the selected form to confirm it meets your needs and complies with your local laws.

- If you need a different form, utilize the search function to find the suitable document.

- Click on the 'Buy Now' button, select a subscription plan, and create an account to proceed.

- Complete the payment process using a credit card or PayPal to finalize your purchase.

- Download your completed form to your device and access it anytime through the 'My Forms' section in your account.

With US Legal Forms, individuals and attorneys alike can navigate legal documentation seamlessly and successfully.

Start your journey toward hassle-free legal document preparation today with US Legal Forms!

Form popularity

FAQ

A TOD account has several disadvantages, including limitations on asset control and complex distribution scenarios. If the owner needs to change beneficiaries, they must take specific legal steps. Additionally, beneficiaries can face tax implications upon the account holder's death. Understanding these factors, with help from uslegalforms, is crucial for successful estate planning.

A Transfer on Death deed with multiple beneficiaries does not inherently avoid inheritance tax. The tax implications can vary based on state laws and the total value of the estate. It's vital to be aware of your state's regulations regarding these taxes to manage your estate effectively. Speaking with a professional or utilizing resources from uslegalforms can give you tailored information.

While a Transfer on Death deed has benefits, it also has disadvantages. For instance, it does not help with creditor claims against the estate, and original property owners may not retain full control if they decide to change beneficiaries. Understanding these limitations can help you make informed decisions about your estate planning. Consulting uslegalforms may provide clarity on these issues.

There is typically no strict limit on the number of beneficiaries you can name on a Transfer on Death deed with multiple beneficiaries. You can include as many individuals as you wish, provided your estate can support the distribution. However, clarity in your deed is essential to ensure proper execution. For personalized assistance, consider checking out uslegalforms.

Yes, a Transfer on Death deed with multiple beneficiaries can designate more than one individual to receive the property after the owner's death. This allows you to distribute your assets among family members, friends, or charities. However, ensure that the deed clearly specifies how the property will be divided among the beneficiaries. For detailed guidance on structuring this, uslegalforms can be a helpful resource.

To transfer on death deed with multiple beneficiaries, you need to include their names in the deed itself. This requires a clear description of how ownership is divided among the beneficiaries, whether equally or through specific percentages. After drafting the deed, you must sign it and file it with your local recorder's office to make it official. uSlegalforms can guide you through the process, ensuring that your deed correctly reflects your wishes for both beneficiaries.

The transfer on death deed with multiple beneficiaries can complicate estate planning if not set up correctly. One major disadvantage is that it may not protect your assets from creditors or legal claims, which can affect your beneficiaries. Additionally, if one beneficiary predeceases you, it could create issues unless specified in the deed. Therefore, it's essential to seek advice and ensure your deed aligns with your overall estate planning goals.

Yes, you can designate multiple beneficiaries on a transfer on death deed. This allows you to evenly distribute your assets amongst those beneficiaries, making it a flexible estate planning tool. By utilizing a transfer on death deed with multiple beneficiaries, you ensure that your wishes are honored without the complexities of probate. If you're considering this option, US Legal Forms provides the resources and forms needed to create a clear and effective deed.

While transfer on death deeds with multiple beneficiaries provide benefits, they also come with potential issues. One common concern is that these deeds may not override existing wills or trusts, leading to confusion among heirs. Additionally, the deeds do not protect your assets from creditors, which could be a concern for some individuals. Engaging with USLegalForms can provide guidance on these issues to help you navigate the complexities.

Evaluating whether a transfer on death deed with multiple beneficiaries or a traditional beneficiary designation is better depends on your specific needs. A TOD deed allows for a smooth transition of property without going through probate, whereas a beneficiary designation may apply to accounts like retirement plans. Understanding the nuances of each option can help you make an informed decision. Consulting experts at USLegalForms can clarify these choices for you.