Minnesota Transfer On Death Deed Form With Signature

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

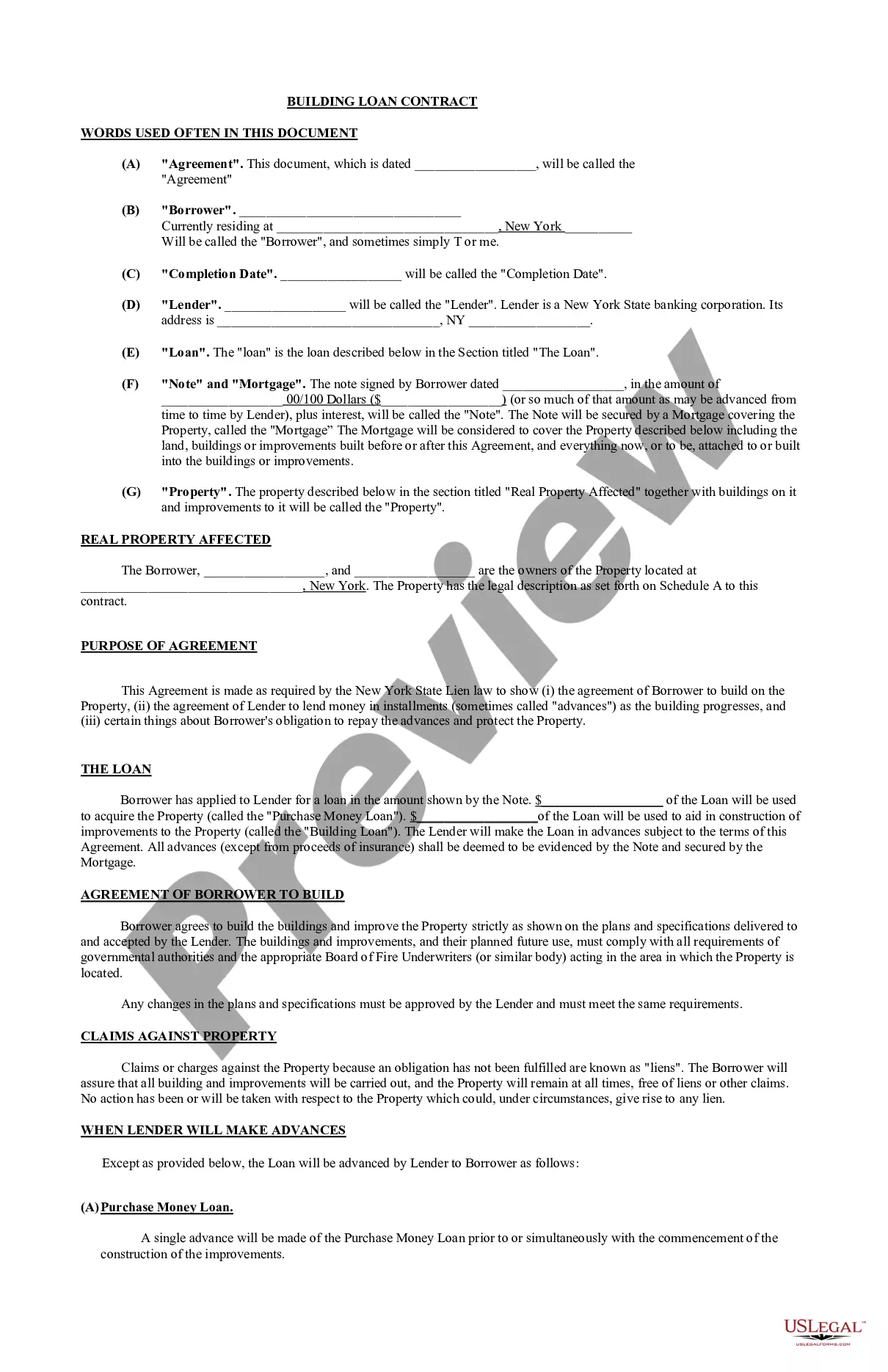

The Minnesota Transfer On Death Deed Form With Signature you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Minnesota Transfer On Death Deed Form With Signature will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it suits your needs. If it does not, use the search option to get the right one. Click Buy Now once you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Select the format you want for your Minnesota Transfer On Death Deed Form With Signature (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your paperwork again. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

A motor vehicle is registered in transfer-on-death form by designating on the certificate of title the name of the owner and the names of joint owners with identification of rights of survivorship, followed by the words ?transfer-on-death to (name of beneficiary or beneficiaries).? The designation ?TOD? may be used ...

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.