Michigan Laws For Riding In The Front Seat

Description

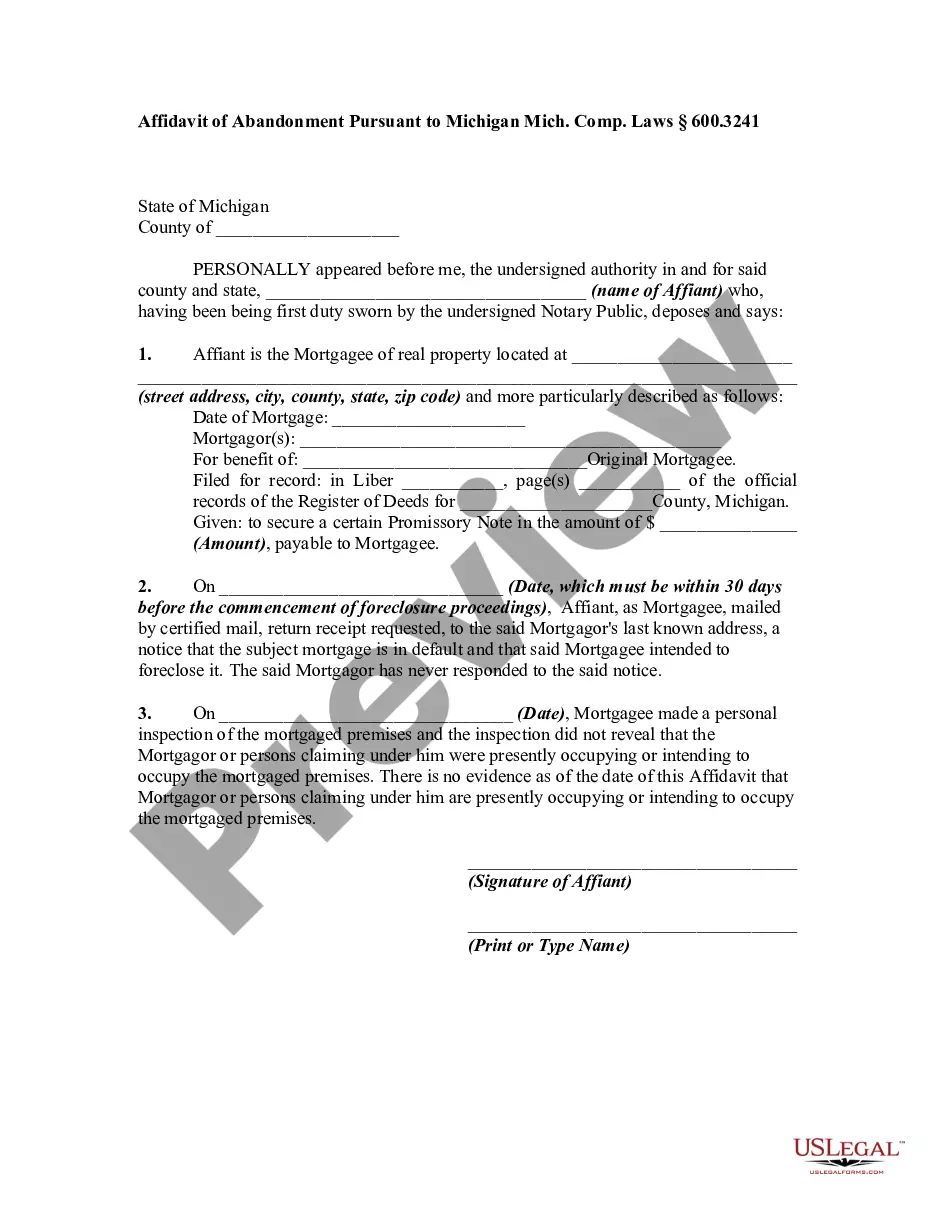

How to fill out Affidavit Of Abandonment Pursuant To Michigan Mich. Comp. Laws ' 600.3241?

Legal administration can be exasperating, even for experienced professionals.

When you are seeking Michigan Regulations For Sitting In The Front Seat and lack the time to search for the correct and current version, the tasks can be onerous.

Tap into a resource pool of articles, guidelines, manuals, and materials relevant to your circumstances and requirements.

Save time and exertion seeking the documents you require, and utilize US Legal Forms’ superior search and Review feature to locate Michigan Regulations For Sitting In The Front Seat and obtain it.

Ensure that the template is valid in your state or county.

- If you hold a monthly subscription, Log In to your US Legal Forms account, look for the form, and procure it.

- Check your My documents tab to view the documents you have previously downloaded as well as to organize your folders as you please.

- If this is your initial experience with US Legal Forms, create a free account and gain unrestricted access to all the benefits of the library.

- Here are the actions to take after obtaining the form you desire.

- Confirm this is the correct form by previewing it and reviewing its description.

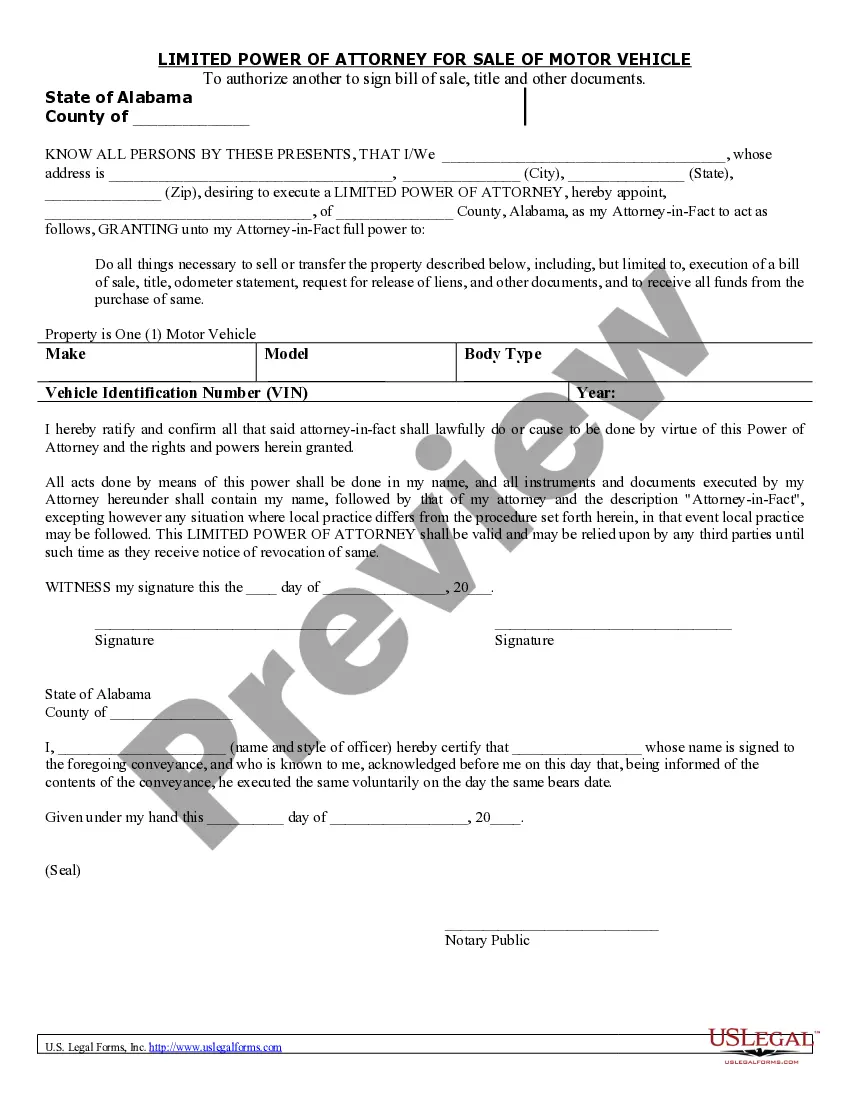

- Access state- or county-specific legal and professional documents.

- US Legal Forms fulfills any needs you might possess, from personal to commercial paperwork, all in one location.

- Employ cutting-edge tools to tackle and oversee your Michigan Regulations For Sitting In The Front Seat.

Form popularity

FAQ

If you settle a debt with a lender or collection agency, you can expect to receive a 1099-C. Make sure you receive confirmation of the settlement payment and forgiveness. That way, you can match it up with the information on the tax form.

The general rule is that lawsuit settlements are taxable, except in cases that involve an actual, physical injury (?observable bodily harm?) or illness that you suffered. In other words: personal injury settlements usually aren't taxable, while other types of settlements usually are.

If you receive a 1099-C, you may have to report the amount shown as taxable income on your income tax return. Because it's considered income, the canceled debt has tax consequences and may lower any tax refund you are due.

Fortunately, the IRS has tax exemptions for debt cancellation. You might not have to pay income taxes on the amount if one of the following situations apply: The debt is canceled as a gift, inheritance or bequest. Student loans that are canceled if you work for a certain time period for certain classes of employers.

IRS Form 1099-C is used by creditors (including domestic bank, a trust company, a credit union) to report the cancellation of $600 or more in debt owed to the debtors such as an individual, corporation, partnership, trust, estate, association or company.

About Form 1099-C, Cancellation of Debt.

Settling a Debt May Increase Your Taxable Income In addition, the IRS considers the forgiven amount as income, which means you may need to pay taxes on it. That additional income might also push you into a higher tax bracket, resulting in a larger tax bill.

A lender files a 1099-C with the IRS ? and they'll send you a copy of the form. While you don't have to file the 1099-C, you should use it to prepare and file your income tax return.