Property Laws In Massachusetts

Description

How to fill out Massachusetts Property Management Package?

Whether for commercial intentions or for individual matters, everyone must handle legal affairs at some stage in their life.

Filling out legal documents requires meticulous focus, beginning with selecting the appropriate form template.

With a vast US Legal Forms catalog available, you won’t need to waste time searching for the correct template on the internet. Utilize the library’s user-friendly navigation to locate the right form for any situation.

- Obtain the template you need by using the search bar or catalog browsing.

- Review the form’s summary to confirm it aligns with your situation, jurisdiction, and area.

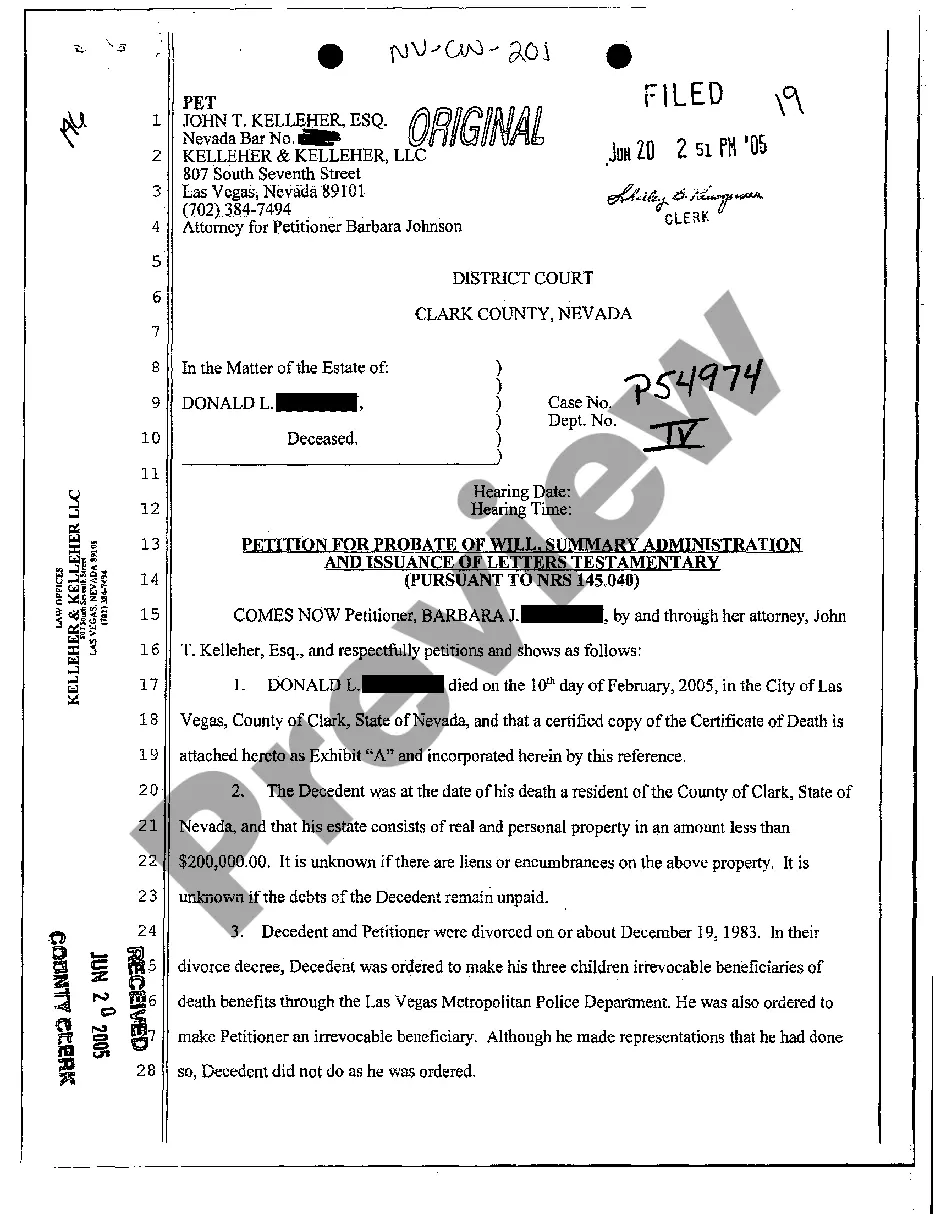

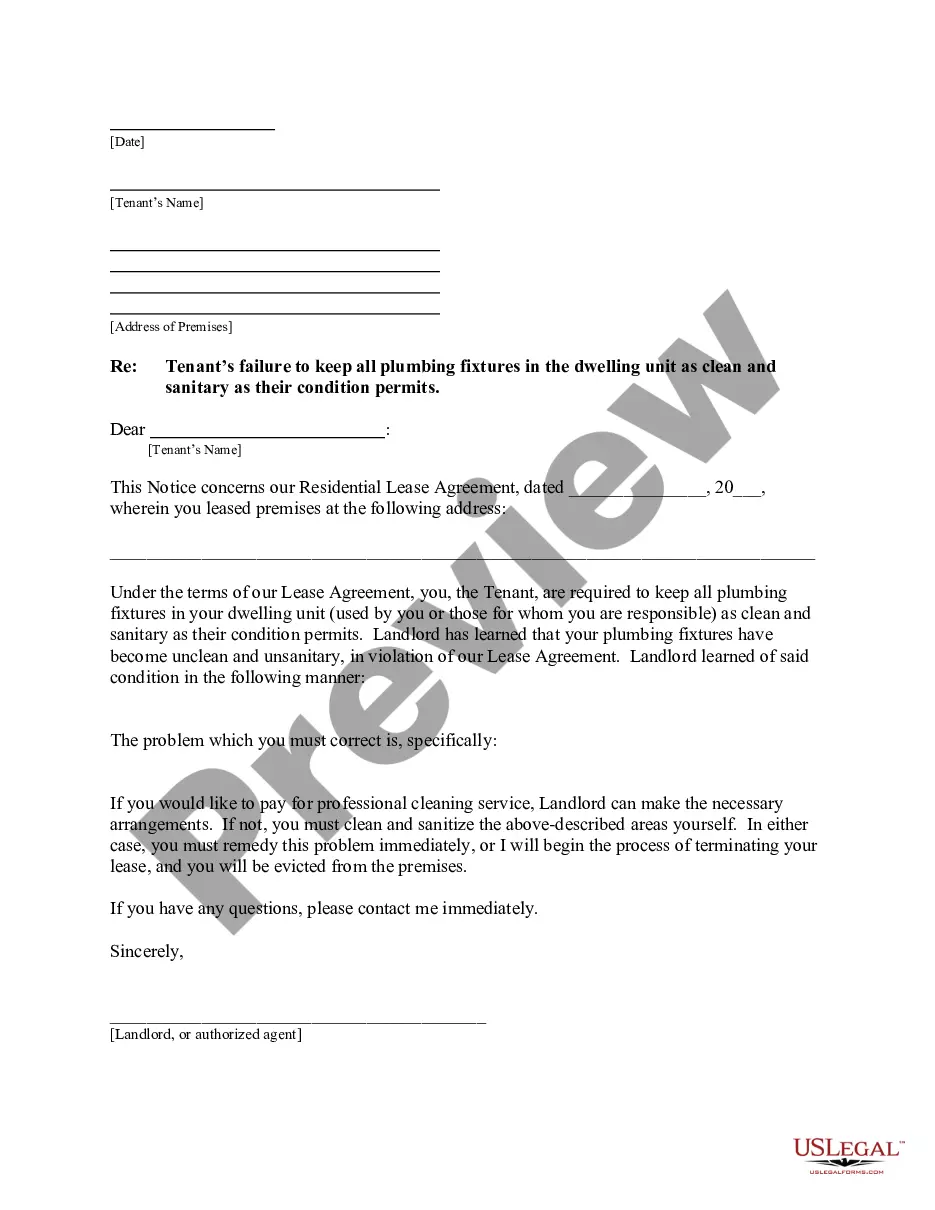

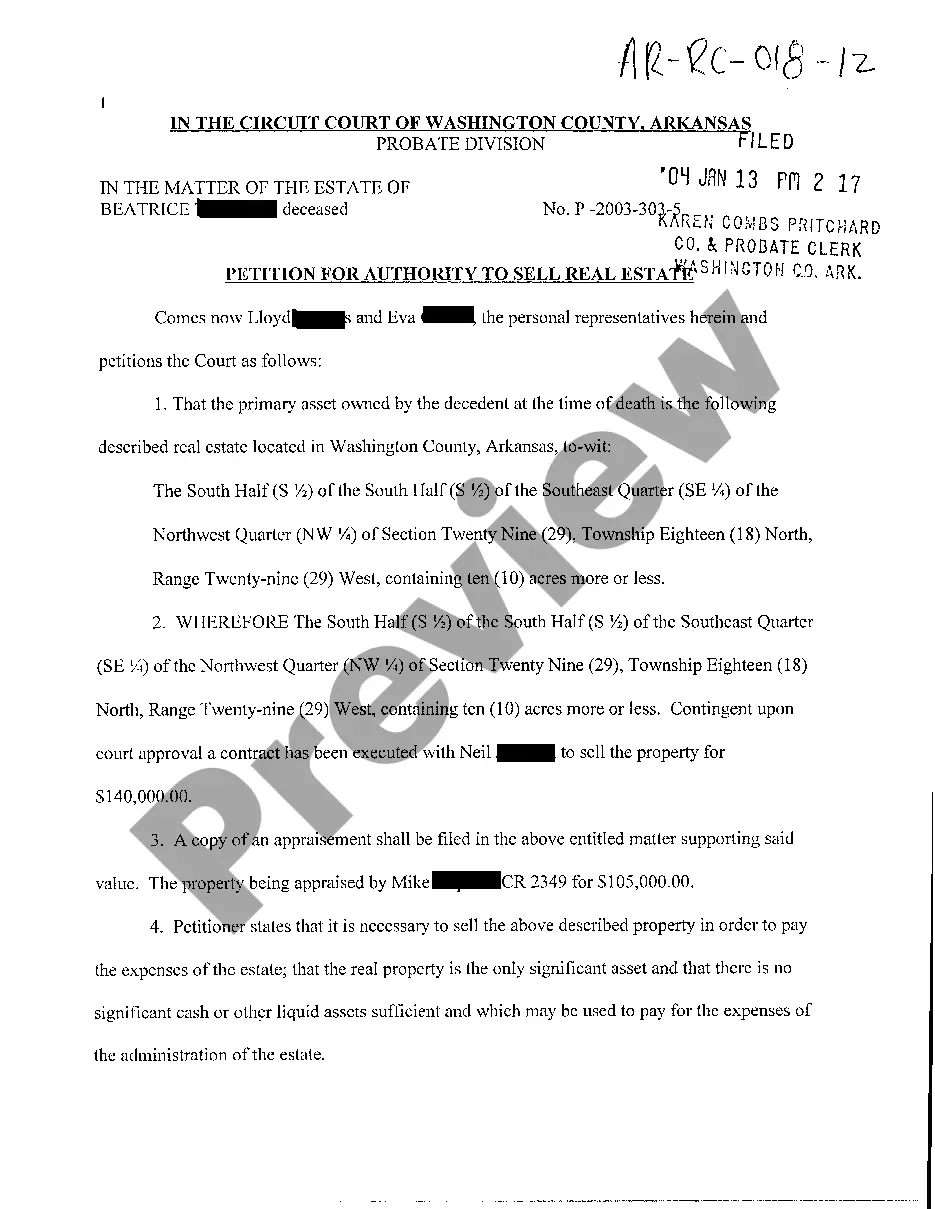

- Click on the form’s preview to examine it.

- If it is not the correct document, return to the search feature to find the Property Laws In Massachusetts template you need.

- Download the file if it meets your specifications.

- If you possess a US Legal Forms account, click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing plan.

- Complete the profile registration form.

- Select your payment option: you may use a credit card or PayPal account.

- Choose the document format you prefer and download the Property Laws In Massachusetts.

- Once it is downloaded, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

Massachusetts levies an excise on each vehicle at the rate of $25 per $1,000 of valuation. City or town assessors can access information on a vehicle's value from a database of valuation figures.

Massachusetts Property Tax Rates Tax rates in Massachusetts are determined by cities and towns. They are expressed in dollars per $1,000 of assessed value (often referred to as mill rates). For example, if your assessed value is $200,000 and your tax rate is 10, your total annual tax would be $2,000.

If the property involved in a judgment lien is real property (real estate), the lien must be recorded in the Registry of Deeds in which the property is located. If the property involved is personal property, paperwork will be filed with the city or town clerk.

All personal property situated in Massachusetts is subject to tax, unless specifically exempt by law.

Although a disclosure statement is not required, the state does mandate the disclosure of two types of information to any prospective buyer: the existence and hazards of lead paint, and the presence of a septic system on the property. Sellers in Massachusetts must disclose the presence of lead to prospective buyers.