Ma Mortgage Mortgagors Withdrawal

Description

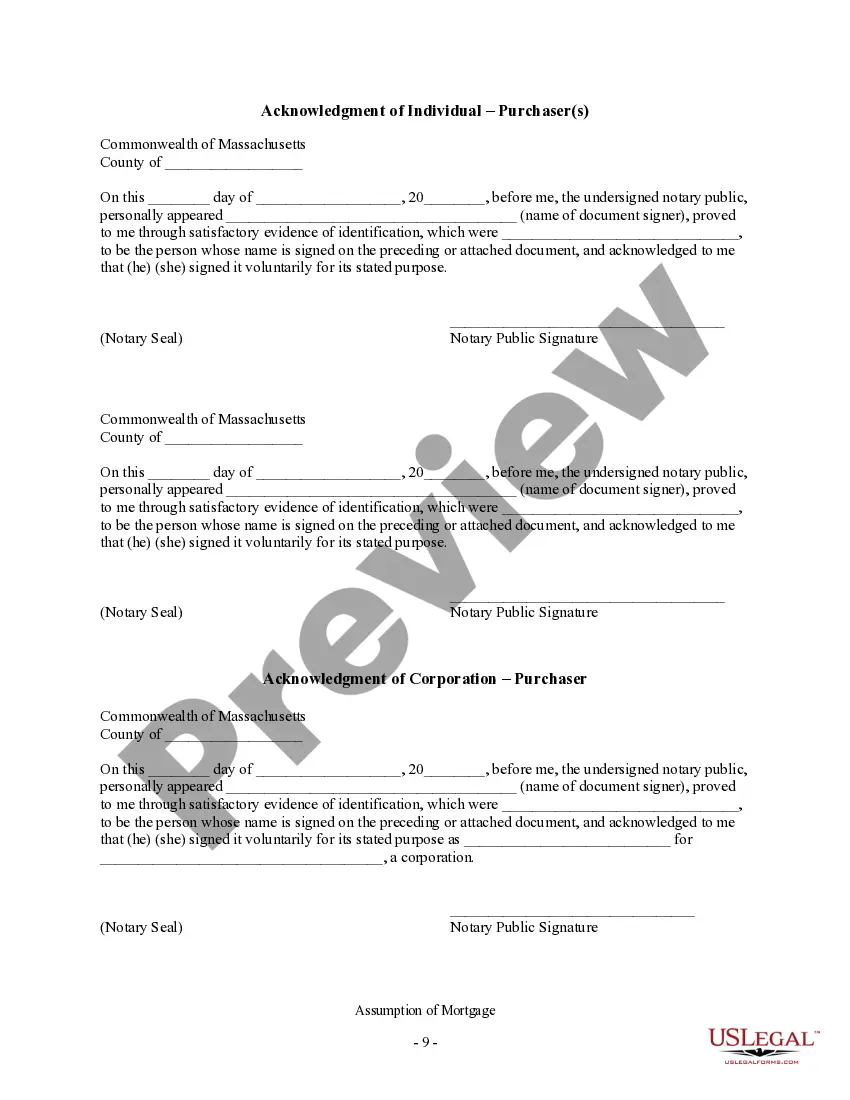

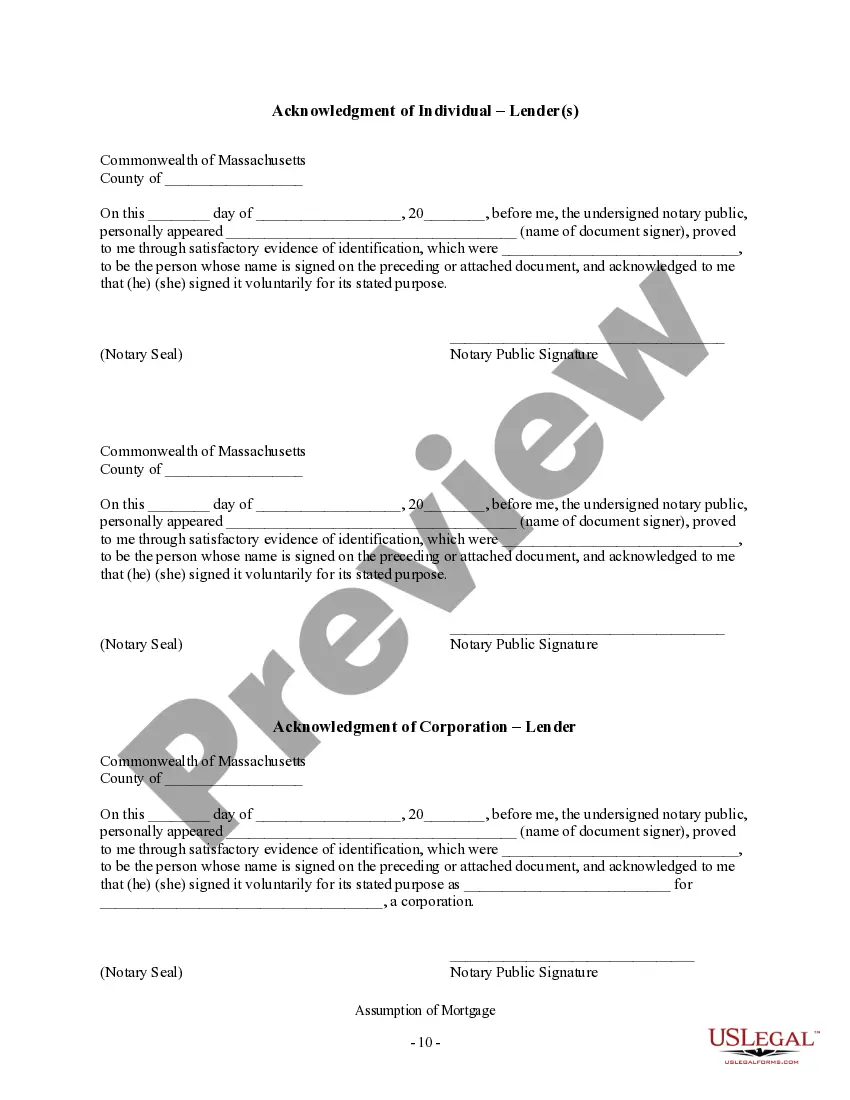

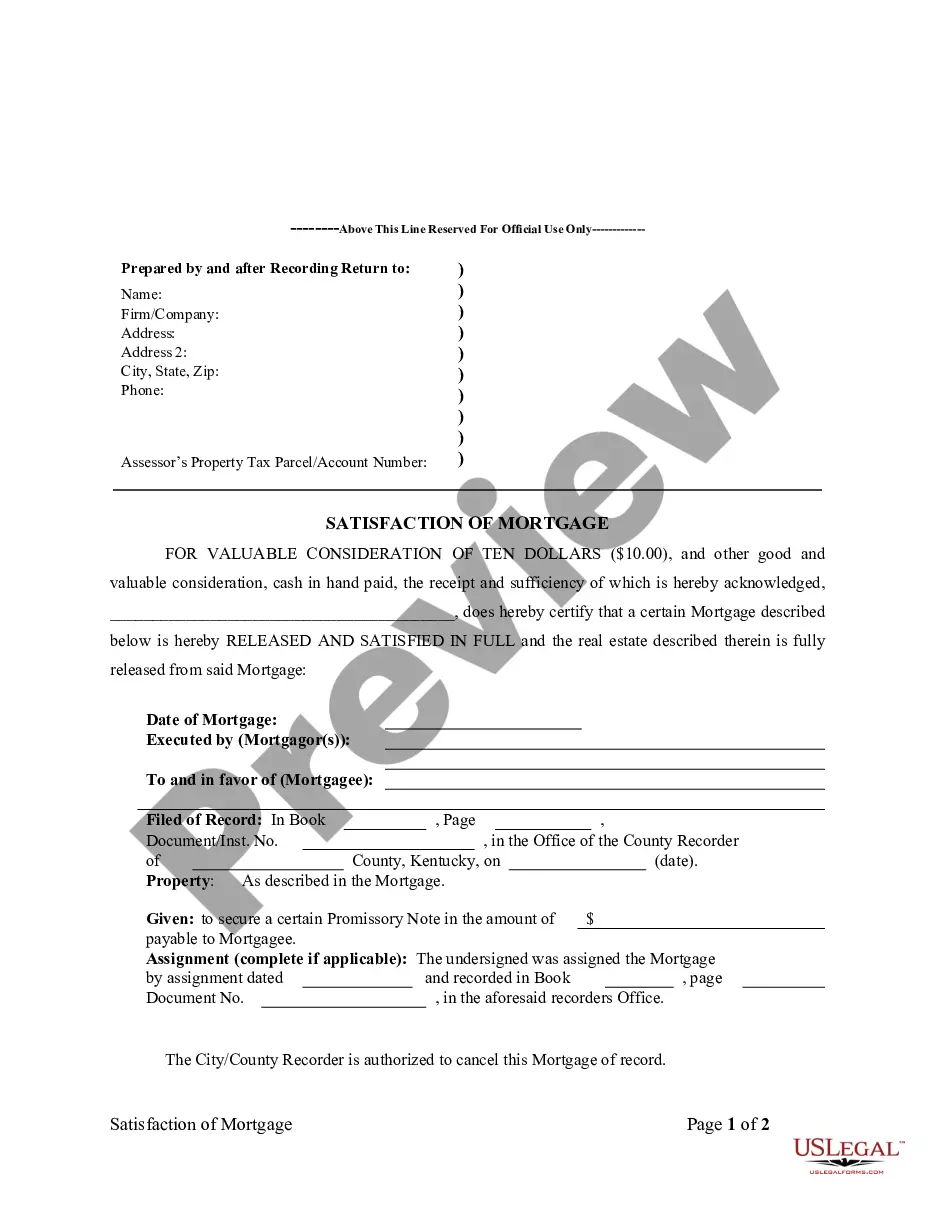

How to fill out Massachusetts Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

The Ma Mortgage Mortgagors Withdrawal you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and local laws. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, easiest and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Ma Mortgage Mortgagors Withdrawal will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it fits your needs. If it does not, utilize the search bar to find the right one. Click Buy Now once you have found the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Select the format you want for your Ma Mortgage Mortgagors Withdrawal (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers again. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

What Is a Mortgage Equity Withdrawal (MEW)? A mortgage equity withdrawal (MEW) is the removal of equity from the value of a home through the use of a loan against the market value of the property. A mortgage equity withdrawal reduces the real value of a property by the number of new liabilities against it.

In general, a lender cannot cancel a loan after closing unless there are specific circumstances outlined in the loan agreement or if fraud or misrepresentation is discovered. Once the loan has been closed and funded, the lender has typically committed the funds and established the mortgage lien on the property.

Usually, there are no such restraints on making mortgage equity withdrawals. This could lead to homeowners wiping out the value and equity they invested into the home, which might have been used for their retirement needs. Furthermore, these equity withdrawals could be contributing factors in housing bubbles.

In economics, mortgage equity withdrawal (MEW) is the decision of consumers to borrow money against the real value of their houses. The real value is the current value of the property less any accumulated liabilities (mortgages, loans, etc.)

Home equity loans can help homeowners take advantage of their home's value to access cash easily and quickly. Borrowing against your ownership stake could be worth it if you're confident you'll be able to make payments on time, and especially if you use the loan for improvements that increase your home's value.