Massachusetts Records Corporations With Credit Package

Description

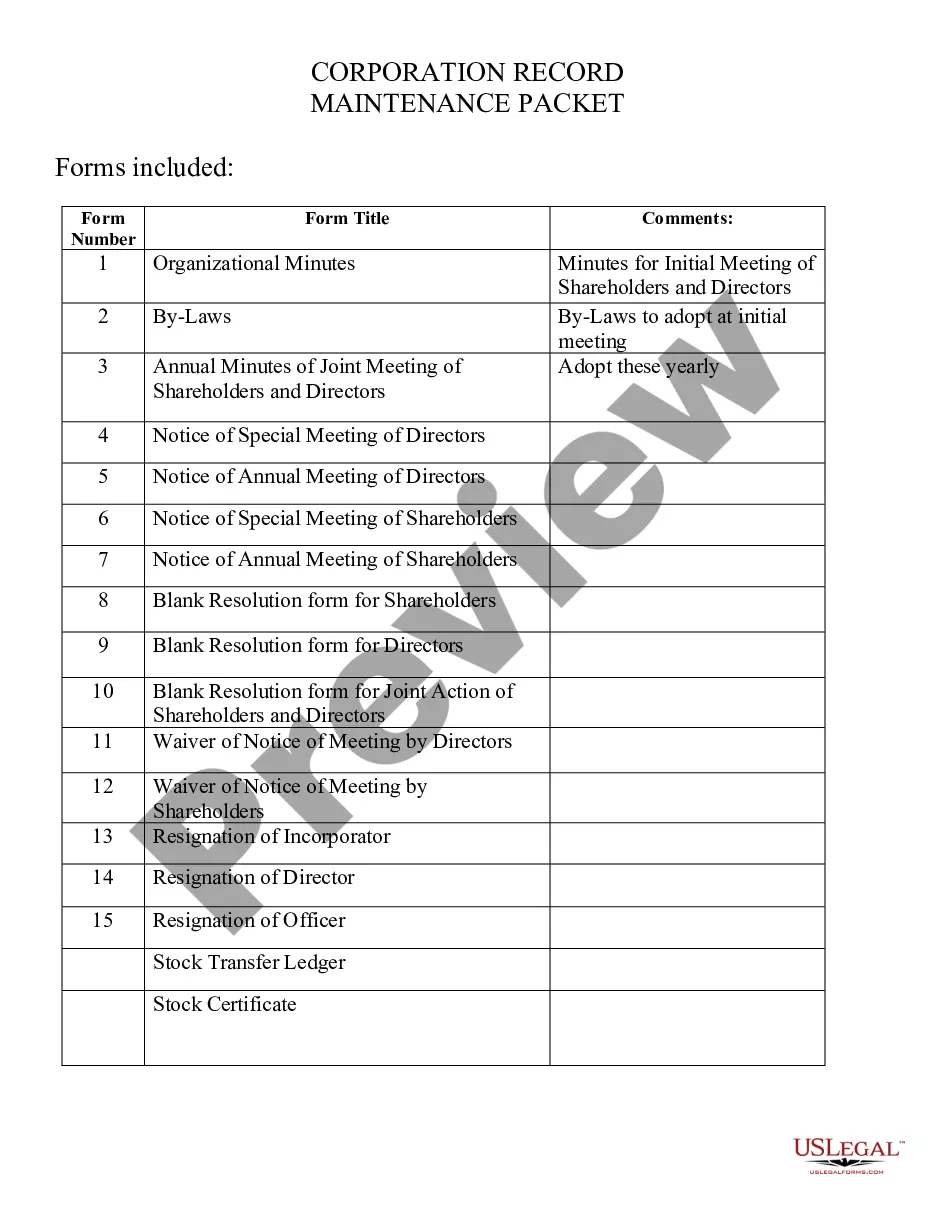

How to fill out Massachusetts Corporate Records Maintenance Package For Existing Corporations?

Managing legal documents and processes can be a lengthy addition to your daily routine.

Massachusetts Records Corporations With Credit Package and similar documents usually necessitate you to look for them and comprehend the optimal way to fill them out accurately.

Therefore, if you are overseeing financial, legal, or personal affairs, having a complete and user-friendly online directory of forms readily available will be extremely beneficial.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific documents and a plethora of tools to help you finalize your paperwork swiftly.

Simply Log In to your account, find Massachusetts Records Corporations With Credit Package and obtain it immediately from the My documents section. You can also retrieve previously saved documents.

- Browse through the database of pertinent documents accessible to you with just a single click.

- US Legal Forms grants you state- and county-specific documents accessible at any time for download.

- Safeguard your document management tasks by utilizing a high-quality service that enables you to create any form in a matter of minutes with no extra or concealed fees.

Form popularity

FAQ

Hear this out loud PauseAll foreign and domestic corporations registered in Massachusetts are required to file an annual report with the Secretary of the Commonwealth within two and one-half months after the close of their fiscal year.

The reports are due 2.5 months after the fiscal year has come to a close. Nonprofit corporations must pay $18.50 to file an annual report, and they must file by November 1. LLCs have the most expensive annual reports in the state of Massachusetts. These companies must pay $520 to file with the Corporations Division.

How to create an S-Corp. in Massachusetts Choose a name for the corporation. ... Appoint a Registered Agent. ... File Articles of Organization. ... Articles of Organization Signed by Incorporator(s) or Authorized Agent. ... Submit Appropriate Filing Fees for Articles of Organization. ... Secure an Employer Identification Number.

Hear this out loud PauseEach entity registered with the Massachusetts Secretary of the Commonwealth (the ?Secretary?) may be required to register for corporate excise and file an annual corporate return with the Massachusetts Department of Revenue (the ?DOR?).

Hear this out loud PauseMost Massachusetts Annual Reports can be filed online or with paper forms. To file online, log in to the Corporations Division's online filing portal. To file a paper form, you'll need to download and print one from the file by mail or walk-in section of the Corporation Division's website.