Ma Corporate Records Form 355sbc

Description

How to fill out Massachusetts Corporate Records Maintenance Package For Existing Corporations?

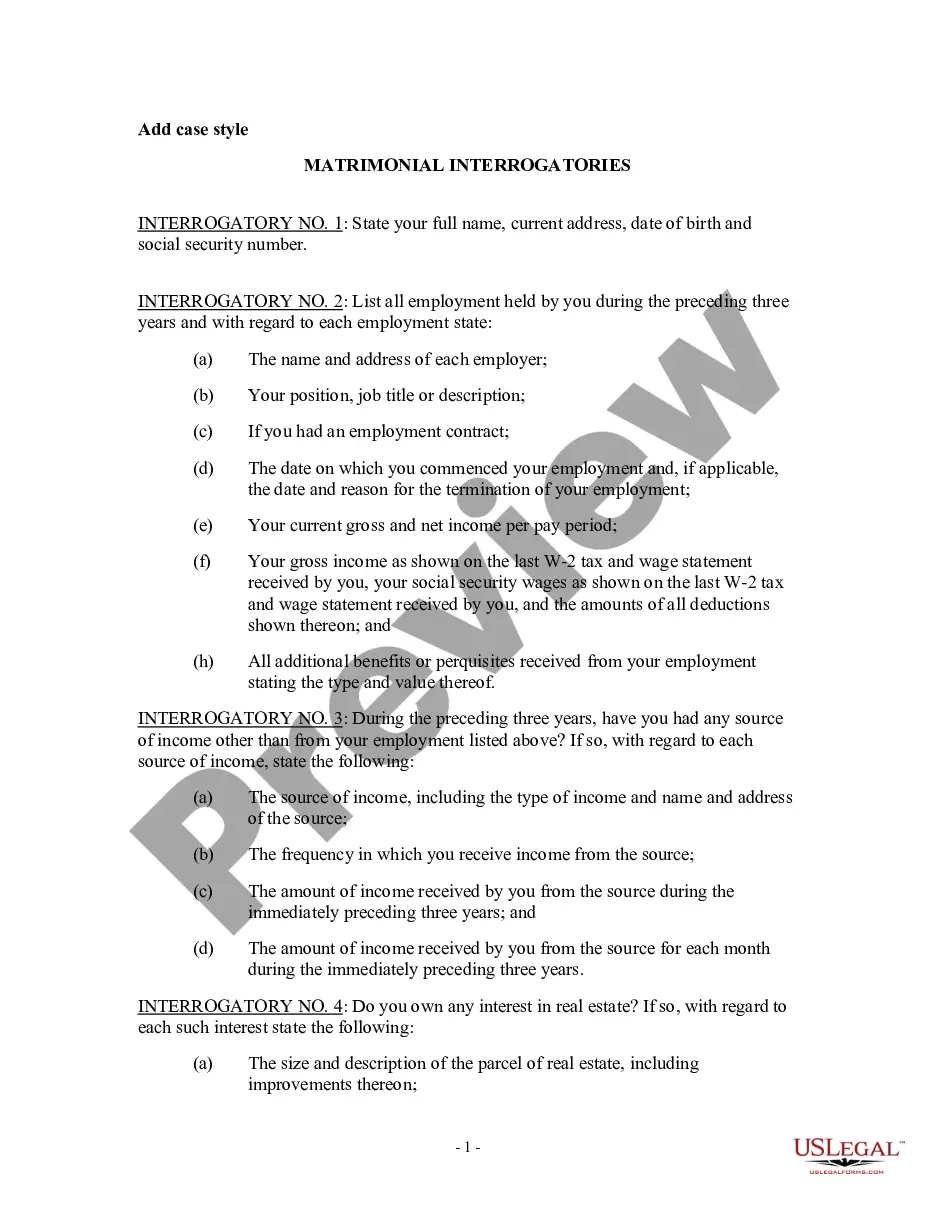

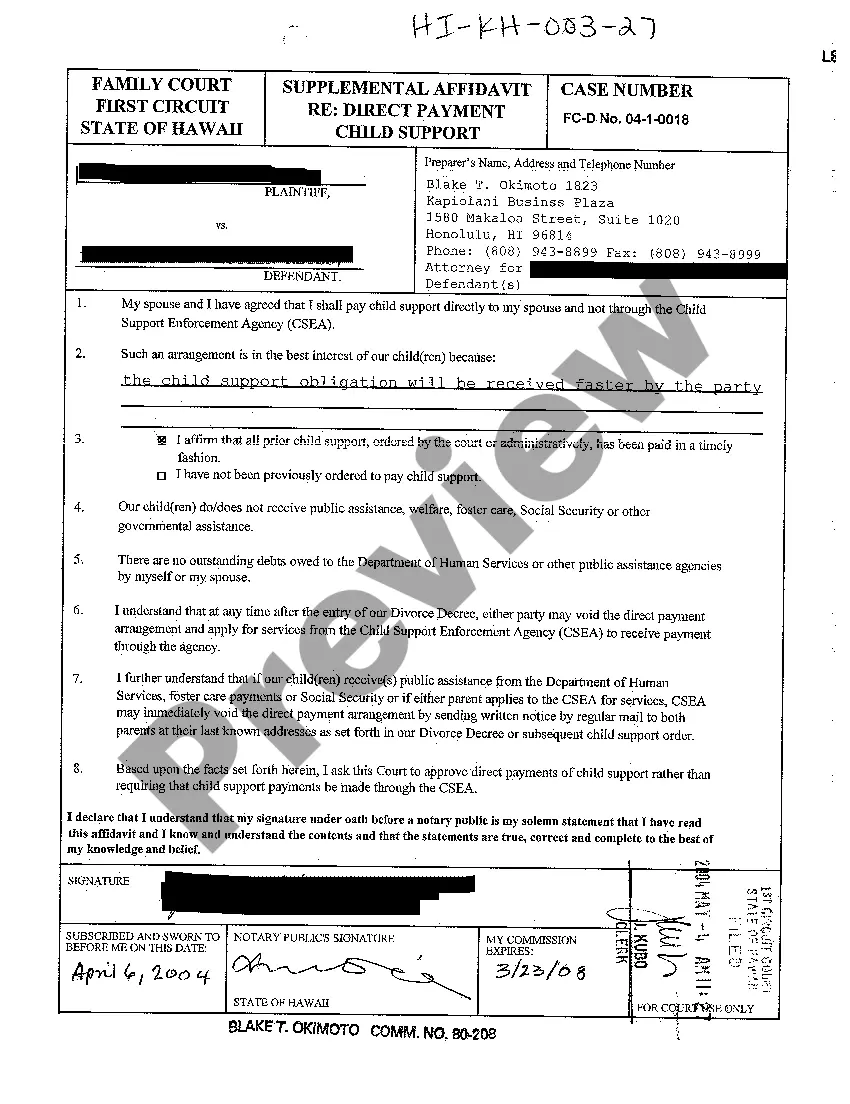

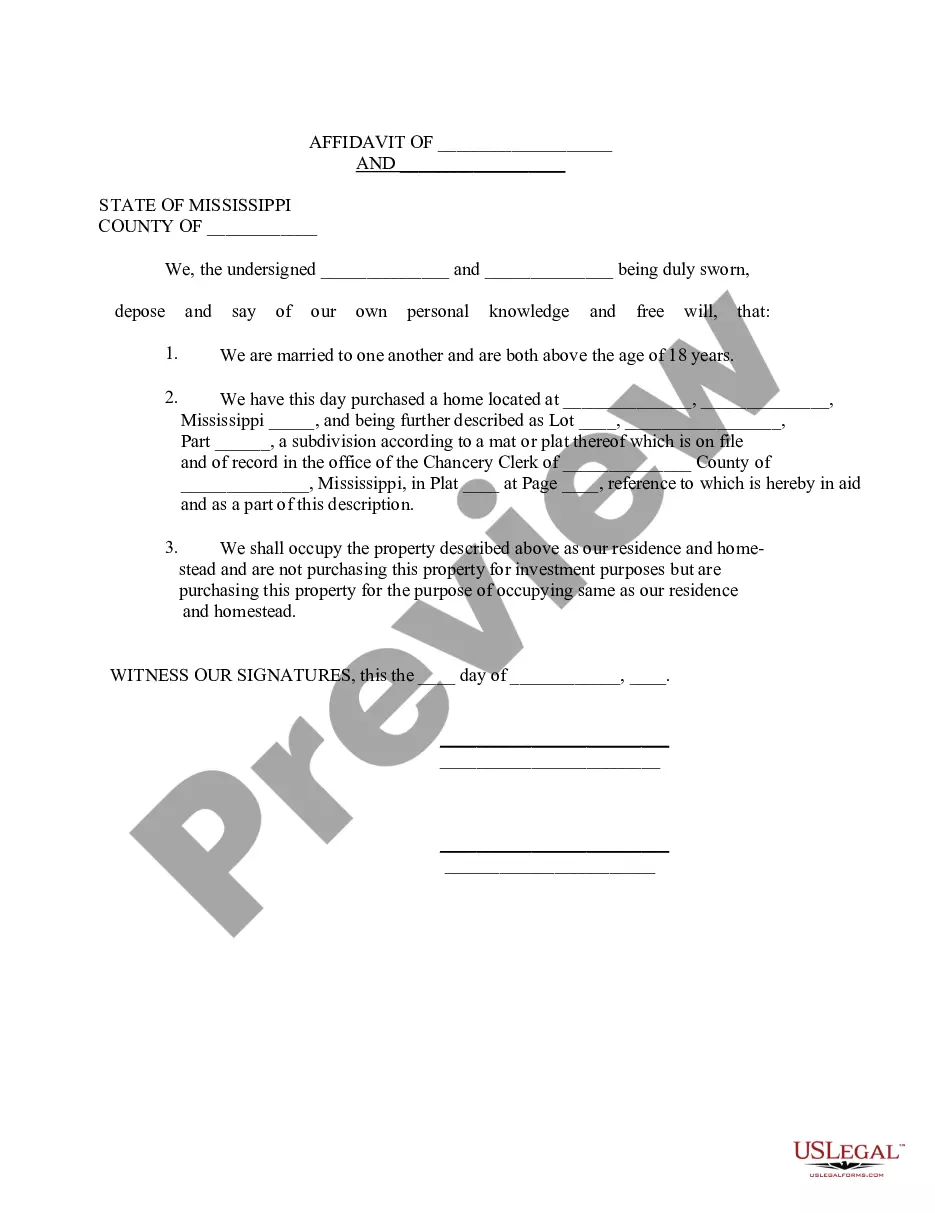

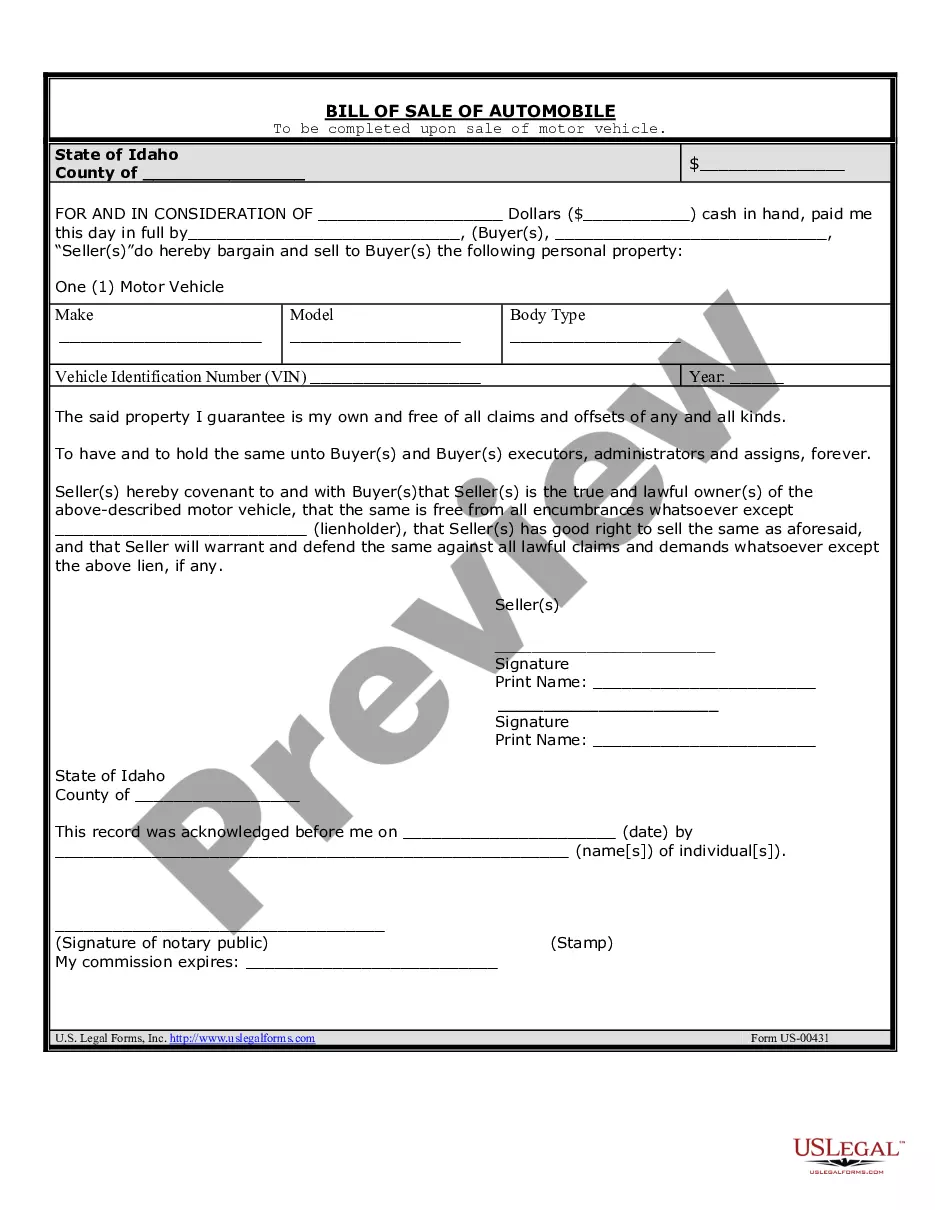

The Ma Corporate Records Form 355sbc displayed on this page is a versatile official template created by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with over 85,000 authenticated, state-specific documents for any corporate and personal need. It’s the fastest, simplest, and most reliable method to acquire the records you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you desire for your Ma Corporate Records Form 355sbc (PDF, Word, RTF) and save the document on your device.

- Search for the document you require and review it.

- Explore the file you searched and preview it or examine the form description to confirm it meets your requirements. If it does not, use the search tool to find the correct one. Click Buy Now when you have located the template you want.

- Register and access your account.

- Choose the pricing option that fits you and establish an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

Arizona tax rates have decreased. As a result, we are revising withholding percentages and are requiring taxpayers to complete a new Form A-4 for 2023.

Income Tax Filing Requirements In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are: Single or married filing separately and gross income (GI) is greater than $12,950; Head of household and GI is greater than $19,400; or.

You may check your court orders or contact the Criminal Department at (602) 506-8575 (if your case was in Maricopa County) to confirm whether your civil and firearm rights have been restored. information. ? Your civil and/or firearm rights were automatically restored under A.R.S. § 13-907.

Phoenix, AZ 85038-9085. Arizona Department of Revenue, P.O. Box 52138, Phoenix, AZ 85072-2138.

If you need forms, here are four easy ways: On our website. You can access forms on the website anytime here. In our lobbies. In each of our three lobbies, you will find tax booklets for your convenience to take home and use. Free Tax Return Preparation Services.

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

The employer should select 2.0% on behalf of the employee. The new default Arizona withholding rate is 2.0%.

Common Arizona Income Tax Forms & Instructions The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.