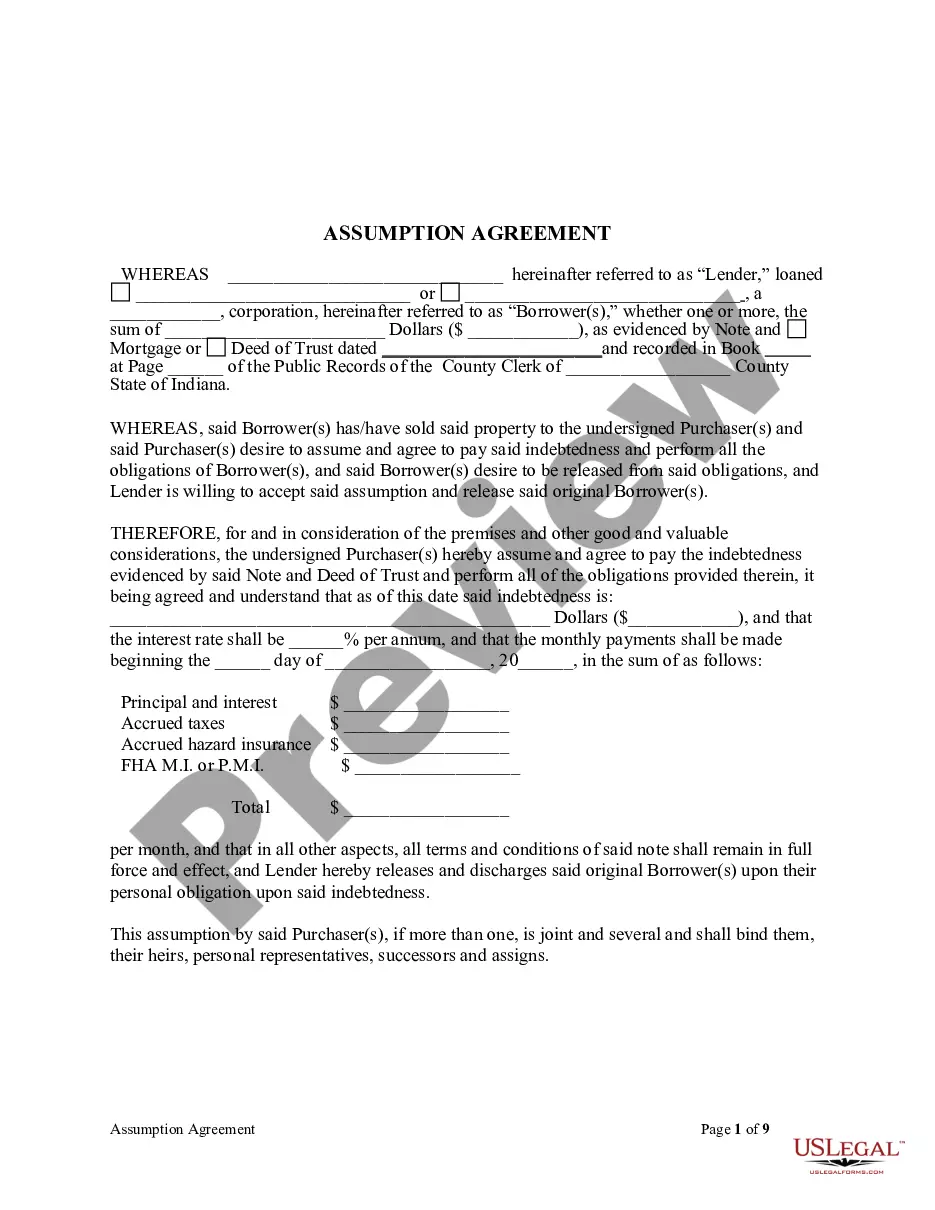

Agreement Release Mortgagors With No Consent

Description

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

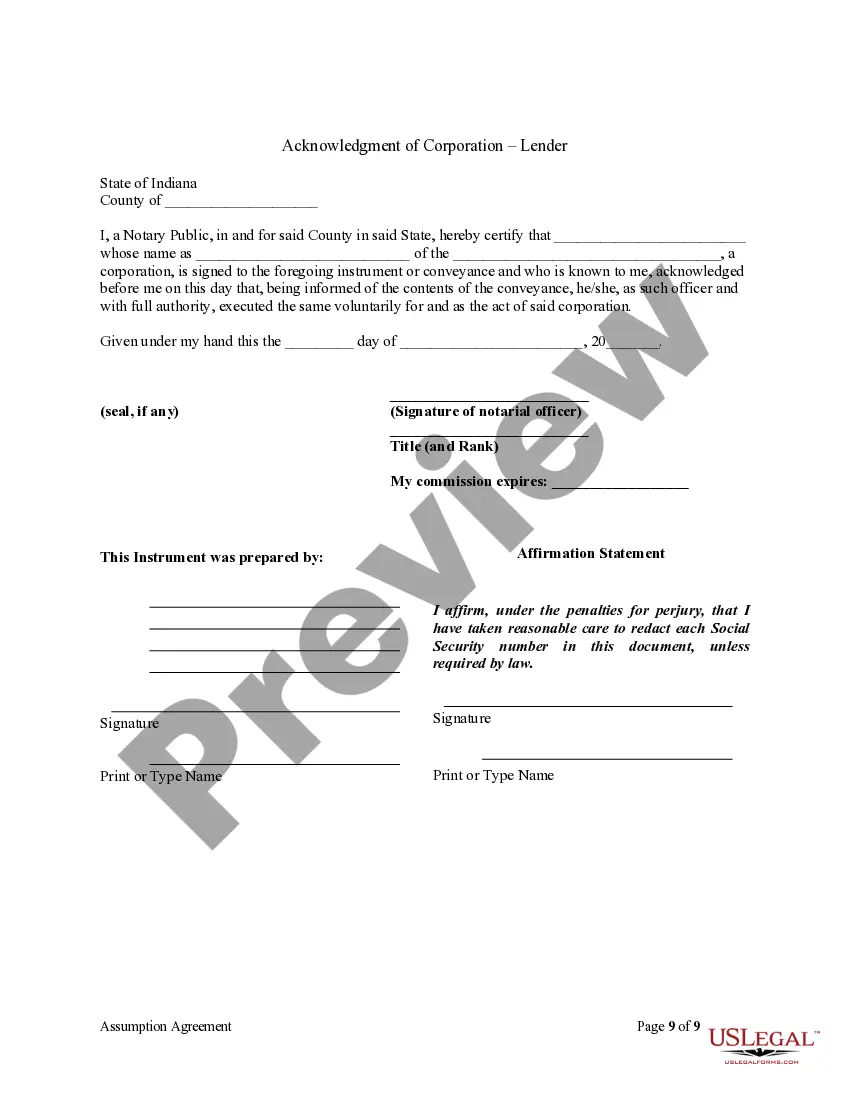

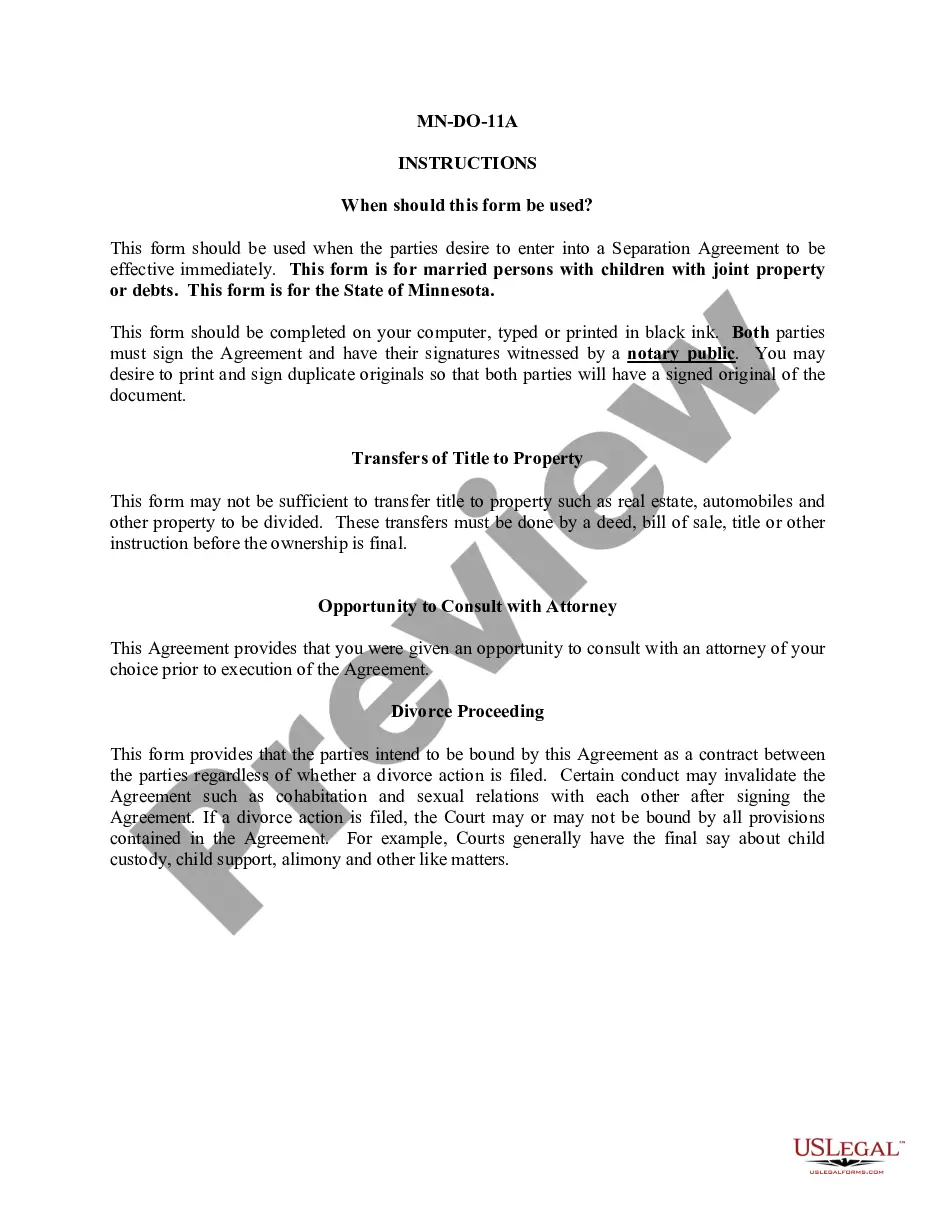

- Begin by visiting the US Legal Forms website and check if you have an existing account. If so, log in to download your required form.

- For new users, explore the available templates. Ensure to check the Preview mode and form description to select one that fits your local jurisdiction.

- If modifications are needed, utilize the Search tab to find an alternative template that meets your requirements.

- To acquire the document, click the Buy Now button. Select a suitable subscription plan, and register an account to access our extensive resources.

- Complete your purchase by entering your payment details using a credit card or PayPal.

- Finally, download your document for completion. You can also revisit and manage your forms anytime from the My Forms section in your profile.

By following these straightforward steps, you can efficiently secure the agreement release mortgagors with no consent and benefit from the extensive resources available on US Legal Forms.

Empower your legal processes today with US Legal Forms—your go-to solution for reliable and comprehensive legal documentation.

Form popularity

FAQ

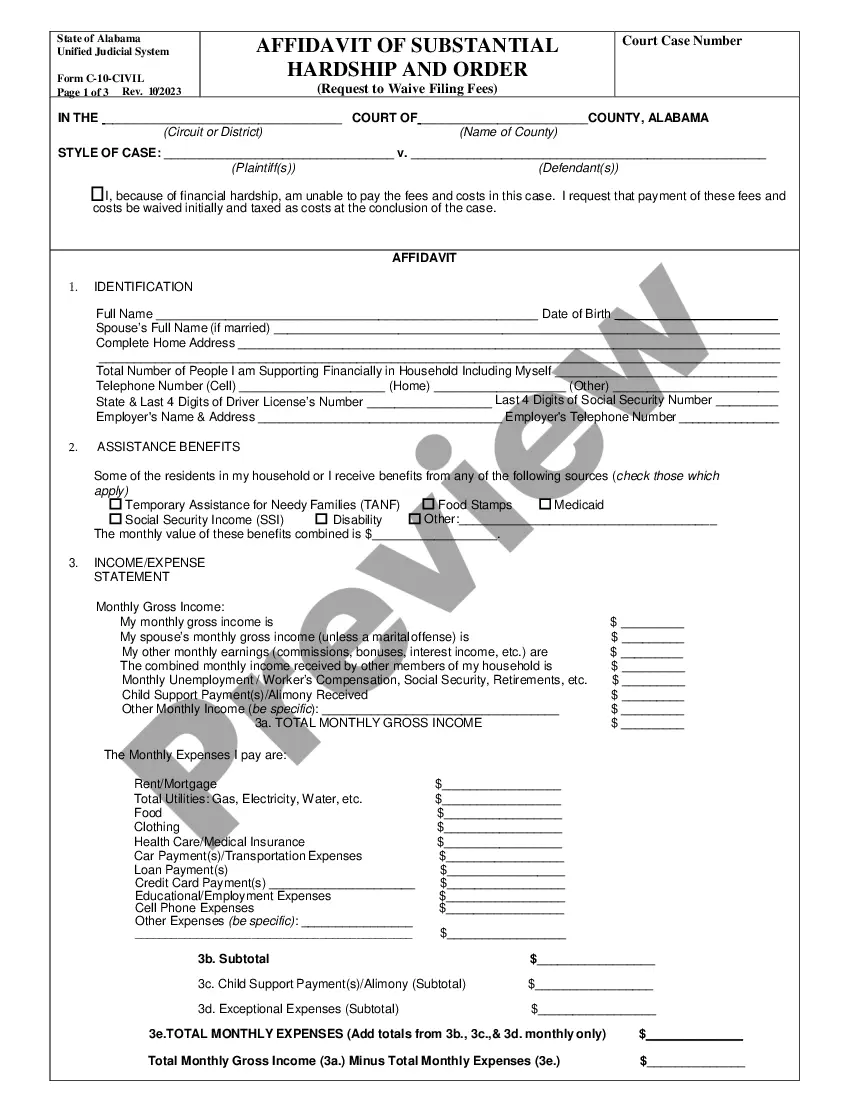

The key difference lies in their scope and application. A discharge signifies the end of financial obligations for all parties involved, while a release may not fully cancel these obligations for each mortgagor. This distinction is particularly important for anyone dealing with agreements that relate to the release of mortgagors with no consent, as it impacts the responsibilities each party retains.

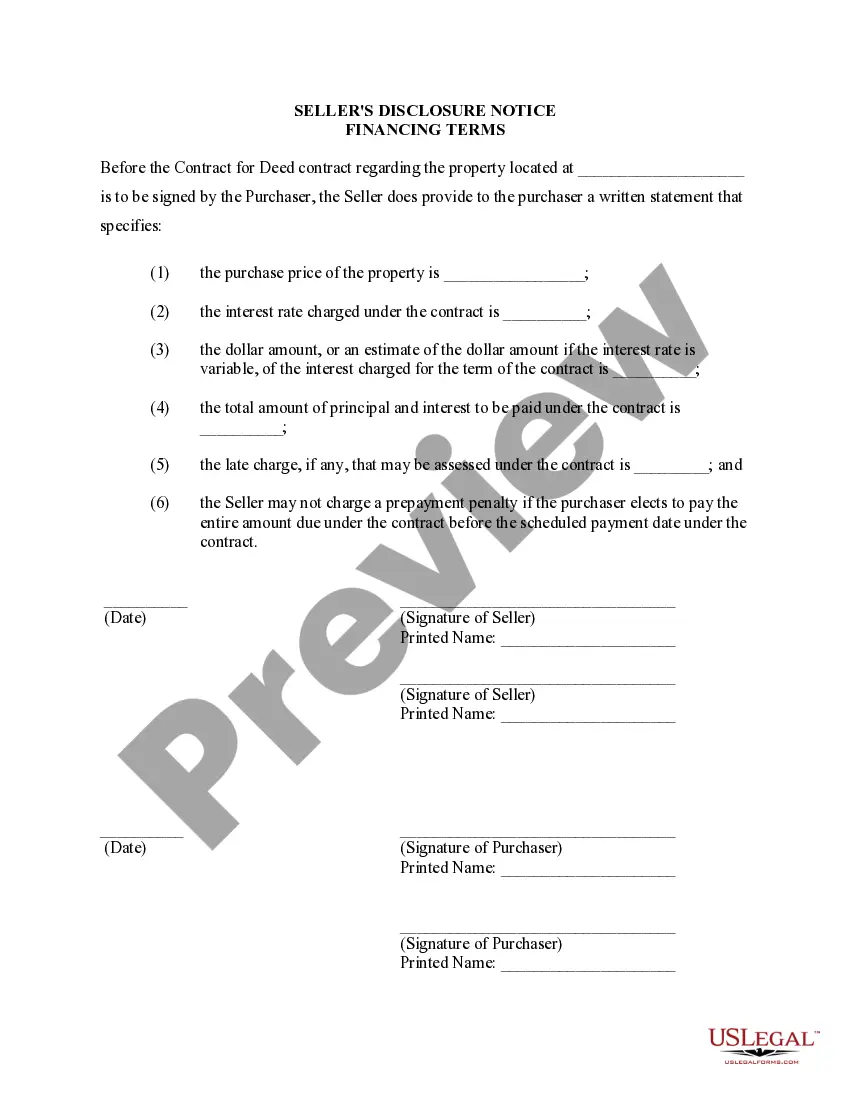

A release on mortgage refers to a document that formally frees the mortgagors from their obligations after the debt is settled. This release plays a vital role in documenting that the mortgage has been satisfied and protects the rights of all parties involved. By understanding the intricacies of a release on mortgage, individuals can ensure that they’re addressing agreements related to the release of mortgagors with no consent effectively.

Removing someone from a mortgage without refinancing can be achieved through a mortgage release or assumption, depending on your lender’s policies. You should contact your lender to discuss the possibility of an agreement release mortgagors with no consent. It is vital to determine if the remaining borrower meets the financial criteria to take over the mortgage. This way, you secure an efficient process while maintaining your financial records.

If you split up with someone with whom you share a mortgage, it is essential to review your financial responsibilities. You may need an Agreement release mortgagors with no consent to transfer the mortgage solely to one party. This can lead to refinancing or selling the property, depending on your circumstances. Using uslegalforms can help clarify your options and streamline the process.

Removing someone from a mortgage without their permission is not standard practice and may require an Agreement release mortgagors with no consent, often leading to legal complexities. Most lenders require consent from all parties involved before making changes to a mortgage. If you find yourself in this situation, consulting with uslegalforms can provide you with options to explore.

To change a joint mortgage to a single person's name, you typically need to seek an Agreement release mortgagors with no consent from the co-mortgagor. This process may involve contacting your lender for guidance, as they will need to approve the change. You might also need to provide documentation showing your ability to take over the mortgage on your own. Consulting with uslegalforms can help you navigate this process more effectively.