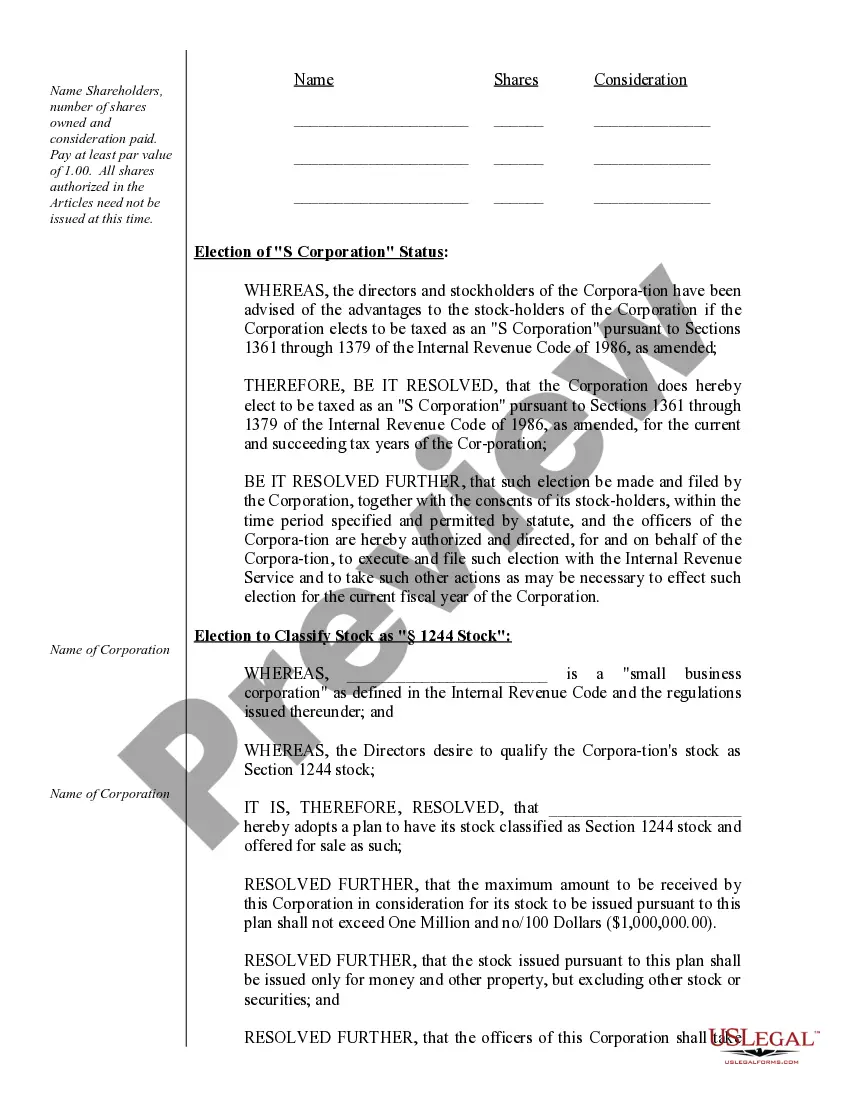

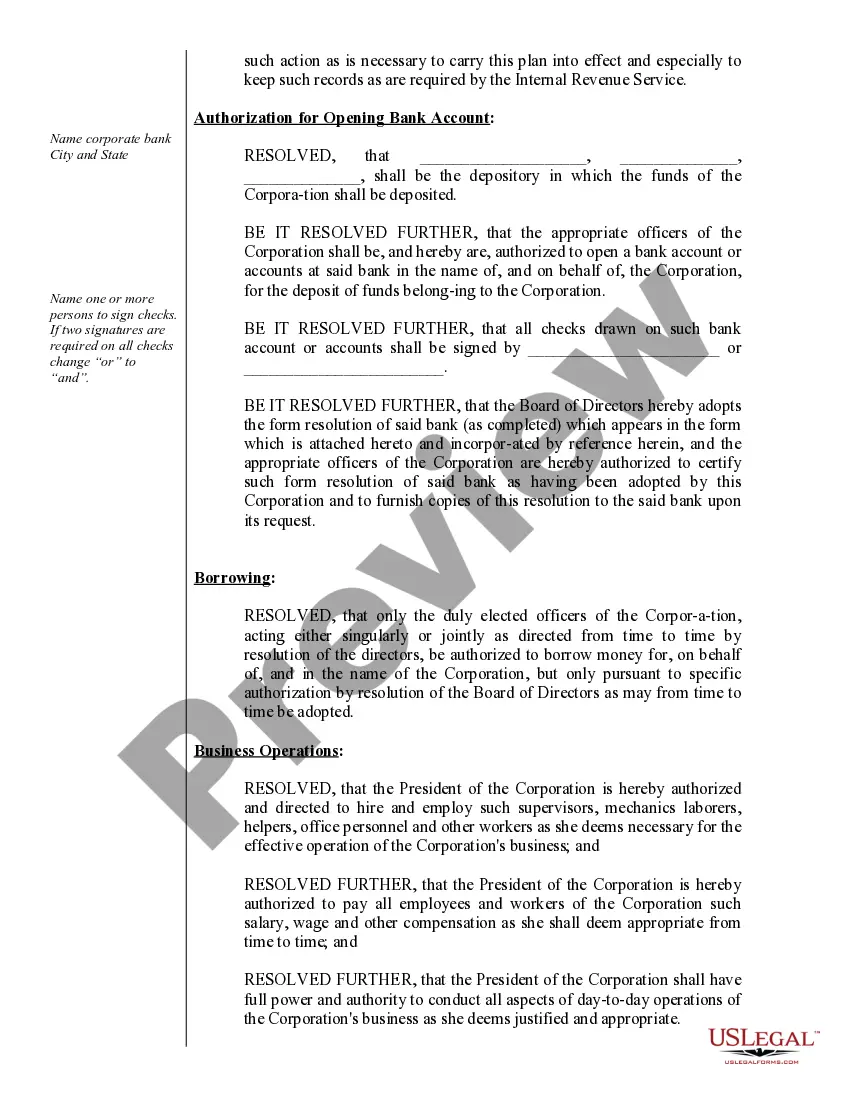

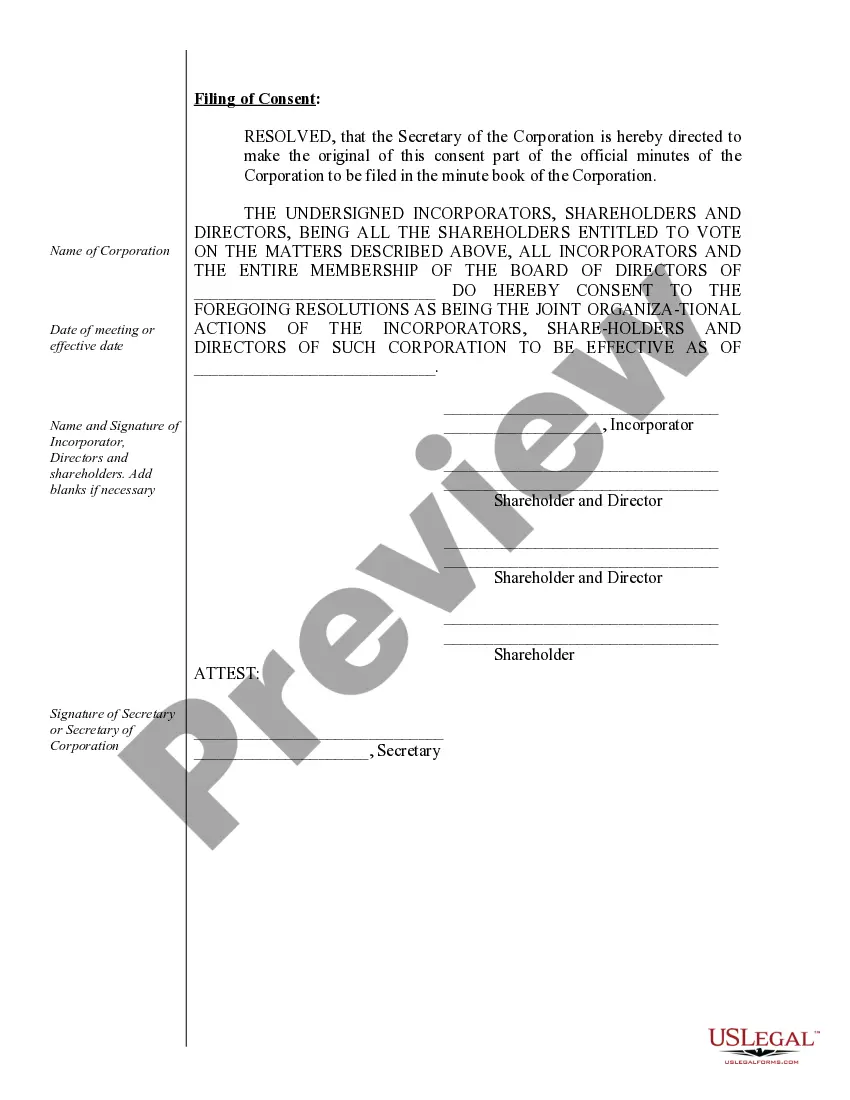

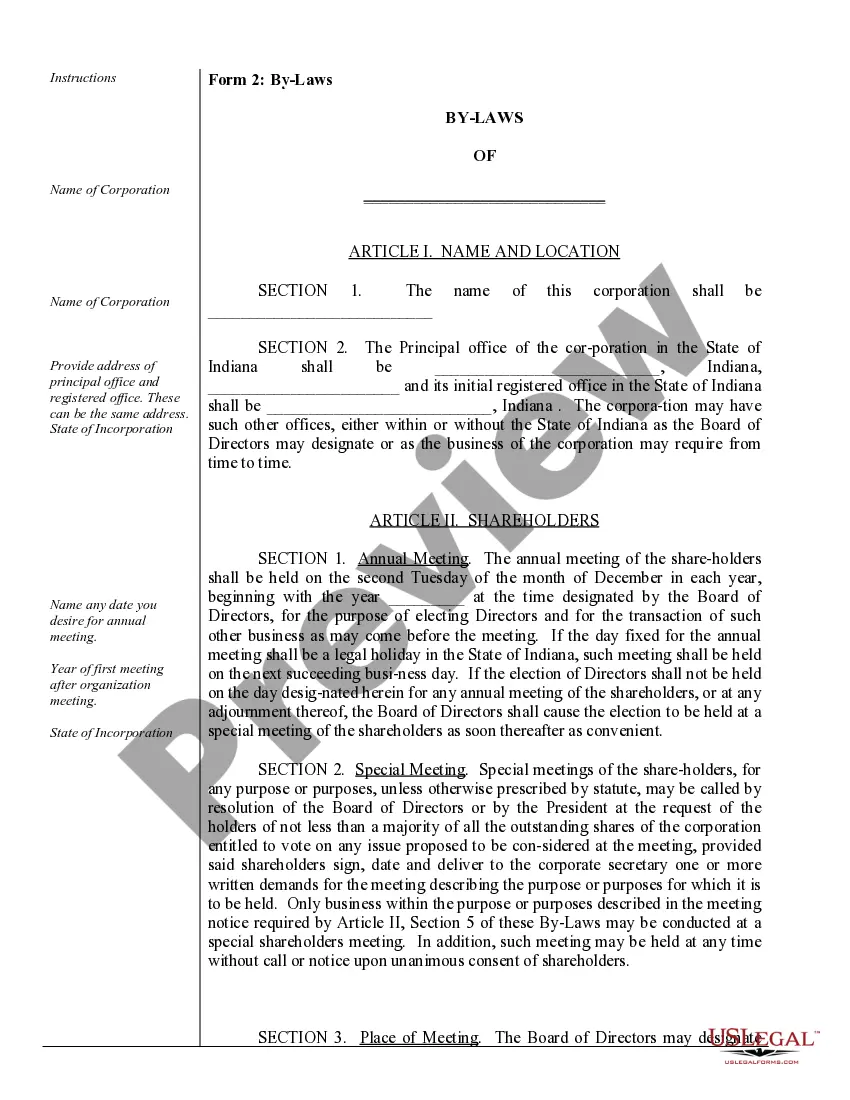

Indiana Corporate Records For Sale

Description

How to fill out Indiana Corporate Records Maintenance Package For Existing Corporations?

Managing legal documentation and activities can be a lengthy addition to your day.

Indiana Corporate Records For Sale and similar forms commonly necessitate that you seek them out and navigate the process to fill them out correctly.

As a result, if you are handling financial, legal, or personal matters, utilizing a thorough and straightforward online directory of forms readily available will significantly help.

US Legal Forms is the premier internet platform for legal templates, featuring over 85,000 state-specific forms and an array of tools that will aid you in completing your documentation effortlessly.

Is this your first time using US Legal Forms? Sign up and create your account in a few minutes, granting you access to the form directory and Indiana Corporate Records For Sale. Then, follow the steps below to fill out your form: Ensure you have located the correct form by using the Preview option and reviewing the form details. Select Buy Now when ready, and choose the subscription plan that suits your requirements. Click Download then complete, sign, and print the form. US Legal Forms has twenty-five years of experience assisting clients in managing their legal documentation. Find the form you need today and simplify any process without stress.

- Browse the collection of relevant documents accessible to you with a single click.

- US Legal Forms provides you with state- and county-specific forms available at any time for download.

- Protect your document management processes using a top-notch service that enables you to create any form within minutes without incurring additional or hidden costs.

- Simply Log In to your account, find Indiana Corporate Records For Sale, and download it directly from the My documents section.

- You can also access forms you have previously saved.

Form popularity

FAQ

Business Entity Reports are filed with the Indiana Secretary of State. Reports can be filed on INBiz or submitted by Paper. INBiz helps ensure filings are not rejected. 90% of paper forms are rejected due to forms being filled out incorrectly.

Indiana Articles of Incorporation will ask you for your company's name and office address, registered agent information, authorized shares, and incorporators. Your Indiana corporation's name must include one of the following words or its abbreviation: Corporation, Incorporated, Company or Limited.

File My Business Entity Report These reports must be filed every two years for both nonprofit and for-profit businesses. The filings are due during the anniversary month of your business's formation or the anniversary month in which you were granted authority to do business in the state.

Domestic and Foreign For Profits, Limited Liability Companies (LLC), Limited Liability Partnerships (LLP), and Limited Partnerships (LP) pay a $50 fee and file a report every other year (biennially). 2. Domestic and Foreign Nonprofit Corporations pay a $20 fee and file a report every other year (biennially).

All Indiana LLCs need to pay $31 per year for the Business Entity Report (or $50 per year if you file your Business Entity Report by mail). These Indiana LLC fees are paid to the Secretary of State. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.