Form A Corporation In Idaho Withholding Report

Description

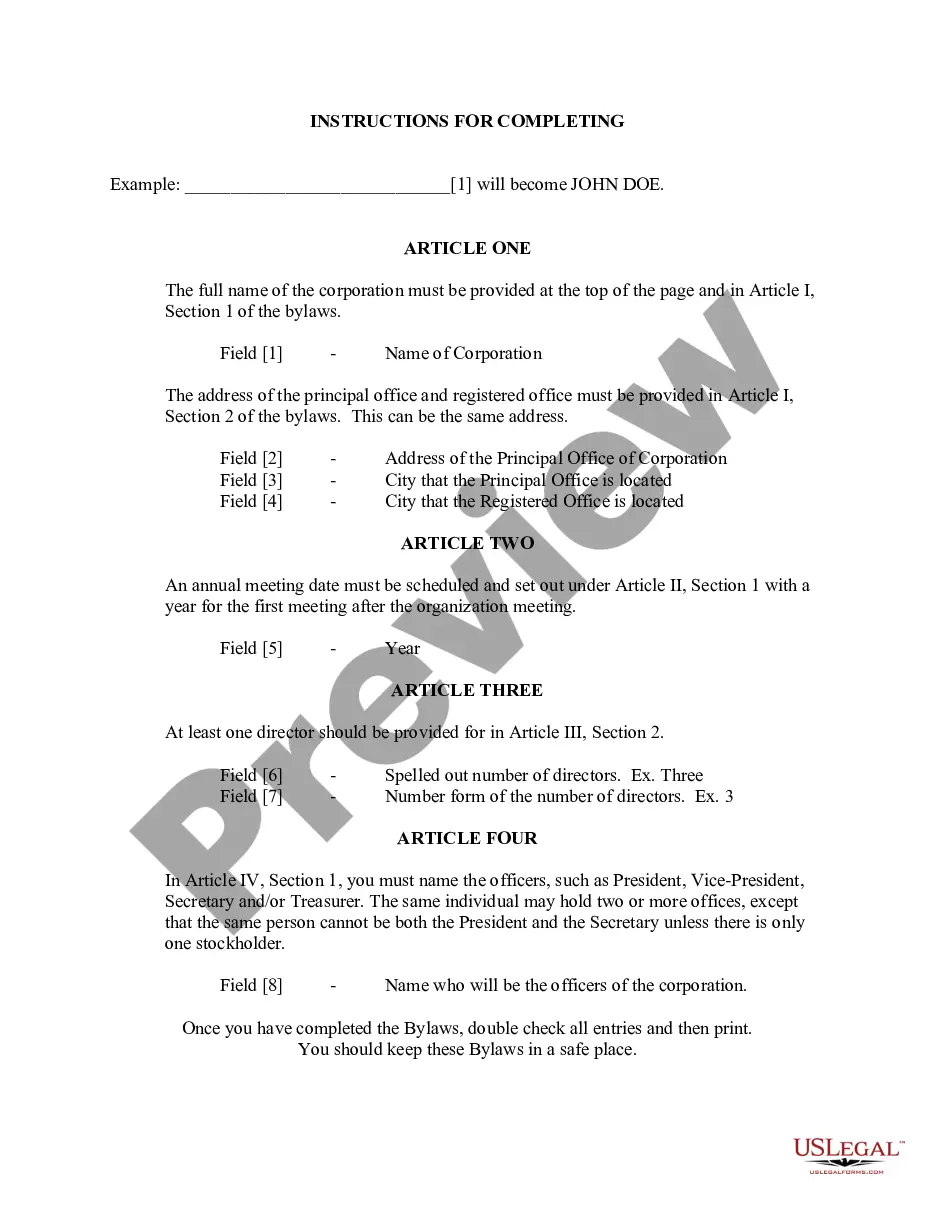

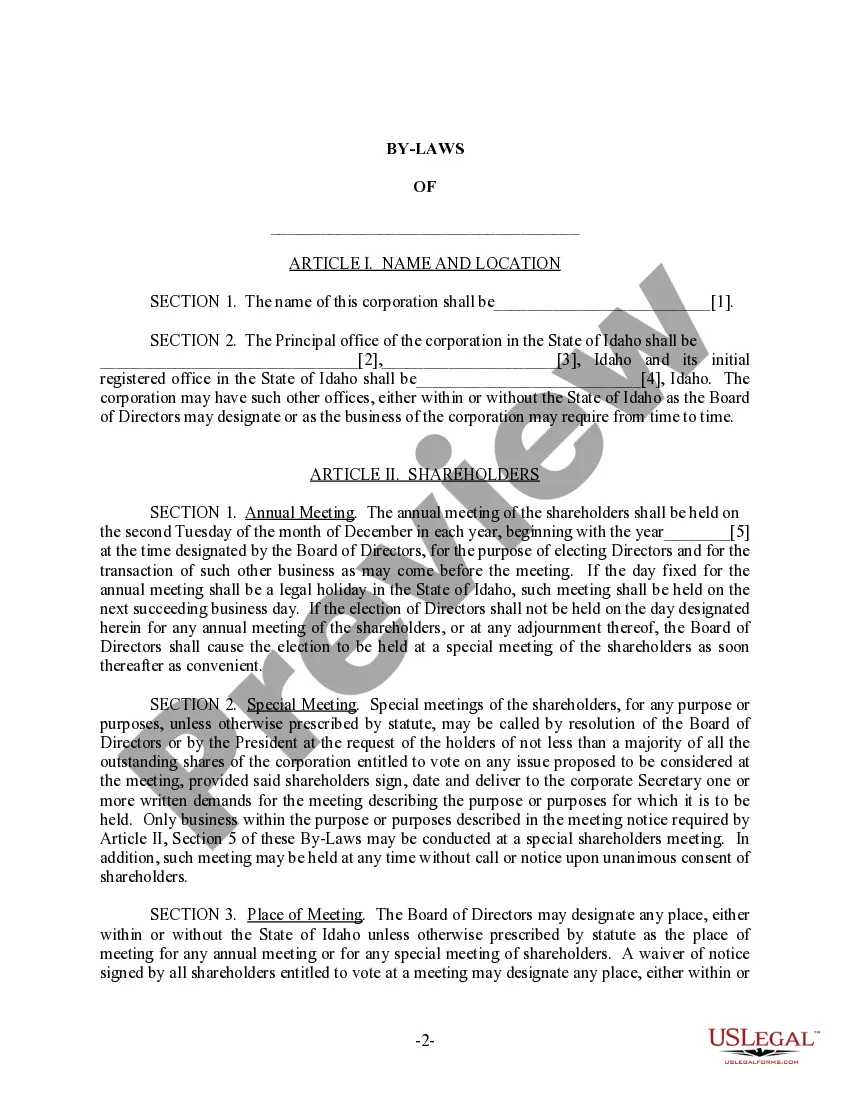

How to fill out Idaho Bylaws For Corporation?

Bureaucratic processes demand meticulousness and correctness.

Failure to manage the completion of documents like Form A Corporation In Idaho Withholding Report regularly can lead to misunderstandings.

Choosing the appropriate sample initially will guarantee that your document submission proceeds seamlessly and avoid any complications from resubmitting a file or repeating the task from the start.

If you are not a subscribed user, finding the necessary sample will require a few extra steps.

- You can always acquire the correct sample for your documentation at US Legal Forms.

- US Legal Forms is the most extensive online forms repository that provides over 85 thousand templates for various industries.

- You can find the most current and suitable version of the Form A Corporation In Idaho Withholding Report by simply searching for it on the platform.

- Identify, store, and download templates in your profile or verify the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can effortlessly gather, store in a single location, and navigate the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Next, proceed to the My documents page, where your document history is maintained.

- Browse the form descriptions and download those you need at any time.

Form popularity

FAQ

The percent withheld from your paycheck in Idaho varies based on your income level and the withholding allowances you claim. Idaho has a progressive income tax system, and withholding rates can range from 1.125% to 6.925%. Keep in mind that additional factors, such as local taxes, may also apply. By forming a corporation in Idaho withholding report, you ensure your withholding rates align with state regulations, optimizing your tax obligations.

Determining the number of withholding allowances is essential for managing your tax withholdings correctly. This is influenced by various factors, such as your filing status, number of dependents, and whether you have other sources of income. You can use the IRS Withholding Calculator as a helpful tool to assess your situation. If you form a corporation in Idaho withholding report, understanding these allowances can lead to better financial planning.

Idaho withholding amounts depend on your earnings and the information provided on your W-4 form. Employers subtract specific withholding amounts based on your claimed allowances, filing status, and income. Utilizing the Idaho withholding tables can help streamline this process. If you form a corporation in Idaho withholding report, you'll want to ensure accurate withholding calculations to prevent future tax issues.

Idaho income taxes are determined based on your taxable income, which includes wages, interest, and other earnings. The state uses a graduated tax rate structure, meaning higher income levels face higher rates. You can can easily calculate these taxes by referencing the latest tax tables provided by the Idaho State Tax Commission. When you form a corporation in Idaho withholding report, understanding these calculations is essential for compliance.

Idaho does not have a statewide business license requirement, but local jurisdictions may have specific rules. It is crucial to check with your city or county government for any licensing requirements. Having the proper licenses can help your corporation operate smoothly and avoid penalties, particularly when you’re managing your Idaho withholding report.

Yes, you can serve as your own registered agent in Idaho, provided you have a physical address in the state. This means you will receive legal documents and official mail on behalf of your corporation. However, if you prefer a more professional approach, consider using a registered agent service, simplifying your responsibilities and ensuring you never miss important correspondence related to your Idaho withholding report.

Forming an S Corporation in Idaho starts with registering your business as a corporation. After incorporation, you must file Form 2553 with the IRS to elect S Corporation status. This status provides tax benefits, allowing profits to pass through to shareholders. Remember to adhere to Idaho's requirements when handling the Idaho withholding report to ensure smooth operations.

To obtain an Idaho withholding account number, you can register online through the Idaho State Tax Commission's website or submit a paper application. You will need to provide your corporation's details and tax information during this process. It is essential to have this account number if you plan to hire employees and manage your Idaho withholding report correctly.

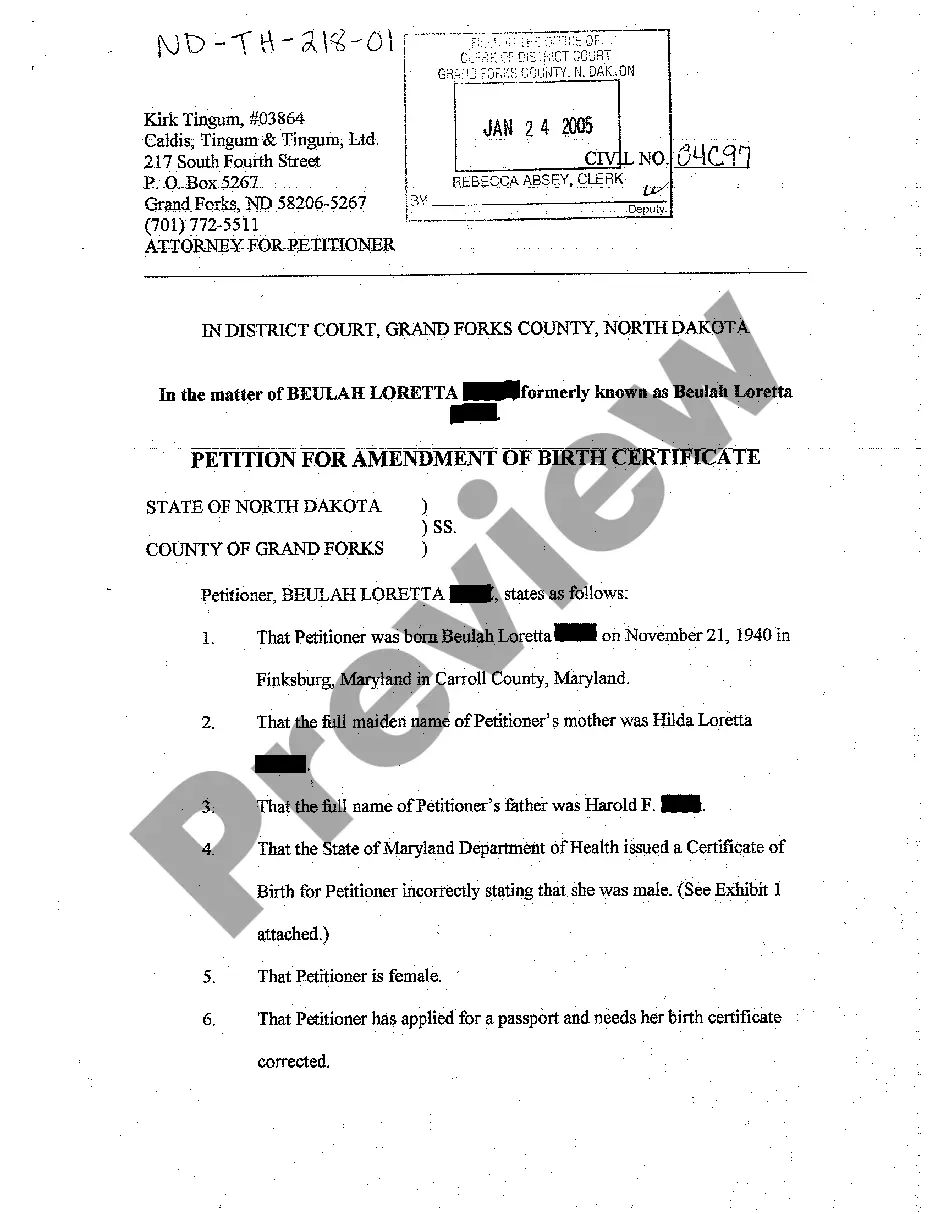

Individuals and businesses that earn income in Idaho and meet certain thresholds must file an Idaho state tax return. This includes both residents and non-residents who derive income from Idaho sources. For those forming a corporation in Idaho, knowing your filing obligations is key to maintaining compliance and ensuring the smooth operation of your new business.

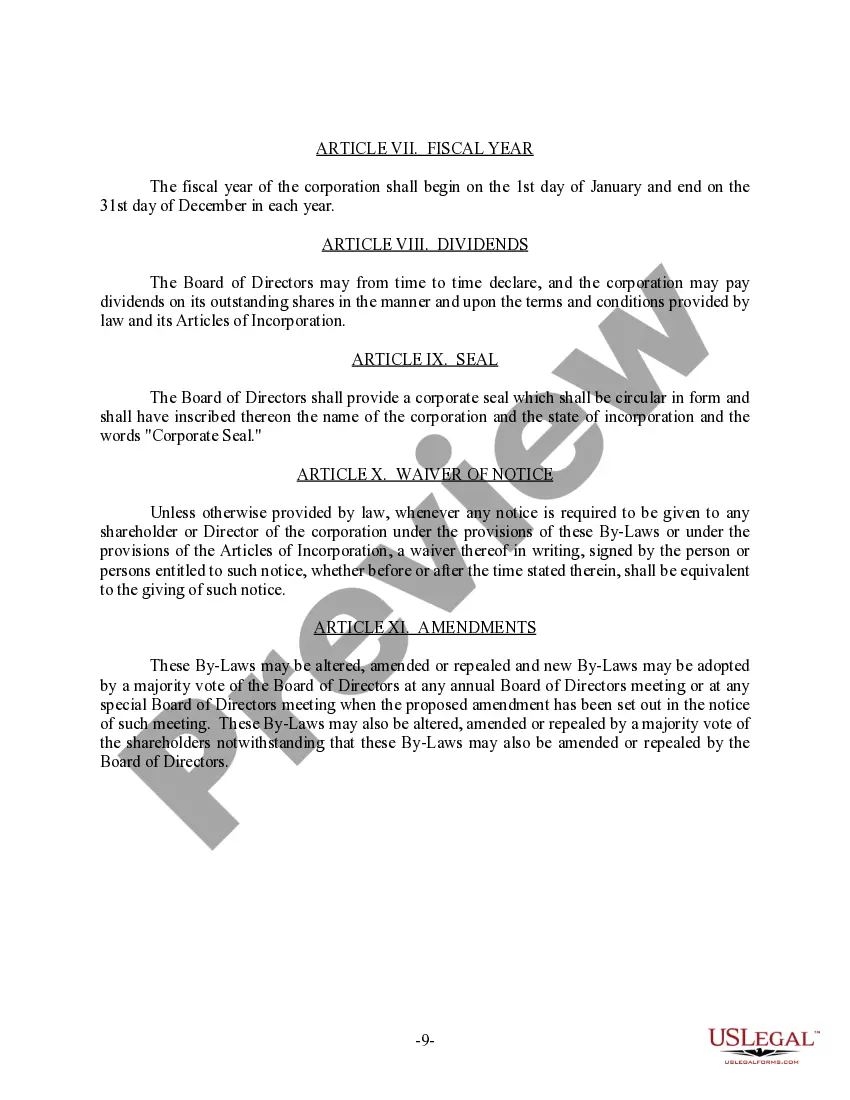

Idaho Form 910 is a document used for filing the Idaho corporate income tax return. It is essential for corporations to fulfill their tax obligations and report their income accurately. If you're in the process of forming a corporation in Idaho, understanding how to fill out Form 910 correctly can help you avoid any missteps in your tax filings.