Release From Mortgage Form

Description

How to fill out Georgia Satisfaction, Cancellation Or Release Of Mortgage Package?

How can you obtain professional legal documents that adhere to your state laws and create the Release From Mortgage Form without hiring an attorney.

Numerous online services provide templates to address different legal scenarios and requirements.

However, it might take a while to identify which of the accessible samples suit both your needs and legal standards.

If you lack an account with US Legal Forms, follow the steps outlined below.

- US Legal Forms is a trustworthy resource that aids you in finding official documents prepared according to the most recent state law revisions and helps you save on legal fees.

- US Legal Forms is more than just a typical online directory; it is a repository of over 85,000 verified templates for various business and personal situations.

- All documents are organized by region and state to streamline your search process.

- Furthermore, it connects with robust tools for PDF editing and electronic signing, allowing users with a Premium account to easily complete their forms online.

- Securing the required paperwork demands minimal effort and time.

- If you already possess an account, Log In to confirm your subscription status.

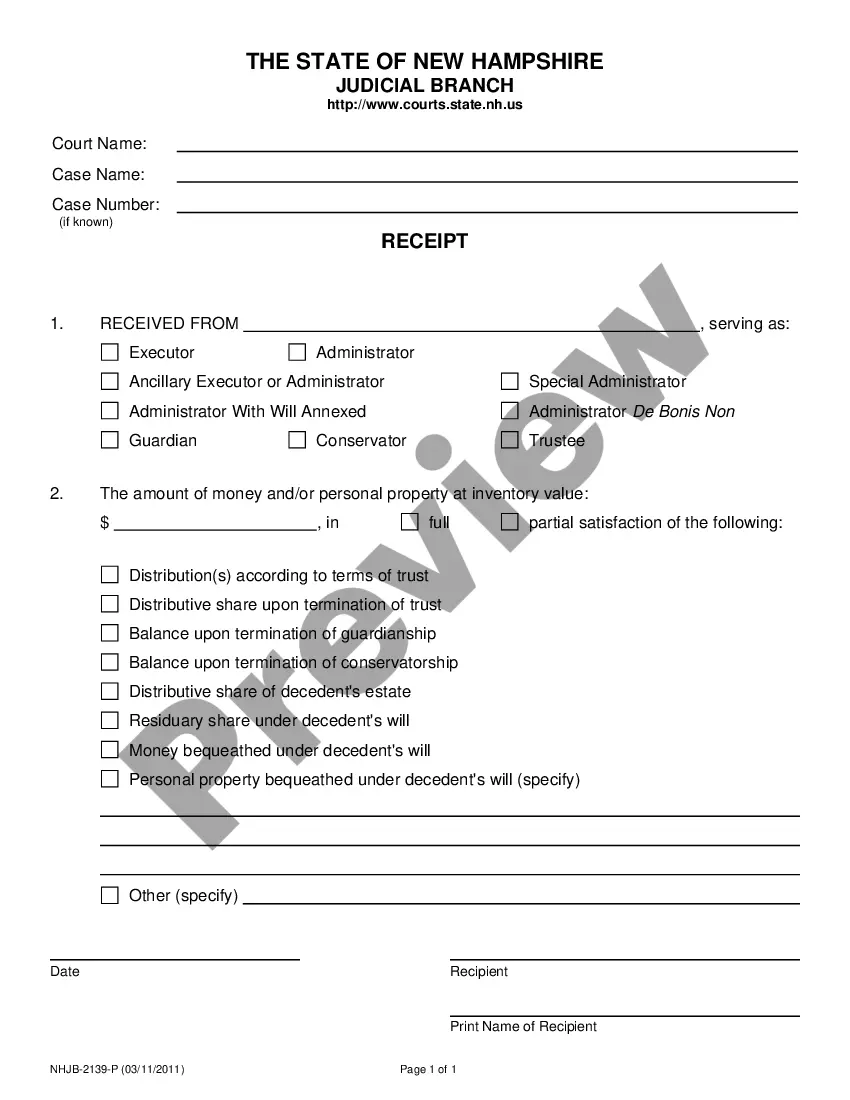

- Download the Release From Mortgage Form by clicking the corresponding button next to the document title.

Form popularity

FAQ

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

What is a Mortgage Release? A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage. This release of mortgage is recorded or filed and gives notice to the world that the lien is no more.

What is the distinction between a release and a discharge? With a release, your creditor confirms that all the sums due have been paid. The document certifies that the property is mortgage-free. The discharge releases only part of the property or only one of the individuals responsible for the mortgage payments.