Satisfaction Of Judgment Form Pennsylvania

Description

How to fill out Florida Satisfaction Of Judgment?

It’s well known that you cannot become a legal expert instantly, nor can you learn how to swiftly prepare the Satisfaction Of Judgment Form Pennsylvania without possessing a specific set of expertise.

Assembling legal documents is a lengthy process that demands specialized training and abilities. So why not entrust the creation of the Satisfaction Of Judgment Form Pennsylvania to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can access everything from court papers to templates for internal communication.

If you need a different template, start your search again.

Register for a free account and select a subscription plan to purchase the form. Click Buy now. Once the transaction is finalized, you can download the Satisfaction Of Judgment Form Pennsylvania, complete it, print it, and send or mail it to the necessary parties or organizations.

- We recognize how important compliance and adherence to federal and state laws and regulations are.

- That’s why, on our site, all forms are specific to locations and current.

- Here’s how you can begin with our platform and obtain the form you need in just a few minutes.

- Locate the document you require using the search bar at the top of the page.

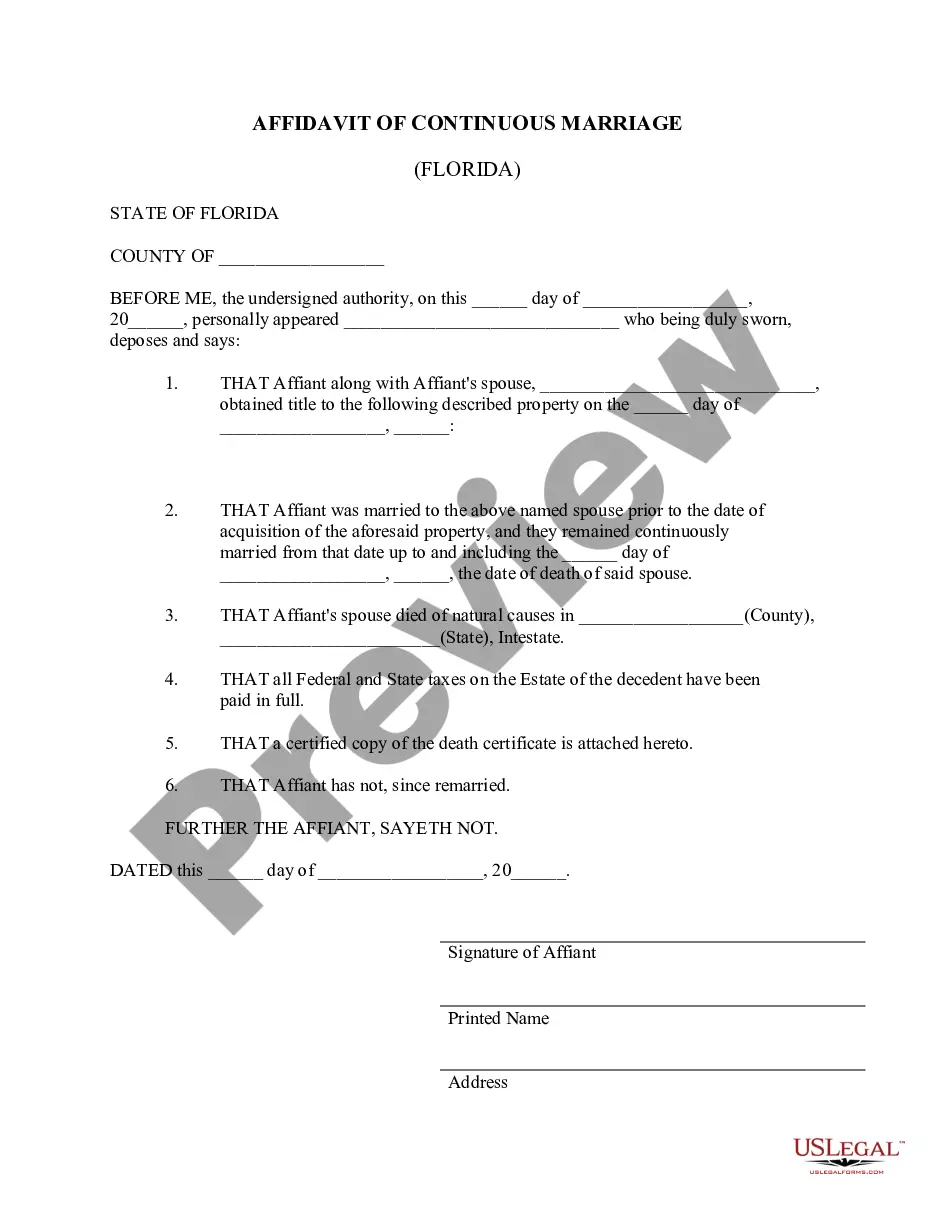

- Preview it (if this option is available) and read the accompanying description to determine if the Satisfaction Of Judgment Form Pennsylvania is what you are looking for.

Form popularity

FAQ

The 5 Steps To Collect Debt In Pennsylvania. File Your Judgment With the County Courts. ... File Your Writ of Execution (This the Key for the Sheriff to help you) . ... Seize Bank Accounts by Sending Questions (Interrogatories) to the Banks. ... Levy and Sell Personal Assets and Vehicles. ... Levy and Sell Real Property / Land.

File a praecipe for judgment, a dated copy of the 10 day notice, and a Pennsylvania Rule 236 form. If the debtor is an individual, you must file a notarized affidavit of nonmilitary service. File an original and a copy for each debtor with a Rule 236 form. Include a stamped envelope addressed to each debtor.

If a judgment debtor has paid in full, settled, or otherwise complied with a judgment rendered in a magisterial district court, anyone interested in the judgment may request the entry of satisfaction of the judgment by filing a written request in the office of the magisterial district judge who rendered the judgment.

As the judgment creditor, you may transfer the judgment to any county, though it makes the most sense to transfer the judgment to a county where the person possesses personal property. You may also continue to apply a judgment lien against the property until the amount of the judgment is satisfied.

Tells the court and others that a judgment has been paid in full or in part. Can be recorded with a county to release a lien against the judgment debtor's land or filed with the Secretary of State to release a lien against the debtor's personal property.