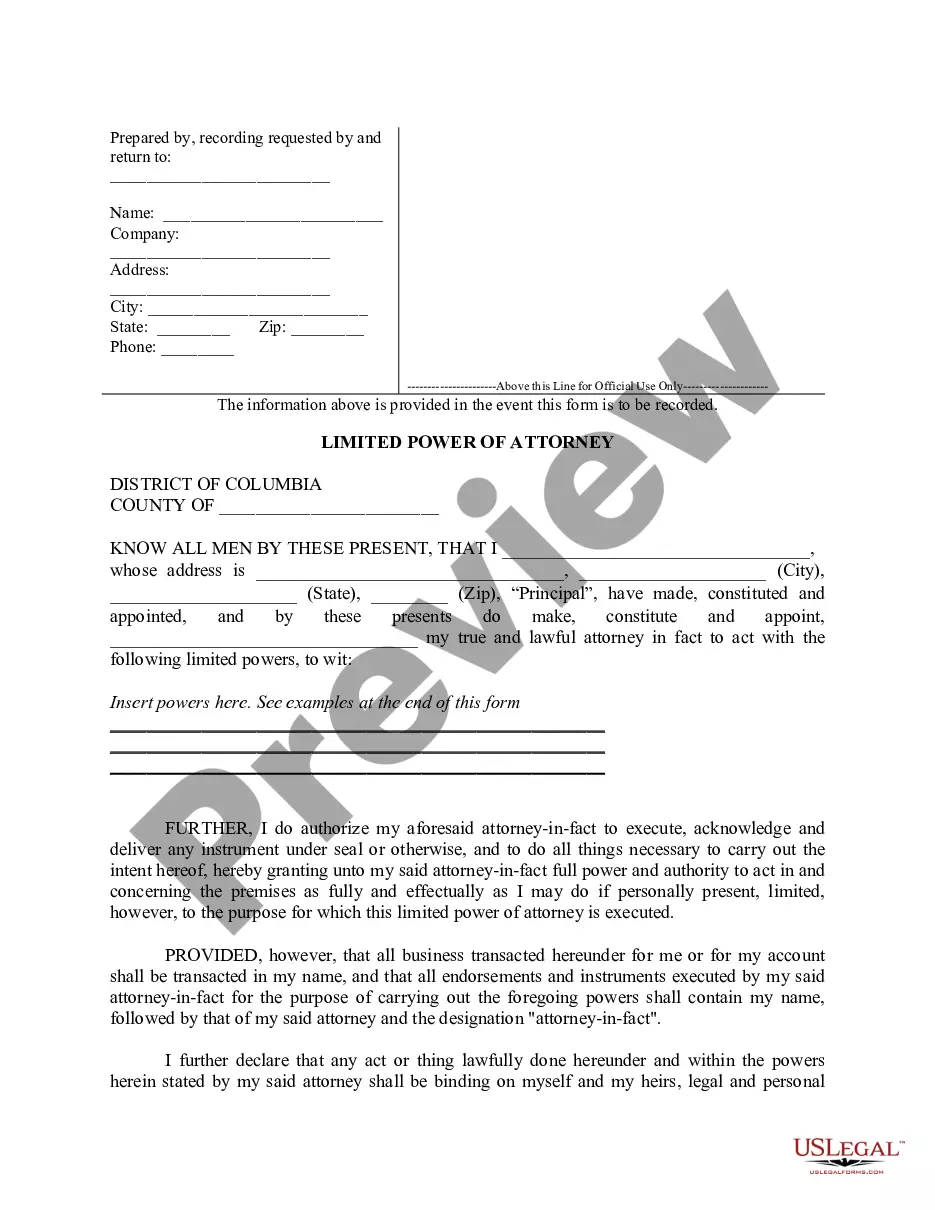

Power Attorney For Property

Description

How to fill out District Of Columbia Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your US Legal Forms account if you're an existing user. Ensure that your subscription is active; if not, renew it according to your payment plan.

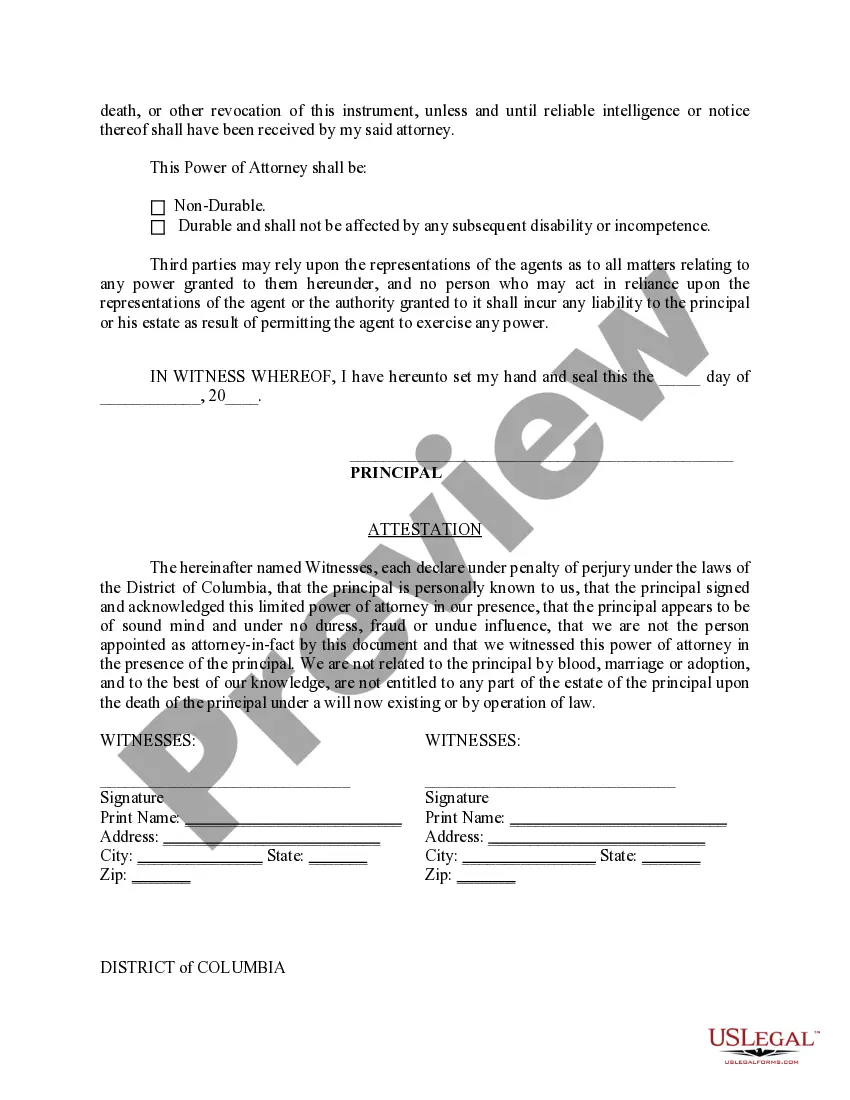

- If you're new to US Legal Forms, start by reviewing the available forms in Preview mode. Confirm that the Power of Attorney form meets your specific requirements and complies with your jurisdiction.

- Should the initial form not fit your needs, utilize the Search function to find the most suitable template for your situation.

- Once you have selected the correct document, click on the Buy Now button and choose your desired subscription plan. You'll need to register for an account to access the full library.

- Proceed to checkout by entering your payment details via credit card or PayPal.

- After completing your purchase, download the form onto your device for completion. You'll also find it under the My Forms section in your account for future access.

In conclusion, US Legal Forms provides users with a comprehensive and user-friendly platform to effortlessly create a Power of Attorney for property. With access to over 85,000 forms and the support of premium experts, you can ensure that your legal documents are accurate and reliable.

Start today by visiting US Legal Forms to explore the vast library and empower yourself with the legal documents you need.

Form popularity

FAQ

One disadvantage of a power attorney for property is the potential for misuse if the agent is not trustworthy. The agent has significant authority, which can lead to financial abuse if they do not act in your best interests. Additionally, revoking a power of attorney can be complicated if you are no longer able to manage your affairs. It’s essential to choose your agent carefully and to consider these risks when creating the document.

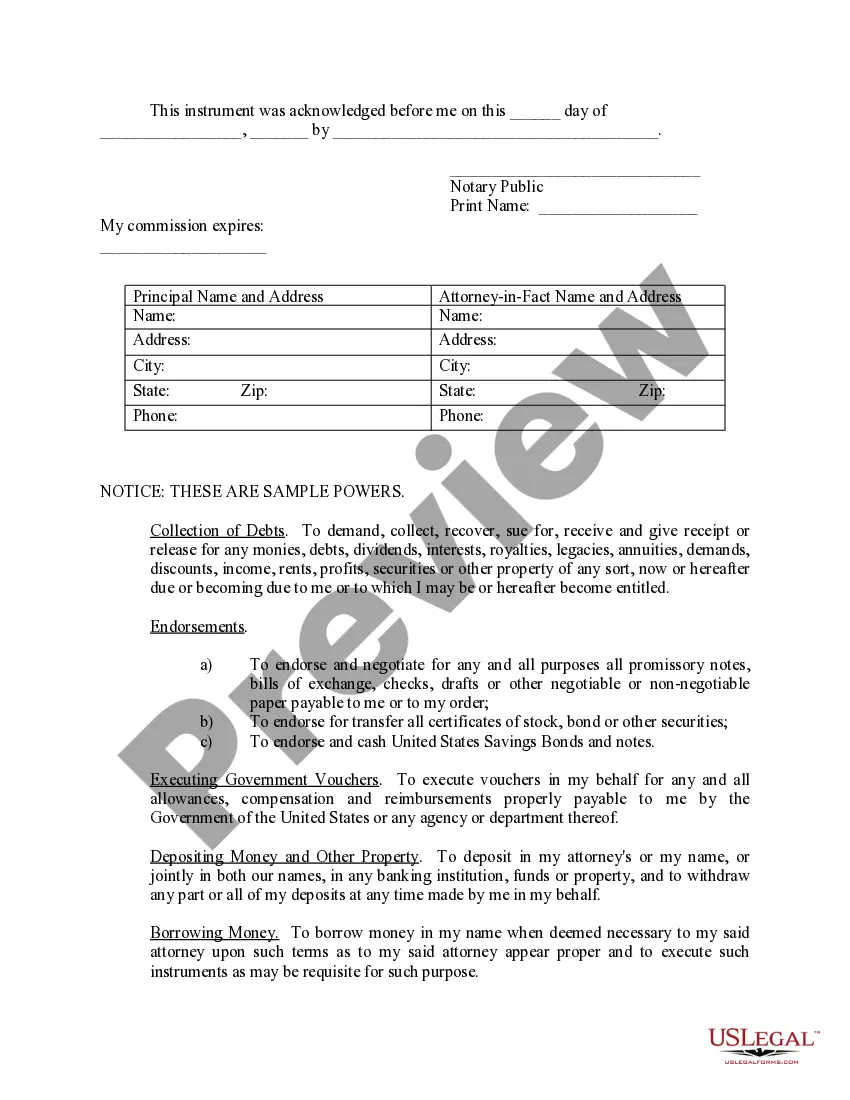

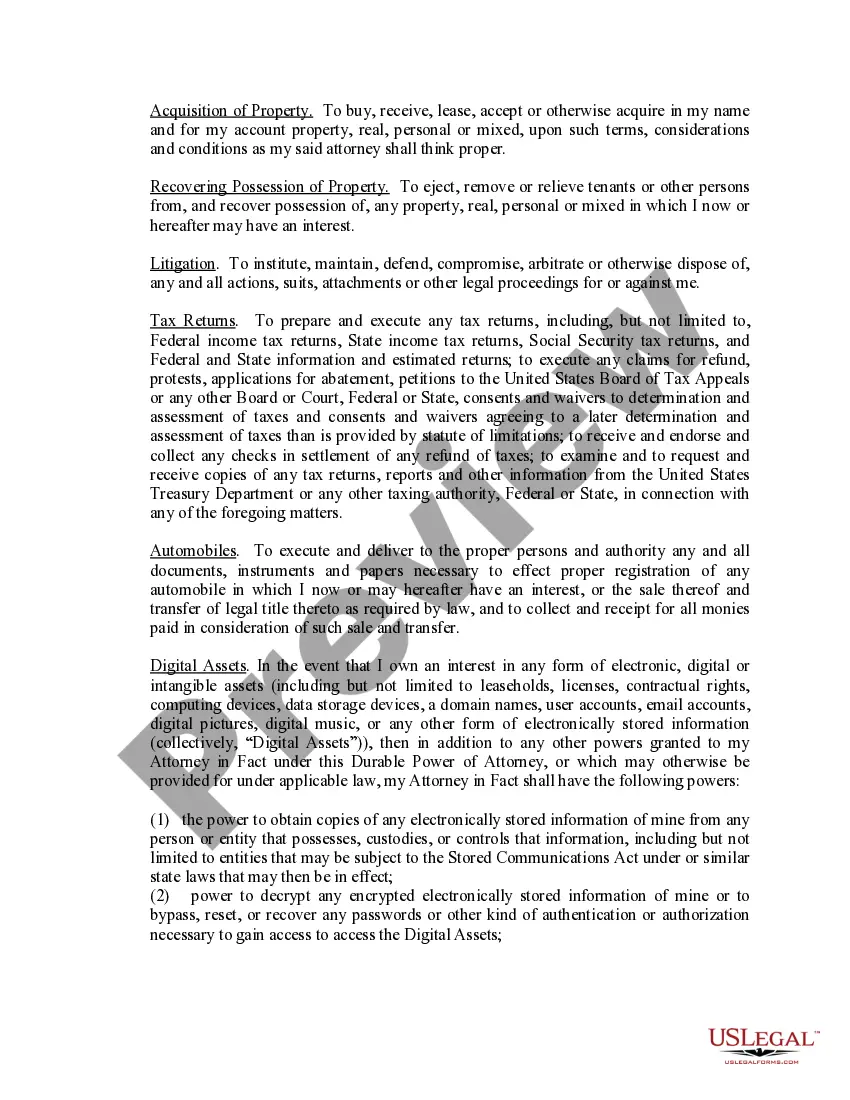

To write a simple power of attorney for property, start by stating your name and the name of the person you are appointing as your agent. Clearly outline what powers you are granting them, such as managing your real estate or financial accounts. You can simplify this process by using customizable templates from platforms like USLegalForms, ensuring your document meets legal requirements. Always remember to sign and date the document for it to be valid.

The easiest way to set up a power of attorney for property is to use a template available online. Platforms like USLegalForms offer user-friendly templates that guide you through the process. By filling out the required information, you can create a document that clearly states your intentions. This makes it simple for you to give someone authority to handle your property matters.

You can obtain power attorney for property without a lawyer by using online templates or services like uslegalforms. These platforms provide customizable documents that meet state requirements. However, it’s wise to double-check the final document to ensure it fulfills all legal stipulations.

The best choice for power attorney for property should be someone who understands your wishes and needs. Consider individuals who are not only trustworthy but also familiar with your financial affairs. This choice often hinges on the person’s ability to act in your best interest during critical decisions.

To establish power attorney for property in Pennsylvania, you need to complete a written document that outlines the specific powers granted. You must sign the document in the presence of a notary public or two witnesses. It’s essential to follow Pennsylvania state laws to ensure that the power of attorney is valid.

While a family member may be a suitable choice for power attorney for property, it is not a strict requirement. A trusted friend or even a professional can serve effectively. The key is to ensure that the person is trustworthy and capable of managing your affairs with integrity.

The best choice for power attorney for property is someone you trust implicitly, such as a family member or close friend. This person should be responsible, reliable, and capable of making thoughtful decisions in your best interest. Consider their ability to handle financial matters and conflicts of interest before appointing them.

A major disadvantage of power attorney for property is the potential for abuse. The appointed person holds significant control over your property, and if their intentions are not trustworthy, it may lead to financial complications. Therefore, selecting the right individual is crucial for safeguarding your assets.

Having multiple people with power attorney for property can provide checks and balances. This arrangement ensures that decisions reflect a broader perspective and reduce the risk of misuse. It can also help if one person is unavailable or incapacitated, allowing another to step in seamlessly.