Lien Release Letter From Bank

Description

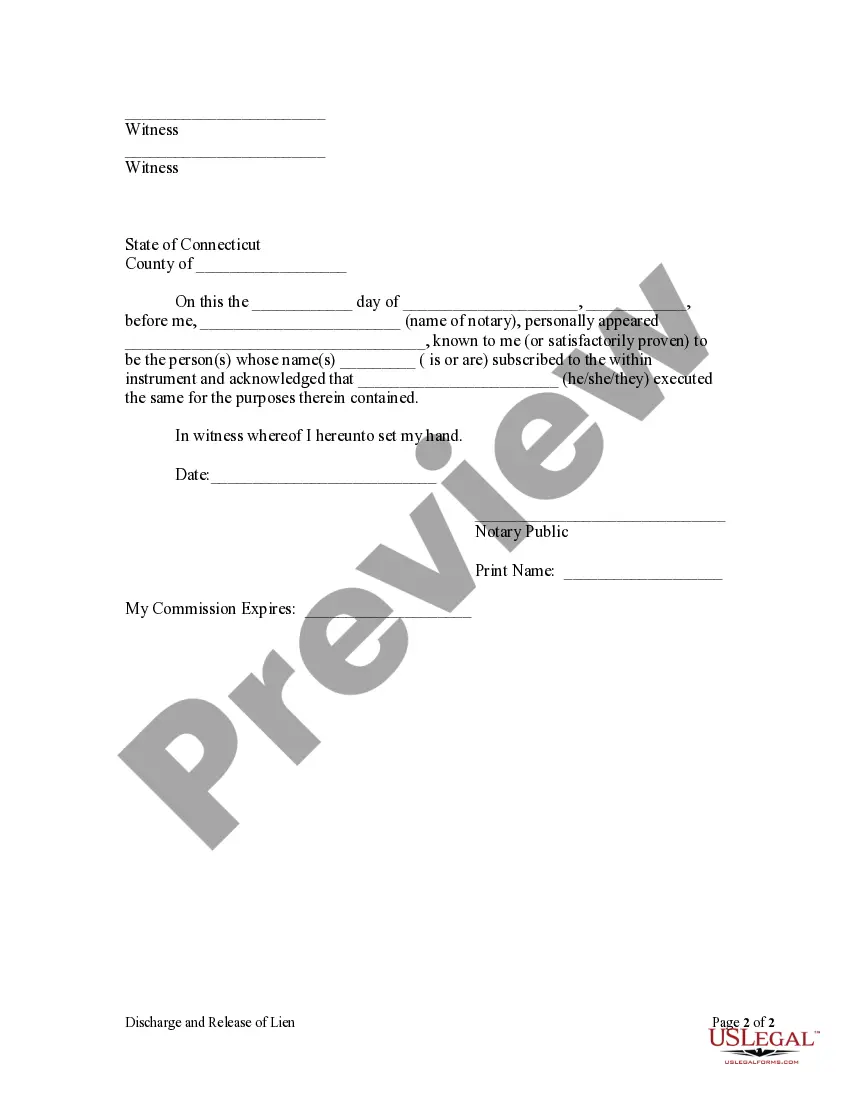

How to fill out Connecticut Discharge And Release Of Lien By Individual?

- If you're a returning user, login to your account and navigate to the document library. Ensure your subscription is active, and renew it if necessary.

- For first-time users, start by reviewing the available forms. Use the Preview mode to verify that the lien release letter meets your local jurisdiction's requirements.

- If your initial selection doesn't fit, utilize the Search tab to find other applicable templates.

- Once you find the appropriate document, click the Buy Now button. Choose a subscription plan that works for you, and create an account to access the library.

- Complete your purchase by entering your payment details or using PayPal to finalize your subscription.

- After purchasing, download the lien release letter from your account dashboard under the My Forms section for easy access.

US Legal Forms empowers users by providing a robust selection of over 85,000 legal documents, ensuring quick and efficient access to forms while offering expert assistance for precise completion.

By following these steps, you'll have your lien release letter in no time. Don't hesitate to get started on securing your legal documents today!

Form popularity

FAQ

A release letter indicates that a borrower has fulfilled their payment obligations and releases the bank's claim on collateral. In contrast, a termination letter usually ends a contractual agreement without necessarily addressing payment completion. Understanding this distinction is important, especially when seeking a lien release letter from bank to clear property titles.

Getting a lien release letter from the bank is straightforward once you have settled your debt. Reach out to your bank's customer service or visit a local branch to initiate the process. They will provide instructions on what information is needed, and following their guidance can help you receive the document promptly.

The time it takes to receive a lien release from a bank often depends on the institution and your specific situation. Usually, after submitting your request and ensuring all conditions are met, you might wait anywhere from a few days to a few weeks for the bank to issue the lien release letter. Keeping track of your communication can help expedite the process.

Upon receiving a release of lien, review the document carefully to ensure all information is accurate. Keep the release letter secure, as it serves as legal proof that the lien has been lifted. Moreover, consider informing your mortgage lender and updating your records to reflect this change, ensuring that your property title is clear.

When a bank puts a lien on your house, it indicates that you owe a debt associated with the property. This lien gives the bank the right to claim your house if you fail to repay the debt. It is crucial to address the issue promptly to avoid foreclosure actions and seek a lien release letter from bank once the debt is settled.

A lien release signifies that the financial obligation tied to the lien has been fully satisfied. This means the bank no longer has a claim on your property or assets. Essentially, it grants you full ownership rights without any encumbrance from the bank.

After receiving a lien release letter from bank, it’s essential to ensure that your credit report reflects this change. Verify that the lien has been removed from your credit history, as it can affect your financial standing. Additionally, file the lien release with your local property records office to safeguard your interests.

Completing a lien release involves obtaining a lien release letter from bank, which formally states that the lien has been removed. You must fill out any necessary forms required by your state or local jurisdiction. Do not forget to submit this documentation to the appropriate agency to update public records.

Removing a lien from your bank account typically involves paying off the debt that led to the lien. Once you settle the outstanding amount, request a lien release letter from bank to confirm that the bank has released its claim. Ensure you keep a copy of this letter for your records, as it serves as proof that the lien is no longer valid.

To obtain your lien release letter, contact your bank directly and request the necessary forms or information required for the release process. Ensure that you provide all relevant details, such as your account number and any documents proving you have satisfied the lien's conditions. Once the bank processes your request, they will issue your lien release letter, allowing you to confirm the release officially.