Connecticut Llc Operating Agreement With State

Description

How to fill out Connecticut Single Member Limited Liability Company LLC Operating Agreement?

Individuals typically link legal documentation with something complex that solely a professional can handle.

In a certain sense, this is accurate, as formulating a Connecticut Llc Operating Agreement With State requires significant knowledge of the subject matter, including state and county laws.

However, with US Legal Forms, everything has become simpler: ready-to-use legal templates for any personal and business situation tailored to state regulations are compiled in a single online directory and are now accessible to all.

You can print your document or upload it to an online editor for quicker completion. All templates in our catalog are reusable: once acquired, they remain in your account. You can access them anytime via the My documents tab. Explore all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and purpose, making it easy to find the Connecticut Llc Operating Agreement With State or any specific template in just a few minutes.

- Users with an existing subscription can simply Log In to their accounts and click Download to receive the form.

- New users must first create an account and subscribe prior to downloading any documentation.

- Here is a detailed guide on how to acquire the Connecticut Llc Operating Agreement With State.

- Review the page content thoroughly to ensure it aligns with your requirements.

- Examine the form description or look at it through the Preview feature.

- If the previous example does not meet your needs, search for another template using the Search bar at the top.

- When you find the relevant Connecticut Llc Operating Agreement With State, click Buy Now.

- Select a subscription plan that suits your needs and financial situation.

- Proceed to create an account or Log In to reach the payment page.

- Make the subscription payment using PayPal or a credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

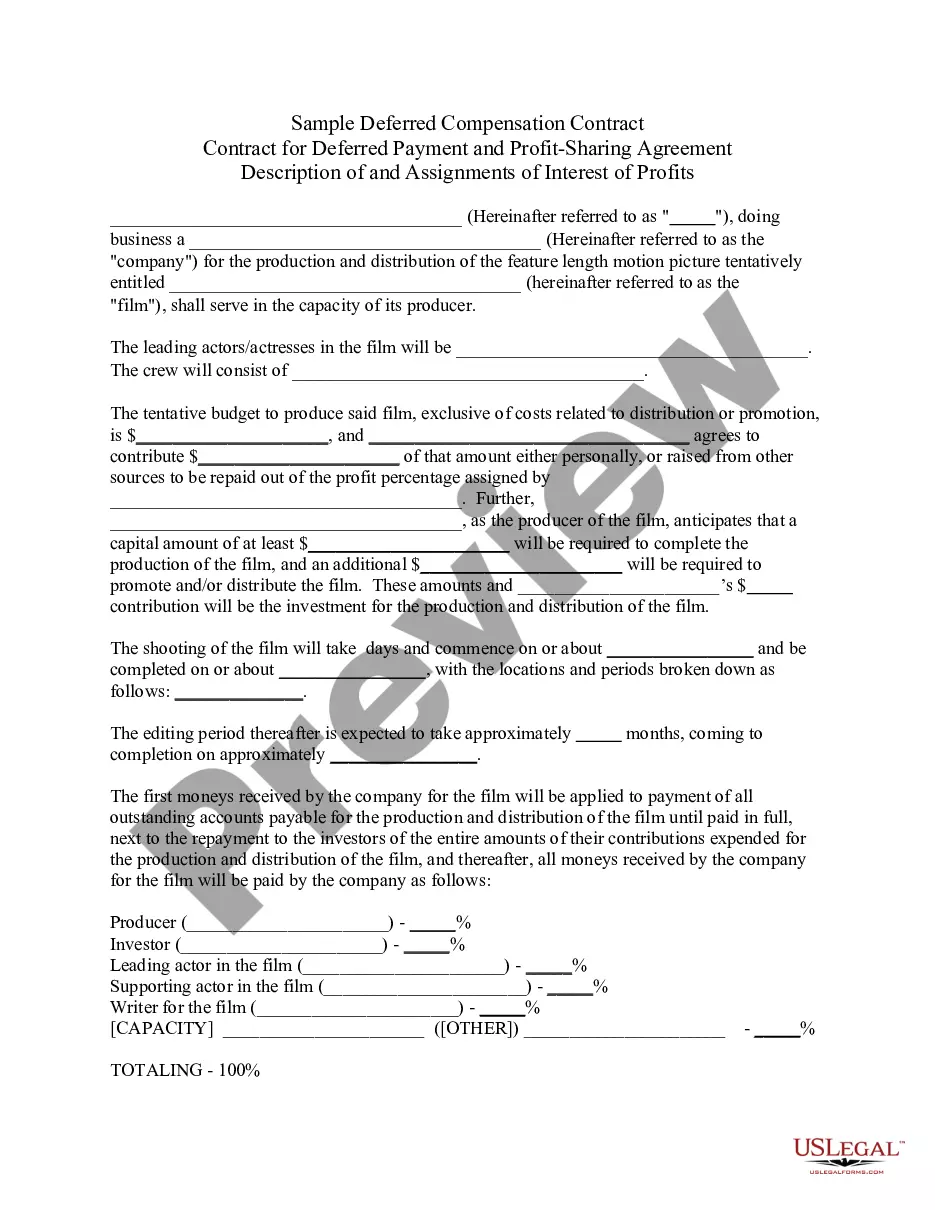

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Prepare an Operating AgreementAn LLC operating agreement is not required in Connecticut, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.