State Of Colorado Operating Agreement For Single Member Llc

Description

How to fill out Colorado Limited Liability Company LLC Operating Agreement?

Regardless of whether it's for professional reasons or personal issues, everyone must confront legal matters at some stage in their life.

Filling out legal documents requires meticulous attention, beginning with selecting the appropriate form template.

Once it is downloaded, you can complete the form using editing software or print it out and finish it manually. With a vast US Legal Forms library available, you won't need to waste time looking for the right template online. Take advantage of the library’s user-friendly navigation to find the appropriate template for any event.

- For instance, if you select an incorrect version of a State Of Colorado Operating Agreement For Single Member Llc, it will be denied when you submit it.

- Thus, it is crucial to acquire a trustworthy source of legal documents such as US Legal Forms.

- If you need to procure a State Of Colorado Operating Agreement For Single Member Llc template, follow these straightforward steps.

- Retrieve the template you require using the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

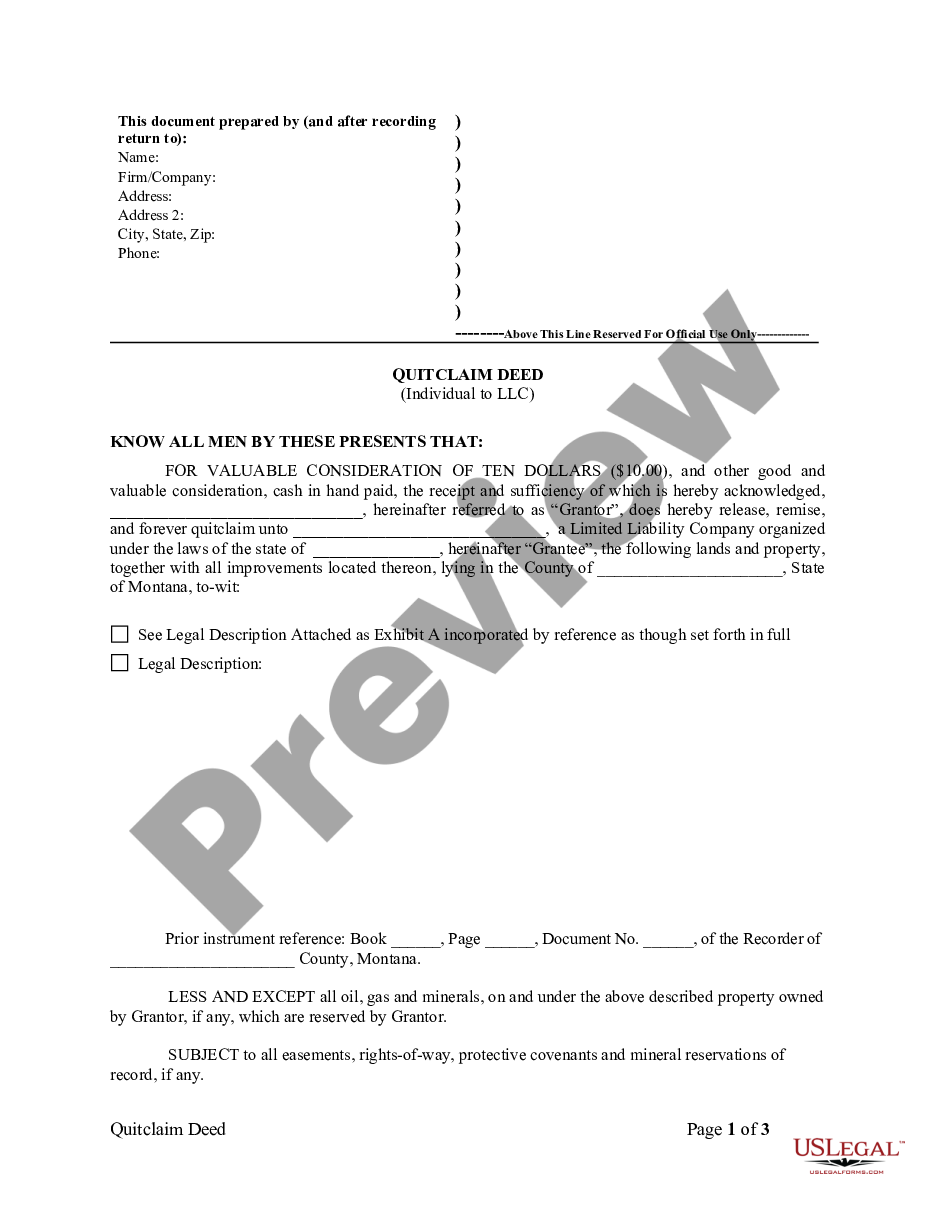

- Select the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to locate the State Of Colorado Operating Agreement For Single Member Llc sample you need.

- Download the file if it meets your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Fill out the account registration form.

- Select your payment method: either utilize a credit card or PayPal account.

- Choose the file format you prefer and download the State Of Colorado Operating Agreement For Single Member Llc.

Form popularity

FAQ

As a Colorado single-member LLC, you are not technically required to have an operating agreement. Nevertheless, you want to make sure that you have one between yourself and the company. Remember, the LLC is a separate legal entity.

Does my LLC Operating Agreement need to be notarized? No, your Operating Agreement doesn't need to be notarized. Each Member just needs to sign it. Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legal document.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.

It's a contract between you and your members that clearly defines how your LLC will handle important procedures like voting, transferring membership interest, allocating profits and losses, and closing up shop, should the time come. Your operating agreement is an internal document, kept on record with your LLC.

A Colorado single-member LLC operating agreement is a legal document that establishes operating terms between the owner and the business itself. The state of Colorado does not require an agreement, however, it is highly recommended that all businesses have one in place, no matter what the size of the business.