Estate Form Information With Third Parties

Description

How to fill out California Estate Planning Questionnaire And Worksheets?

Handling legal documents and processes can be a lengthy addition to your day.

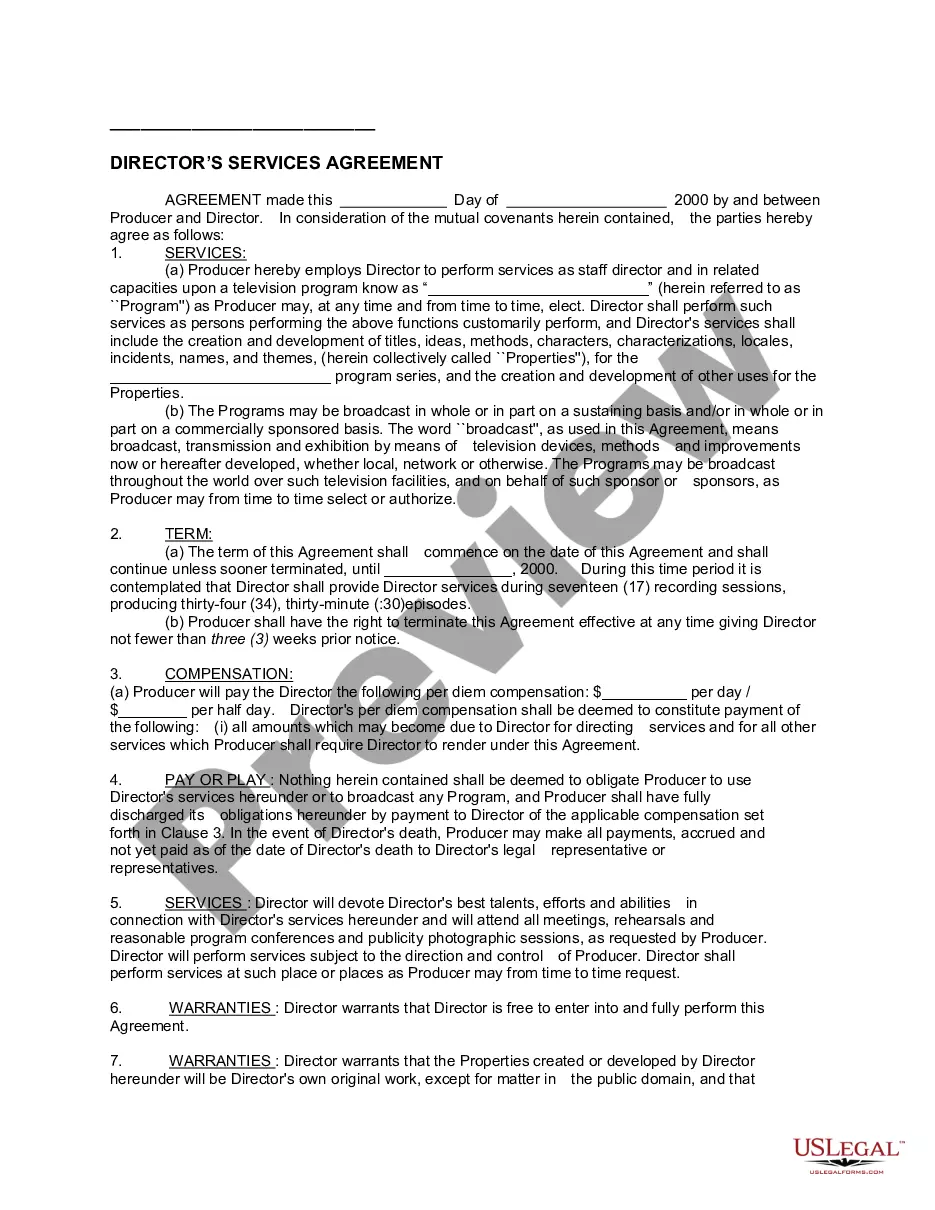

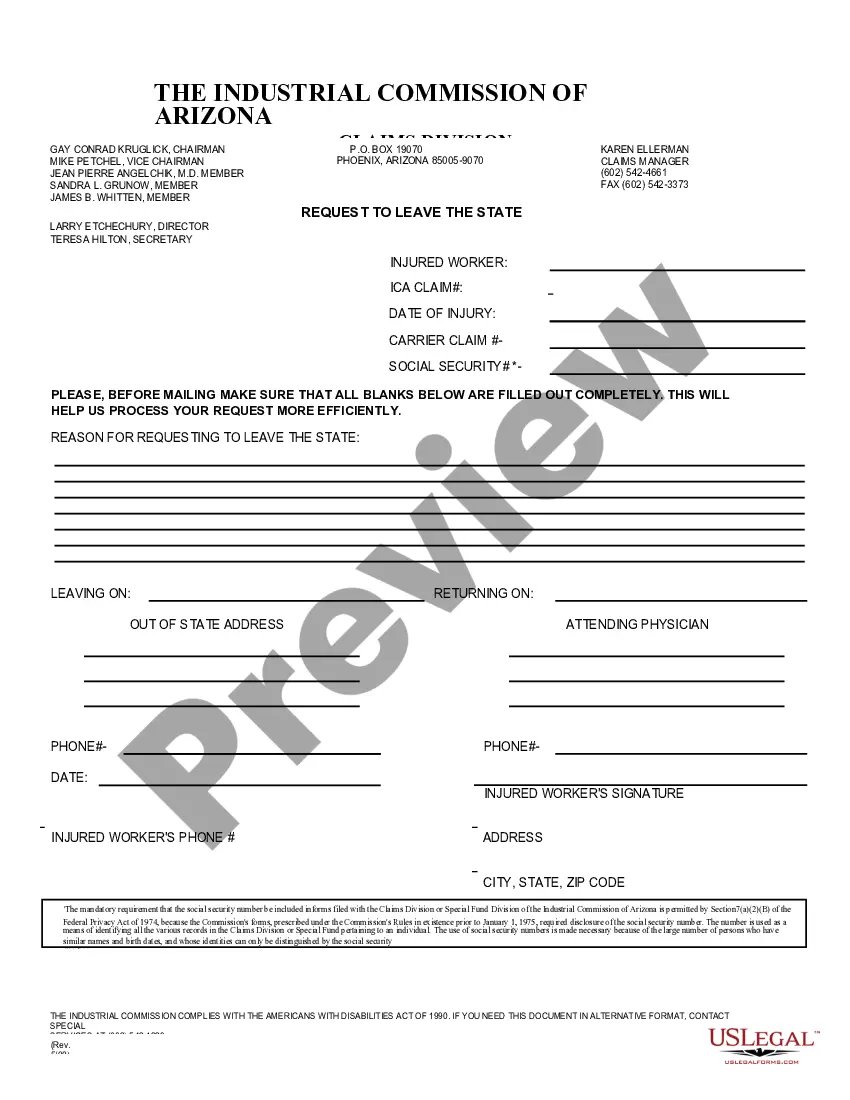

Estate Form Information With Third Parties and similar documents typically necessitate you to locate them and navigate through to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal issues, utilizing a complete and straightforward online repository of forms readily available will significantly help.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and various resources to aid you in completing your documents with ease.

Is this your first experience with US Legal Forms? Register and set up an account in a few minutes, and you will gain access to the form library and Estate Form Information With Third Parties. Then, follow the steps outlined below to complete your document: Ensure you have found the correct form using the Review option and examining the form description. Select Buy Now when ready and choose the subscription plan that suits you best. Click Download then fill out, eSign, and print the form. US Legal Forms has 25 years of expertise assisting clients manage their legal documents. Acquire the form you need today and streamline any process effortlessly.

- Explore the collection of pertinent documents available to you with just one click.

- US Legal Forms provides you with state- and county-specific forms accessible at any time for download.

- Protect your document handling processes by utilizing a premium service that enables you to prepare any form in minutes without any extra or concealed charges.

- Simply Log In to your account, locate Estate Form Information With Third Parties, and download it immediately from the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

To uncover hidden assets of a deceased individual, start by reviewing their financial records, such as bank statements and tax returns. You may also want to consult estate form information with third parties, which can include asset search services. Engaging a professional investigator may also provide assistance in locating undisclosed assets.

Gaining access to an estate typically involves proving your relationship to the deceased or obtaining legal authorization as an executor. You may need to provide estate form information with third parties to facilitate this process. If you're uncertain about the steps to take, consider seeking professional guidance.

To obtain information on an estate, visit the probate court where the estate was filed. You can also check online resources for estate form information with third parties, which may provide additional details. Furthermore, consulting an attorney can help you navigate the complexities of estate inquiries.

Typically, beneficiaries named in the will and the executor have the right to see estate accounts. Some jurisdictions may also allow creditors to access this information. Understanding the estate form information with third parties can clarify the rules that apply in your specific situation.

The three-year rule for deceased estates generally refers to the timeframe within which certain tax filings must be completed after a person's death. This rule ensures that beneficiaries report the estate's income and file necessary documents. Familiarizing yourself with estate form information with third parties can help streamline this process.

To obtain executor of estate paperwork, first identify the probate court where the estate is filed. You can request copies of the documents from the court clerk’s office. It's essential to understand that estate form information with third parties may be necessary to complete your request accurately.

To find the estate of a deceased person, start by checking public records in the local probate court. You may also want to search online databases that provide estate form information with third parties. Additionally, reaching out to family members or close friends can yield valuable insights regarding the deceased's estate.

Common mistakes when filing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, include incorrect valuations of assets and failure to include all applicable deductions. Additionally, some filers overlook the importance of timely submission, which can lead to penalties. To avoid these pitfalls, utilize resources like USLegalForms for accurate estate form information with third parties, ensuring a smoother filing process.

The 5 by 5 rule in estate planning allows a beneficiary to withdraw up to $5,000 or 5% of the trust's value each year without incurring gift taxes. This rule provides flexibility in accessing funds while ensuring compliance with tax regulations. When considering estate form information with third parties, knowing about this rule can help in making informed decisions regarding trust distributions.

Certain assets do not become part of a deceased person's estate. For instance, life insurance policies with named beneficiaries, retirement accounts, and jointly held properties typically pass directly to the surviving owners or beneficiaries. Understanding these distinctions is crucial for clear estate form information with third parties, as it can affect the overall estate management process.