P023 Contract Default Withholding

Description

How to fill out California Contract For Deed Package?

- If you are a returning user, log in to your account and select the required form template from your dashboard. Make sure your subscription is active before proceeding.

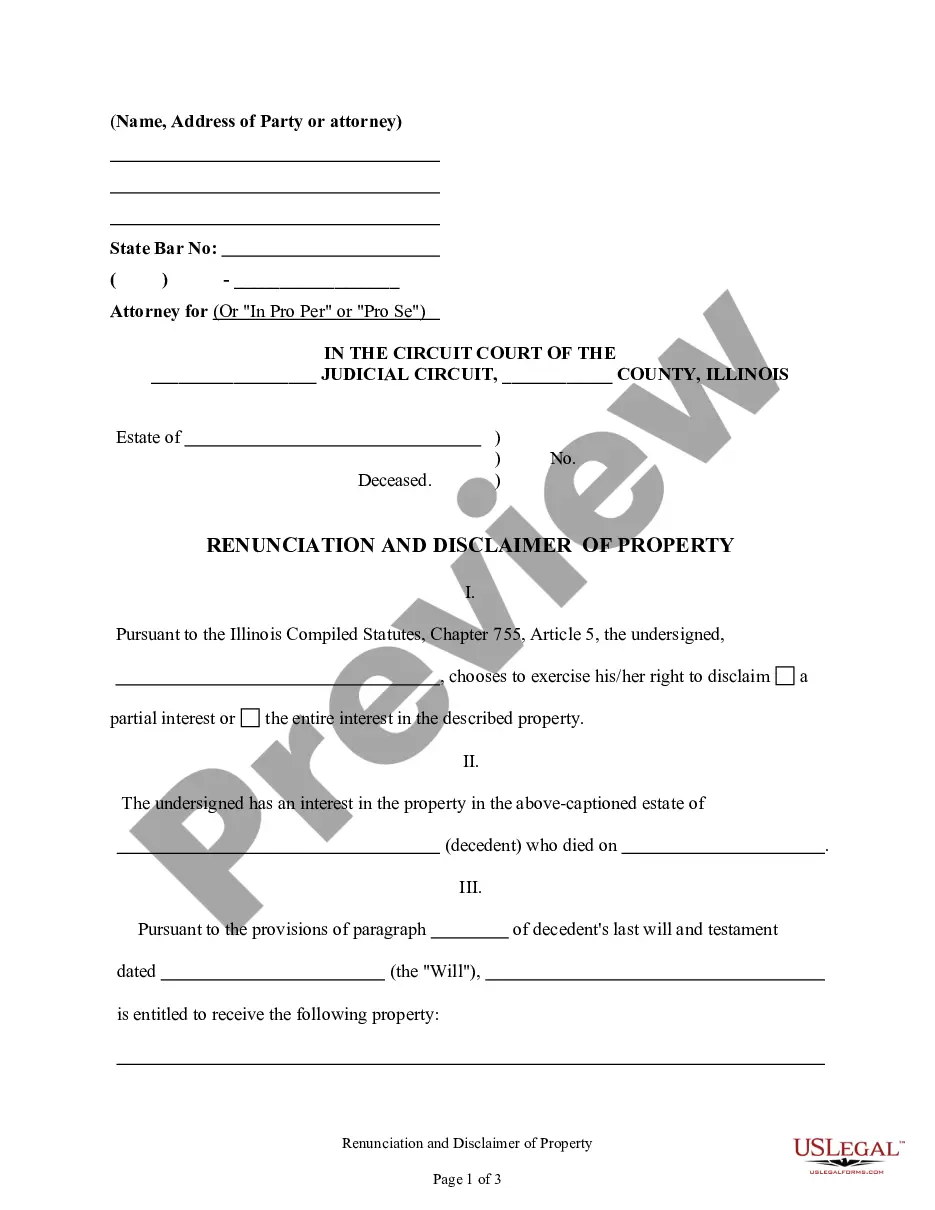

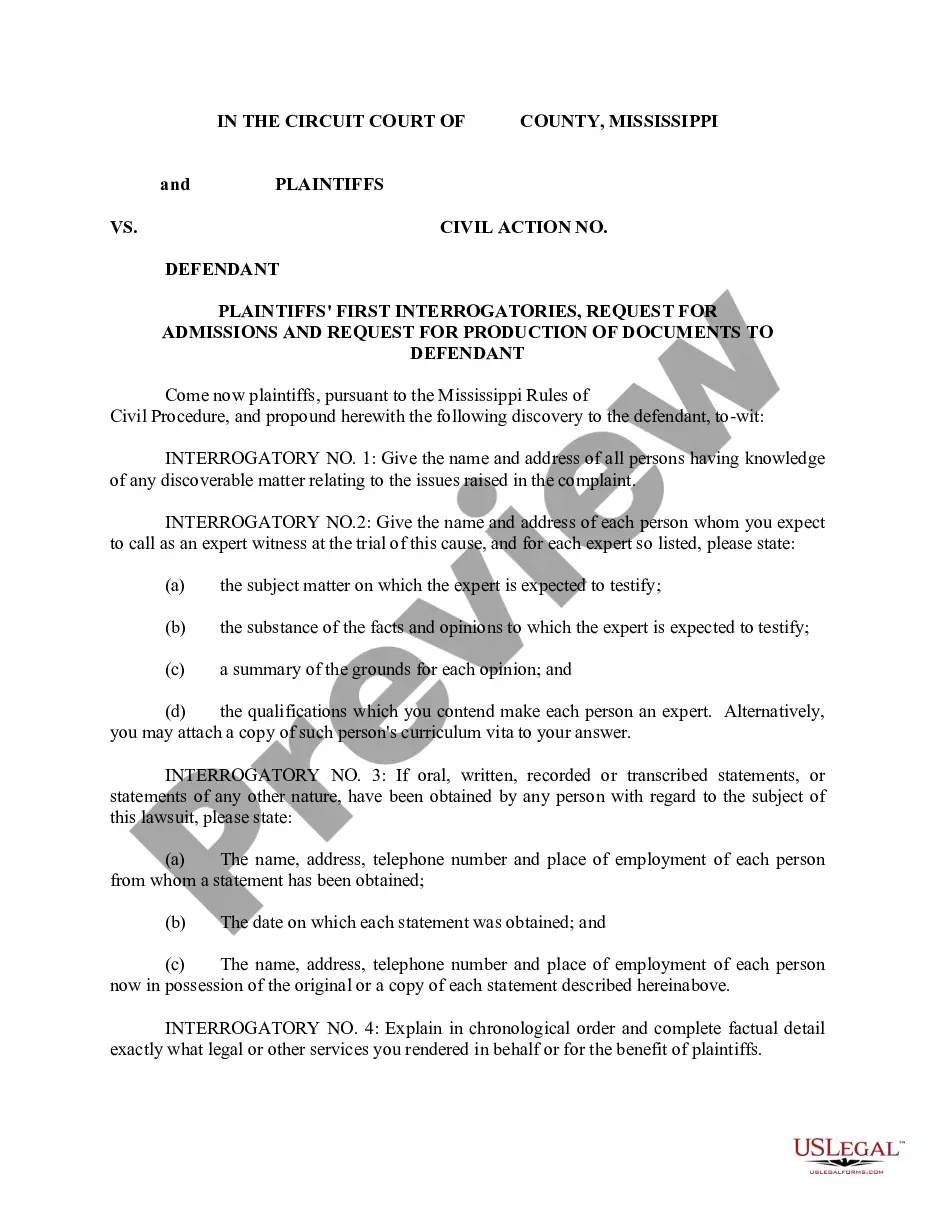

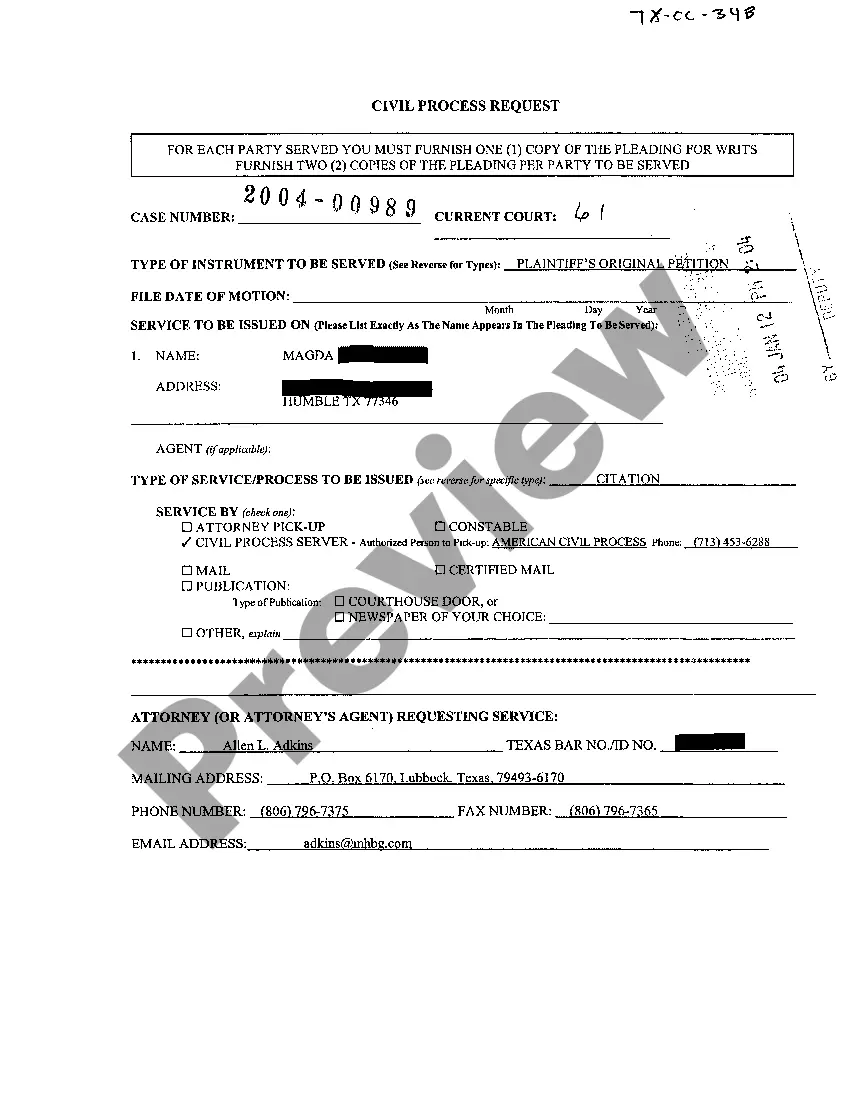

- For first-time users, start by browsing the extensive online library to find the right P023 contract default withholding template that fits your local jurisdiction needs. Use the Preview mode to check for details.

- If the initial form doesn’t suit your requirements, utilize the Search feature to locate the appropriate template quickly.

- Once you find the correct document, click on the Buy Now button to choose a subscription plan that fits your needs. Create an account to unlock access to the comprehensive library of forms.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download the template directly onto your device for easy access in the future through the My Forms section of your profile.

Following these straightforward steps ensures that you have the right legal document at your fingertips, crafted to meet specific legal requirements. US Legal Forms assists you at every stage, from selection to download.

Start utilizing the resources at US Legal Forms today to simplify your legal documentation process!

Form popularity

FAQ

If you claim 0 on your W4 and still owe taxes, you may face a larger tax bill during tax season. This situation might indicate that your withholding does not accurately reflect your tax liability. To address this issue and improve your P023 contract default withholding, consider reassessing your W-4 and making adjustments as necessary.

For additional withholding, you should enter an amount that reflects your financial needs or tax situation. If you expect to owe taxes at the end of the year, you might consider a higher additional withholding amount. It's helpful to consult with a tax professional to adapt this to your P023 contract default withholding requirements.

Entering 0 for additional withholding means you do not want any extra amounts taken from your paycheck. This option may be suitable if you anticipate a refund or a balanced tax bill. However, consider your financial situation and how it relates to P023 contract default withholding before deciding.

To fill out a withholding exemption, you'll need to complete the appropriate section on your W-4 form. Provide all necessary details, including your total income and the number of deductions. Completing this correctly is vital for managing your taxes and understanding your P023 contract default withholding situations.

When filling out your tax withholding forms, provide accurate information about your income, dependents, and anticipated tax credits. This information helps determine the proper amount of withholding so you're not caught off guard come tax season. Using resources like uslegalforms can simplify this process and ensure you meet P023 contract default withholding requirements.

To obtain a CWA, or Certificate of Withholding Accuracy, you need to ensure your income reporting aligns with the P023 contract default withholding criteria set by the IRS. Completing the appropriate forms accurately and submitting them on time is crucial, and platforms like uslegalforms can provide the guidance necessary to streamline this process.

The basis of expanded withholding tax is grounded in the laws that govern tax obligations, particularly relating to P023 contract default withholding. This means certain payments, such as interest or dividends, may require additional withholding. Being aware of these regulations helps you manage your tax situation more effectively.

You may become subject to backup withholding under P023 contract default withholding if you fail to provide your correct taxpayer information or if there are specific reportable payments to the IRS. Staying informed about your tax status and requirements can help you avoid being subject to this withholding. Use resources like uslegalforms to stay compliant.

Computing expanded withholding tax involves assessing the broader tax regulations that apply under P023 contract default withholding. Begin by determining the income categories that fall under expanded withholding, then calculate accordingly using the relevant tax rates. Having the right information handy, such as what's provided by uslegalforms, can simplify this task greatly.

To calculate total withholding, add together all amounts withheld across different income sources, including any P023 contract default withholding that may apply. This comprehensive calculation gives you a clear picture of your overall tax obligations. Tools available on uslegalforms can assist you in managing these calculations effectively.