Deduction For Indebtedness

Description

How to fill out California Authorization For Deduction From Pay For A Specific Debt?

It's well-known that you can't turn into a legal authority in a single night, nor can you learn to swiftly prepare Deduction For Indebtedness without possessing a specific skill set.

Developing legal documents is an arduous task that necessitates specialized training and expertise. Therefore, why not entrust the generation of the Deduction For Indebtedness to the experts.

With US Legal Forms, which boasts one of the most comprehensive legal template collections, you can locate everything from court documents to templates for internal business communication. We understand how essential compliance and adherence to federal and local statutes and rules are. This is why, on our platform, all templates are specific to locations and current.

You can regain access to your documents from the My documents section at any time. If you are an existing client, you can easily Log In, and find and download the template from the same section.

Regardless of the nature of your paperwork—be it financial, legal, or personal—our platform has the solution for you. Experience US Legal Forms today!

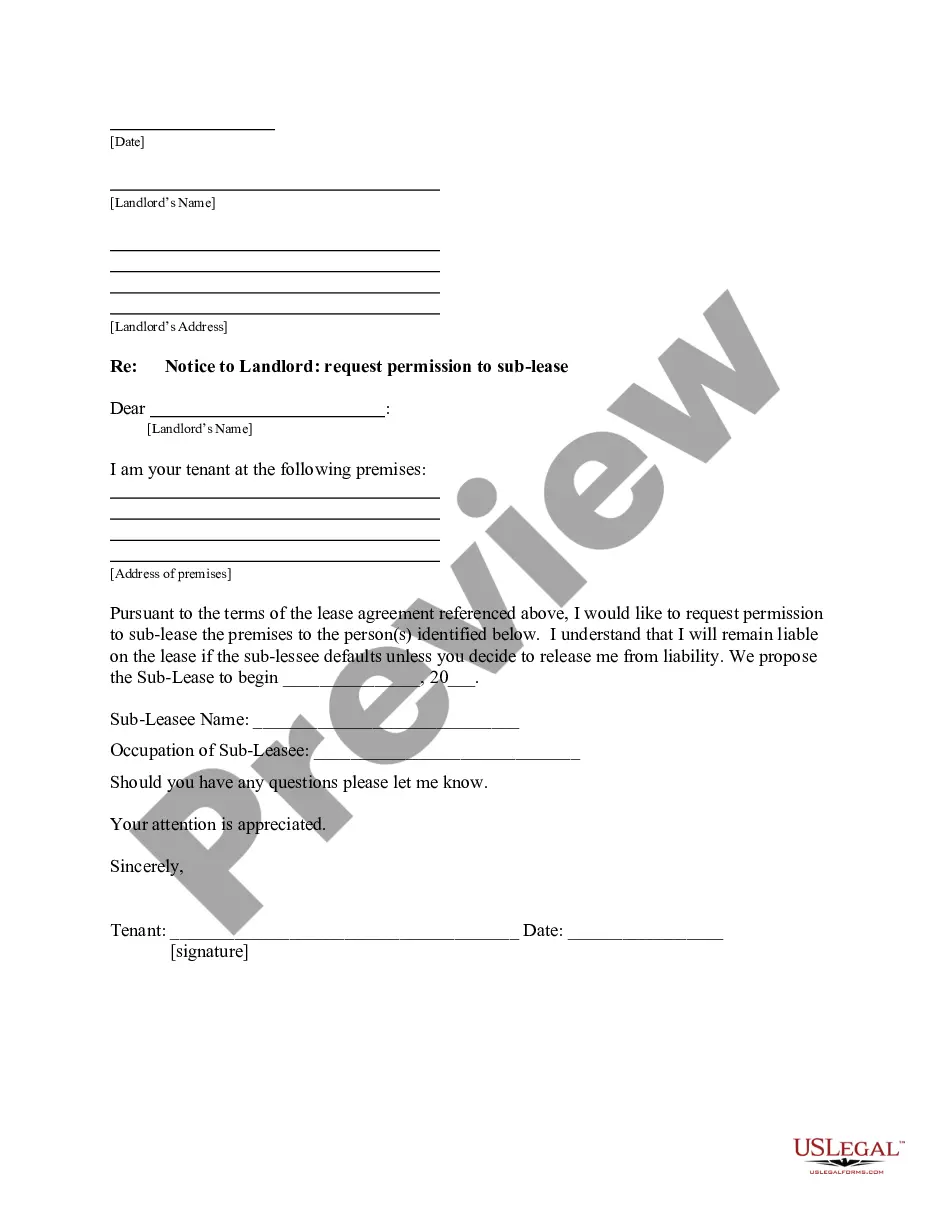

- Locate the document you require by utilizing the search function at the top of the page.

- Preview it (if this option is available) and examine the accompanying description to ascertain whether Deduction For Indebtedness is what you seek.

- If you need a different form, start your search again.

- Create a free account and choose a subscription plan to acquire the form.

- Select Buy now. Once the transaction is finalized, you can download the Deduction For Indebtedness, complete it, print it, and dispatch it to the intended recipients.

Form popularity

FAQ

To claim a capital loss on a bad debt, you have to file an election with your income tax and benefit return. To make this election, write and sign a letter stating that you want subsection 50(1) of the Income Tax Act to apply to the bad debt. Attach this letter to your return.

Under the accrual method, you generally report income when you earn it, so if the uncollectible amount was included in income, you could deduct the business bad debt. The bad debt may be claimed as an operating loss and simply subtracted from the business' profits.

How to deduct bad-debt loss. Generally, you can't take a deduction for a bad debt from your regular income, at least not right away. It's a short-term capital loss, so you must first deduct it from any short-term capital gains you have before deducting it from long-term capital gains.

Lenders or creditors are required to issue Form 1099-C, Cancellation of Debt, if they cancel a debt owed to them of $600 or more. Generally, an individual taxpayer must include all canceled amounts (even if less than $600) on the "Other Income" line of Form 1040.

Under the direct write-off method, bad debts are expensed. The company credits the accounts receivable account on the balance sheet and debits the bad debt expense account on the income statement. Under this form of accounting, there is no "Allowance for Doubtful Accounts" section on the balance sheet.